Chip cards are reaching ubiquity in the United States — nearly 75 percent of cards processed on Square now contain a chip, up from around 40 percent in September of last year. At the same time, mobile payments like Apple Pay, Android Pay, and Samsung Pay have entered the market, with an uptick in adoption among certain demographics (like millennials).

As the U.S. undergoes this sea change in payments technology, we conducted a survey with over 1,000 consumers to gauge sentiment and appetite toward chip cards and NFC payments. Below are the key takeaways. (To go into the survey findings more in depth, read our white paper).

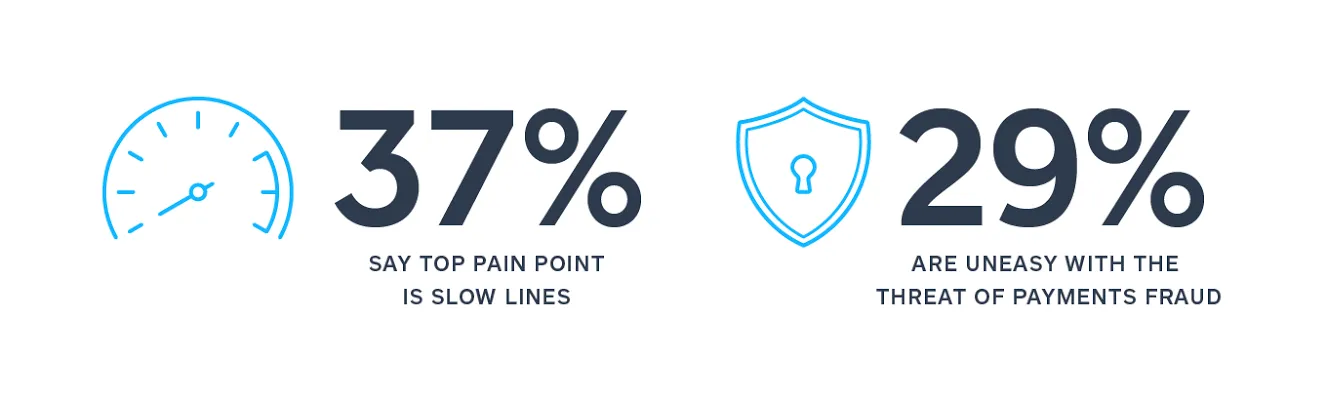

Speed and security are paramount.

Consumers surveyed reported being most frustrated with slow lines and checkout. At the same time, they rank security as the most important element of paying with both chip cards and mobile payments.

