Square Business Software and Tools

Integrated software and hardware solutions that power your business

Learn how Square can support every side of your business, no matter your industry or size.

Over £200,000 in annual sales?

You may be eligible for custom pricing

A toolkit for every business

Square business software and enterprise tools power a wide variety of business types. Whether you’re just opening your doors or you’re streamlining processes to scale, Square provides the business solutions you need for every step.

Business management

Sell anywhere and get paid anytime with flexible omnichannel tools that connect and customise all parts of your business.

Square Invoices

Contract builder

Build and customise professional contracts for your business.

Invoicing software

Quickly send and track invoices to save time and get paid faster.

Invoice templates

Download and customise free professional invoice templates to send to clients.

Square Online

ECommerce platform

Turn any business into an online business with a free eCommerce website.

Online ordering system

Create an online ordering page for your restaurant to accept online orders, to promote repeat purchases and to streamline deliveries.

Photo Studio app

Shoot professional-level photos from your own device.

QR code ordering system

Provide contactless, self-serve ordering and payment for your dine-in customers with a scannable QR code.

Website templates

Create custom website templates for eCommerce, retail, restaurants, services and more.

Square Payments

Buy now, pay later

Let your customers pay in instalments while you get paid upfront, online or in person.

Online payments

Keep your online transactions safe with secure online payments.

Payment Links

Accept payments almost anywhere with Square Payment Links. Easy to create, to share and to track.

Payment processing

Get paid faster with secure payment processing solutions. Offer fraud protection with no monthly fees.

Payment risk manager

Get insight into payment fraud patterns. Set custom rules and alerts to detect and manage risk.

Tap to Pay on Android

Accept contactless cards, Apple Pay, Google Pay and other digital wallets from compatible Android devices.

Tap to Pay on iPhone

Accept contactless cards, Apple Pay and other digital wallets with your iPhone.

Square Point of Sale

Square Dashboard

Keep your business at your fingertips with real-time reports and insights into what’s selling.

Square point-of-sale software

Easily sell in person, online, over the phone or out in the field.

Virtual Terminal/Computer POS

Bill remotely or take payments over the phone and record them on your computer.

Square for Restaurants

Table management system

Take bookings, manage turnarounds and organise service with our table management system.

Table reservation system

An effective and simple all-in-one table reservation system for restaurants of all sizes.

Square Kitchen Display System

Keep orders, delivery and front- and back-of-house operations in sync from one screen.

Square Restaurant POS

An all-in-one POS system built to help owners, managers and staff make the most of every shift.

Square for Retail

Inventory management

Built-in inventory management tools sync with your online store and give you access to inventory tracking, to stock alerts and to inventory reports.

Square Retail POS

Streamline your business and sync in-store and online sales, inventory, purchase orders, customer information, reporting and more.

POS Hardware

Whether you need a card reader or an all-in-one POS system, our tools allow you to start selling fast.

Customer engagement

Connect with existing customers, reach new ones and grow relationships with tools that integrate seamlessly with Square solutions.

Square Appointments

Appointment reminders

Automatic appointment reminders for customers.

Cancellation policy templates

Include your cancellation policy within your online bookings flow for reduced confusion.

Class and course bookings

Easily manage class schedules, capacities and customer bookings with real-time analytics and a user-friendly interface.

Instagram booking

Let clients book appointments directly from Instagram without leaving the app for free.

Online booking

Create a free website that enables customers to book their appointments and purchase items.

Square Appointments POS

The point-of-sale solution for bookings, payments, retail, inventory and more.

Waitlist software

Allow your customers to join your waitlist so you can always fill an unexpected cancellation.

Square CRM

Card on file

Safely store credit and debit card information for repeat clients. Charge saved cards at the tap of a button.

Customer directory

Access customer information such as purchase history or loyalty status. Use the data to make smarter business decisions and to bring customers more of what they love.

Customer feedback

Collect customer feedback right from email and text message receipts.

CRM software

Manage your sales, marketing, customer support and contacts in a single system.

Square Email Marketing

Email marketing powered by your POS. Integrate customer data to send targeted campaigns in minutes.

Square Gift Cards

Boost sales and bring in new customers by offering physical or digital gift cards online or in person.

Square Loyalty

Build a customisable loyalty programme straight from your point of sale or Square Online store to keep customers coming back.

Square Subscriptions

Subscription management software

Create predictable revenue streams for free with subscription management software.

Team management

Manage your team and run your business all from one place, with connected scheduling and management tools.

Square Staff

Square Shifts

Manage rotas, time tracking, payroll prep and sales data all in one place.

Square Team Communication

Communicate one-on-one or with groups through the Square Teams app to keep your entire team connected.

Square Advanced Access

Increase your business security, gain team member insights and customise your team’s access to POS, Dashboard and Team app.

Money

Manage your money and control your cashflow – all seamlessly connected through Square.

