Table of contents

Payroll for your company doesn’t have to be an impossible task. If you’re looking to learn how to manually process payroll yourself, you have some options.

Below, we walk you step by step through what each process entails, as well as which option might be best for your business. Remember, this post is for educational purposes only. For specific advice, be sure to consult with a professional.

How to do payroll taxes manually

Payroll taxes are federal, state and local taxes withheld from an employee’s paycheck by the employer. They include Income Tax, Social Security, and Medicare. In order to properly calculate what your payroll tax should be, you need to know the current tax rates. For example, the Social Security tax for 2024 is 6.2% and the Medicare tax rate is 1.45%. The percentages are determined on a yearly basis.

If you want to know how to process payroll yourself, read below.

How to process payroll yourself

Summary: Doing your company’s payroll on your own costs less, but is time consuming and prone to errors.

If you’re tax savvy, you may be able to take on a DIY approach to paying your employees. But given all the payroll mistakes you can make (and nasty fines you can incur as a result), make sure you’re completely comfortable with everything you need to do before you dive in.

To get started:

Step 1: Have all employees complete a W-4 form.

To get paid, employees need to complete Form W-4 to document their filing status and keep track of personal allowances. The more allowances or dependents workers have, the less payroll taxes are taken out of their paychecks each pay period. For each new employee you hire, you need to file a new hire report.

Step 2: Find or sign up for Employer Identification Numbers.

Before you do payroll yourself, make sure you have your Employer Identification Number (EIN) ready. An EIN is kind of like an SSN for your business and is used by the IRS to identify a business entity and anyone else who pays employees. If you don’t have an EIN, you can apply for one here on the IRS site. You may also need to get a state EIN number; check your state’s employer resources for more details.

Step 3: Choose your payroll schedule.

After you register for your Employer Identification Numbers, get insured (don’t forget workers’ compensation), and display workplace posters, you need to add three important dates to your calendar: employee pay dates, tax payment due dates, and tax filing deadlines (read more about basic labor laws here).

Step 4: Calculate and withhold income taxes.

When it comes time to pay your employees, you need to determine which federal and state taxes to withhold from your employees’ pay by using the IRS Withholding Calculator and your state’s resource or a reliable paycheck calculator. You must also keep track of both the employee and employer portion of taxes as you go.

Step 5: Pay payroll taxes.

When it’s time to pay taxes, you need to submit your federal, state, and local tax deposits, as applicable (usually on a monthly basis).

Step 6: File tax forms & employee W-2s.

Finally, be sure to send in your employer federal tax return (usually each quarter) and any state or local returns, as applicable. And last but not least, don’t forget about preparing your annual filings and W-2s at the end of the year.

Note: This is not an exhaustive list of your responsibilities as an employer. For advice specific to your business, be sure to go over federal and state requirements or consult with a professional.

Alternative 1: Use a payroll service

Summary: Going with a small business payroll provider is low-to-medium cost and reliable.

Don’t worry if the DIY method is not for you, payroll services make it easier for small business owners to pay their employees and get back to their core business functions. According to the Square Future of Commerce report, 35% of surveyed retailers plan on automating payroll and benefits in order to decrease hands-on time for themselves or staff.

