Payment processing for taking and making money

Take payments with technology built for a smooth, secure transaction, whether it’s your first or your thousandth.

Make more than $250K in annual revenue?

See if you’re eligible for custom pricing ->

Accept major payment methods.

Move faster with payments made for the busiest days

Set up a payment system with the features you need. Square has a flat rate, with no hidden fees or lock-in contracts.

Instant Transfers

Move money to your external bank account instantly for a 1.5% fee.¹ You can also transfer money for free. Standard transfers arrive in your bank account the next day.

Recoup costs with automatic surcharges

Pass on in-person card processing fees to your customers with surcharges added to every EFTPOS transaction. And offset staffing costs on weekends and public holidays with surcharges applied automatically on the days of your choosing.3

Offline Payments

Internet down? Take card payments when your service is temporarily unavailable. Offline payments are processed automatically when you reconnect within 24 hours.2

Tap to Pay

Accept contactless cards and digital wallets in person and on the go with just your phone. No additional hardware required.

Serve customers however they want to pay

Serve customers however they want to pay

In person

Accept payments at your counter or on the go. It’s easy to get started. Try the Square POS app on your phone or pick from a range of hardworking hardware.

Learn more →Accept

Contactless payments

Mobile payments

Chip + PIN payments

Buy now, pay later payments4

Processing Fee

1.6% per tap or insert

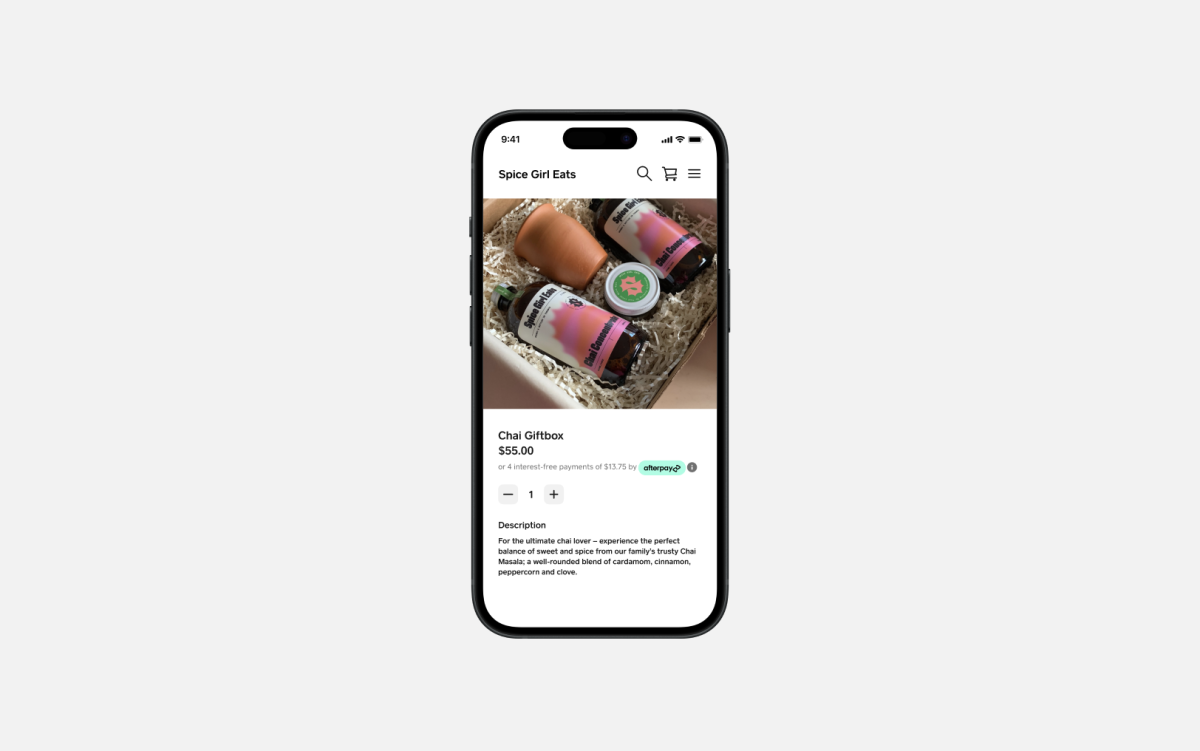

Online

Take payments online. Let customers buy now, pay later with Afterpay. Set up a free online store or sell through social media. You can also connect your current online store or app to one of our secure and trusted payment APIs.5