Square Loans

Instant transfers

Cash out in minutes with instant transfers for a small fee – or for free with next-business-day transfers.1

Square Loans

For eligible customers, receive customised loan offers based on your Square sales.2

APIs, SDKs and integration partners

Square provides the partners, the platforms and the tools you need to run your business.

APIs and SDKs

Bookings API

Integrate Square Appointments into your application to create and manage bookings.

Catalogue API

Programmatically catalogue products or services, including items, variations, categories, discounts, taxes, modifiers and more.

Checkout API

Create a link to a Square-hosted payment page that’s shareable across online channels such as email, web pages and social media.

Customers API

Create and manage customer profiles, including membership in customer groups.

Inventory API

Implement programmatic management of inventory counts and changes in products or services.

In-App Payments SDK

Build a custom payment flow and accept Square-powered payments from within native mobile applications built on Android, iOS, Flutter or React Native.

Orders API

Track and manage the life cycle of a purchase. Record purchase items, calculate totals, track an order’s fulfilment and update a catalogue inventory.

Point of Sale API

Opens the Square Point of Sale application on top of a native mobile or mobile web application UI to take payments using a Square Reader or Square Stand.

Terminal API

Integrate with any web or mobile application to take payments using a Square Terminal.

Web Payments SDK

Build your own custom payment flow into a website or web application and accept multiple payment methods with Square such as credit card, Clearpay, digital wallet payments and more.

Explore more APIs and SDKs

Use our Developer APIs and SDKs to build on the platform that sellers trust.

App marketplace

Square App Marketplace

Connect Square to the apps you already use to manage your business.

Processing fees

In person

When you process a payment in person, Square charges a fee of 1.75% per chip and PIN or contactless payment.

1.75% per transaction

Online

1.4% + 25p for UK card transactions or 2.5% + 25p for non-UK card transactions.

1.4% + 25p or 2.5% + 25p per transaction

Manually entered

When you manually key in your customer’s card details or use a card on file, the fee is 2.5%.

2.5% per transaction

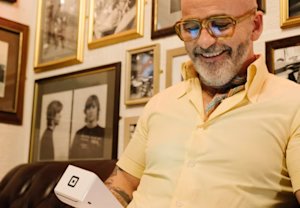

Reviews from business owners across the UK

Trusted by millions of businesses worldwide

FAQs

Business software is the programs, solutions and tools that allow businesses to perform specific functions. Business software improves efficiency and accuracy, and helps remove the need for manual tasks that can hinder business growth.

Yes, business software can help with a wide variety of tasks, including accounting, inventory management, customer relationship management, marketing and more.

Square offers a robust set of business solutions and tools that enable businesses of all types to handle common functions, such as accounting or customer relationship management, along with more specialised functions, such as developing a custom eCommerce store, creating a targeted marketing campaign or managing orders in real time.

When selecting the right business software, consider the tools you currently use and the tools you’ll need as you grow. No matter the size or type of your current business, the most important factor in selecting the right business software is how all the tools, solutions and functions connect and work together.

Square offers an ecosystem of tools that work together to power your entire business and allow you to sell anywhere. As you grow or expand, you can add the tools you need to scale, and they’ll connect with the Square software or hardware you already have in place.

Square Point of Sale integrates with popular cloud accounting software, such as Xero and QuickBooks. This means that Square transactions can flow automatically into your accounts, improving accuracy and reducing the need for manual data entry – a great time saver at tax return time.

Square works with any UK-issued and most international contactless, chip and PIN or magnetic stripe cards with a Visa, Mastercard, American Express, Maestro, Visa Electron or V Pay logo. Square also supports mobile wallets such as Apple Pay, Google Pay and Samsung Pay. Square processes all card types at the same standard rates.

Since Square is an ecosystem of customisable business software and hardware, it serves businesses in every industry, including restaurants, hospitality, retail, health and beauty, professional services, home repair and many more. Square tools suit businesses of all sizes and can benefit businesses looking to streamline operations and offer customers more ways to connect and pay.

Security is engineered into Square hardware and software from the ground up. All payments are encrypted to protect from hackers. Encryption is designed and maintained by Square, so you don’t have to go through third parties. Our in-house teams constantly monitor our server security, so your business can rest easy. Learn more about Square secure payment processing.

Simply sign up and create an account or contact our sales team to ensure you have all the tools needed to support your unique business needs.

1Funds are subject to your bank’s availability schedule, but are generally available in your bank account within 20 minutes of initiating an instant transfer. Minimum amount is £15 and maximum transfer limit is £3,500 per day.

2All loans are issued by Squareup Europe Ltd., registered in England and Wales (no. 08957689), 6th Floor, One London Wall, London, EC2Y 5EB. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Offer eligibility is not guaranteed. All loans are subject to approval. Terms and conditions apply.