Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Invoices Manage your services with an all-in-one invoicing software

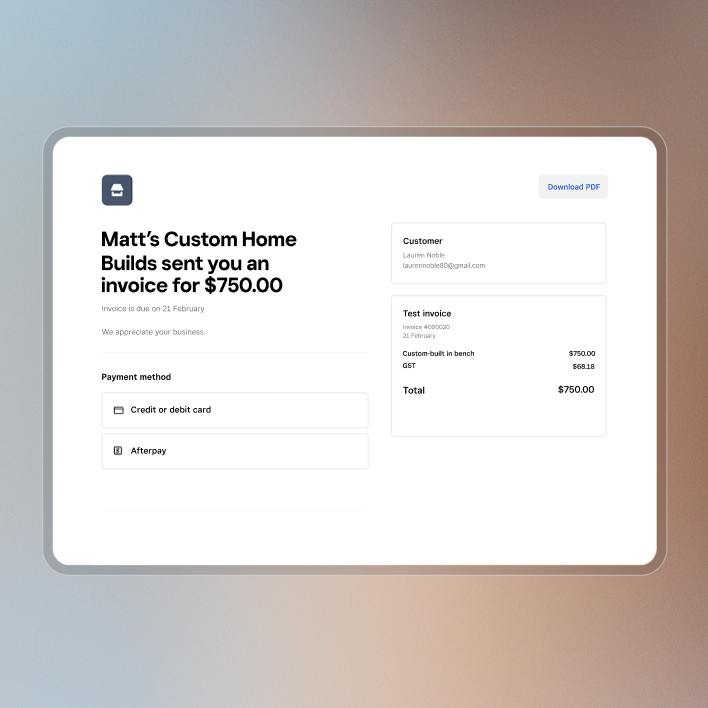

Give customers more ways to pay

Offer multiple ways to accept payments, whether it’s by card, Apple Pay, Google Pay or Afterpay1 – in person or online.

Take in-person transactions and issue refunds

Accept card payments in person and give refunds from your online Dashboard or from the Square POS app.

Get paid remotely

Send digital invoices in seconds via email, text message or a shareable link so you can get paid fast by your customers.

