Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

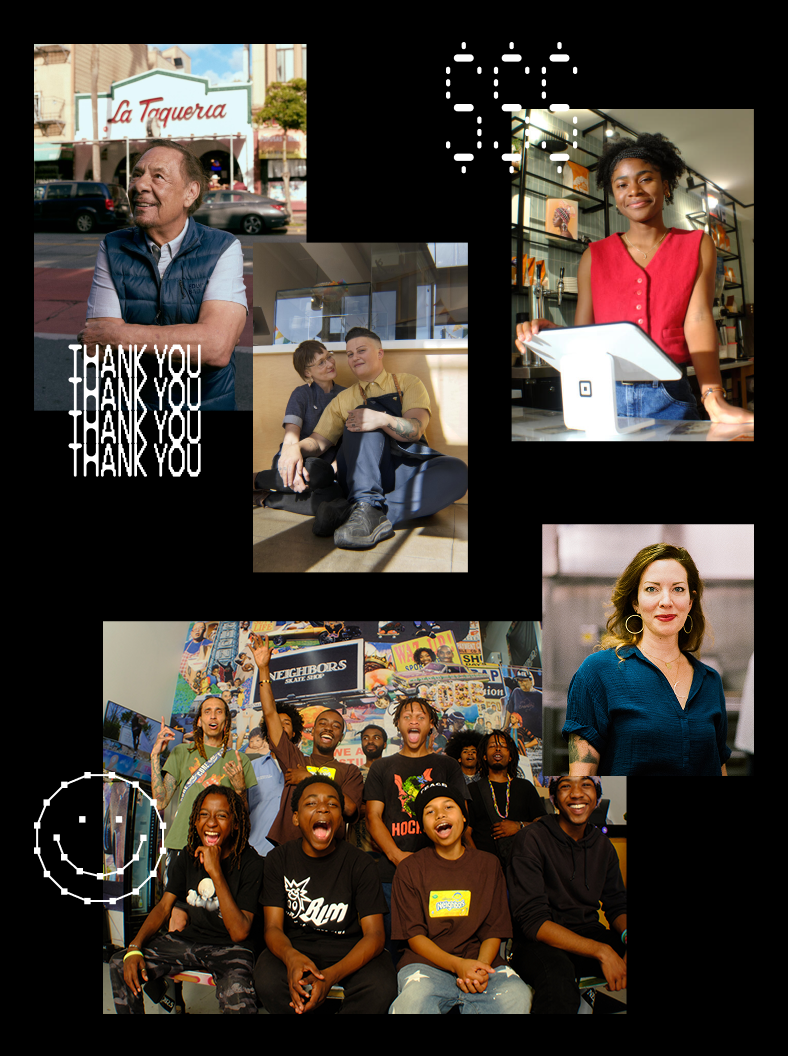

Cornerstone Grant Real support for local businesses: $10K and experts in your corner

Investing where traditional banks don’t

In today’s economic landscape, the inequalities that have long shaped our systems are becoming impossible to ignore. For many business owners, the barriers to funding aren’t new — they’re built into structures that were never designed with them in mind. That’s why Square Financial Services, Inc. and Square Banking are launching a grant that offers more than just money.

