Payment processing you can rely on

Never miss a sale. Square payment processing serves customers better with tools and integrations that make work more efficient.

Accept credit card payments anywhere customers are.

Accept credit card payments anywhere customers are.

In person

Accept payments at your counter or on the go. It’s easy to get started. Try the Square POS app on your phone or pick from a range of hardworking hardware.

Learn more →Accept

Contactless payments

Mobile payments

Chip and PIN payments

Processing Fee

2.5% per credit card transaction

0.75% + 7 cents per debit transaction

Online

Take payments online. Set up a free online store or sell through social media. You can also connect your current online store or app to one of our secure and trusted payment APIs.

Learn more →Accept

Online payments

Square Payment Links

API and SDK payments

Invoices

Processing Fee

2.8% + 30 cents – 3.3% + 15 cents per transaction

Remote

Make paying even more convenient for your customers. Accept credit card payments over the phone using Square Dashboard as a virtual point-of-sale terminal. Send an invoice or key in a payment manually with the Square POS app. Start taking payments in minutes.

Accept

Keyed-in transactions

Dashboard payments

Card on File

Invoices

Processing Fee

3.3% + 15 cents per transaction

Buy now, pay later

Allow customers to pay in instalments with Afterpay. There’s no risk. You get paid in full immediately, they pay four interest-free instalments over six weeks.¹

Learn more →¹ Late fees may apply. Eligibility criteria apply.

See afterpay.com for complete Afterpay terms.

Accept

Afterpay online payments

Processing Fee

6% + 30 cents per transaction

Transparent pricing means no surprises at the end of the month.

With Square there are no hidden fees. You only pay for what you process.

Please note: Different pricing may apply with certain products and/or subscription plans.

¹Card on File payments taken through Square for Appointments are 2.8% + 30 cents. Learn more about Appointments pricing.

We’re trusted by Canadian businesses.

NEW

Take contactless payments with just your iPhone or Android phone.

Accept contactless cards and digital wallets in person with Tap to Pay on iPhone or Tap to Pay on Android.

Tools battle-tested for business

What started with payments has turned into a mission to change how businesses run. Every feature, product and capability Square develops solves your biggest challenges.

Instant transfers

Move money to your external bank account instantly for a 1.5% fee or the next business day for free.³

Reporting and Analytics

Track your business in real time with Square Dashboard. Get insights to inform your next move.

Security

Operate with confidence. Square provides fraud protection, data security and dispute management and supports your PCI compliance.

Money for whatever’s next

Manage your sales when and how you need to as they flow into your Square Balance. Make transfers to your bank account, budget for expenses, spend instantly with your Square Card or pay back a loan from Square.⁴

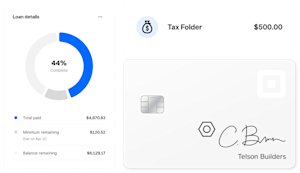

Spend

Access the money you make with your Square Card as soon a sale comes in. No waiting. No recurring fees.⁵

Budget

Organize and separate funds for your business with Balance Folders. Set aside a portion of your sales for taxes, payroll, rent and other expenses automatically.

Grow

Get a small-business loan from $300–$250,000. We’ll customize your offer based on card sales with Square.⁶

Integrate state-of-the-art payments at scale.

We know how to manage complexity, just like you. With the Square Developer platform, you can connect Square payments to your custom business software for a centralized view of your data. Try one of our prebuilt integrations for the software you already use, or build your own experiences using our APIs.

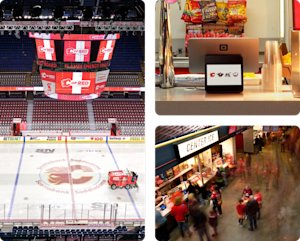

Calgary Sports and Entertainment

“When we saw that the Square Register featured seller- and buyer-facing displays and was capable of taking payments and enabling integrated commerce right out of the box, it seemed like the perfect fit. We realized that Square was really innovating in terms of customer and fan engagement, which is exactly what we were after to achieve our goal of becoming cashless and contactless.”

