Stay protected with advanced fraud monitoring

Get insight into payment fraud patterns, and set custom rules and alerts to detect and manage risk.

Our fraud prevention and detection software automatically identifies unusual payments and fraud patterns.

Payment monitoring

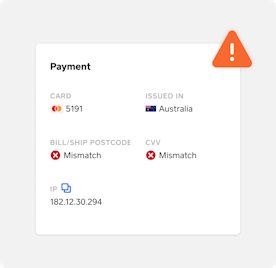

Every payment is screened to detect suspicious online transactions with real-time results available in your Dashboard.

Machine learning

Square uses sophisticated machine learning to spot and block online payment fraud and secure businesses of all sizes.

Fraud protection

3D Secure verifies payments and puts the responsibility for fraud disputes back on the card issuer and away from you – free of charge.

Custom flexibility

Take control of fraud detection on online purchases. Set the level of risk that works best for you and your business.

Manage risk with powerful, easy-to-use tools.

Assess risky payments

Advanced analytics help spot online fraud activity. Get alerts to review suspicious payments and take action to prevent fraudulent disputes.

Protect your business

Stop fraud at the source by activating 3D Secure. Let the card issuer confirm the customer’s identity before completing a purchase and take responsibility for any related fraud disputes.

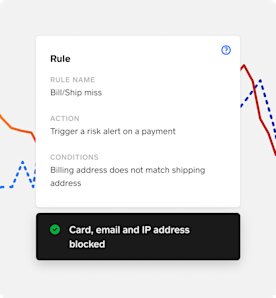

Block repeat fraud

Add suspicious cards, emails and IP addresses to your Block List, or manually block flagged payments to help prevent repeat fraudsters from making purchases on your website.

Make your own rules

Noticing a trend? Advanced analytics allow you to easily see fraud activity so you can create alerts and set rules that automatically control when you accept payments.

There are many ways to sell online with Square.

Start your free eCommerce store using Square Online and receive fraud protection at no cost with Risk Manager. Alternatively, you can process payments using other eCommerce solutions, including your preferred eCommerce platform, or create a custom solution with Square APIs.

A fully integrated service of fraud-protection features

Square payment processing rates apply.

View Square’s payment processing rates

Risk Manager Resources

Fight fraud on your terms.

Frequently Asked Questions

Risk Manager is a fraud prevention tool that helps you spot and manage potential online payment fraud. Risk Manager allows you to customise the level of risk you’re willing to accept running your online business.

Risk Manager is free to use. We’re exploring a potential premium version to release in the future where certain additional features would include a fee. We’ll announce this new version if and when it’s available.

A risk evaluation shows the fraud risk based on machine-learning models and algorithms. Risk evaluation is a free, informational tool that helps you decide how to manage potentially fraudulent transactions processed on your account.

Risk Manager is designed to help prevent chargebacks. Sellers are liable for all accepted payments and disputes they receive. Square does not assume liability for accepted payments.