When we launched Square Loans we had a clear goal: get money into your hands quickly to help you grow your business. We eliminated paperwork and lengthy application processes so you could get the funds you need as soon as the next business day.

We are now transitioning from a merchant cash advance to a flexible loan product to help us expand the program and further empower you to reach your goals. You love Square Loans — over 90% of you who have been offered a second Square Loans offer have accepted it — and have shared with us suggestions for how to make the product even better. For example, with flexible loans, we now offer an early repayment option, which gives you flexibility to repay when you choose.

Square Loans is still as fast, simple, and transparent as ever. There is no burdensome paperwork to apply, qualified sellers can get funds as soon as the next business day, repayment happens as a fixed percentage of your daily card sales, and the cost of the loan is a fixed dollar amount that never changes.

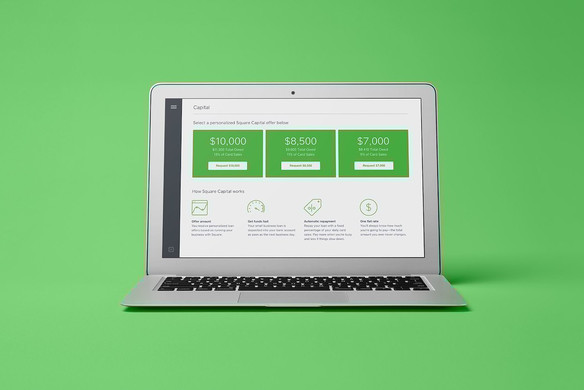

So you might be wondering, do I need to do anything different? Nope, just check your Square Dashboard to see if you have an outstanding offer through Square Loans.

We love hearing about how Square Loans has helped so many of you increase sales and reach new business goals, and we want to be part of even more of these success stories. We’re excited to grow this product alongside you and your business.

Square Loans, LLC and Square Financial Services, Inc. are both wholly owned subsidiaries of Square, Inc. Square Loans, LLC d/b/a Square Loans of California, LLC in FL, GA, MT, and NY. All loans are issued by either Celtic Bank or Square Financial Services, Inc. Square Financial Services, Inc. and Celtic Bank are both Utah-Chartered Industrial Banks. Members FDIC, located in Salt Lake City, UT. The bank issuing your loan will be identified in your loan agreement. The individual authorized to act on behalf of the business must be a U.S. citizen or permanent resident and at least 18 years old. Loan eligibility is not guaranteed. All loans are subject to approval.

![]()