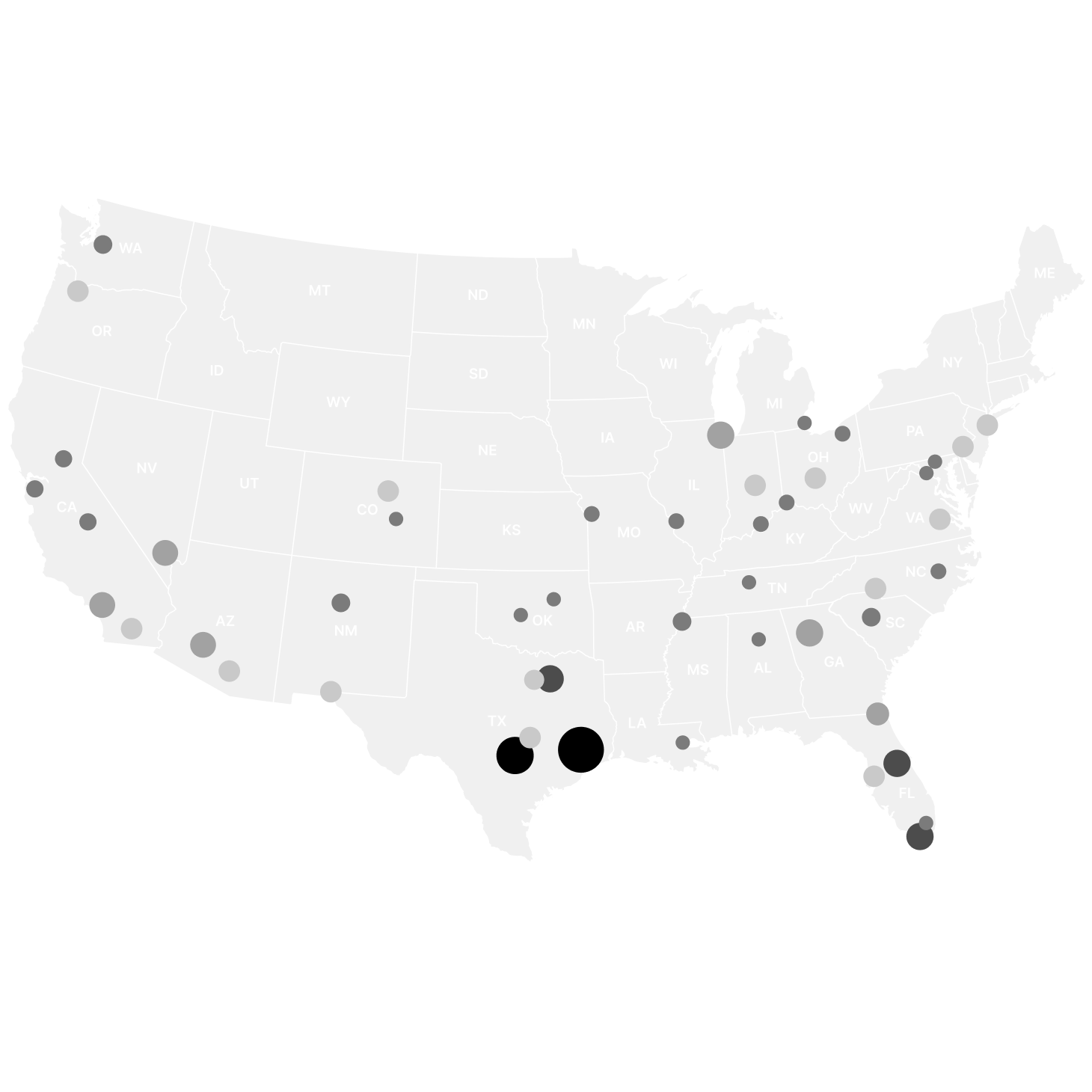

Over half of Square loans already go to sellers in regions with the lowest traditional approval rates — this program is one more way we’re helping close the gap.

Source: Internal Square Data, 2024 & SBA Lending Data 2024

Apply now for your chance to be one of four businesses that get:

A $10,000 grant

Funding to help you grow, start something new, or upgrade your tools

Financial guidance

A year of mentorship from Keila Hill-Trawick (a top 200 Forbes CPA) and Aja Evans (a board-certified therapist and author)1

Additional visibility

Features in Square newsletters sent to 1 million people, on social media, and The Bottom Line

Ready to make it happen?

How it works

Submit your application by September 30, 2025

We’ll evaluate all applications with a panel review

Grant recipients will be announced in November via Email

Grant recipients will get a year of financial advice and mentorship from Keila Hill-Trawick (a top 200 Forbes CPA), Aja Evans (a board-certified therapist and author), and Northwest Mountain Minority Supplier Development Council

Grant recipients will be announced through a press release, highlighted on Square social media, and be featured in Financial Wellness Newsletter which is sent out to over one million subscribers

Requirements

Current Square seller, with at least 6 months of ongoing transactions

US based business with fewer than 20 employees

Must qualify as a small business under SBA guidance and have a gross annual revenue under $2M

