Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square Payments Built for however you do business

Flexible, reliable payment methods

Secure, compliant processing

Instant access to sales revenue 24/7 for a small fee¹

No lock-in contracts required, no hidden fees

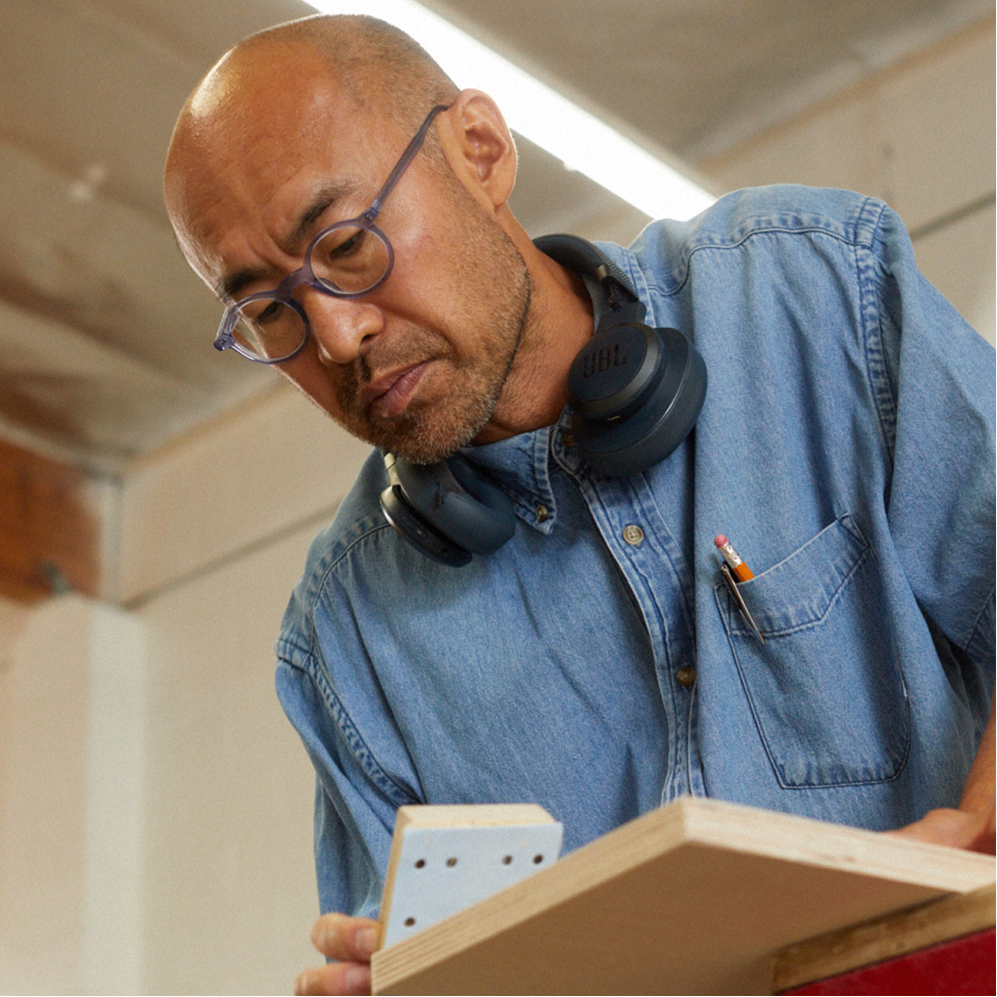

Accept payments anywhere

In person

Take payments at your counter or on the go with a range of hardware options that fits your business needs.

