Table of contents

Over the past few years, bitcoin has evolved from a hot topic of debate into an accepted medium of exchange. For tech-savvy and international customers, it’s a borderless asset that reduces payment delays and foreign exchange fees. For customers with privacy and security concerns, bitcoin payments occur from wallet to wallet, without the need to store credit card details. Plus, bitcoin can be immediately liquidated.

Patrick Robinson of Coast to Coast Coffee shares the sentiment many bitcoin users have. “[Bitcoin’s] the freedom to give the money back to the people. That’s what bitcoin was created for. It’s so we didn’t have to be subject to the banks and the traditional financial system that we’re stuck in now. That’s why I love bitcoin… it was created for financial freedom for everyone.”

As tax season approaches, we know that this might be the first time businesses using Square Bitcoin Conversions and Bitcoin Payments1 will need to figure out how to prepare for tax season and account for some of their bitcoin transactions. When a small business accepts bitcoin as payment for goods or services, the IRS treats the transaction as ordinary taxable business income. Bitcoin is classified as property (a digital asset), not currency, for federal tax purposes. Digital assets can be bought, sold, transferred, or traded and the tax impact varies depending on how you utilize these funds. We want to provide some visibility of the important new tax documents coming your way and how you can prepare for this tax filing season.

Bitcoin and taxes: 1099-DA essentials

What tax forms will I be receiving at the end of the year? Which bitcoin products will require me to get a 1099-DA?

Starting on October 8, 2025, businesses using Square had access to a portfolio of bitcoin products. Today, you can access:

- Bitcoin Conversions: When processing payments with Square, you can automatically convert up to 50% of your daily card sales into bitcoin.

- Bitcoin Wallet: You can buy, sell, hold, or withdraw bitcoin alongside Square Banking tools.

- Bitcoin Payments: You can accept bitcoin as a payment method for 0% processing fees through 2026 and settle it either in USD or Bitcoin.

When you use either one or a combination of these products, you might be subject to a capital gains or loss and be required to report it to the IRS. For that, we will issue you a 1099-DA form.

What’s a 1099-DA?

Form 1099-DA is a new IRS tax form, officially called “Digital Asset Proceeds from Broker Transactions,” for reporting sales and exchanges of digital assets. Starting in 2025, Square is required to issue this form to you and the IRS to standardize and simplify the reporting of digital asset transactions.

