Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Spend, budget, move and grow your money effortlessly

It all starts with your Balance: a place where you can store and instantly access all the money you process through Square. From there, the sky’s the limit. Make purchases as soon as sales hit your account, budget for taxes and rainy days, move money to your external bank account instantly and get fairer access to funding. With a single place to take payments and manage your money, you’re in total control of cash flow.

$0

monthly account fees

$0

transaction fees

$0

minimum balance

0

waiting for your money

SPEND

Make purchases right when you need to

Get instant access to your sales with Square Card. As soon as a sale hits your Square Balance, you can use your card to make purchases for the business or pay suppliers, without incurring credit card debt. It’s completely free, and comes without all the usual fees.

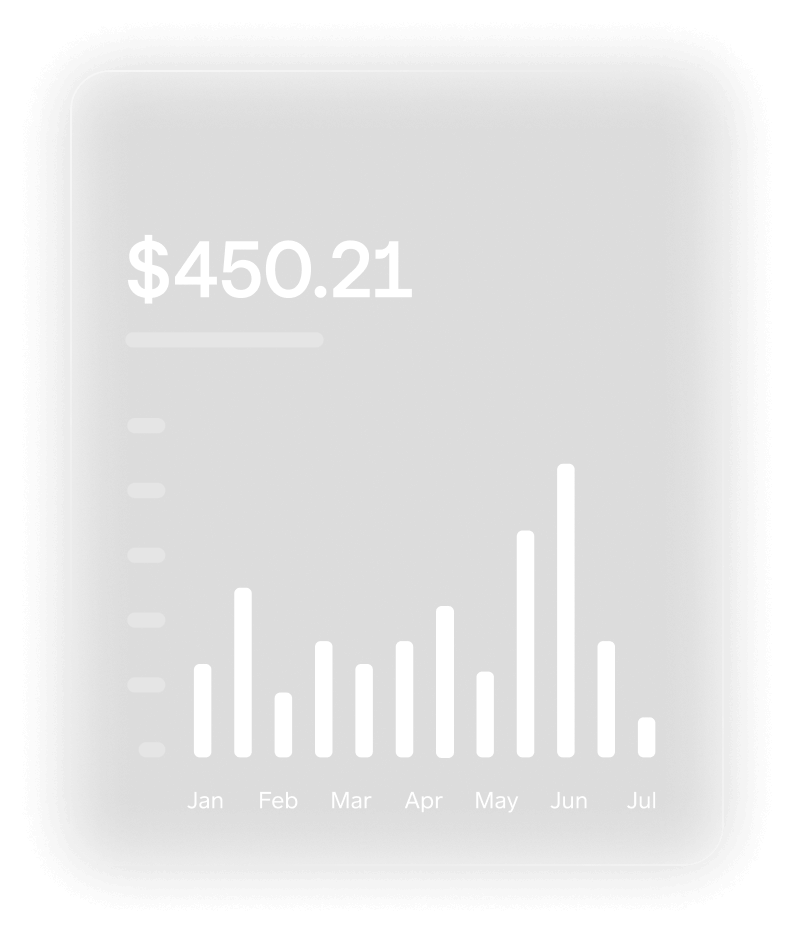

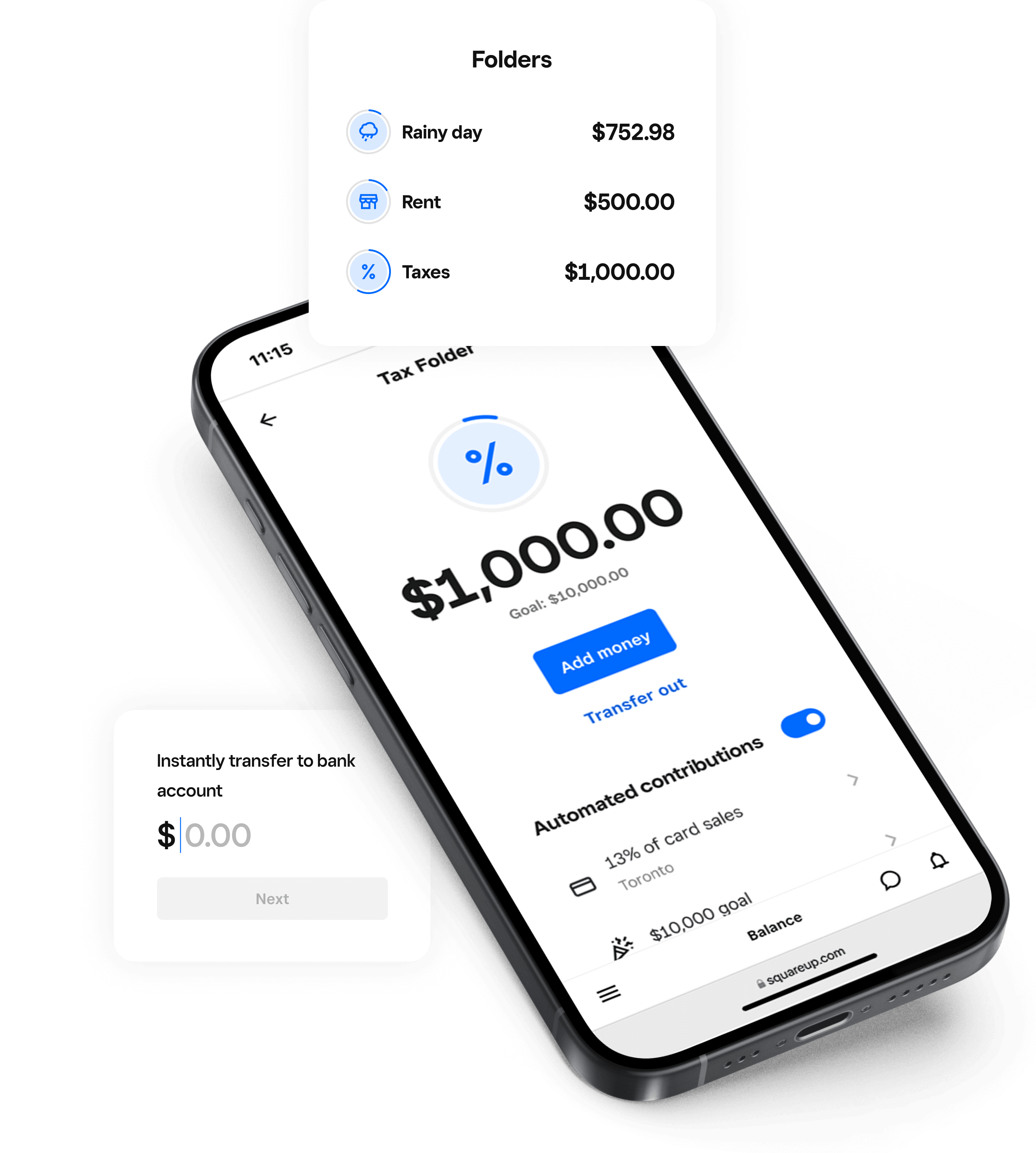

BUDGET

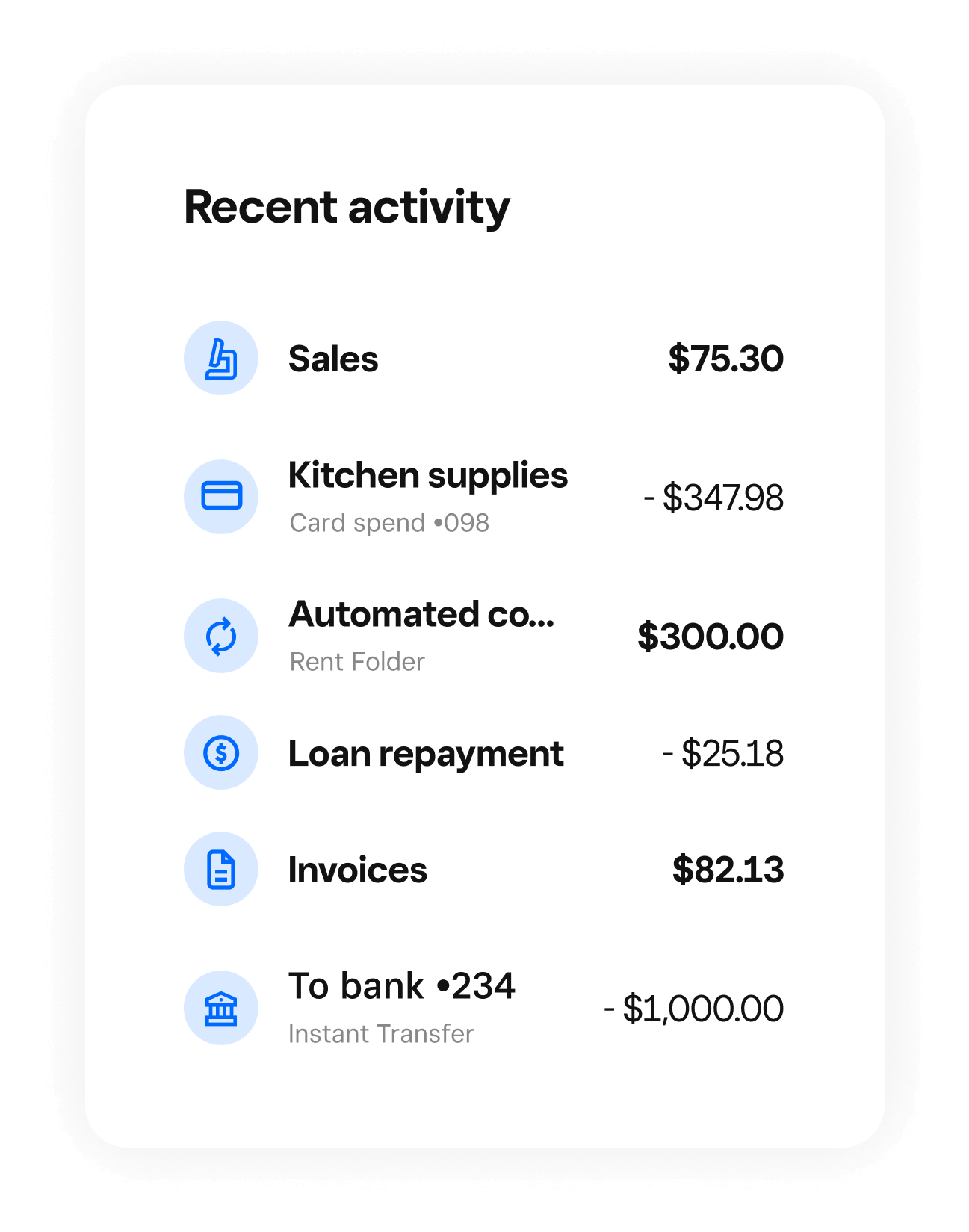

Automatically budget for expenses

Organize your money into Balance Folders so you can budget for upcoming expenses like taxes and new equipment, and build a nest egg for your biggest ideas. Make it even easier by automatically setting aside a percentage of your daily sales for any of your folders.