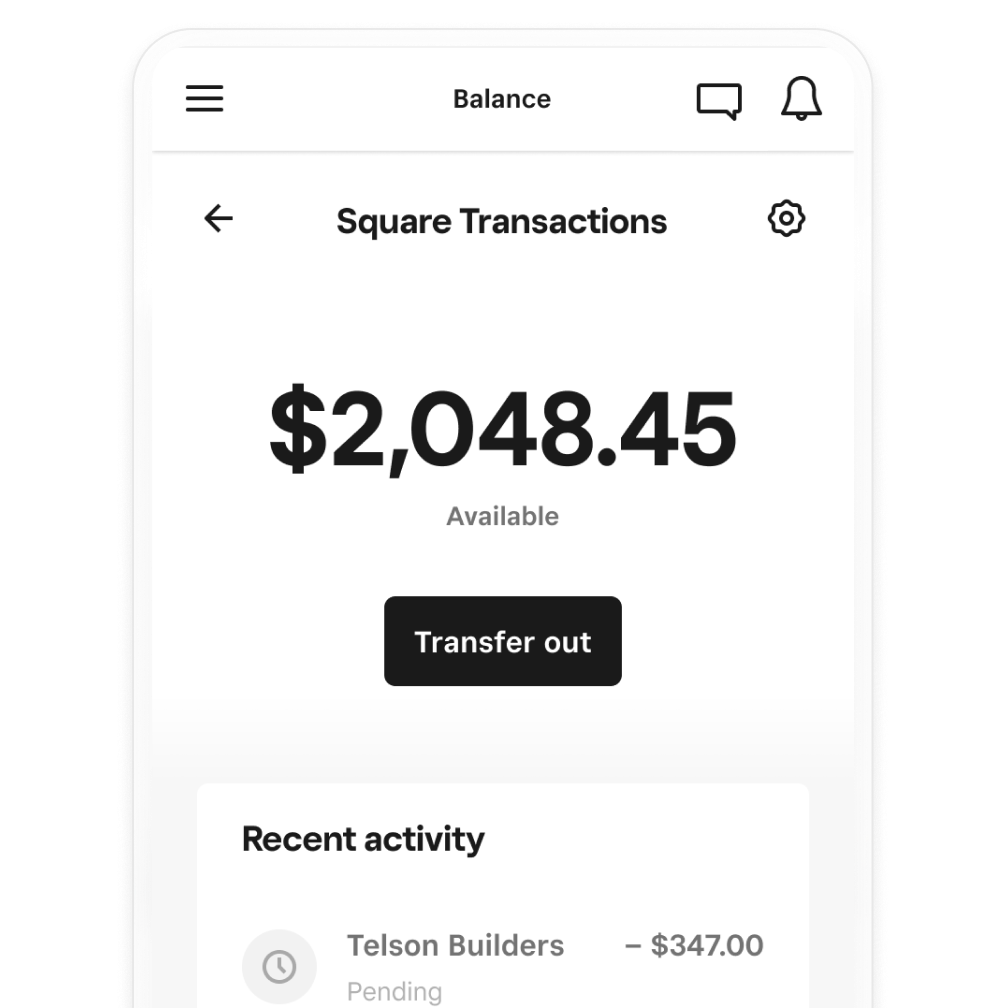

Access your funds fast

Transfer funds to your external bank account the next day for free – or instantly for a fee.2

Keep customer cards on file

Save customer payment cards to your customer directory, automate your billing for any invoice and get paid sooner.

Create automated discounts and taxes

Set taxes and discounts that apply to invoices automatically when you add items or services.