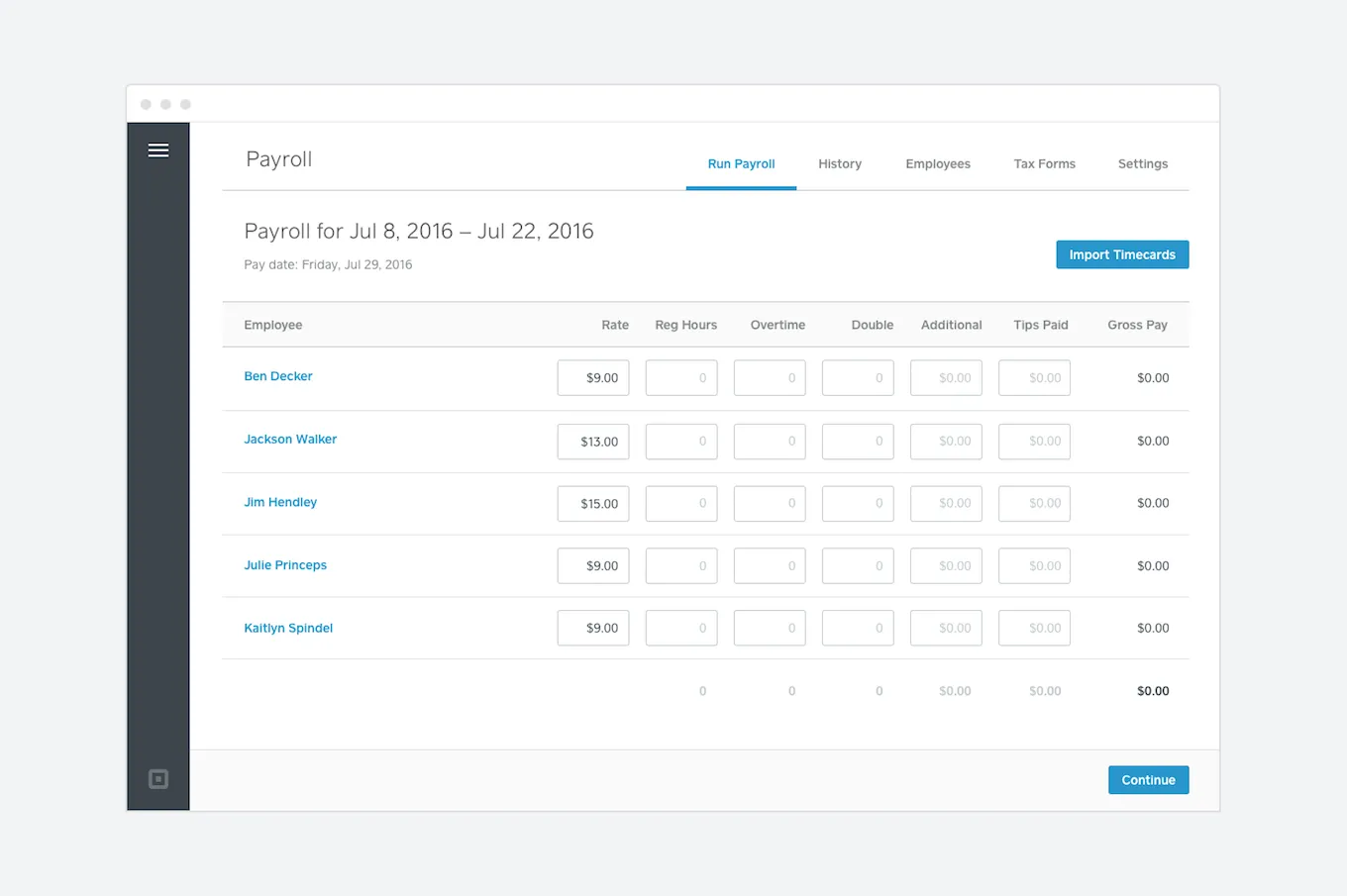

Most payroll services calculate employee pay and taxes automatically and send your payroll taxes and filings to the IRS and your state’s tax department(s) for you. With a full-service provider like Square Payroll, you can even keep track of hours worked, import them directly to your payroll, and pay employees by direct deposit.

Here’s how it works:

How to process payroll with a payroll service

Just like with the DIY option above, you need to have all your employees complete a Form W-4 and find or register for Employer Identification Numbers.

From there:

Step 1: Choose a full-service payroll provider.

If you’re not sure how to do payroll yourself, use payroll software that reduces the risk of errors or fines. Many payroll processing services, like Square Payroll, handle your payroll taxes, filings, new hire reporting for you, and allow you to complete payroll online. Sign up takes minutes — so you can quickly start doing your own payroll the same day you sign up. Discover the benefits of using Square’s payroll solutions for your business.

Step 2: Add your employees.

You need to set up your employees before you process their payroll. Adding employees you’re paying for the first time is generally quicker; if you’re switching to a new payroll provider, then you also need to add your current employees’ year-to-date payroll information. Either way, you generally need to enter employee names, addresses, Social Security numbers, and tax withholding information. If you’re using Square Payroll and would like to pay employees using direct deposit, you can just enter your employees’ names and email addresses so they can enter their personal information themselves.

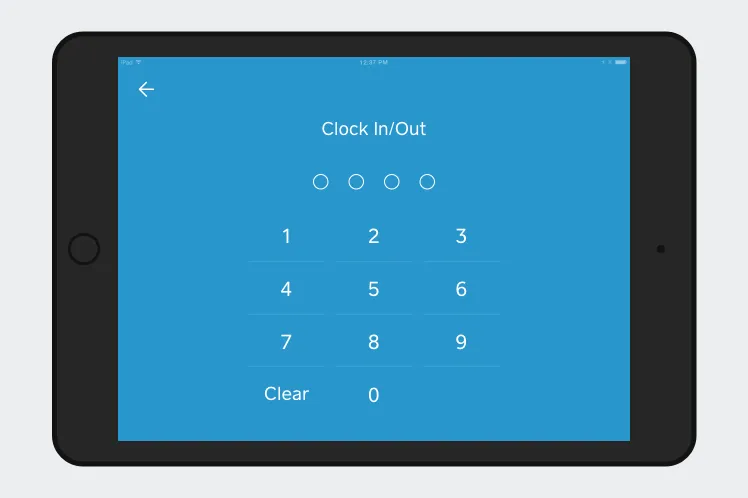

Step 3: Track hours worked and import them.

The U.S. Department of Labor requires employers to keep track of wage records such as timecards for up to two years. Certain states may have longer retention requirements; be sure to check the specific requirements in your state. You can track time using your Square Point of Sale and import the timecards to payroll.

Step 4: Process your first payroll run.

Click Send and you’re done!

Step 5: Keep track of your tax payments and filings.

Power your business with Square

Millions of companies use Square to take payments, manage staff, and conduct business in-store and online.

Get startedIn general, the IRS requires tax forms to be kept for three years. Certain states may have longer retention requirements; be sure to check the specific requirements in your state. With Square Payroll, you can find copies of your tax filings in your dashboard.

Alternative 2: Hire an accountant

Summary: Hiring an accountant is the most expensive option, but it’s reliable.

If you don’t want to learn how to do payroll yourself for your company or use a payroll service, consider hiring an accountant. A good accountant can process your payroll and make sure your tax payments and filings are taken care of. Check out these five tips that can help you find your ideal accountant.

Ready to get started?

No matter how you decide to do payroll, Square offers resources and tools to streamline the process. Explore Square’s payroll solutions tailored for small businesses and discover a stress-free way to pay your team.

![]()