Ask tradies running their own operations what their number one business challenge is, and you’re likely to get the same answer 9 times out of 10: getting paid.

Waiting weeks — or even months — to get paid for projects is the path to an instant cash-flow crisis. It can easily have a negative impact on your ability to pay wages, pay other suppliers and purchase new tools or equipment for future jobs.

The fact is, it is impossible to service your current clients properly and win more projects without enough capital to resource your operations. And we’re not just talking about financial capital; time capital is just as important.

Here are four ways that can help your business — and you can implement them all on the go.

How to improve cash flow and get some time back in your day

1. Use digital tools to get paid on the spot

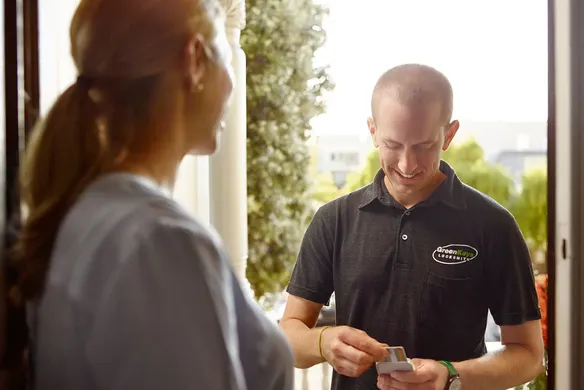

The best way to get paid fast is to give your clients the ability to pay instantly. Having a mobile credit and debit card reader on hand or in your toolbox or work ute helps you get paid straight away. It also provides a simple and convenient way for customers to settle their bills immediately, without worrying about cash.

And whether you’re on the road, back at the office or at home, you can simply take a payment over the phone. Digital platforms, like Square’s Virtual Terminal, allow you to enter a customer’s credit or debit card information straight into a web browser, eliminating a payment lag and ensuring you get paid instantly — no matter where you are.

2. Start sending user-friendly e-invoices

Don’t spend hours manually writing up and mailing out invoices and chasing payments. If your client isn’t onsite to pay immediately, send an electronic invoice from your phone as soon as a job is done. E-invoicing allows your clients to conveniently enter their card details and make quick, on-the-spot payments as soon as they receive the invoice, rather than logging into their internet banking apps or recalling their bank account information. You can also schedule recurring invoices and allow your customer to store cards on file so you don’t have to re-enter details for regular clients.

3. Integrate your payments and accounting software

Digital or cloud-based solutions are often talked about, but not often explained in simple terms, so here it is. Having a digital point-of-sale platform that allows you to take card payments in person, online or over the phone is a faster, more secure and more reliable way to ensure you get paid.

Square’s point-of-sale platform system also easily integrates with online accounting software, such as QuickBooks and Xero, so that all your transactions flow automatically into your accounts, providing you with an instant record of your transactions, all in one place. Not only is this great for accuracy, it significantly reduces the need for manual data entry (which is a great time-saver for busy tradies), especially at tax time.

4. Use payment data to improve your business

Having data and analytics tools is a must these days, especially for time-poor tradies who need to be on the tools as well. The right analytics platform can help you gain important insights into what’s working and what needs to change in your business, so you can continue to make informed decisions to maximise profit.

Related Articles

- Pipes Plumbing Tells Us How Mobile Invoices and Payments Have Changed the Game for Tradespeople

- The Most Frequently Asked Questions by New Square Sellers

- Everything You Need to Know About Cloud-Based Point-of-Sale Systems

![]()