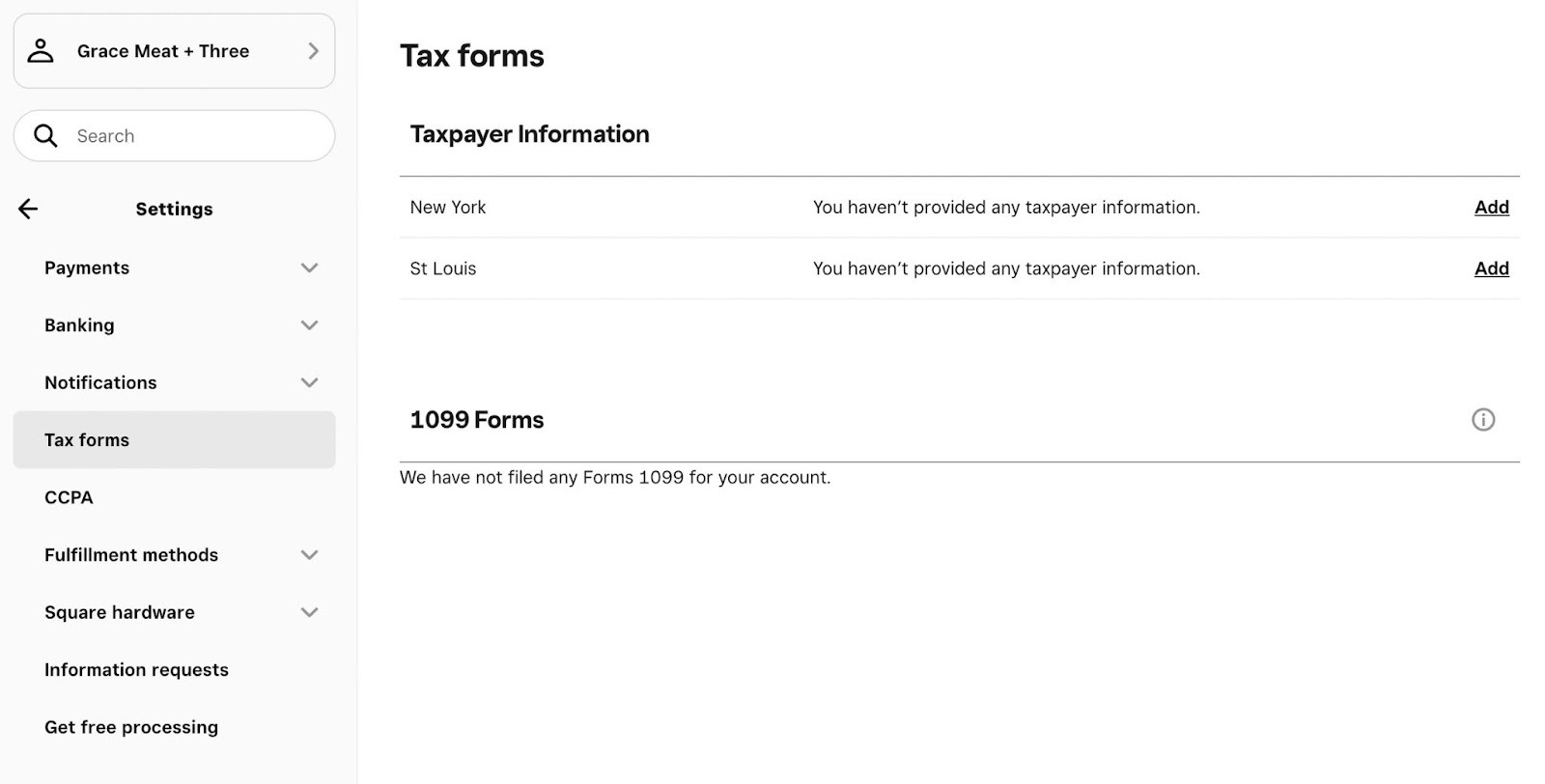

Where can I find the 1099-DA?

You’ll be able to find your 1099-DA under Settings > Tax Forms, where all your tax forms should be present.

When will I receive my 1099-DA?

We strive to provide your tax forms in a timely manner and aim to send you the tax forms latest by February 15, 2026.

What does my accountant need to know?

I’d like to send a full list of all bitcoin transactions to my accountant, how can I do that?