Learn more →Accept

Online payments

Square Online Checkout payment links

API and SDK payments

Buy now, pay later payments4

Invoices

Processing Fee

2.2% per online transaction

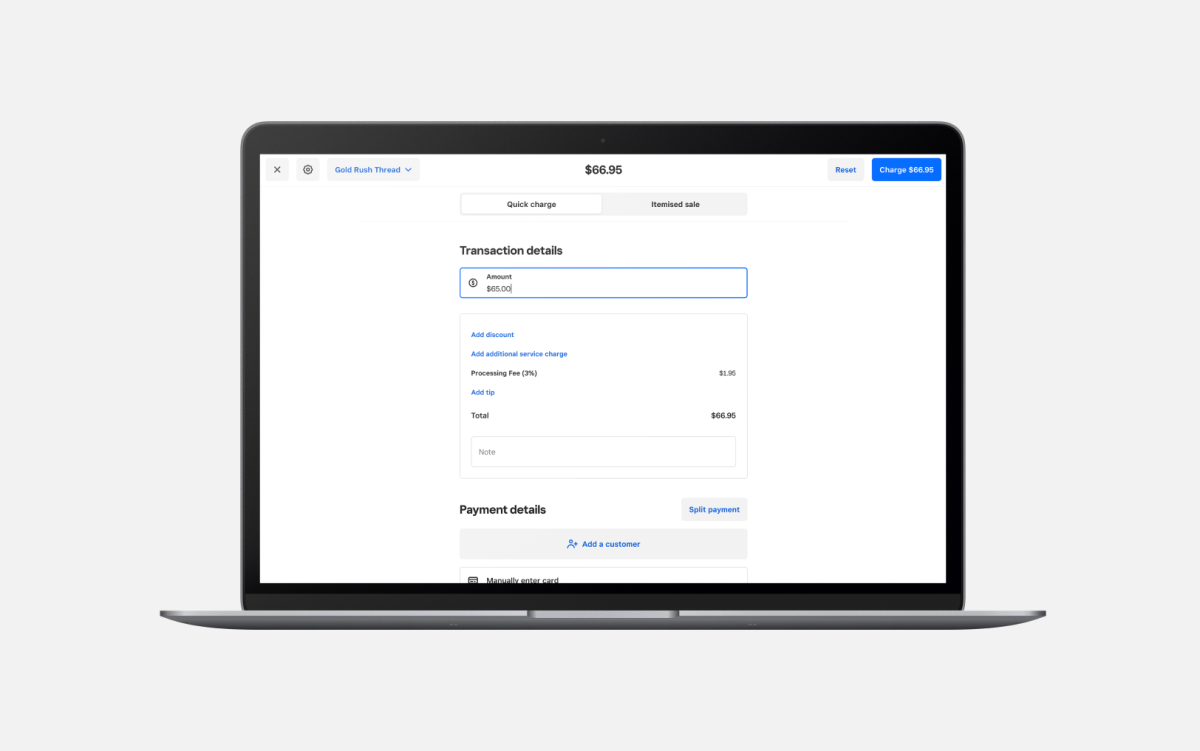

Remote

Make paying even more convenient for your customers. Accept credit card payments over the phone using Square Dashboard as a virtual point-of-sale terminal. Send an invoice or key in a payment manually with the Square POS app. Start taking payments fast.

Accept

Keyed-in transactions

Dashboard payments

Card on File

Invoices

Processing Fee

2.2% per transaction

Every payment you take comes with protection

Offer state-of-the-art payments at scale

With the Square Developer platform, you can connect Square payments to your custom business software for a centralised view of your data. You can also build your own payment experience using our APIs.

Integrate the software you depend on

Try one of our pre-built integrations for the software you already use, like Xero and QuickBooks.

Hear from businesses in growth mode

‘From the beginning, three years ago, Square has made it super easy for me to take payments up until this day.’

Amelia Jane Hextell, Owner, Milly The Space

‘Square helped us grow because we could have two terminals running at the same time. Our business multiplied by two.’

Juan Lozano and Elena Pastor, Owners, Tierra Bulk Foods

‘Square has fundamentally helped my business because it improved my cash flow dramatically.’

Alex Kelly, Owner, Skinny’s Garage

Transparent pricing means no surprises at the end of the month

There’s one rate per payment method. No hidden fees. With Square, you only pay for what you process.

Afterpay

6% + 30 cents

per Afterpay transaction (excl. GST)

Please note: Different pricing may apply with certain products and/or subscription plans.

1.6% card present rate applies for Square Sellers who sign up on or after 30 May 2024. The rate of 1.9% will apply for Square Sellers who signed up prior to this date when using Square Reader, Square Stand or Tap to Pay, as listed in the Square Fee Schedule.

Free services included in every transaction:

- Dispute management

- Active fraud prevention

- End-to-end encrypted payments

- Connected POS

- Live phone support

- PCI compliance

Payments built for every kind of business

Home and Repair

Get paid on time for your services. Send an invoice or take contactless payments in person. Do it while you’re in the field, online or in the office.

Learn more →SELLERS USE:

Market Stalls

Set up shop at weekly markets as well as big events. Take payments with Square hardware or just your phone. Do it all with speed and ease.