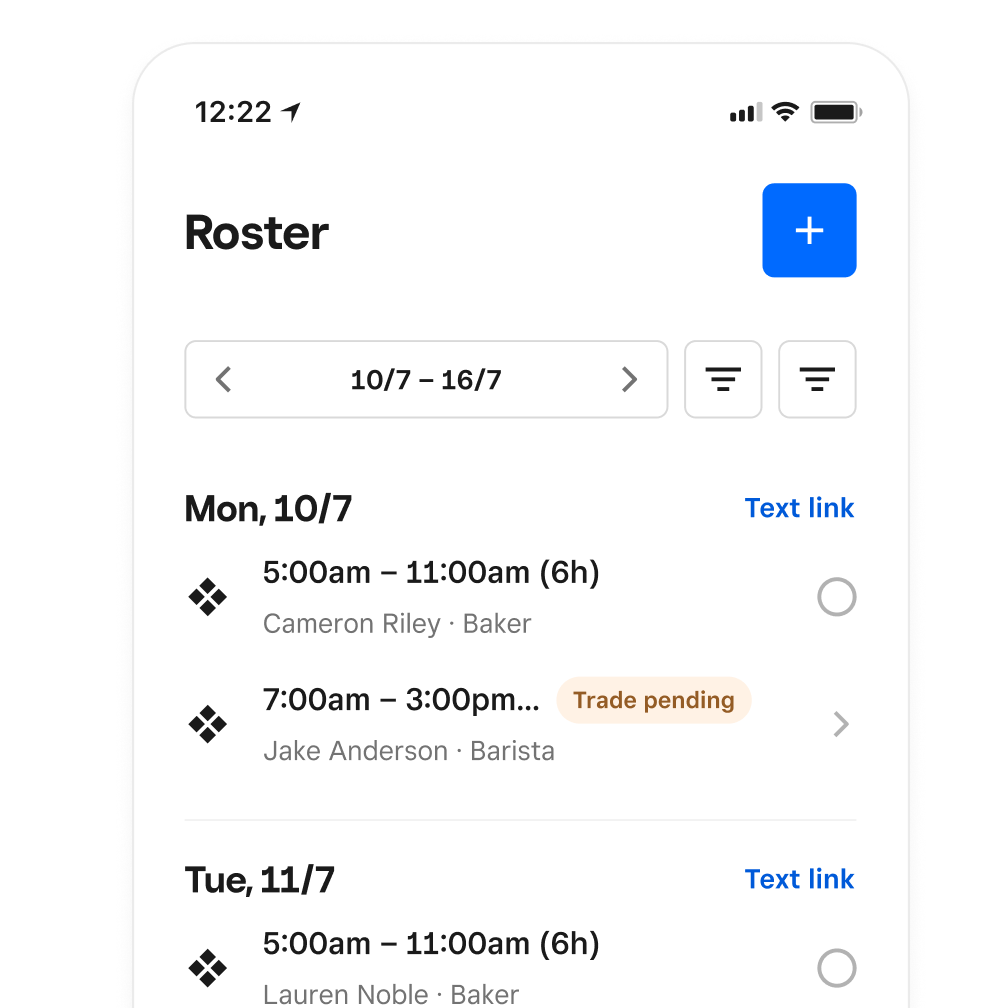

Manage your business from anywhere

Send digital invoices and estimates, accept payments, send reminders and track which invoices are paid and unpaid.

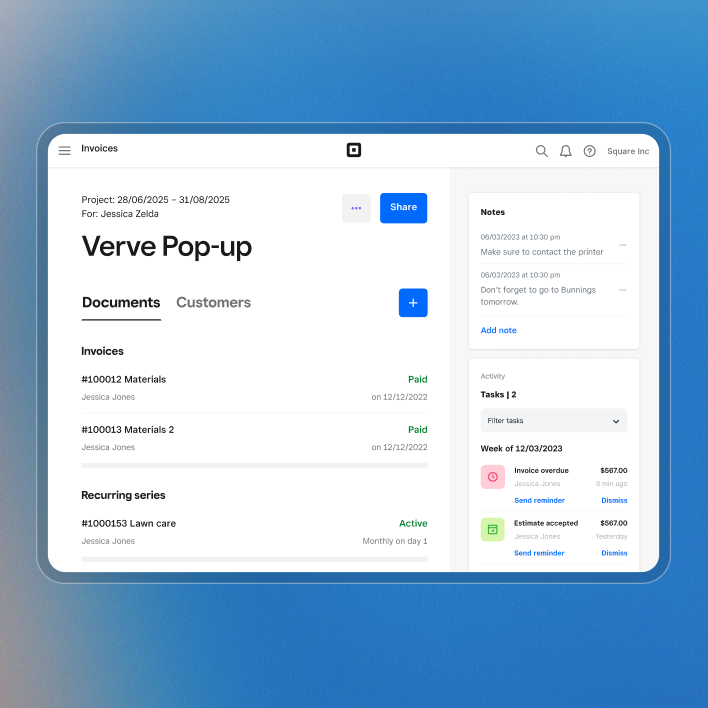

Keep your projects organised from start to finish

Track your project progress every step of the way – from invoice delivery and review to when they’re paid – all in real time.

Access everything from one place

See your full project pipeline at a glance. Keep projects organised, share details with customers and let them review and sign invoices, estimates and contracts.

Build packages that fit customers’ needs

Give your customers the flexibility to choose what suits them with unique packages of items and services.

Streamline your workflow with editable templates

Take advantage of editable and reusable contract templates – build clauses from scratch, use AI or adapt prebuilt clauses to fit your needs.

Secure commitments with e-signature

Protect your business and empower your customers with e-signature contracts they can sign from anywhere.