— Ziad Mehio, vice president, technology and food service

Explore our large business solutions

Learn about our developer platform

Find the software integration you need

Free services included in every transaction:

- Dispute management

- Active fraud prevention

- End-to-end encrypted payments

- Live phone support

- PCI compliance

Payments built for every kind of business

Professional Services

Request payments from your clients online with invoices or checkout links. Improve your client experience with data analytics.

Learn more →SELLERS USE:

Food & Drink

Accept payments quickly, whether you’re tableside, behind the counter, online or on the phone. Enable orders for curbside pickup or delivery.

Learn more →SELLERS USE:

Hair & Beauty

Keep a card on file to hold appointments, request a prepayment for services or charge cancellation fees. All your sales are integrated in your POS.

Learn more →SELLERS USE:

Healthcare & Fitness

Take payments at your gym or online. Online bookings are integrated with payments so you can easily invoice or send out shareable checkout links.

Learn more →SELLERS USE:

Retail

Cater to shoppers in person, online or on the go. Take returns at any time. Have peace of mind knowing your data is secure.

Learn more →SELLERS USE:

Home & Repair

Get paid on time for your services. Send an invoice or take contactless payments in person. Do it while you’re in the field, online or in the office.

Learn more →SELLERS USE:

Find the information you need to keep going.

Getting started

Read articles and business guides to get the ball rolling.

Pricing and processing fees

Learn what makes Square pricing so transparent and predictable.

Security and risk

Explore the security measures we keep in place to protect your business and customers.

Scalable solutions

See the Square tools businesses turn to in order to reach even bigger goals.

Find the information you need to keep building.

Read articles and business guides to get the ball rolling.

How to Start a Business

A Guide to Business Loans

Tap to Pay on iPhone

The Benefits of SquareLearn what makes Square pricing so transparent and predictable.

Our Fees

Fees & Payments FAQ

Credit Card Processing Fees & Rates

Compare SquareExplore the security measures we keep in place to protect your business and customers.

Secure Payments

PCI Compliance

Two-Factor Authentication

Business GlossarySee the Square tools businesses turn to to reach even bigger goals.

FAQ

Payment processing is the system that allows businesses to accept and manage customer payments, whether online, in person or over the phone. When a customer pays using a credit or debit card, the payment processor securely transmits their information from the point of sale to the card network and the customer’s bank. The bank then approves or declines the transaction based on available funds and security checks. If approved, the funds are deposited into the business’s account, typically within one to two business days.

With Square Payments, payment processing is simple—our system handles every step securely and automatically, from authorization to settlement.

It’s easy to sign up for Square and start taking payments right away, or you can contact sales for help getting started. We offer a range of hardware options for in-person payments. Square Payments works for all kinds of business types and sizes, with tailored solutions for each.

There are three main components that make up payment processing:

- The merchant (business): The company accepting payments for goods or services.

- The customer (cardholder): The person making the payment using their credit or debit card.

- The payment processor: The company (like Square) that facilitates the transaction between the customer’s bank and the merchant’s bank.

Behind the scenes, a payment gateway (for online transactions) encrypts and transmits data securely, while the card networks (like Visa or Mastercard) and banks handle authorization and settlement. Together, these parts ensure every payment is fast, secure and reliable.

A payment gateway acts like a digital point of sale for online payments. It securely captures and encrypts a customer’s card information, sending it to the payment processor for authorization.

A payment processor, on the other hand, is the system that communicates with banks and card networks to approve or decline the transaction and move funds into the merchant’s account.

Square combines both—serving as both the payment gateway and the processor—so businesses in Canada can accept payments seamlessly without needing multiple providers or complex integrations.

Yes. Processing fees will apply to each transaction, but vary depending on the payment method.