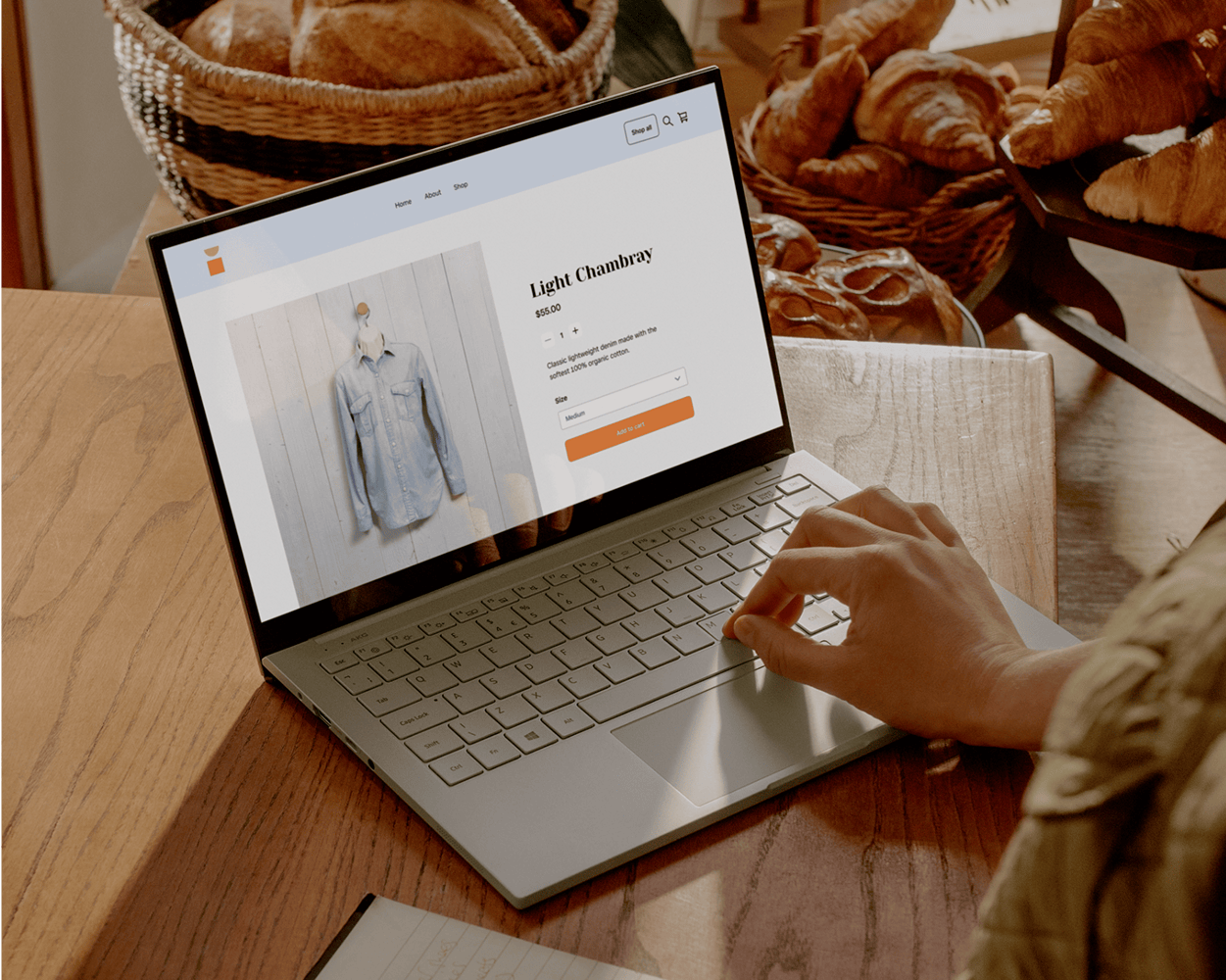

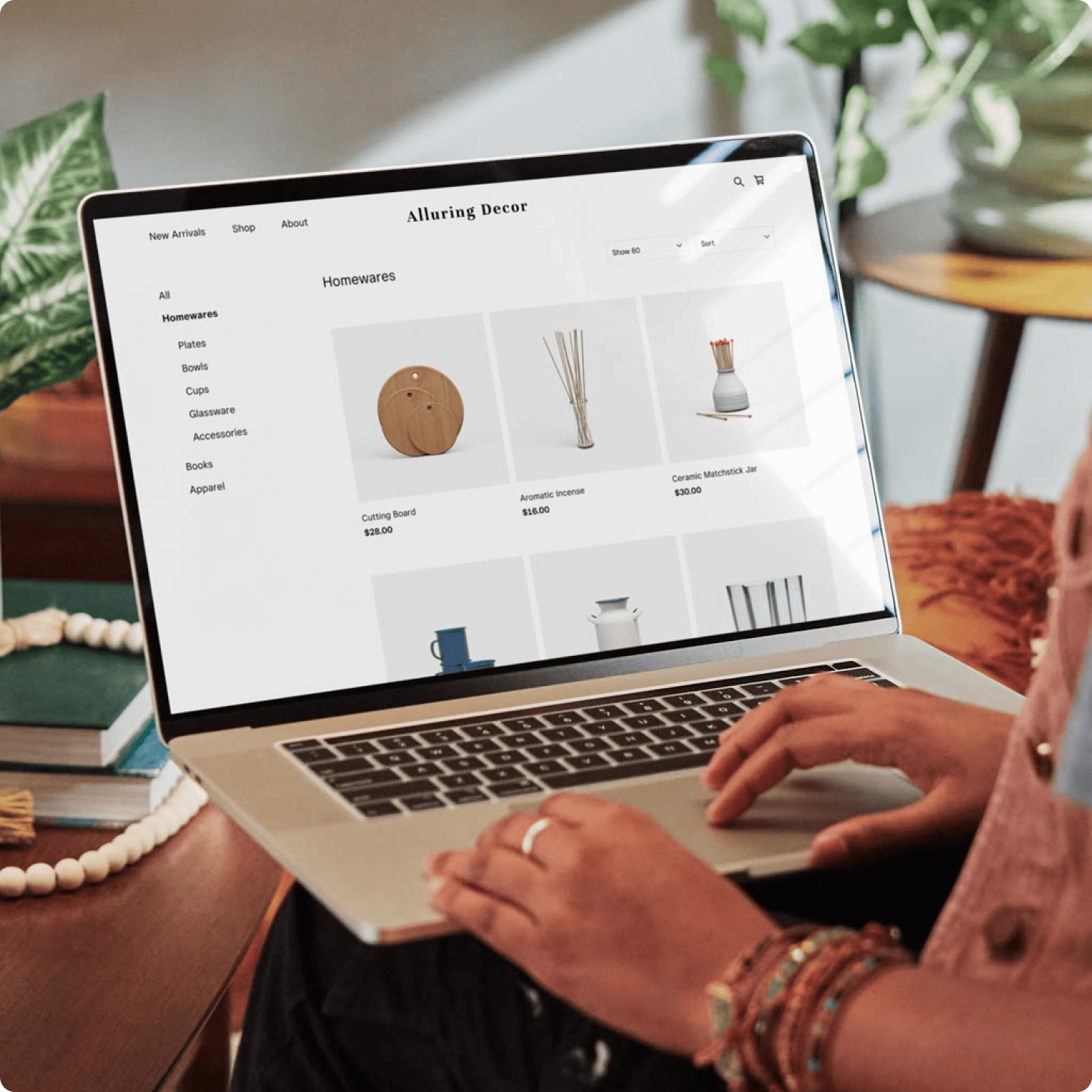

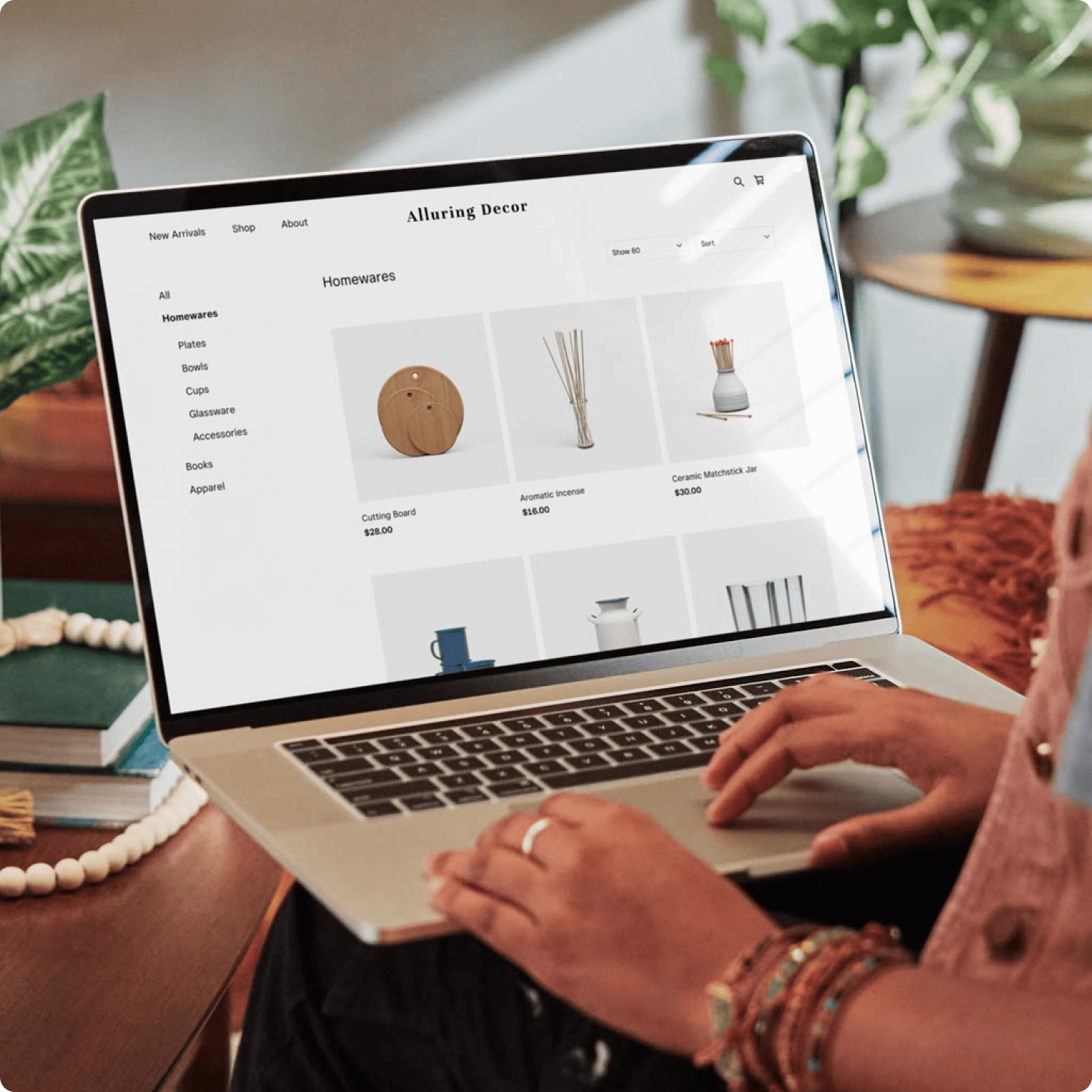

Online

Set up a free online store or send payment links. You can also connect your current online store or app to one of our secure payment APIs.

Remote

Take over-the-phone payments just as easily by keying in credit cards online with Square Virtual Terminal or with the Square app. Send invoices customers can pay with a credit card.

Buy now, pay later

Let customers pay over time with Afterpay. You get paid in full immediately, and they pay in four interest-free instalments.2

