Table of contents

Whether you’re a small business, sole trader or freelancer, getting paid on time is vital to keeping your cash flow healthy. A clear, professional invoice helps you get paid faster, maintain accurate sales records and meet tax requirements.

Below, you’ll explore several invoice examples for Australian businesses, what to include, what’s legally required, and where to download a free example of an invoice that you can customise for your own business.

What an invoice must include in Australia

In Australia, invoices need to meet specific requirements set by the Australian Taxation Office (ATO). These ensure your records are accurate and compliant.

Your invoice must include:

- The word ‘Invoice’ clearly shown at the top, or ‘Tax Invoice’ if you’re charging GST

- A unique invoice number

- Your business name and contact details

- Your Australian Business Number (ABN)

- Your buyer’s name or business details

- A description of the goods or services provided

- The date issued and the payment due date

- The amount charged and any GST applied

- Your payment terms and accepted payment methods

You need an ABN to legally operate and invoice as a business in Australia. It identifies your business to clients and government agencies and ensures the correct tax treatment of your payments.

If your business is registered for GST, your invoice becomes a tax invoice. You must issue one if a customer requests it or if the total sale is $82.50+ (including GST).

If your tax invoice totals $1,000+ (including GST), you need to include the buyer’s identity or ABN.

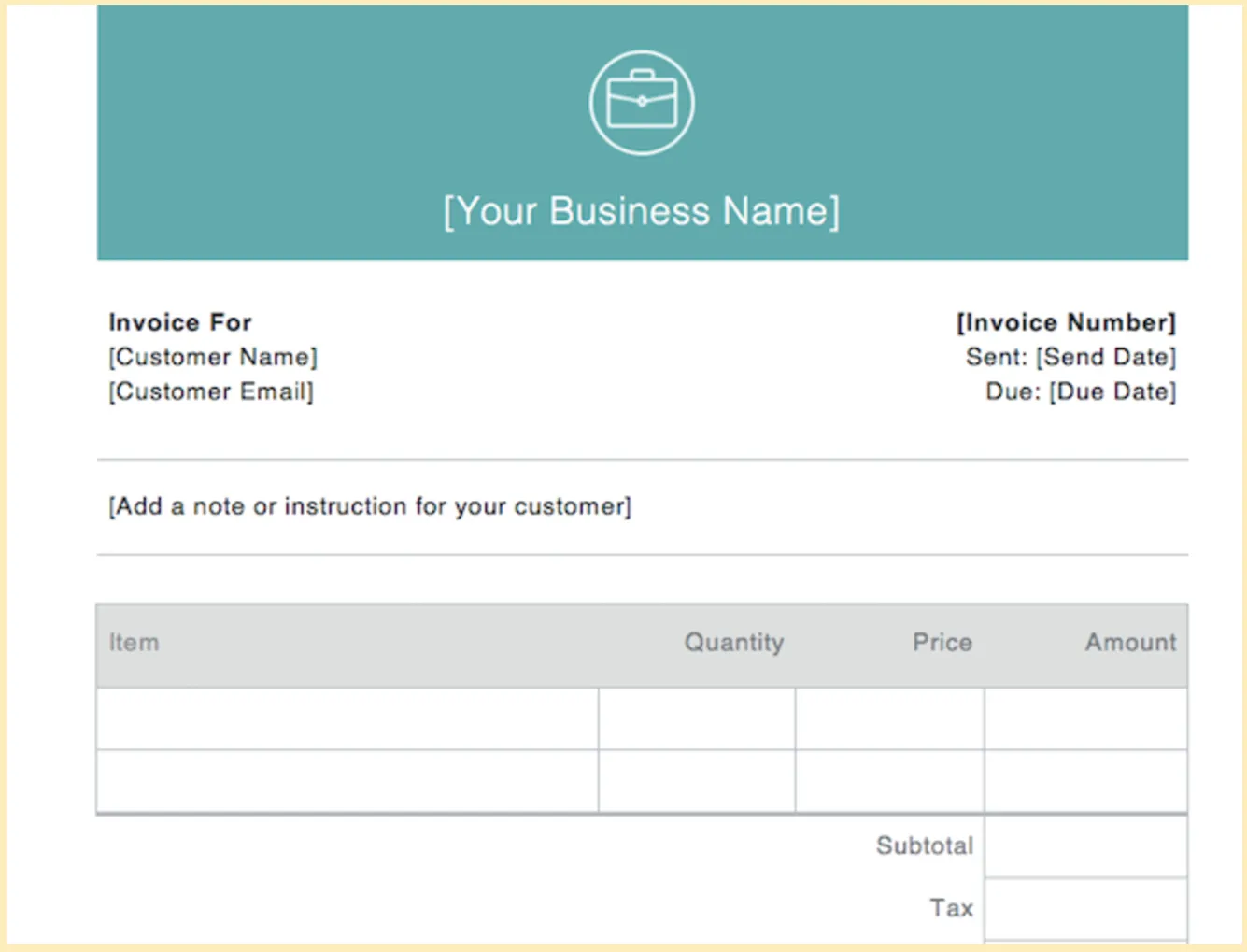

Basic blank invoice example

Here’s an invoice example Australian small businesses or sole traders typically use for simple transactions. It covers the essentials in a clear, easy-to-read format.

