Table of contents

Accepting payments anytime, anywhere is possible with a virtual POS.

What is a virtual POS (VPOS)?

A virtual POS, or a VPOS, is a virtual point-of-sale terminal that allows you to process card-not-present payments without a credit card reader, app, or special hardware.

It allows you to accept payments via email or phone without storing or writing down shoppers’ credit card information. The technology also enables you to see all your payments in one place, streamlining the entire process.

What kind of businesses typically use a virtual POS?

A virtual POS device can be a valuable tool for many types of businesses and different types of transactions. Here are some examples:

- Large wholesale orders: A virtual POS can be beneficial for small businesses — whether or not they have a brick-and-mortar store — when they are processing massive orders.

- White-glove service: With a more personalised level of service comes a more deliberate ordering process. A virtual POS makes sense for transactions in which you are guiding customers through every aspect of the sale, from purchase to shipping to delivery and setup.

- Remote billing over the phone: It’s not possible for every transaction to take place in person, and a virtual POS enables businesses to offer customers the flexibility of remote transactions.

- When billing clients for hours worked: For businesses that offer services like marketing or consulting, a virtual POS provides a way to process payments from clients faster and more efficiently than invoicing.

- Incremental sales or customer support orders: A virtual POS also comes in handy for non-typical payments and transactions.

How our free VPOS terminal works

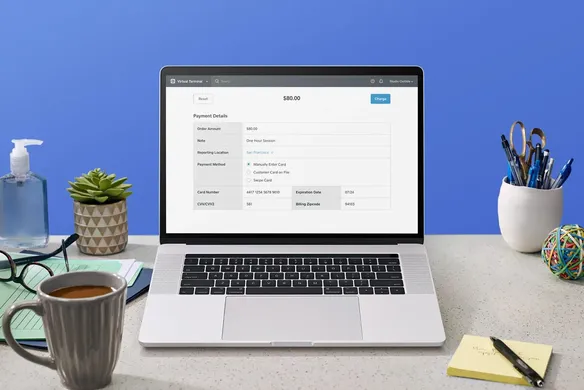

Using Square’s VPOS — called Virtual Terminal — is a simple, seamless process. There are no monthly fees and no need for extra software or a credit card reader. Pay only a 2.2% fee per payment you accept with Virtual Terminal. Here’s how to get started:

- Sign up for a free Square account.

- Log in to your online virtual terminal via Dashboard.

- In the left-side panel, click Virtual Terminal.

- Click Take a Payment.

- Select Quick Charge to charge your customer a single dollar amount or Itemised Sale to add an item, modifier, discount, and tax to the sale. You’re also able to apply taxes, discounts, and tips using Itemised Sale.

- Add an optional note to the sale.

- Under Payment Method, select Manually Enter Card.

- Enter the card details provided by your customer.

- Click Charge.

FAQ

Can I use Virtual Terminal with Square’s other payment products, like Square Point of Sale?

Yes, you can accept payments via any of Square’s payment products, like our web POS, with one account. All earnings are collected and reported in your account.

How much does it cost to use your virtual point of sale?

Payments taken through Square’s virtual point of sale (Virtual Terminal) are subject to a 2.2% credit card processing fee, per transaction if entered manually, and 1.6% percent per transaction if taken as an in-person payment when you connect Square Terminal with Virtual Terminal. Opening an account is free, and there are no monthly fees or merchant account fees.

Can I itemise the bill or only charge a single lump sum?

You can charge a single lump sum only, but you can itemise the purchase in the notes field under the payment details.

Do I need a separate merchant account or payment gateway?

No. Using Virtual Terminal is no different than accepting payments via your Square Reader.

Can I use Square Terminal and Virtual Terminal at the same time?

If you have connected Square Terminal with Virtual Terminal, you have the option to accept payments in person with Square Terminal as an extra convenience when your customers are in person.

![]()