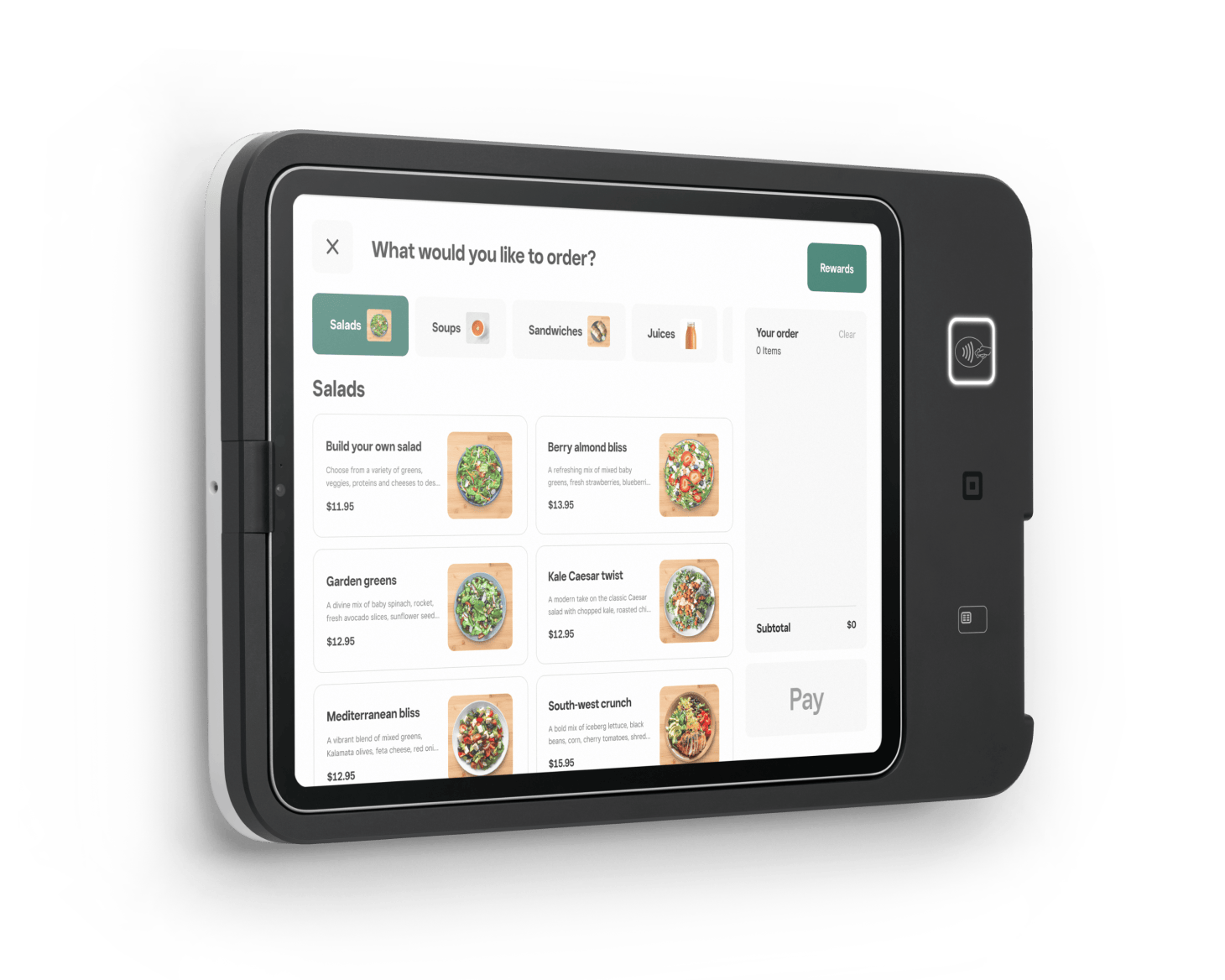

Slick hardware makes checkout a breeze

Take contactless payments with just your phone

Peace of mind in every payment

Accept payments offline

Keep making sales even when you lose service or internet connection. We’ll store your offline payments and receipts for 24 hours.⁵

Move money fast

Transfer funds to an external bank account for free the next day or instantly for a fee.1

Make smarter business decisions

Get immediate business insights and detailed reporting to know where to invest your time and money.

Keep transactions secure

Fraud protection, data security, dispute management and PCI compliance are built right in.

Recover costs with automatic surcharges6

Pass on in-person card processing fees to your customers with surcharges added to every EFTPOS transaction. And offset staffing costs on weekends and public holidays with surcharges applied automatically on the days of your choosing.

Get faster access to funds for your next move

Serving complex businesses at scale

‘When it comes to using Square, it’s one of those things that the more you familiarise yourself with it, the more you realise there’s a lot of information that you can actually extract from it. … To me, it’s the pulse of the business.’

Nicolas Pestalozzi

co-owner

FISHBOWL

‘I was very impressed with how user-friendly the system was. One standout tool is the live reporting, which allows us to control our business in real time and monitor every single aspect of it on the go.’

Alejandro Saravia

Executive Chef

Farmer’s Daughters

‘Square is obviously a lot more streamlined, a lot faster, a lot easier for multiple staff to use. Having multiple businesses of multiple sizes doing various offerings, Square just worked.’

Bridget Amor

co-owner

Blue Bottle Coffee

‘The wonderful thing about Square is I can launch a product, wake up in the morning and I can pull out my phone and get a snapshot of sales for all the stores and what percentage of sales are from the new product.’

Matt Longwell

Product Manager Coffee & Equipment

Blue Bottle Coffee

‘Square allowed us to build a solution that was very much tailor-made for SoFi Stadium. You walk up to the Square Terminal, and it’s immediately familiar to the customer. It’s efficient, fast and reliable as well.’