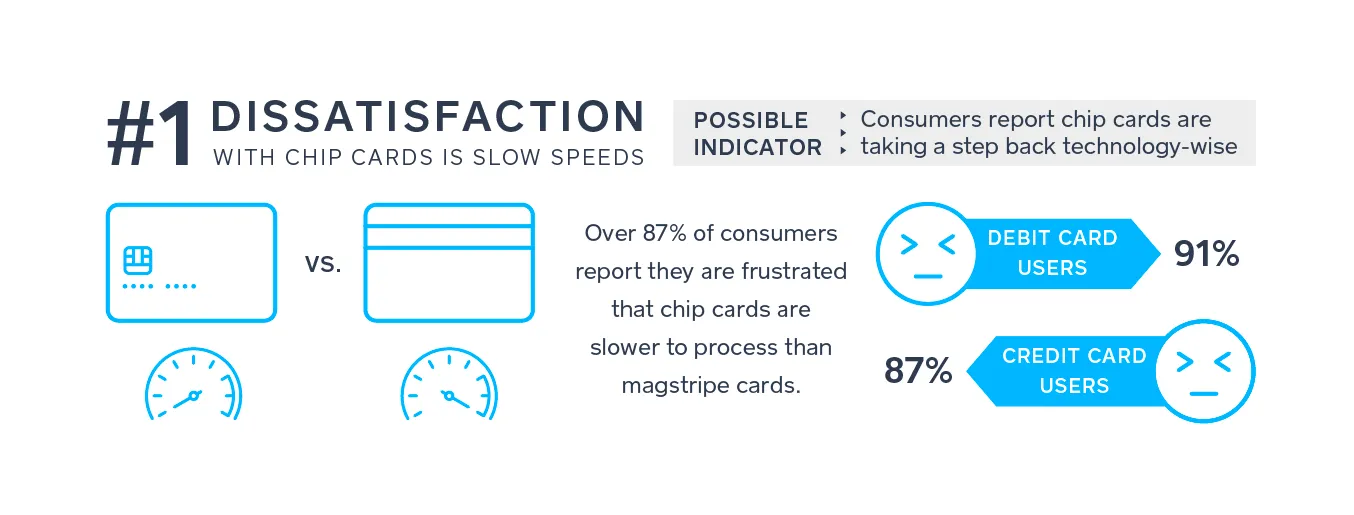

Chip card transaction time is the most frustrating.

Of people who marked dissatisfaction with the chip card payment experience, most highlighted the speed of transactions as the most frustrating element. (Chip cards can be slower to process than magstripe cards because of their more robust security checks.)

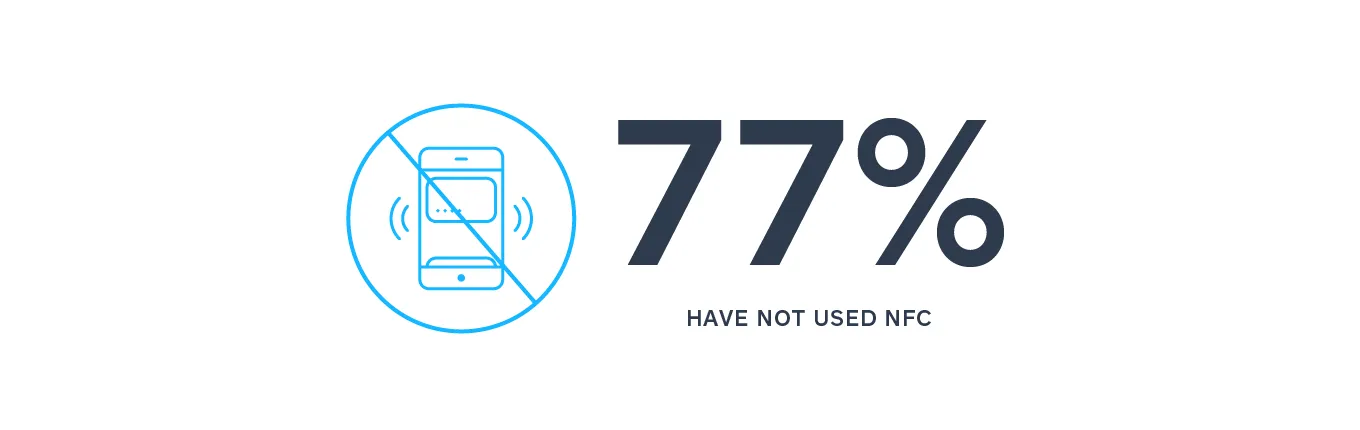

Mobile wallets are the most secure form of payment, yet consumers are unaware.

Most consumers surveyed hadn’t yet adopted mobile wallets (Apple Pay, Android Pay, or Samsung Pay), citing perceived security concerns as the main deterrent.