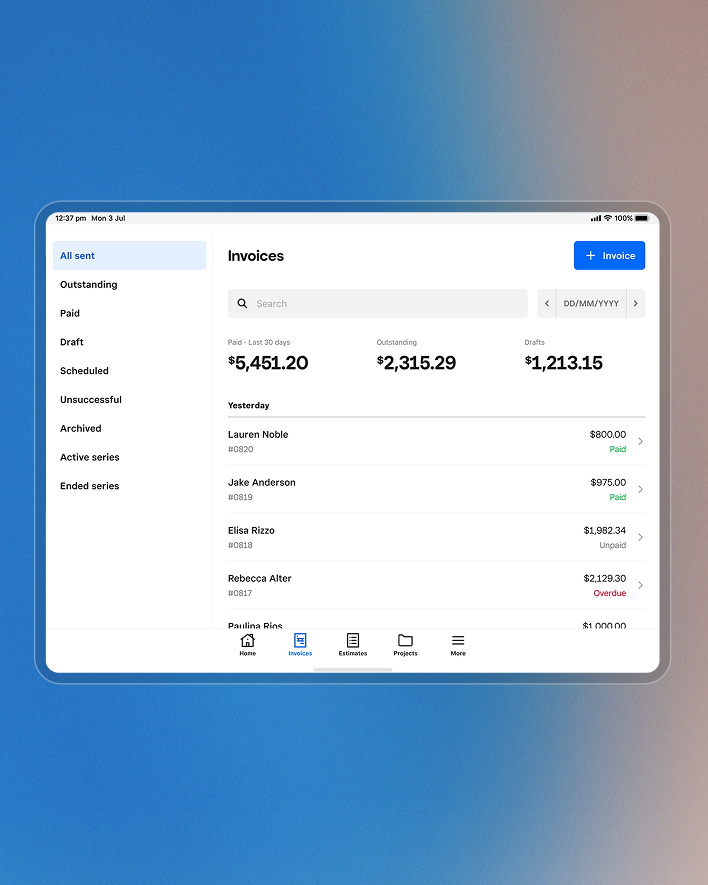

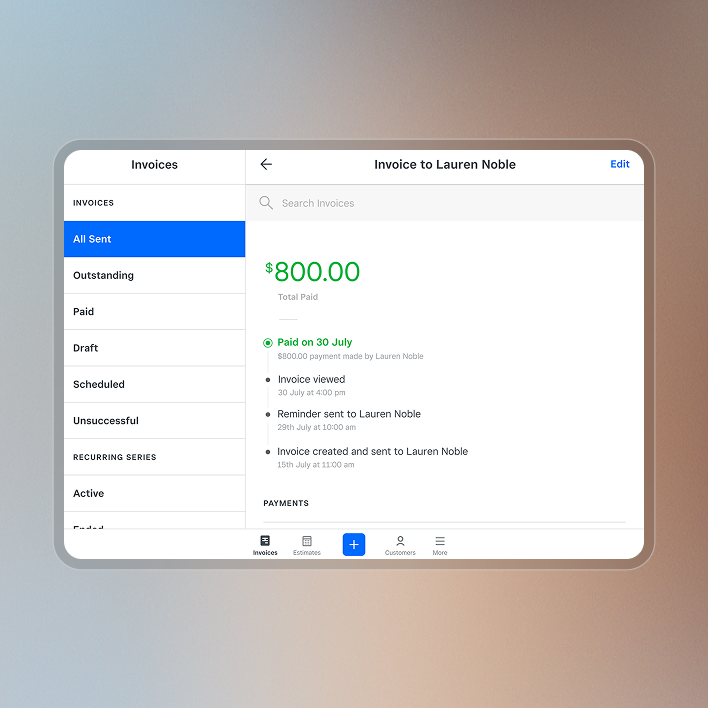

View your invoice status

Know the progress of your invoices at any time to track what’s paid, unpaid or overdue.

Make data-driven decisions

Master your cash flow with insights across locations, employees, items, services, estimates, invoices and payments to help make decisions.

Save time by automating your billing

End the hassle of tracking down payments with recurring billing and auto-reminders for upcoming or late payments.

Send deposit requests

Request a deposit to secure your customer’s commitment. Set a separate due date for the remaining balance easily.

Schedule recurring invoices

Set up recurring billing on a schedule that suits your business needs and customer preferences.

Set up automatic payment reminders

Reduce overdue invoices with automatic payment reminders sent before, on or after the due date.

Create flexible payment schedules

Schedule multiple payments for any job on a single invoice and base payments on specific milestones or phases.

Make billing easier

Simplify your billing with batch invoices by sending one invoice to multiple customers simultaneously.

Turn your estimates into invoices

Convert accepted estimates to invoices automatically and request payment from your customers instantly.