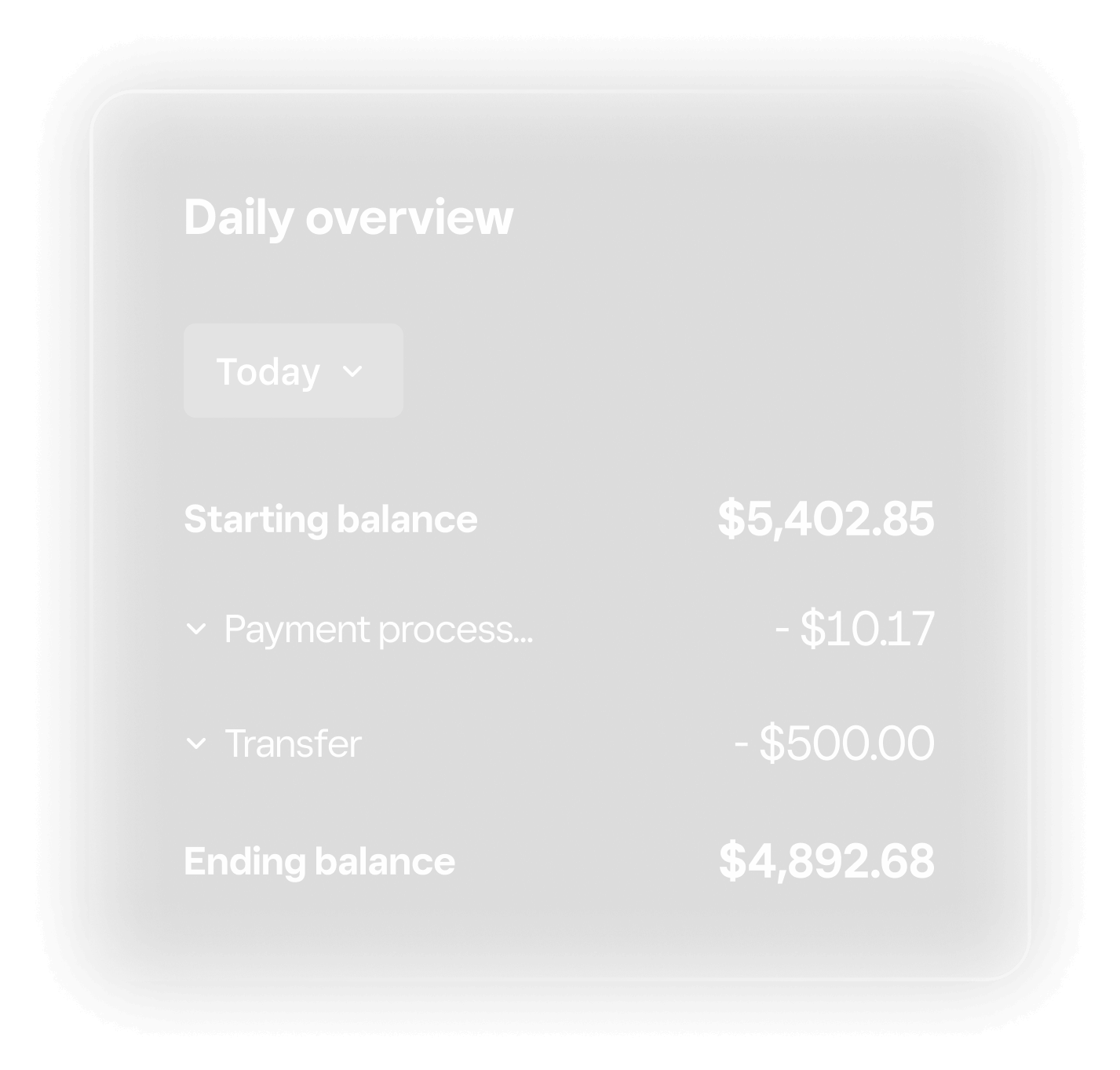

MOVE

Take control of your cash flow

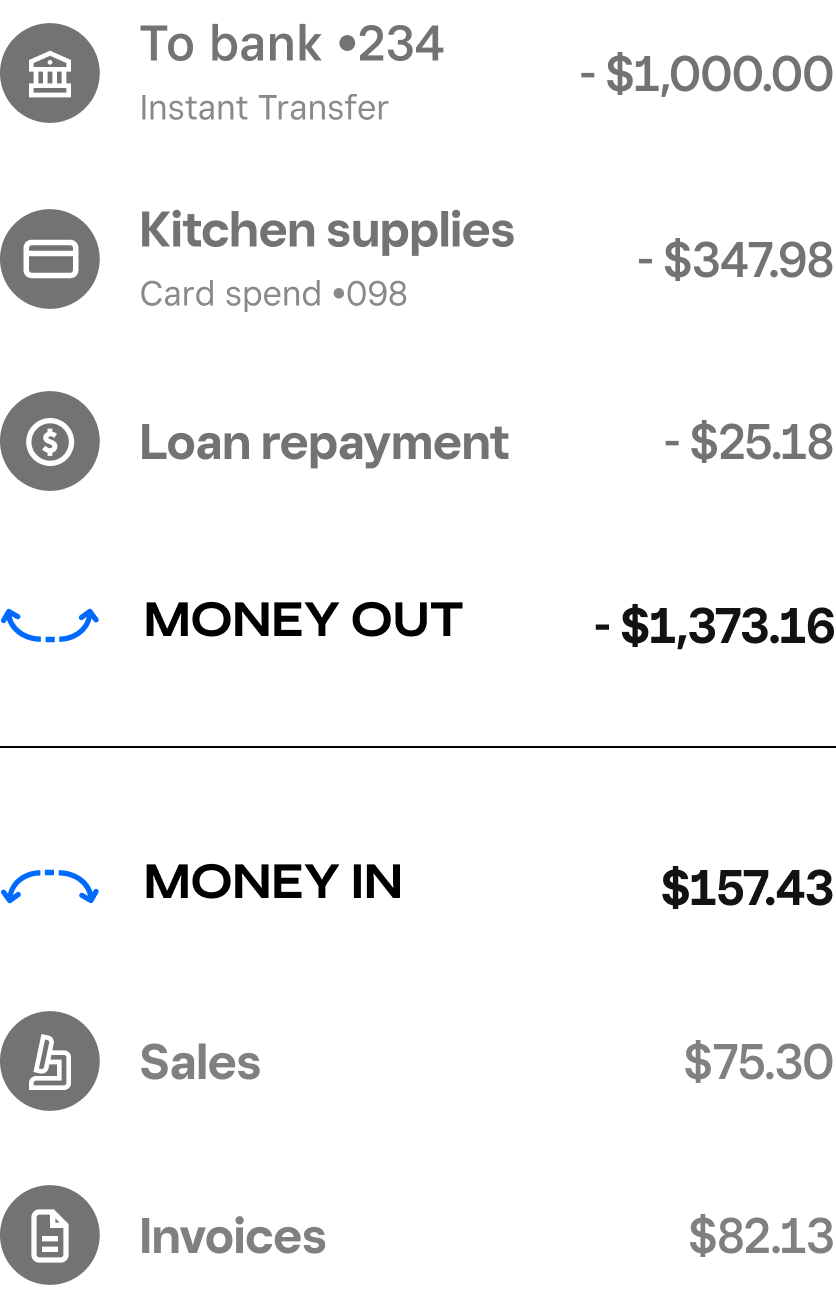

Watch your Square sales flow into your Balance, then transfer money to your bank account when and how you need. Get your funds instantly (even on weekends), in one to two business days, or on a custom, recurring schedule. Whether you store money in your Square Balance or move it to your bank, you still get a clear picture of how funds move in and out of your business.