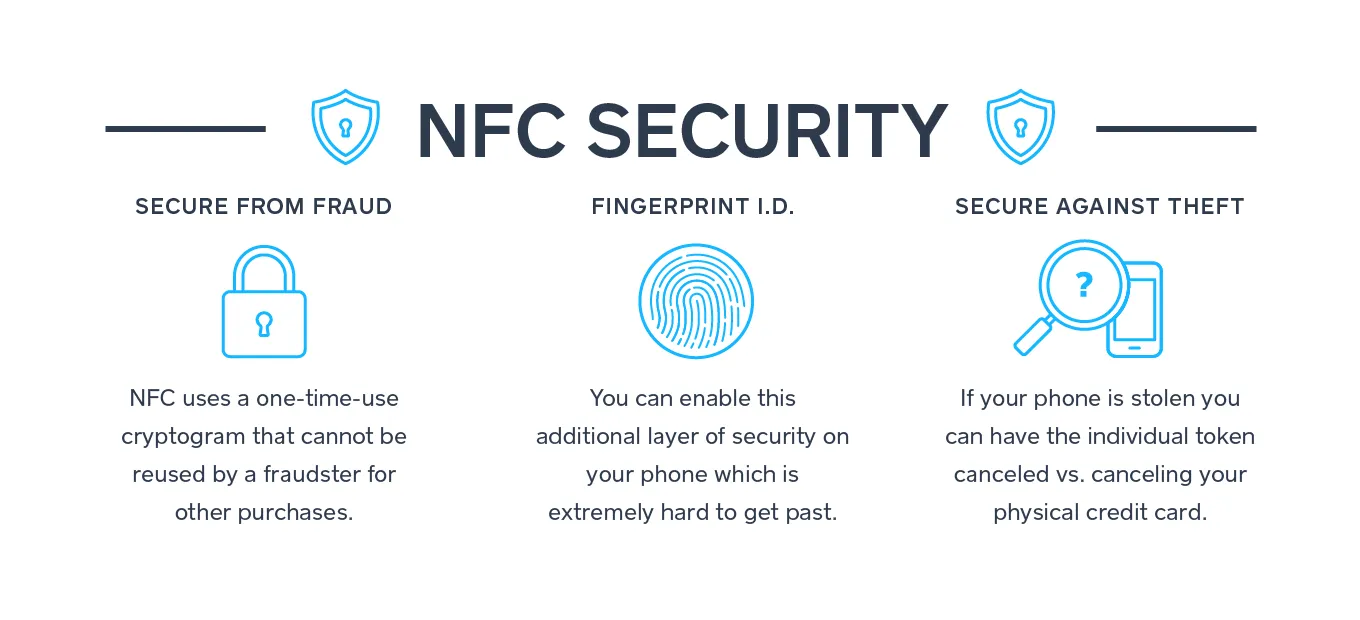

However, mobile payments are actually the most secure of all payment types. With the majority of mobile payment solutions (Apple Pay and most Android devices), you can activate fingerprint identification technology, which makes it extremely difficult for fraudsters to access anything within your phone. Furthermore, NFC mobile payments utilize sophisticated layers of security like tokenization and cryptograms to lock down bank details like no other method.

