Table of contents

Many years ago, the idea of tipping in an Australian establishment was unheard of. In certain countries around the world, particularly in the US, tipping is just par for the course. However, this practice is based on the fact that hospitality workers in the US generally earn very little in actual wages, and they need tips to survive.

In Australia, thanks to minimum wage laws and industry awards, staff are usually paid quite well and don’t expect tips. However, in recent years it’s become more common to find cafes, bars and restaurants implementing systems to collect tips. So, with tipping on the rise, do you understand how to manage the tax implications of receiving tips? Both employees and employers have some responsibilities when it comes to tips, but it varies considerably depending on how tips are collected and distributed in your workplace. In actual fact, this is one of those rare instances where the employee has more reporting responsibility than the employer.

Read on to find out more about managing tax on tips in Australia.

Are tips taxable in Australia?

As you prepare for the end of financial year, it’s worth knowing your obligations when it comes to tips. We often don’t think too much about tips, because the amounts are usually pretty low. However, that’s not always the case, and some employees around the country actually do quite well out of tips throughout the year. It all adds up over 12 months, and can represent a significant amount of income.

Tips, or gratuities, as the ATO likes to call them, are definitely taxable, and need to be reported in personal tax returns. Whether tips are received directly from a customer or from the employer, you need to report all tips as taxable income. This means keeping manual records of the tips you earn, and reporting them when you do your tax return.

What qualifies as a tip?

A tip is any additional payment received in recognition of service. As we said, most businesses use a tip jar, and distribute the money evenly to staff. This is recognised as a tip. In rarer cases, employees may receive direct cash tips from customers.

There really aren’t too many different options for tipping in Australia, so these are the two most common forms of tips you may experience.

Methods for collecting and distributing tips

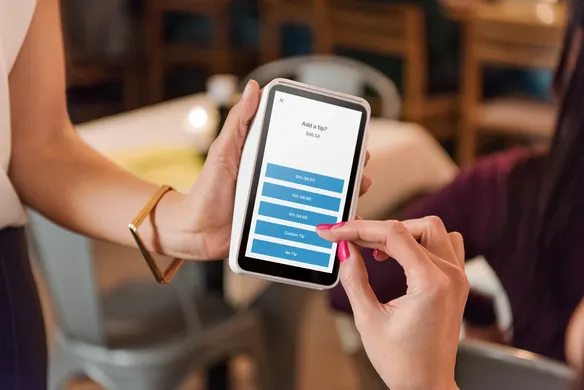

In Australia, because the practice of tipping isn’t commonplace, there aren’t a lot of systems in place for collecting tips. You would rarely pay the bill in a restaurant and ask to give more as a tip. Especially with electronic payments, the process becomes even more difficult because most POS systems aren’t set up for tipping.

The most common form of tipping, believe it or not, is a jar on the counter. Customers can put their tips in there, and the tips would be distributed evenly among staff at the end of the day or week, according to how many hours they work. It may not be a fair system, because a customer might be tipping purely because of a particular employee’s level of service. However, it’s just how it is for most Aussie businesses.

Alternatively, if you operate a venue where it’s easy to determine which staff member worked a specific table, you might have a POS system that allows for tips, and also lets you report on who actually earned those tips. This method is ideal for staff members, because the tips can be included in their pay. This makes it a lot easier for them to keep track of what they’ve earned. Having said that, there is no responsibility for employers to include tips as income on an employee’s income payment summary.

Do you have to report cash tips to the ATO?

As an employee, you definitely need to report tips to the ATO. You do this as part of your annual tax return. While the rules are a little strange because tips paid through your employer don’t need to show up on your income payment summary, you’ve still got a personal obligation to declare tips as income.

It can be frustrating to manage this, because often the amounts are so small. Plus, depending on where you work, you may take home a tiny amount at the end of a shift. Unfortunately, it’s still your obligation to keep accurate records of those tips, even if they’re paid in cash.

If your employer collects all of the tips and pays your share each week or fortnight as part of your wages, it’s a bit easier for you to keep records. It’s worth checking how this appears on your payslip though, because if it doesn’t show as taxable income, it’s likely that the amounts won’t be included in your annual payment summary. In this instance, you’ll have to record them separately.

Employer responsibilities

There are plenty of employer responsibilities when it comes to tips, especially if you collect all of the tips on behalf of staff and distribute them accordingly. Many businesses choose to do this completely separate from their normal payroll process, to avoid any confusion. Ideally, this is the best way to do it, because it avoids any confusion.

As an employer, you don’t need to report an employee’s tips as a PAYG deduction. Nor do you need to include it in their payment summary. For that reason alone, it’s best to keep tips away from payroll. While it’s not a requirement to maintain records of tips that are paid to staff, it’s probably a good idea to keep receipts or records of what gets distributed to who.

Collecting tips and GST

If you collect tips on behalf of your staff and distribute them accordingly, you don’t have to report the tips as income (like your daily takings). You also don’t have to pay GST on the tips. This is primarily because the tips never really enter the business. Especially with a tip jar, it’s simply a bit of extra cash that gets handed out to the employees.

However, if you have a tip jar in your business, and you collect that money as income without passing it on to the staff, it becomes income. In this instance, the money is going directly into your business, therefore you’ll need to report it on your BAS, and also in your end-of-year financials.

So, when determining how to manage tips in your workplace, it’s a good idea to keep it as simple as possible. From a business point of view, using a tip jar and just splitting the cash among staff at the end of a shift is probably the easiest way. However, that does put the onus back on your employees to keep records of their own tip income.

This article is only for educational purposes and does not constitute legal, financial or tax advice. Make sure you consult a professional regarding your unique business needs.

![]()