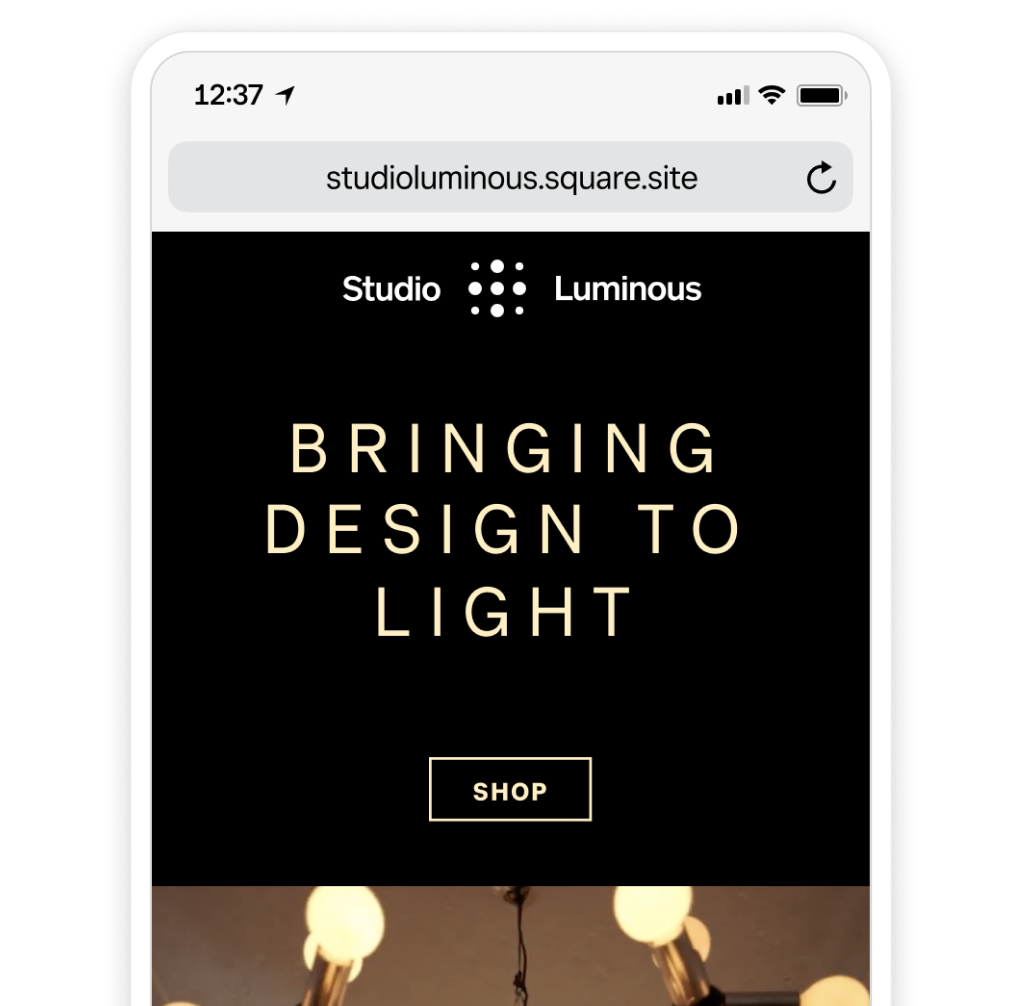

Make your business stand out

Offer professional estimates to clients. Secure business deals by sending contracts with the right context.

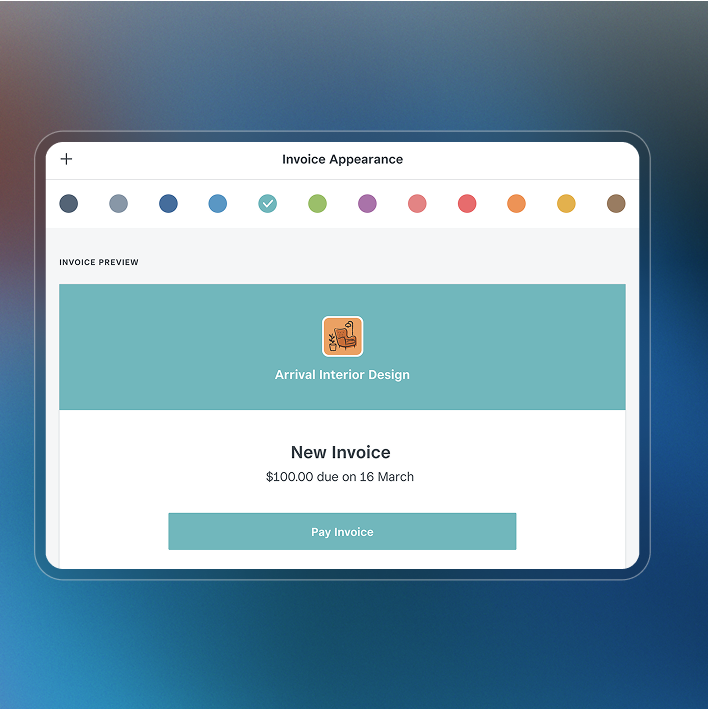

Brand your invoices

Customise your invoices with your business logo and a flexible colour scheme to match your brand colours for a professional touch.