Skarpi Hedinsson

Former CTO of SoFi Stadium & Hollywood Park

SoFi Stadium

Know what rates you’ll pay

In-person

1.6%

per transaction

Contactless payments

Mobile payments

Chip + PIN payments

Online

2.2%

per transaction

Square Online payments

Online API payments

Invoices

Remote

2.2%

per transaction

Keyed-in transactions

Card on File

Square Virtual Terminal payments

Buy now, pay later

6% + 30 cents

per transaction (excl. GST)2

Afterpay in-person payments

Afterpay online payments

Afterpay remote payments

Get custom pricing

If you process over $250,000 per year, our team may be able to create a custom pricing package for your business.

Quick reads to get you going

FAQs

How do I start taking payments with Square?

It’s easy to sign up for Square and start taking payments quickly, or you can contact sales for help getting started. We offer a range of hardware options for in-person payments. Square Payments works for all kinds of business types and sizes, with tailored solutions for each.

Does Square have processing fees?

Yes. Standard processing rates will apply to each transaction but vary depending on the payment method.

Are Square payments secure?

Yes. Security features are built into every Square payment. Square also follows industry requirements to monitor your account for suspicious activity and supports PCI compliance. Every Square payment includes:

Dispute management

Active fraud prevention

End-to-end encrypted payments

Live phone support

PCI compliance

What is a payment processor?

A payment processor is a tool that allows merchants to accept card payments and transfer funds successfully. It manages the end-to-end transaction between a merchant, card network and bank in order to complete a fund transfer.

How do Tap to Pay on iPhone and Tap to Pay on Android work?

Tap to Pay on iPhone and Tap to Pay on Android let you take payments directly on your phone, with no additional hardware necessary. At checkout, select Tap to Pay and have your customer tap their card or contactless payment to complete the transaction.

Which debit and credit card brands are accepted?

Square works with any Australian-issued and most international chip or swipe cards with a Visa, Mastercard or American Express logo, as well as bank-issued EFTPOS chip cards.7

When are bank transfers sent?

We offer a couple of options based on your needs. You can choose a standard option to get paid as fast as the next day automatically, manually at a time that suits you or instantly for a fee1.

Which devices work with Square?

The Square Reader is compatible with most Apple devices running iOS 14.0 and above, and Android devices running version 7.0 and above.

Does Square have payment solutions for large businesses?

Square Payments solutions are here to support businesses at any scale. Our payments platform offers a range of in-person and online payments APIs and SDKs so you can accept payments from your eCommerce site, mobile app, custom point of sale and more. Get in touch with our sales team to get started.

Try Square

1Requires a linked, eligible bank account and cost a fee per transfer. Funds are subject to your bank’s availability schedule. Up to $5,000 AUD per day. The minimum you can transfer is $5.

2Late fees, eligibility criteria and T&Cs apply. Afterpay Australia Pty Ltd Australian Credit Licence 527911.

3Tap to Pay on iPhone requires a supported payment app and the latest version of iOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install. Some contactless cards may not be accepted by your payment app. Transaction limits may apply. Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Tap to Pay on iPhone is not available in all markets. For Tap to Pay on iPhone countries and regions, see: https://developer.apple.com/tap-to-pay/regions/.

4Android is a trademark of Google LLC. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC.

5You can process transactions through offline payments for up to 24 hours in a single offline session. Your offline payments will be declined if you do not reconnect to the internet within 24 hours of the start of your first payment. By enabling offline payments, you are responsible for any expired, declined or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. eftpos-only cards, Square Gift Cards and Afterpay transactions do not work with offline payments. Offline payments are not supported on older versions of Square Reader (1st generation – v1 and v2). Learn more on [identifying your contactless reader] or how to [enable and use offline payments].

6Limitations apply. Surcharging available on Square Point of Sale, Square for Restaurants, Square for Retail and Square Appointments. Surcharge must not be higher than your cost of acceptance. Weekend and public holiday surcharges must comply with ACCC guidelines and applicable law. See our Payment Terms for more details.

7American Express is not supported for not-for-profits or charities unless registered with the Australian Charities and Not-for-profits Commission.

Square AU Pty Ltd ABN 38 167 106 176, AFSL 513929. Square’s AFSL applies to some of Square AU’s products and services but not others. Please read and consider the relevant Terms of Service, Financial Services Guide and PDS before using Square’s products and services to consider if they are right for you.