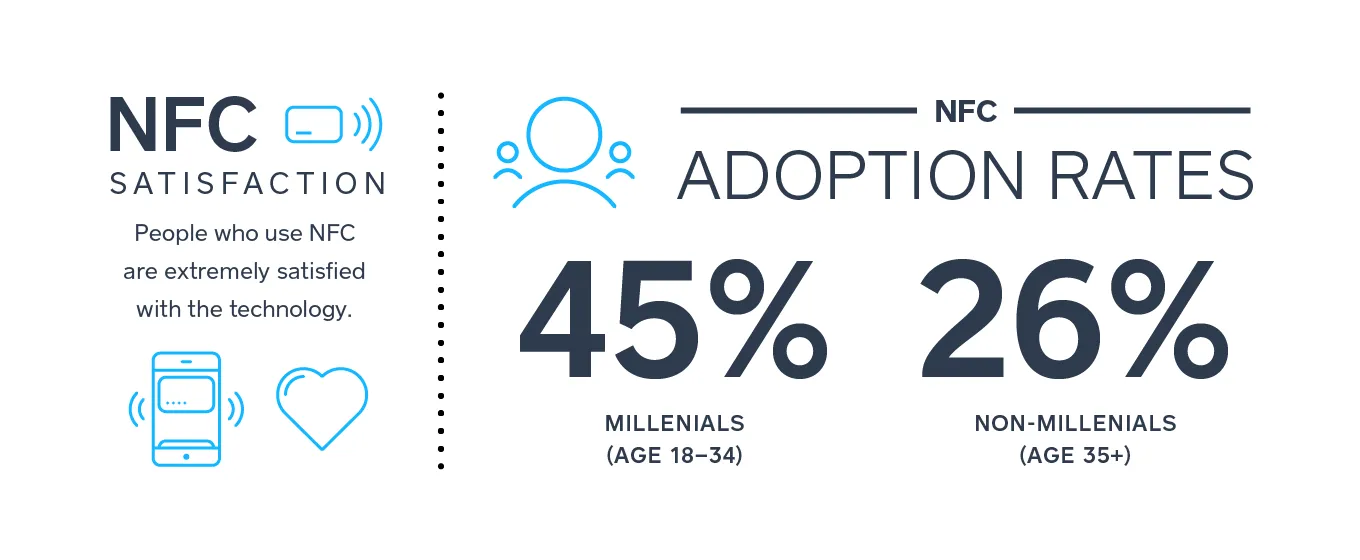

People who do use mobile payments love them.

The consumers who use NFC are really into it — most cite it as their ideal payment method above credit cards.

They name convenience, security, speed, and utility as a backup wallet as their top reasons for continued usage.

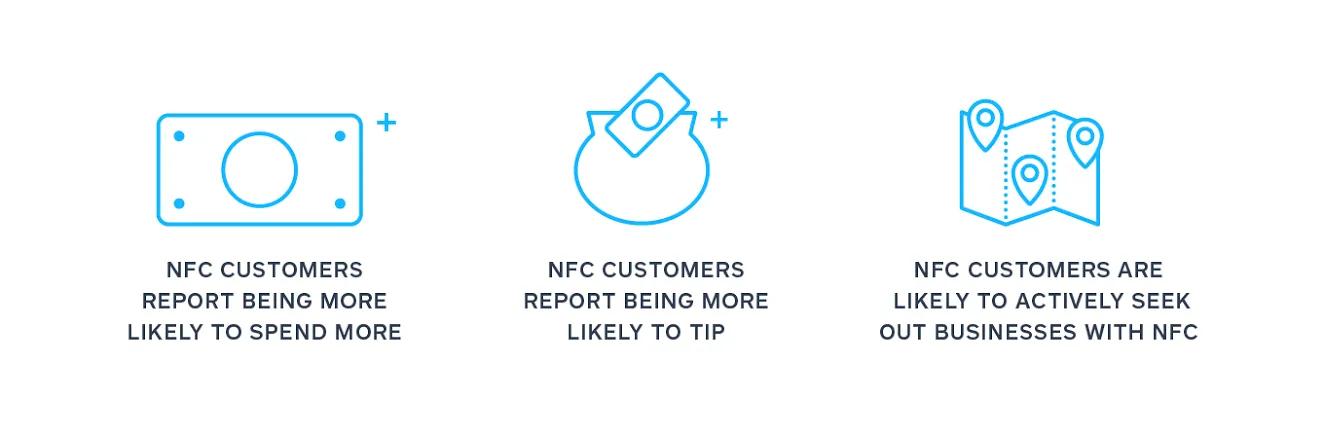

Mobile payments are good for business.

Perhaps the most interesting takeaway for sellers is that getting set up to accept mobile payments may help boost your bottom line. Of respondents who use mobile payments, most reported a likelihood to seek out stores that are set up to accept the technology. And most state they tend to spend more (and tip more, in fact) when they use mobile wallets to pay.

In summary, consumers today are worried about their credit card information being compromised. They’re also extremely frustrated with long lines at stores, wanting the checkout counter experience to be as quick and easy as possible. But what the majority of consumers don’t yet realize is that not only are mobile payments the fastest and most convenient way to pay, they’re also the safest. Once consumers become educated on these points (and continue to be frustrated with the chip card experience), you can see that mobile payments are poised for more widespread adoption. So if you want to boost your bottom line, and offer the safest, most convenient payment method possible, it’s a smart strategy to adopt a POS that accepts mobile payments in addition to chip cards. The Square Reader for contactless and chip accepts both mobile and chip card payments.

![]()