MERCHANT SERVICES 101:

Merchant services are simple with Square.

How you accept credit and debit cards is a big decision that can cost you time and money. It’s important that you know exactly what you’re signing up for.

What are merchant services?

Merchant services encompass the hardware, software, services and financial relationships that businesses need in order to accept and process card payments. Many types of entities in Australia are authorised to be merchant services providers, also known as merchant account providers, credit card processors, acquirers, acquiring banks or processors.

What is a merchant account?

A merchant account – aka merchant services account – establishes a business relationship with a merchant services provider, like a bank, and enables a business to accept debit and credit cards, Apple Pay, Google Pay and other contactless payments, eCommerce transactions and more.

What you can expect from merchant services.

Card payments

Enables you to start taking card payments online, in person and on the go.

Hardware

Payments hardware to help you quickly ring up items.

Software

Software that makes it easier to keep track of and process payments.

Bank transfers

Ability to transfer money to a bank account to give you fast access to the money you make.

Security

Ensure your business is PCI compliant and help protect it against fraud and payment disputes.

How Square supports every part of your business.

Clear and consistent pricing

What you see is what you get with Square. That means no hidden fees or surprises. One low rate for every contactless or chip and PIN payment (per hardware/software plan). That’s it.

No long-term contracts

With Square, you don’t have to worry about getting locked into long-term commitments or costly contracts.

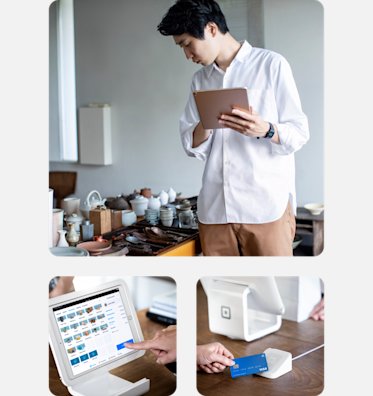

POS software

Get started for free with our range of POS software to suit every business. They work with your phone or tablet and seamlessly integrate with our range of hardware options.

Affordable hardware

Square’s hardware is reasonably priced and works for businesses of all kinds. Plus, there are no maintenance fees or hardware rental fees to worry about.

Dedicated Square support

Phone support from our Australian-based team is available from 9 am to 5 pm AET. Alternatively, email us 24/7 or message us via online chat. You can also connect with other sellers in our Seller Community.

Get started right away

See how easy it is to get set up with Square. It only takes a few minutes to get up and running.

Built-in security

From fraud protection to dispute management to making sure your business is PCI compliant, Square provides tools and services that are built to protect your business.

Everything you need to start taking card payments.

Software designed for every type of business.

Take care of your entire business with Square’s software. Our tools are built for desktop, tablet and mobile, so you can run your business anyway you want.

Hardware to push your business further.

No matter where you’re selling, Square has just the hardware you need to ring up items and accept payments fast. And there are no hidden fees or hardware rental fees to worry about.

Square Register

Get an all-in-one POS register that lets you start selling right out of the box.

Square Terminal

Take payments, print receipts and run your business with a powerful and portable payment terminal.

Square Stand

Turn your iPad into a point of sale and take every kind of payment.

Square Reader

Take contactless payments anywhere with a reader that pairs directly with your device.

Custom pricing for your business.

If you’re processing more than $250,000 every year, we may be able to design custom pricing packages for your business. Custom pricing will vary depending on your processing volume, average ticket size, your history as a Square seller and many other factors.

FAQs

A merchant facility is a broad term that describes the hardware, software, services and financial relationships needed for businesses to accept and process credit or debit card payments from their customers.

You’ll need a dedicated bank account in order for Square to transfer your Square Balance, so you can spend your well earned money.

Switching is easier than you think. You can sign up for free in minutes and be ready to start taking payments. If you need extra help, our Customer Success team is available Monday-Friday, 9 a.m. to 5 p.m. AEST.

Square pricing is simple and transparent. You’ll pay 1.6% every time a customer taps or inserts their card in person and 2.2% per transaction for any online payments or where you manually enter customer details. That’s it. There are no additional fees.

With Square merchant services you can accept credit cards, debit cards, EFTPOS or mobile payments through our payment gateway for both in-person and online or card-not-present payments.

1.6% card present rate applies for Square Sellers who sign up on or after 30 May 2024. The rate of 1.9% will apply for Square Sellers who signed up prior to this date when using Square Reader, Square Stand or Tap to Pay, as listed in the Square Fee Schedule.