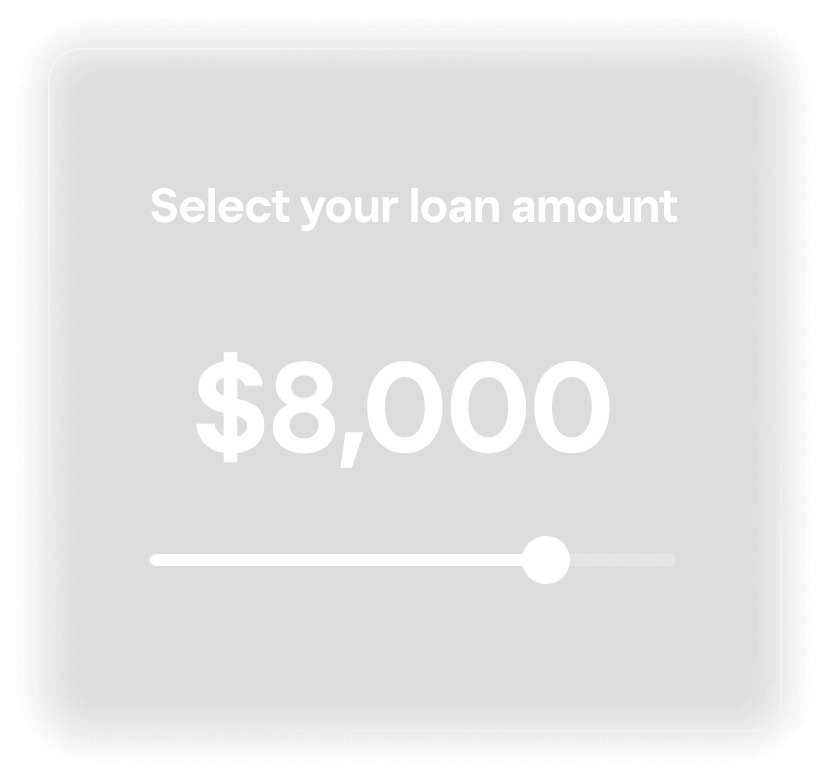

GROW

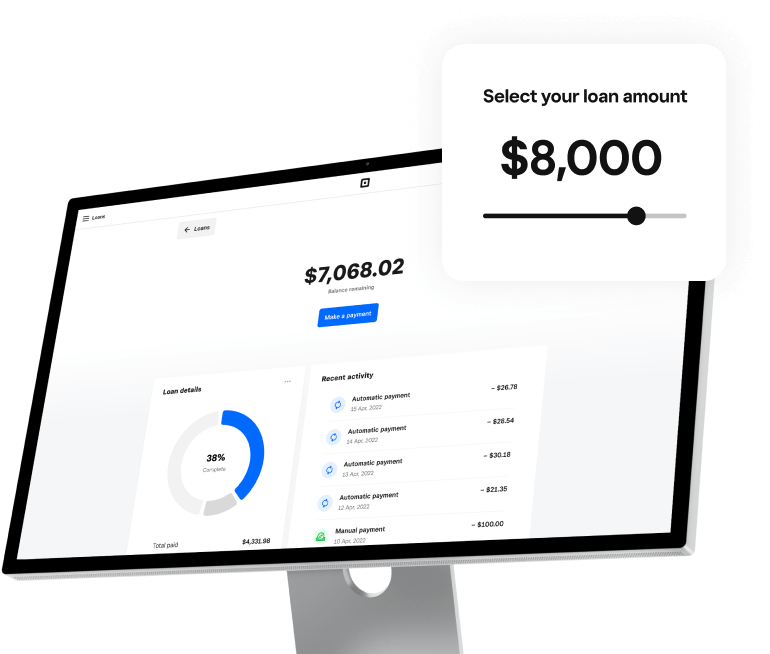

Invest in your business

You may become eligible to apply for Square Loans based on your processing data, like sales patterns and processing volume and frequency. Loan offers are customized for your business, and designed so you can pay them back with confidence. If you’re approved, you’ll get the money as soon as the next business day.

FAQ

Looking for more?

-

Square is a technology company that provides financial services. Square is not a bank.

Square has financial services tools to help business owners manage the money they make through Square.

-

Once you have a Square account for your business, you can access Square Balance from Dashboard or your Square app. When you take payments with Square, your sales flow directly into your Balance. From there, you can access and manage that money however you need.

- Spend the money in your Balance as soon as you make a sale by using a Square Card Learn more →

- Budget for upcoming expenses by divvying up the money you make into Balance Folders Learn more →

- Move money to your bank account on your schedule Learn more →

- Grow your business with a loan from Square Learn more →

-

Square Card is a free business expense card that is connected to your Square Balance. Take a payment, and watch the money you earn flow directly into your Balance. Your Square Card draws from your Square Balance, so the money you make from Square sales is available to spend right away. Use Square Card anywhere Mastercard® is accepted, including in person, online and at ATMs.

It’s free to order and personalize your Square Card, and it’s free to use your card to make purchases.

Square Card is only available to business owners who take payments with Square. To order your card, visit Balance in your Square app or Dashboard. It only takes 2 minutes to order and it's completely free.

-

Balance Folders help you automate budgeting for upcoming expenses. You can create folders for tax, rent, payroll or even a rainy day and automatically allocate a percentage of every sale to be set aside in that folder. Folders are completely free.

You can create as many folders as you need in your Square Balance. Name your folder(s) whatever you’d like or choose one that we’ve already created. Select the percentage from every sale to set aside into your folders. You can adjust or pause your contributions at any time. Visit Balance in your Square Dashboard to create a folder.

-