The best payment processor for small businesses in Canada offers transparent pricing, no hidden fees, fast deposits and reliable customer support. Square is built with small businesses in mind—whether you’re selling online, in person or on the go.

Square offers:

- Simple, transparent pricing with no monthly fees or long-term contracts.

- Free point-of-sale tools and online payment solutions.

- Fast access to funds, often within one business day.

- Comprehensive support for both in-person and eCommerce payments.

With millions of businesses worldwide trusting Square, it’s one of the most popular and reliable payment processors for Canadian entrepreneurs.

Square helps Canadian businesses manage their Goods and Services Tax (GST) efficiently through its built-in sales and reporting tools. Merchants can easily set up tax rates directly in their Square Dashboard or Point of Sale app, ensuring GST is automatically applied to every sale where applicable.

Square’s reporting features also make it simple to track and export tax data for accurate filing with the Canada Revenue Agency (CRA). Business owners can generate detailed sales summaries that separate taxable and non-taxable sales—saving time during tax season and helping ensure compliance with Canadian tax regulations.

For additional flexibility, Square allows you to create custom tax settings (such as GST, PST or HST), depending on your province or territory.

Learn more about when your business should charge GST/HST or if your business is exempt.

Yes. Security features are built into Square to make every payment safe. Square also follows industry requirements to monitor your account for suspicious activity and supports PCI compliance. Every Square payment includes:

- Dispute management

- Active fraud prevention

- End-to-end encrypted payments

- Live phone support

- PCI compliance

Tap to Pay on iPhone and Tap to Pay on Android let you take payments directly on your phone, with no additional hardware necessary. At checkout, select Tap to Pay and have your customer tap their card or contactless payment to complete the transaction.

Square Payments solutions are here to support businesses at any scale. Our payment platform offers a range of in-person and online payment APIs and SDKs so you can accept payments from your eCommerce site, mobile app, custom point of sale and more. Get in touch with our sales team to get started.

Take payments with confidence. Get paid fast.

Get business insights by signing up for marketing from Square.

Subscribe to our email list to receive advice from other business owners, support articles, tips from industry experts and more.

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualized content on the topics you care about most by telling us a little more about yourself.

1Card on File payments taken through Square for Appointments are 2.8% + 30 cents.

2Late fees may apply. Eligibility criteria apply. See afterpay.com for complete Afterpay terms.

3Instant transfers require a linked debit card and cost a fee per transfer. Only physical Canadian debit cards with Visa Debit or PLUS network support can be linked to a Square account at this time. Funds are subject to your bank’s availability schedule but are generally available in your bank account within 20 minutes of initiating an instant transfer. Minimum amount is $25 CAD and maximum is $5,000 CAD in a single transfer. New Square sellers may be limited to one instant transfer per day of up to $500 CAD.

4Your Square balances are not deposits, not CDIC-insured and are not interest-bearing. Terms apply. Learn more.

5Square Card is issued by Square Canada, Inc. pursuant to a licence by Mastercard International Incorporated and may be used wherever Mastercard is accepted. Funds generated through Square payment processing services are generally available through Square Card immediately after a payment is processed. Fund availability times may vary due to technical issues. Square does not charge fees, but ATM withdrawal fees charged by ATM providers may apply. Square Card is funded on a prepaid basis. Square Card is not a bank account and Square Card funds are not CDIC-insured.

6All loans are issued by Square Canada, Inc. Actual fee depends on payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Offer eligibility is not guaranteed. All loans are subject to approval. Not available in Quebec. Terms and conditions apply.

7Tap to Pay on iPhone requires a supported payment app and the latest version of iOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install. Some contactless cards may not be accepted by your payment app. Transaction limits may apply. Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Tap to Pay on iPhone is not available in all markets. For Tap to Pay on iPhone countries and regions, see: https://developer.apple.com/tap-to-pay/regions/.