Learn more →SELLERS USE:

Food and Drink

Accept payments quickly, whether you’re tableside, behind the counter, online or on the phone. Enable orders for curbside pickup or delivery.

Learn more →Hair and Beauty

Keep a card on file to hold appointments, request a prepayment for services or charge cancellation fees. All your sales are integrated in your POS.

Learn more →SELLERS USE:

Retail

Cater to shoppers in person, online or on the go. Take returns at any time. Have peace of mind knowing your data is secure.

Learn more →SELLERS USE:

Professional Services

Request payments from your clients online with invoices or checkout links. Improve your client experience with data analytics.

Learn more →SELLERS USE:

Find the information you need to keep going

Getting started

Read articles and business guides to get the ball rolling.

Pricing and processing fees

Learn what makes Square pricing so transparent and predictable.

Security and risk

Explore the security measures we keep in place to protect your business and customers.

Scalable solutions

See the Square tools businesses turn to reach even bigger goals.

Find the information you need to keep building.

Read articles and business guides to get the ball rolling.

EFTPOS Solutions

A Guide to Business Loans

Tap to Pay on Android

The Benefits of SquareLearn what makes Square pricing so transparent and predictable.

Credit Card Processing

Processing Fees & Rates Explained

Payment Methods to Start Accepting

Touch-Free and Remote PayExplore the security measures we keep in place to protect your business and customers.

Secure Payments

PCI Compliance

Two-Factor Authentication

Business GlossarySee the Square tools businesses turn to reach even bigger goals.

Start taking card payments today

Get business insights by signing up for marketing from Square.

Subscribe to our email list to receive advice from other business owners, support articles, tips from industry experts, and more.

Nice to meet you

We think businesses are as unique as the people who run them. Get individualised content on the topics you care about most by telling us a little more about yourself.

FAQs

A payment processor is a tool that allows merchants to accept card payments and transfer funds successfully. It manages the end-to-end transaction between a merchant, credit card network and bank in order to complete a fund transfer.

A payment gateway enables online payments by verifying credit card information. A payment processor does the work of facilitating the transaction between a merchant, credit card company, and bank.

A merchant account establishes a relationship between a business and a merchant services provider, like a bank. This agreement allows a business to accept credit cards and debit cards, along with other forms of payment. Not all merchant services providers require a merchant account. All you need is a dedicated bank account to process payments with Square.

Once a customer’s card is tapped or inserted, the payment amount is sent to a payment processor. The payment processor sends that information to a card network like Visa or Mastercard. The card network then sends a request to the issuing bank, which approves or declines a transaction. The approval or denial is sent to the payment processor, which relays the message to the merchant.

When you take a payment with Square, we only keep a fraction of the fee – so you can put more of your money right back into your business.

Square works with any Australian-issued and most international chip or swipe cards with a Visa, Mastercard or American Express logo, as well as bank-issued EFTPOS chip cards.

We offer a couple of options based on your needs. You can choose a standard option to get paid as fast as the next day automatically or manually at a time that suits you.

The Square Reader is compatible with most Apple devices running iOS 14.0 and above, and Android devices running version 7.0 and above.

Android is a trademark of Google LLC. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC.

1 Instant transfers available for a small fee. Requires a linked, eligible bank account and cost a fee per transfer. Funds are subject to your bank’s availability schedule. Up to $5,000 AUD per day. The minimum you can transfer is $5.

2 For Square Reader and Square Stand, you can process transactions through offline payments for up to one hour in a single offline session and will be declined if you do not reconnect to the internet within 24 hours of the start of your offline payment session. For Square Terminal and Square Register, offline payments will be declined if you do not reconnect to the internet within 24 hours of taking your first offline payment. By enabling offline payments, you are responsible for any expired, declined, or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. eftpos-only cards, Square Gift Cards and Afterpay transactions do not work with offline payments.

3 Limitations apply. Surcharging available on SPOS, Restaurants and Retail. Surcharge must not be higher than your cost of acceptance. See our Payment Terms for more details.

4 Late fees may apply. Eligibility criteria apply. See afterpay.com for complete Afterpay terms.

5 Square AU Pty Ltd ABN 38 167 106 176, AFSL 513929. Square’s AFSL applies to some of Square AU’s products and services but not others. Please read and consider the relevant T & C’s, Financial Services Guide and PDS before using Square’s products and services to consider if they are right for you.

*Instant transfers require a linked debit card and cost a fee per transfer. Only physical Canadian debit cards with Visa Debit or PLUS network support can be linked to a Square account at this time. Funds are subject to your bank’s availability schedule, but are generally available in your bank account within 20 minutes of initiating an instant transfer. Minimum amount is $25 CAD and maximum is $5,000 CAD in a single transfer. New Square sellers may be limited to one instant transfer per day of up to $500 CAD.