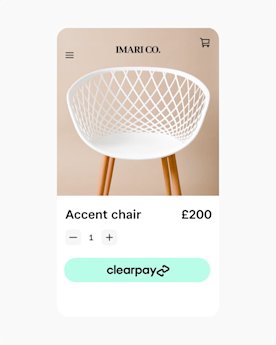

Bring in more business with buy now, pay later.

Let customers pay in instalments, while you get paid in full with Clearpay. More options for them. More sales for you.

BNPL by the numbers

Offering Clearpay as a BNPL (buy now, pay later) payment option can help boost your sales and attract valuable customers – at no risk to your business.

40%

Clearpay customers spend 40% more per transaction than traditional customers.¹

50%

Clearpay customers shop 50% more frequently than traditional customers.¹

20 M

Clearpay has over 20 million active customers around the world.²

Always know what you'll pay.

In person, Online, and APIs

6%+30p per transaction

You can remove Clearpay at any time by updating your settings in Payment Methods.

Clearpay works with the best of Square.

The BNPL payment method is integrated with

Square products and services.

Offer interest-free instalments with Clearpay.

Enabling Clearpay with Square is free. There are no subscription fees or start-up costs. You only pay when you make a sale. Give your customers more flexibility at checkout and see how your business can grow.

FAQs

Buy now, pay later, or BNPL, is a payment option where a customer pays for a purchase over time in instalments, while merchants get paid in full. With Clearpay, Square merchants can let customers pay in four interest-free instalments over six weeks.

The buy now, pay later payment method from Clearpay is available to many businesses in the UK. To see if you are eligible for Clearpay and to enable it for your business, log in to your Square Dashboard and review your Payment Methods.

If Clearpay is available to your business, you can toggle on Clearpay acceptance both Online and In-Store from within this setting. If you do not see Clearpay available within your Payment Methods, you are ineligible to offer Clearpay at this time. Get more details

Merchants using Clearpay get paid in full at the time of purchase, minus a processing fee on the total order.

Clearpay Processing Rates

- In Person, Online, and APIs: The processing rate for all Clearpay transactions is 6% + 30p.

The platform is set up so Clearpay takes on the risk of customer fraud for you so you can focus on growing your business. You will receive the full payment and at no risk to your business.

Clearpay is an optional payment method that Square offers to sellers. If at any time you decide you do not want to offer Clearpay at checkout, you can turn it off within your Dashboard settings.

All transactions processed through Clearpay will be charged at our standard Clearpay rates. This Clearpay specific rate allows you to get paid in full, while Clearpay takes on all risk associated with customer fraud and late payments.

Clearpay Processing Rates

- In Person, Online, and APIs: The processing rate for all Clearpay transactions is 6% + 30p.

Simply direct your customers here to set up their Clearpay account. Make sure you are contacting your customers with the necessary marketing permissions.

If your customer chooses to make a return, they will be refunded their full payment amount.

For details on how to guide a customer to make an in-person Clearpay return, please reference this article.

See Clearpay.co.uk for full terms.

¹“Quantifying The Incremental Impact of Clearpay” Mastercard 2021

²Clearpay Annual Report FY 2021