Applicants must be legal US residents and their business must not currently be in bankruptcy or named as a defendant in an active lawsuit

Financial tools to help you run, grow, and thrive

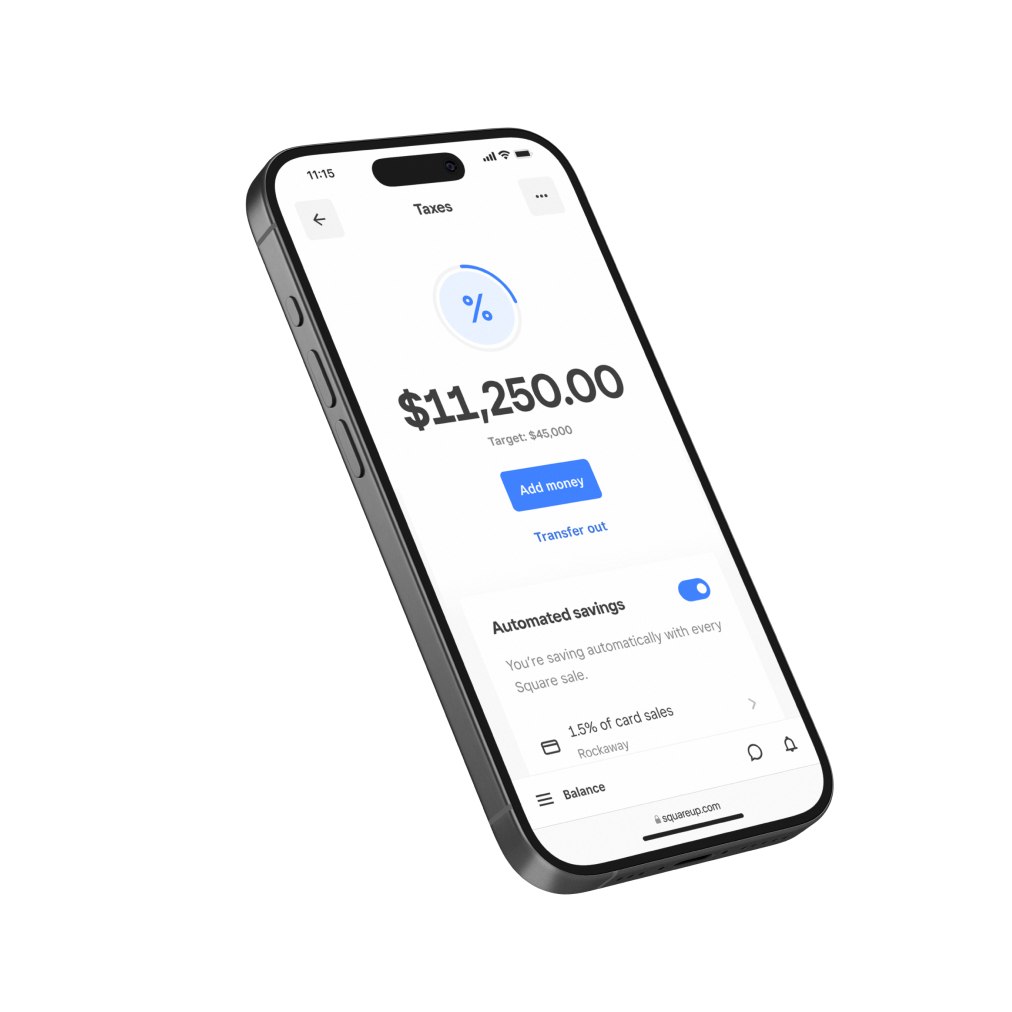

Square Savings

Plan ahead for future expenses. Automatically set aside part of your sales for taxes, expenses, and more with no fees or minimums.2

Square Checking

Tap into your sales revenue 24/7. With a free Square Checking account,3 your money is ready to spend as soon as you make a sale.

