No matter if you have recently made the jump from full-time work to being a business owner, or if you have been in business for years. EOFY and tax time can be a daunting period for all of us. The good news? It doesn’t have to be!

To help break it down and give you practical tax time tips to put into action in your business we’ve enlisted the expertise of Patrice from Mondays Bookkeeping.

1. Pay superannuation for yourself & employees, and pay it on time. By not paying super on time you can be fined and depending on your business entity you can claim this expense.

2. Be organised. Insert ATO deadlines in your calendar so you know what payments are on the horizon and what you need to be prepared for. You can find a calendar of key dates for small businesses here.

3. Create a tax holding bank account, where you or your bookkeeper regularly sets aside tax for quarterly BAS and EOFY.

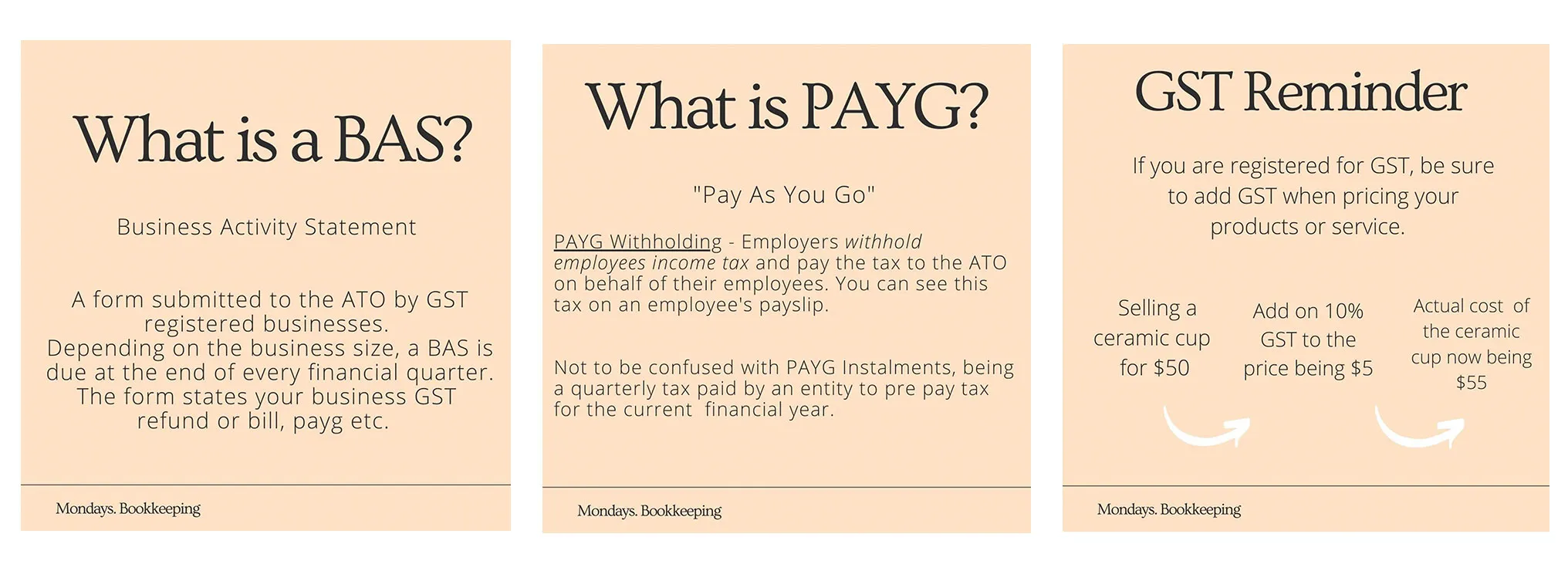

What is a BAS?

BAS stands for Business Activity Statement, if you are a business registered for GST you will need to lodge a BAS on a regular basis, (monthly, quarterly or yearly). This will help you report and pay your GST, PAYG instalments and other taxes. Find out more about BAS here.

4. Schedule a tax planning meeting with your accountant every May/June. It’s a good time to reassess all aspects of your business. Accountants should suggest ideas on how to lower your tax costs coming into EOFY.

5. Seek help, business owners can’t do it all, the juggle is real. If you can, outsource a bookkeeper. It can often be forgotten that outsourcing can actually help grow your business, weigh up the cost, engage people for trial periods and reassess. In most cases, you can also claim these costs.

Follow Mondays Bookkeeping on Instagram for more helpful tips!

Can you explain the relationship between a business owner/bookeeper and an accountant for business owners who may be managing their books on their own?

A business owner, a bookkeeper and an accountant should ideally work together to achieve the best outcome for the client. If you manage your own bookkeeping I would engage an accountant who understands your business and what you actually sell. Depending on how your BAS is lodged, a quarterly check-in with your accountant would be ideal. As your business grows they will have suggestions and ideas about the progression of your business structure and fix any issues you might be having.

From your perspective what are the biggest challenges/pain points business owners experience regarding tax time?

1. Not having enough money to pay their BAS or end-of-year tax. This is an issue that can easily be fixed and is the biggest issue I help resolve with clients. Business owners ideally create a secondary bank account and regularly transfer taxes into this account. When your BAS arises, the money is available, stress-free.

2. Hesitancy to engage in a quality accountant. Some business owners put this on the back burner as they can’t justify the cost or find the experience daunting. I work with some excellent young accountants who fix issues, do a lot of their work behind the scenes, have VIP access to tax portals and genuinely have their client’s best interests at heart.

How can business owners prep for next year’s tax time ahead of time to help make the process easier?

The end of the financial year is the best time to plan for the year ahead. Take time to think about your goals for the year, and where you want your business to be in a year’s time. I often see clients only thinking about the “now” not the future, in business, you must flip the narrative. Put things in place for your future now.

Want to know more? Read more business stories, plus tips and tricks to action in your business on Townsquare.

![]()