Customise your layouts

Create invoices from various layouts and save multiple templates for future use to best fit your business needs.

Build trust with the right context

Tailor your invoices with custom fields – such as terms, policies and messages – to provide important context.

Create custom contract fields

Enhance your contracts with text fields or questions to capture important client information easily.

Plans for any stage

Free

Have what you need to get paid faster

$0/mo

Includes:

Unlimited invoices, estimates and contracts

Unlimited user accounts

Unlimited customers

Project tracking

Accessible from anywhere

Payment link sharing

24/7 payment acceptance

Plus

Most popular

Continue to grow your business with advanced, time-saving features to streamline work and billing

$30/mo

Includes:

Everything in the free plan

Milestone-based payment schedules

Multi-package estimates

Estimate to invoice conversion

Custom invoice templates

Custom fields for invoices and contracts

Batch invoices

Manage all sides of your business

Add hardware that works wherever you do

‘In our industry, sometimes when you’re in a rural area people think they have to pay cash, but being able to use Square allows us to have more flexibility on the payments side.’

Calvin Valdovinos

GDNC Nursery & Landscaping

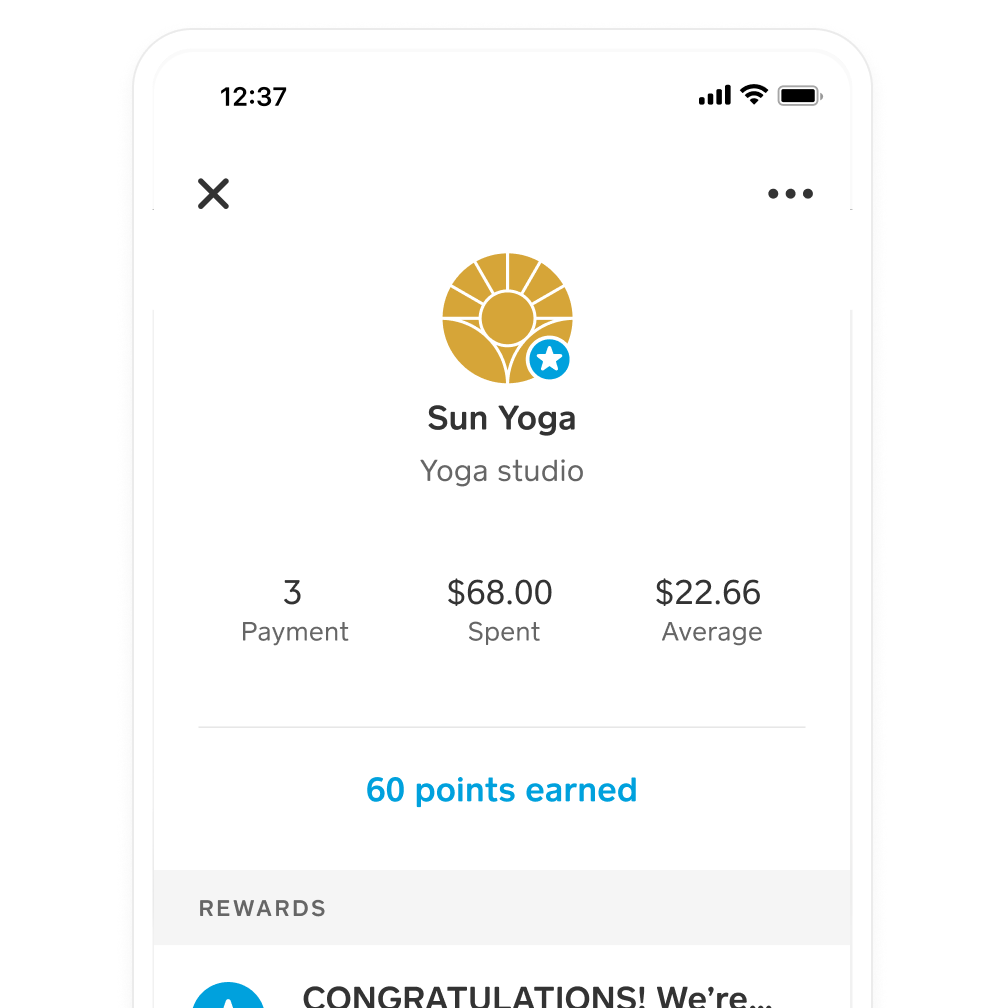

‘The Square Customer Profile tells us every time a customer comes into our shop, how much they’ve spent with us and if they qualify for free oil changes through our loyalty program.’

Brandon Cornelius

Costa Oil

‘Before we used Square Invoices, we used paper invoices for everything. With the Square Invoices technology, we are able to save 40 hours a week in billing that can be dedicated to serving our clients better.’

Anna

The Largo Group

FAQs

What is Square Invoices?

Square Invoices is a free, all-in-one invoicing software that helps businesses request, track and manage their invoices, estimates and payments from one place. Our easy-to-use software will help your business get paid faster by letting you request, accept and record any type of payment method.

What are the benefits of e-invoicing?

A manual invoice process, such as creating invoices on Microsoft Word or Microsoft Excel, can be time-consuming and difficult to manage. E-invoicing lets your business automate invoice processing and save time by tracking key invoice data like open invoices (also known as outstanding invoices). It also helps you manage late payments more efficiently with payment reminders you can send your customers before an invoice due date.

How can I send my customers an invoice?

You can create and send invoices in just a few clicks from anywhere at any time, whether it’s on your mobile device with the Square Point of Sale app or on any web browser from your desktop.

What methods of payment can my customers use?