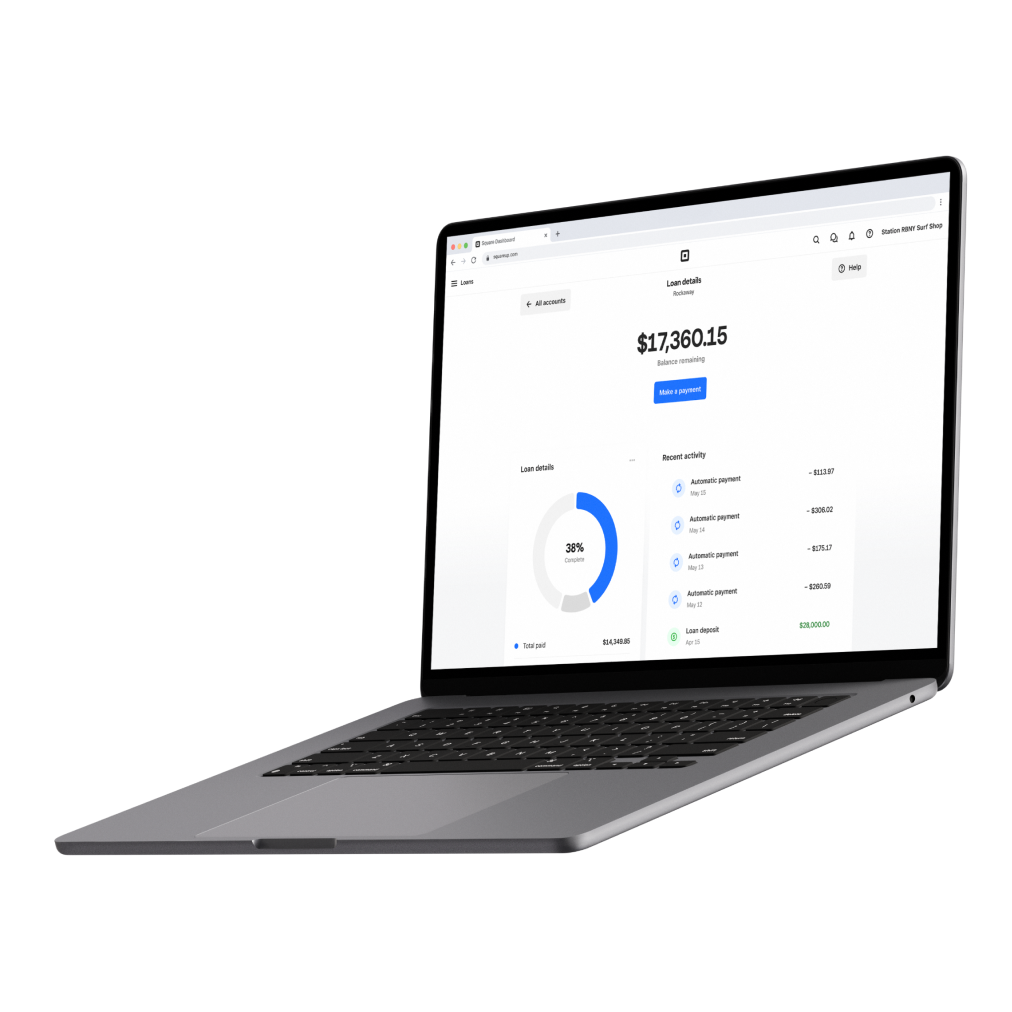

Square Loans

Loan offers are based on your unique business performance. Applying won't affect your credit score.4

1 Keila Hill-Trawick and Aja Evans do not work for Block, Inc. Their views are their own and not endorsed by Block, Inc. or any of its subsidiaries.

2Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.75% per folder on folder balances over $10. APY subject to change, current as of 10/10/22. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

The rate of our savings account is more than 3x the national average of 0.45% APY, based on the national average of savings accounts rates published in the FDIC Weekly National Rates and Rate Caps accurate as of 5/20/2024.

3 Block, Inc. is a financial services platform and not an FDIC-insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met.

Instant availability of Square payments. Funds generated through Square’s payment processing services are generally available in the Square Checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.

ACH transfer fund availability: Instant availability does not apply to funds added to the Square Checking account via ACH transfer. ACH credit transfers to your account may take 1–2 business days.

4All loans are issued by Square Financial Services, Inc. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

© 2025 Square, Inc. and/or Square Financial Services, Inc. All rights reserved.