What is Virtual Terminal? Square Virtual Terminal turns your computer into a credit card terminal. It’s perfect for remote billing or taking credit cards over the phone.

The fast, secure, and smart

way to get paid

Sets up instantly

Start taking payments right away with your free Square account — no extra devices, no monthly fees.

Works where you do

Take payments from anywhere you can access your browser, process payments on the spot, and get paid instantly.

Grows with your business

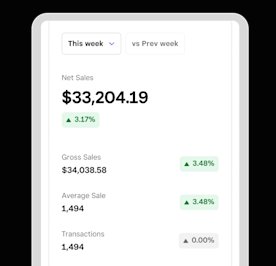

Manage your customers and items, get sales insights, and download reports — all in one place.

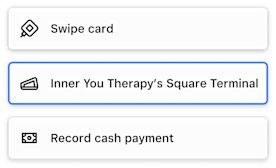

Three ways to take payments from your computer

Simplify your business with Square Virtual Terminal

Learn how real businesses reach their goals with Square

The CAPTERRA logo is a service mark of Gartner, Inc. and/or its affiliates and is used herein with permission. All rights reserved. Capterra reviews constitute the subjective opinions of individual end users based on their own experiences and do not represent the views of Capterra or its affiliates. Capterra reviews constitute the subjective opinions of individual end users based on their own experiences and do not represent the views of Capterra or its affiliates.

Why Square Virtual Terminal over others?

| Square Virtual Terminal | Other payment processors | Banks | |

|---|---|---|---|

| Monthly fee | $0 | $30 | $30+ |

| No commitments | NO MONTHLY CONTRACTS |

OFTEN REQUIRES CONTRACT |

REQUIRES CONTRACT |

| Sales reports and insights | FREE | PART OF MONTHLY FEE |

PART OF MONTHLY FEE |

| Customer engagement tools | FREE | PART OF MONTHLY FEE |

PART OF MONTHLY FEE |

Why Square Virtual Terminal over others?

| Square Virtual Terminal | |

|---|---|

| Monthly fee | $0 |

| No commitments | NO MONTHLY CONTRACTS |

| Sales reports and insights | FREE |

| Customer engagement tools | FREE |

Pricing

Monthly

$0

Processing rate

2.6% + 15 cents

per tap, dip, or swipe.

3.5% + 15 cents

per typed-in, card on file, or payment link transaction

Afterpay

Allow customers to shop now and pay later in four easy payments.

$0 monthly fee

6% + 30 cents per transaction

Get a custom rate

We can create custom pricing packages for some businesses that process more than $250K in card sales.

FAQ

Square Virtual Terminal is a free web-based payment processor that turns your laptop or computer into a virtual payment terminal. It lets businesses process credit and debit cards so you can get paid wherever your customers are. Square Virtual Terminal can also be used for remote payments via phone, mail, email, and text.

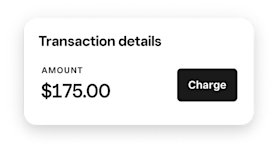

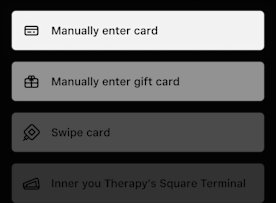

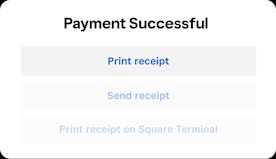

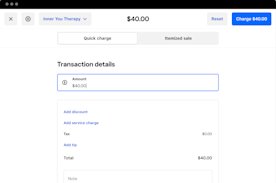

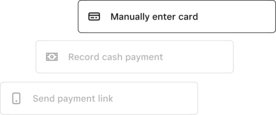

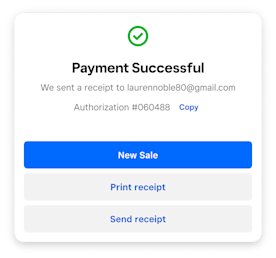

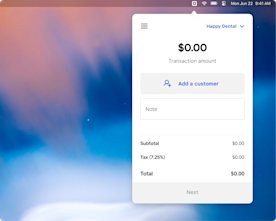

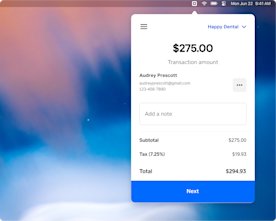

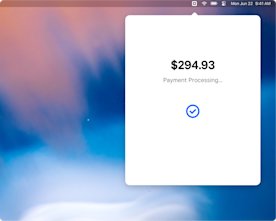

First, you need to sign up for your free account with Square. From your browser, access your Square Dashboard. Open Square Virtual Terminal from the left-side panel of your Dashboard, click Virtual Terminal, then Take a Payment. Enter the payment amount or add items from your item catalog, followed by the payment details. You can manually enter your customer’s card number, expiration date, and CVV (the three-digit number on the back of the card or the four-digit number on the front of American Express cards). Add a note for your customer or describe the purchase, then click Charge. You’re all set — your customer will receive a receipt in their inbox. You can also text or print a receipt to record your payment.

No, just your computer or laptop and access to the internet via a web browser. No additional devices or special equipment is required to start taking payments with Square Virtual Terminal.

A quick charge is when you want to enter just the amount of the transaction by keying in a custom amount. An itemized sale lets you add items from your item catalog. This is possible after setting up an item library for goods or services, which provides you with better insights into sales and gives your customers more detailed receipts.

Square Virtual Terminal is seamlessly integrated with the rest of your Square account. Many businesses like to use multiple payment options based on what their customers need, like using Square Invoices or Square Point of Sale with Square Virtual Terminal. This means your Customer Directory, item catalog, and reporting will all work together, no matter what payment method you choose.

You can accept credit and debit cards, Square Gift Cards, and record cash or check payments. And with payment links via text, your customers can use Afterpay and popular digital wallets like Cash App, Google Pay, and Apple Pay.

Both. Square Virtual Terminal works as a Mac POS system or a Windows POS system. Because it’s browser-based, it’s a digital POS that lets you offer credit card processing, regardless of your operating system.

Yes. If you’re eligible to accept Afterpay, you can send your customer a payment link. Payment links are a secure payment method customers can use to pay right from their mobile device using their debit or credit card, mobile wallets such as Apple Pay or Google Pay, or via Afterpay where available. Payment links take Afterpay payments in real time, even while you’re on the phone with the customer. The link will expire if you close the window or if the customer doesn’t pay as soon as the link has been opened.

Manually entered, keyed-in card transactions are a potentially higher risk than swiped transactions because the cardholder isn’t standing in front of the seller where an ID and signature can be checked. Therefore, credit card networks put measures in place to protect against this potentially higher risk of fraud, including charging Square higher fees.

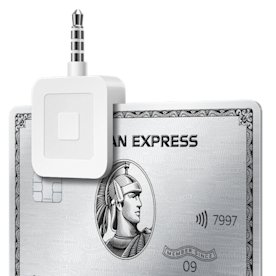

Yes, with Square Virtual Terminal, you can key in your customer’s card info while they’re at the counter or connect Square Terminal to enable tap, dip, and swipe payments while still operating from your computer. You can also connect Square Reader for magstripe to enable card swiping. Learn more about in-person payments with Square Virtual Terminal here.

Square Virtual Terminal has no monthly fee or commitments. You only pay the remote processing fee of 3.5% + 15¢ or 2.6% + 15¢ for in-person payments.

Square Virtual Terminal is built for all types of service and retail businesses, especially those that frequently take remote payments by phone, mail, email, or text or use credit card authorization forms.