Table of contents

Technology has created an enabling environment for an increasing number of people to take their careers into their hands by freelancing. Interestingly, freelancing in Australia isn’t new; in recent years, it has surged as more people seek to leave restrictive 9-5 jobs in favour of greater flexibility and autonomy.

While working for yourself can be rewarding, exciting, fun and liberating. The payment aspect of freelancing still poses a challenge to people without experience. And there is no doubt that you want to get paid after delivering excellently on a project.

How can I get paid as a freelancer? What payment options are available? We’ll delve into that below.

Ways to get paid as a freelancer

Let’s start by discussing the many ways to get paid as a freelancer, it’s essential to examine the what and why. A freelancer doesn’t work for any employer, but instead provides specific professional services to many different businesses. Therefore, as a freelance worker, you are responsible for managing your own income and taxes.

So, if you plan on freelancing in Australia, or you’re doing it already, you will need to figure out how to receive payment for freelance work promptly and without any hassle. Let’s dive into the how.

1. In-person credit card payments

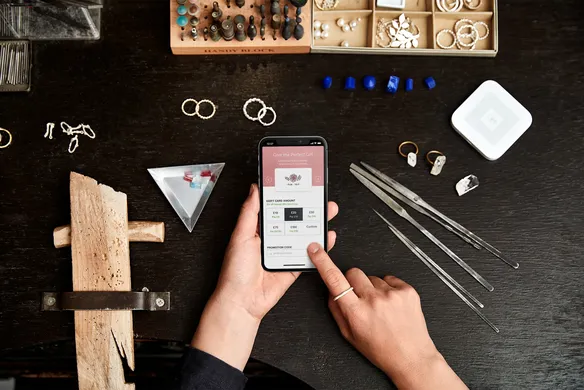

With Square Reader and Square Terminal, you can connect wirelessly with your computer to accept credit card payment over the internet for in-person transactions.

2. Virtual Terminal

Square Terminal gives you an easy checkout experience that makes your payment easy. So, whether the client wants to tap, dip or swipe with a card, use Apple Pay, or Google Pay, you can get paid instantly.

3. Online payment solution

An online payment solution is a great choice when you need to get paid by a client outside Australia or in a different currency. Square Checkout;

- Is fast and easy to use

- Allows you to use various payment options, either payment links, buy buttons, or QR codes.

- Your clients don’t need an account or particular app to pay.

4. Sending invoices

Have you done multiple jobs for a client over a stipulated period? It would help if you had an invoice to itemise and record the details of the transaction. Invoices include the total that the client must pay. Unfortunately, creating and managing invoices can be challenging, especially when dealing with many clients as a freelancer.

Fortunately, Square Invoices provides you with an automated process to create, design, and track cash flow at a glance. You can learn how to create invoices easily here.

5. Website payment gateway

A website payment gateway is an online payment service devised as a channel to make and receive payments when integrated with freelance platforms. Because the process to receive your payment involves inputting your credit/debit card details to receive freelancer payment, you must use a payment gateway that is secured and trusted.

Happily, Square Online is a great way. Simply:

- Setup an eCommerce website that highlights your freelance skills

- Take orders online

- Receive payment fast

6. Mobile payments

Freelancer payments can be received through mobile payments, using mobile applications to receive payments into your bank account directly. Sadly, transfer fees on mobile payments can be high and can take as long as five working days to process, especially if you’re getting paid by a client who isn’t in Australia.

Joyfully, there is a better way; getting paid faster with Square POS:

- Download the Square POS application on your phone

- Enter your credit card details

- Get paid directly to the bank account connected to your credit card.

7. Bank transfer

An electronic payment method enables clients to send money directly from their bank to their account. But there are pros and cons to this payment method.

Pros

- It is safe and cheap.

- If the client is in Australia, it is easy to walk into the bank to make the transfer.

- Security isn’t a significant concern as there is no need to disclose financial details.

- If the client does a walk-in to make the payment, you will get paid on the same day.

- It is convenient

Cons

- The fee for bank transfers is high.

- There’s a high possibility of a client not making payment after the completion of the project.

- There can be a delay in payment as it takes 3-5 working days to process payments made outside Australia.

8. Cash payments

The direct receiving of payment in bills or coins on completion of a job. It is the immediate payment in cash for your freelance service. There are pros and cons to this manner of payment.

Pros

- It is fast and direct

- There is no deposit fee

Cons

- No proper transactional record makes it challenging to track your cash flow.

- It is unsafe

Pro tips for getting paid as a freelancer

Freelancing can be exciting, doing what you love conveniently and sometimes dictating the pace you want to work. As beautiful as this may be, you must take the steps to ensure that you are paid as a freelancer. Here are a few tips

- Ensure you enter a formal agreement with a client: Negotiate the rate for the project with the client, the scope, parameters, deadlines, revisions, and reimbursement. A contract also protects you from potential legal issues, disagreements and ensures you are paid for your work.

- Use technology and tools: There is technology and tools available to freelancers.

- Be an expert in your niche: Learning is a continuous process, and you can increase your income and meet new clients by becoming specialised in your skills.

- Manage your time: Freelancing can sound simple, but it isn’t as easy as it seems. That is why it is essential to plan yourself and stick to your schedule. You can manage your schedule by:

- Create work/life balance

- Always meet deadlines

- Maintain good relationships with clients

- Get the low-down on taxes: In Australia, you are under obligation to pay taxes as a freelancer if your income exceeds $4,000 per year. Therefore, you should set your prices to cover your tax obligations.

Getting paid as a freelancer doesn’t have to be troubling and unsecured. If you make the most of Square’s intelligent tools, you won’t have to worry about how to get paid as a freelancer while saving time and resources.

![]()