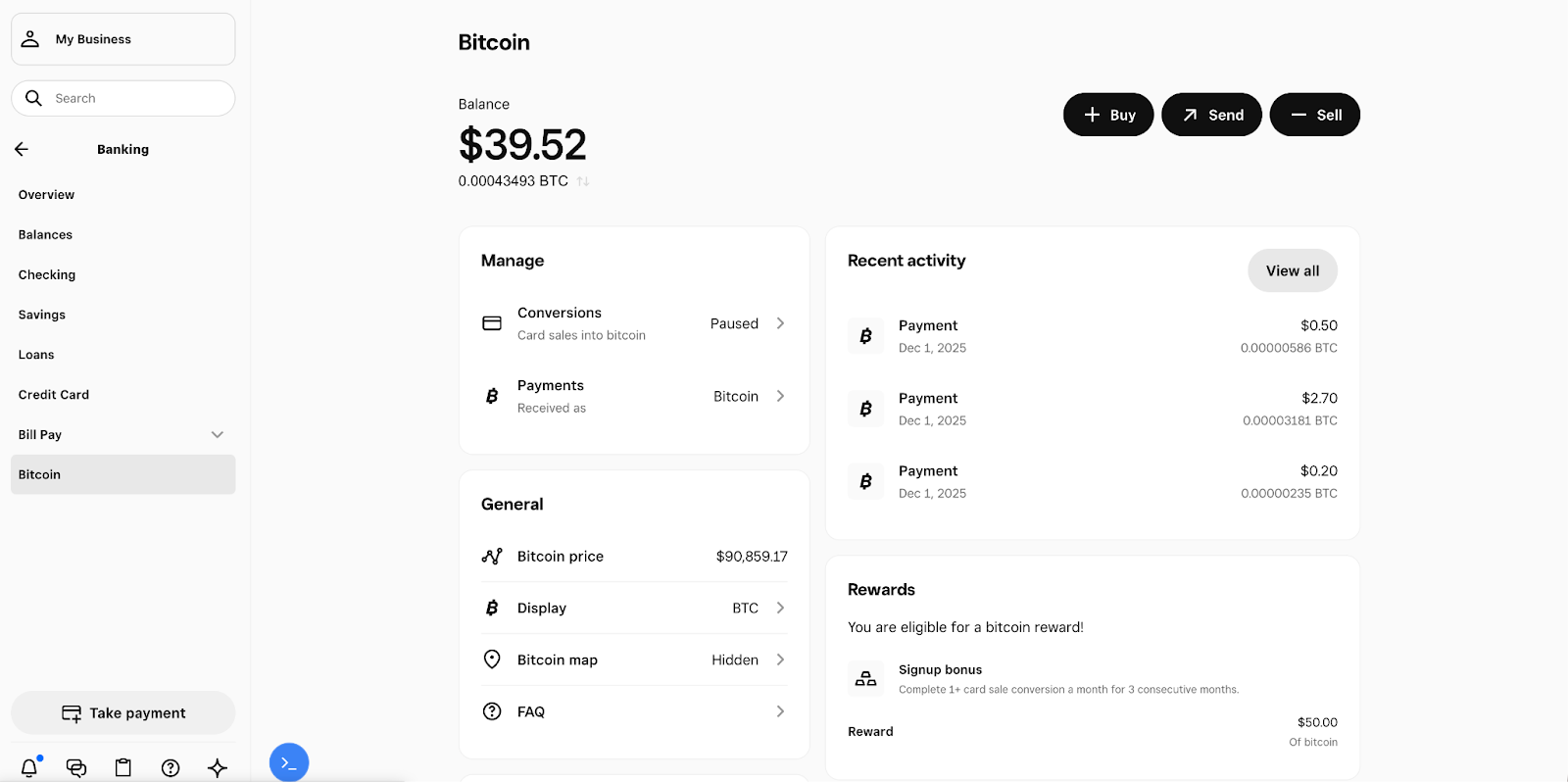

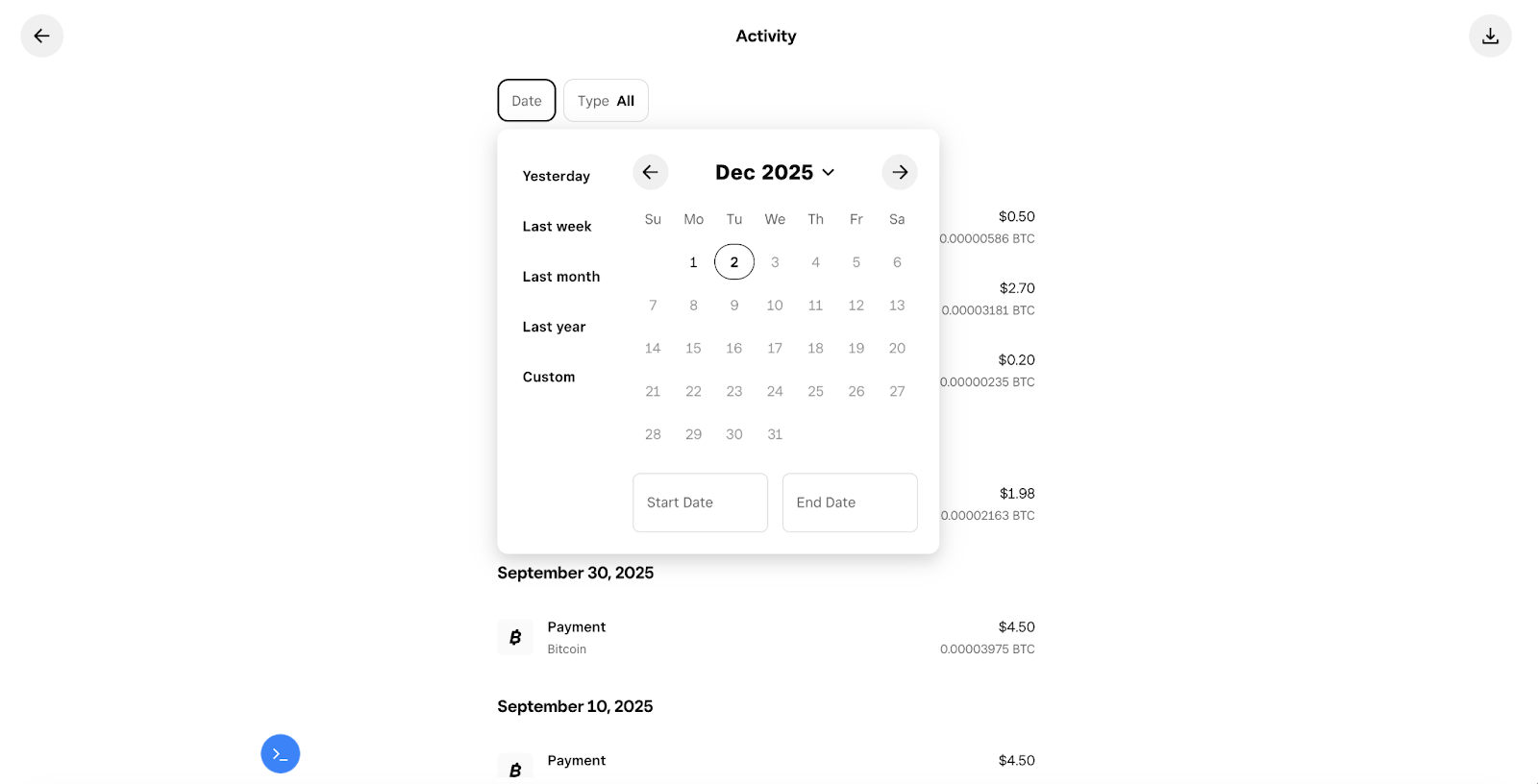

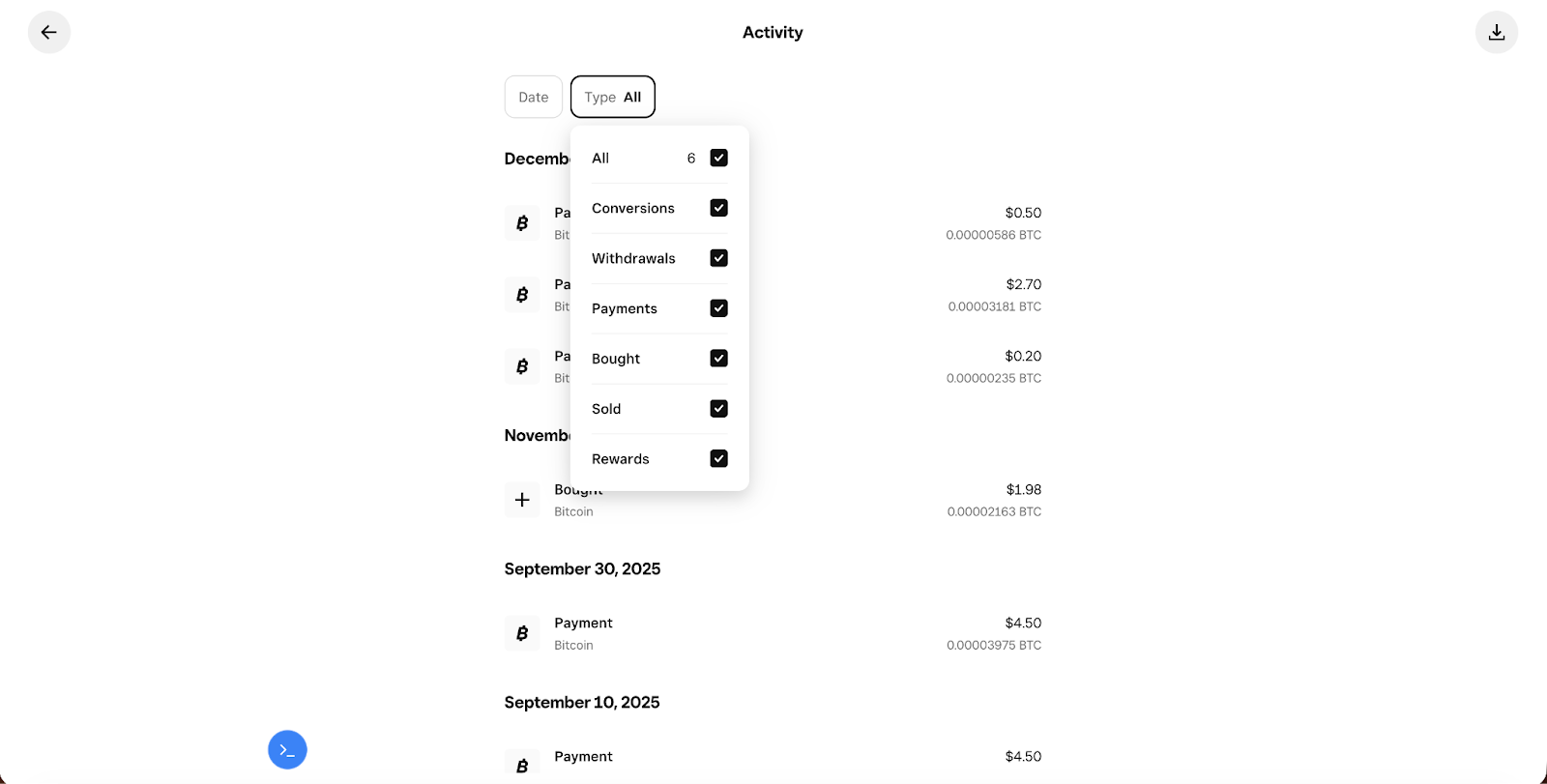

You’ll be able to access all your bitcoin transactions from Banking > Bitcoin tab. From there, you can see your Recent Activity List, where you can filter by date and transaction type.