You can accept all major payment methods: cards, cash, Afterpay and gift cards. Your customers can pay an online invoice through their computer, in person or from their mobile device with their credit card, Apple Pay or Google Pay.

How quickly can I access my funds?

You have the option of transferring your sales revenue daily for free or instantly for a fee.2

How can I automate my billing system?

Square comes with easy-to-understand billing features that help you create recurring invoices and save a card on file to set up auto-billing for any customer. You can also set up automatic reminders before, on or after a payment due date.

Can I send payment receipts?

Yes, you can send text or email receipts for every type of invoice, no matter the payment method. For recurring invoices, your customers will get a receipt for every payment from the first invoice to the final invoice.

Does your invoicing software offer integration to Xero or other accounting software?

Yes, Square offers integrations with the most popular accounting software providers, including Xero, MYOB and QuickBooks Online. With Square, you’re able to seamlessly import payments processed with Square to your accounting software for accurate record-keeping.

Does Square support multi-currency?

No, Square does not support multi-currency acceptance today.

How can I manage my customers better?

Square comes with a customer management system, Customer Directory, that helps your business store and manage contact information for your customers in one place. You can easily save key details like your customer’s business name, email address and phone number for any business invoice.

Does Square offer custom pricing for large businesses?

Yes. Businesses that process over AUD 250,000 per year in card payments may be eligible for custom processing rates and discounts on Square software and add-ons. To find out if your business qualifies, contact the Square Sales team.

Can Square scale with my growing business?

Yes. Square is designed to be flexible and grow with your business, whether you’re adding new locations, staff, products, or managing a loyal customer group. You can manage everything in one place with centralised management tools, synced inventory and unified reporting across all sides of your business.

Square also supports multi-location management, custom staff permissions and integrations with leading apps for accounting, marketing, reservations, eCommerce and fulfillment. This flexibility helps your business stay connected and efficient as it expands.

Get the job done with Square

1 Late fees, eligibility criteria and T&Cs apply. Afterpay Australia Pty Ltd Australian Credit Licence 527911.

2 Requires a linked, eligible bank account and cost a fee per transfer. Funds are subject to your bank’s availability schedule. Up to $5,000 AUD per day. The minimum you can transfer is $5.

3American Express is not supported for not-for-profits or charities unless registered with the Australian Charities and Not-for-profits Commission.