A typical basic invoice includes your business details at the top, followed by your customer’s information, the issue date and the payment due date. Each invoice should have a unique number to help you and your customer match payments with records and keep accounts organised. Common numbering formats are sequential (e.g. INV001, INV002), date-based (e.g. 2025-003), or client or project-based (e.g. EVENTCO-004).

The next section of your invoice shows an itemised description of the products or services provided, the total amount due and how you want your customer to pay you.

If you’re charging GST, you can show the GST amount separately for each item, or a note stating ‘Total price includes GST’ if it’s bundled in the total. If you’re not charging GST, include a note stating ‘No GST has been charged’.

Invoice example for freelancers

Freelancers (e.g. contractors, designers or creatives) typically get paid for their professional skills or project-based work by multiple clients, rather than being employed full-time. Because their work often varies from project to project, their invoices need to show exactly what was delivered and how it was priced.

In addition to containing the basics above, a freelance invoice might:

- Itemise work by project, task, milestone, and/or by the hour if you bill hourly

- List any extra costs incurred while working on a project (for a graphic designer, this might be stock imagery or font licensing fees)

- Note when the client received or will receive the final work

- Include multiple due dates if payment is made in stages for larger projects

Invoice example for contractual work

If you’re working on a contract basis – meaning you’re engaged for a specific project or period under a formal agreement – your invoice should outline the details of that agreement. A contractor invoice might:

- Reference the contract name or number

- Itemise each project, task or deliverable, showing the agreed work and price

- Break out costs for any materials, tools or licences you used to complete the work

- List any agreed specific milestones or payment stages, plus GST if applicable

Invoice example for professional services

Businesses offering professional services (e.g. consulting, accounting, marketing or coaching) should clearly indicate on their invoices what was delivered and when. A professional services invoice should:

- Show your hourly rate ($X/hr) or fixed service fee ($X)

- State the date the service was provided or will be provided

- Include a short description of the service, such as ‘1-hour strategy consultation’ or ‘Quarterly tax review’

- Add terms and conditions in the notes section, such as cancellation or late payment policies

Service-based businesses often provide work that isn’t tied to a physical product. Because of this, clear invoices are especially important. A 2025 Atradius survey found that 27% of late B2B invoice payments in Australia stemmed from disputes or issues with invoices. Being specific about what was done and when helps lower the risk of payment delays or chargebacks.

Invoice example for wholesale businesses

Wholesale businesses often deal with larger orders and bulk pricing – for example, a haircare wholesaler selling shampoo to salons, or a food supplier providing ingredients to restaurants. Breaking down costs in a wholesale invoice helps the customer understand exactly what they’re paying for. You’ll want to:

- List each product name and quantity clearly

- Show the regular retail price, wholesale discount applied and final wholesale price

- Add a subtotal, GST if applicable, and total amount payable

Displaying the discount price alongside the original price in your invoice doubles as a subtle marketing tactic. When retailers see the savings you’ve passed on, it highlights the value of your offer and can encourage repeat orders. Over time, clear discounts can help turn occasional transactions into long-term customer loyalty.

Lump sum invoice example

A lump sum invoice is used when you charge a single flat rate for a group of products or services, rather than itemising each one. It’s ideal for bundled offerings or packaged projects.

Even though the price is presented as a single amount, it still helps to clearly summarise what’s covered by that lump sum to avoid confusion. For example:

- ‘Yoga class – 10 pack (valid for 3 months)’

- ‘Gym membership for 12 months (including unlimited classes)’

- ‘End-of-lease clean – 2-bedroom apartment’

- ‘Web design package – up to 5 pages, basic SEO, mobile-friendly design)’

Industry-specific invoice examples

Different industries have slightly different invoicing needs. Tailoring your invoice to your industry ensures all the right details are captured for your and your customer’s records. It also makes payment reconciliation and tax reporting easier.

For instance, these industries often include the following details on their invoices:

- Retail: Product SKU, discount code or promotion applied, gift card or loyalty points redeemed, return policy

- Trade services: Travel or call-out fee, labour rate, licence number, warranty terms

- Hospitality: Event date, staff charges, per-person pricing, special requests, deposit or final payment details

- eCommerce: Order ID, payment method used, shipping details, tracking number, refund/exchange policy

Free downloadable invoice templates

Now that you’ve seen examples of invoices Australian businesses commonly use, get started quickly with a free invoice template. Simply download and customise it with your business logo, colours and details. This free example of an invoice layout helps you create a professional document – showing customers you run a trustworthy business and helping you get paid promptly.

FAQs on invoice examples in Australia

What’s the difference between a tax invoice and a regular invoice?

In Australia, a tax invoice is used when your business is registered for GST. You must either show the GST amount charged or state that the ‘Total price includes GST’. You need to issue a tax invoice for any sale of $82.50 or more (including GST) or if your customer requests one.

On the other hand, a standard invoice doesn’t include GST details and is typically used by businesses that aren’t registered for GST. Both documents request payment, but only a tax invoice allows your customer to claim GST credits.

Where can I find free invoice examples or templates for an Australian business?

You can download free invoice templates from Square. The templates can be used by a range of business types – from trades and professional services to retail and hospitality – and include sections for itemised costs, due dates and payment terms. These ready-to-use examples can help you create professional invoices that meet Australian tax requirements.

![]()