Taxes on the bitcoin you receive

How is bitcoin treated for tax purposes when received as payment?

If you’ve configured your account to settle your bitcoin payments in bitcoin, you are acquiring bitcoin at that time for your business. When this happens, this transaction will show up in your transactions list but will be excluded from your 1099-DA, since this is not yet considered a sale of the digital asset.

At this point in time, when a business receives bitcoin as a form of payment, the IRS treats the transaction as regular taxable business income. The company must recognize gross income equal to the fair market value (FMV) of the bitcoin in U.S. dollars at the date and time it is received for goods or services. That amount is included in taxable income just as if the customer had paid with cash or a credit card. For sales tax purposes, state and local taxes generally still apply as well, based on the value of the sale.

The FMV of the bitcoin at receipt becomes the “basis” for the value of the digital asset. If your business chooses to sell that digital asset at a later date, other tax consequences come into play.

If you’ve configured your account to settle your bitcoin payments in USD, you will be acquiring and selling bitcoin at the time of transaction. Because these transactions are at the same time, this shouldn’t incur any capital gains or losses.

Do I owe capital gains tax when I convert bitcoin to USD?

When you buy bitcoin, accept bitcoin as a form of payment, or immediately convert your USD sales into bitcoin, you will not be taxed for capital gain purposes at that time. The FMV of the bitcoin received will be taxed under ordinary income rules.

It is only when you sell bitcoin that you will require a 1099-DA.

If you hold bitcoin for any period of time beyond the point of receipt, you will owe either capital gains or capital losses equal to the difference of basis and the amount that the bitcoin settled for when you disposed of it. There are exceptions where a digital asset may be treated as normal income, and you should consult a tax professional for your specific situation.

Key items to track regarding bitcoin include the date and time the bitcoin was received, FMV at the time of receipt, and the date it was sold or used. Square can help you do all of this.

In 2025, basis is not required to be reported on a 1099-DA. This requirement will be put into place for 2026 as part of an IRS phase-in process. As a best practice, track your basis now to alleviate challenges downstream when the asset is sold.

When does a gain or loss apply?

When you dispose of bitcoin, you will be responsible for determining the cost basis for bitcoin at the time of acquisition. See the simplified example below:

You report $1500 (FMV) of business income as bitcoin in October 2025. $1500 is your “basis” for tax purposesYou sell (dispose of) this bitcoin just over a year later in November of 2026 for $1600. The difference between your basis of $1500 and your disposition price of $1600 is $100That $100 is now taxed as a capital gain for 2026 tax purposesYour broker (Square) will issue a 1099-DA in 2026 reporting a $100 gain

How do I calculate the correct value of Bitcoin for tax purposes?

Bitcoin is valued at its basis until sold. The fair market value on the date of purchase is the bitcoin’s value until it is exchanged or sold. Then the value is reassessed on the date of sale. Any difference between the value on the date of receiving the asset and selling the asset will generate a gain or loss situation for tax purposes.

What tax forms or reports do I need to file for Bitcoin Payments or Conversions (federal and state)?

You may encounter a variety of forms that will need to be filed in relation to Bitcoin during the tax year. These include (but are not limited to) Form 8949, Schedule D, Schedule 1 or Schedule C, as well as several other possibilities, which are not provided by Square. These forms should be filled out by the business owner or their tax professional.

You can expect to receive a 1099-DA form from Square to be able to file your taxes. It’s best to work with a financial or tax advisor to determine what tax forms are best to fill out in your specific case.

Can I deduct losses if the value of bitcoin drops before I convert it to USD?

Simply put, you cannot claim any tax effect, gain, or loss, prior to converting the digital asset to USD. The trigger for reporting occurs when you dispose of the bitcoin. At Square, we use the FIFO method to determine the capital gains loss when you dispose of bitcoin. If you’ve bought bitcoin at a higher price and then disposed of it at a lower price, we will capture this capital gain or loss for distribution in your 1099-DA.

Do I still owe taxes on bitcoin I received, even if I haven’t sold it?

Yes, you will owe taxes as ordinary income in the year you received the bitcoin for goods or services delivered. However, you will not owe capital gain taxes if you’ve acquired bitcoin, but you haven’t yet disposed of it.

Square, Bitcoin, and your accounting system

What’s the best way to account for and track bitcoin in my books or accounting software (e.g., QuickBooks)?

The best resource we have is our CSV export from Bitcoin > Banking tab, which will give you the full list of bitcoin transactions you’ve done with your Square account.

![]()