Eligibility comes down to your unique business data. Take payments with Square, and our algorithm may create loan offers based on your Square sales, payment frequency and new and regular customers, among other criteria. We assess the payments data for your business regularly to determine if you’re eligible for a loan. If you become eligible, we’ll reach out with a loan offer. Learn more about Square Loans eligibility.

-

Square Funding is available to businesses who use Square in Quebec. Square Loans is available to all other regions in Canada. Square Funding is a merchant cash advance, which means you’ll get funding up front in exchange for a percentage of future credit or debit card sales processed with Square. Unlike loans, there is no interest or any fees other than a simple funding cost. There are also no monthly payments due.

-

With Square, you can choose when to transfer funds to a bank account. By default, when you start taking payments with Square, your funds will be transferred out every night, and will be available in your bank account in 1-2 business days.

When you order a Square Card or set aside money in a folder, your funds will stay in Square. You can initiate a transfer to your bank account whenever you need. Transfer your money out in 1-2 business days for free or instantly for a small fee if you’re in a pinch.

What would you like to learn about?

Your Square Balances are not deposits, not CDIC-insured and are not interest-bearing. Terms apply. Learn more.

Square Card is issued by Square Canada, Inc. pursuant to a licence by Mastercard International Incorporated and may be used wherever Mastercard is accepted. Funds generated through Square’s payment processing services are generally available through Square Card immediately after a payment is processed. Fund availability times may vary due to technical issues. Square does not charge fees, but ATM withdrawal fees charged by ATM providers may apply. Square Card is funded on a prepaid basis. Square Card is not a bank account and Square Card funds are not CDIC-insured.

Instant transfers require a linked debit card and cost a fee per transfer. Only physical Canadian debit cards with Visa Debit or PLUS network support can be linked to a Square account at this time. Funds are subject to your bank’s availability schedule, but are generally available in your bank account within 20 minutes of initiating an instant transfer. Minimum amount is $25 CAD and maximum is $5,000 CAD in a single transfer. New Square sellers may be limited to one instant transfer per day of up to $500 CAD.

All loans are issued by Square Canada, Inc. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Offer eligibility is not guaranteed. All loans are subject to approval. Not available in Quebec. Terms and conditions apply.