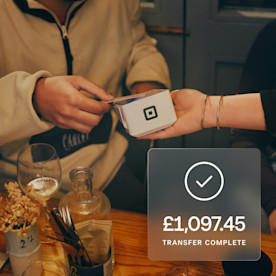

Get your money right when you need it with Instant Transfers

With instant transfers, you can access your money immediately for a small fee – or choose standard as soon as next day transfers free of charge.

Stay in control of your cash flow

Get your funds instantly, next day, or on a custom close-of-day schedule – with little or no fees.

Move your money your way

See all the ways you can transfer your money with Square.

| Compare transfer options | Speed | Price |

|---|---|---|

| Instant | Instantly on demand into your external bank account. | 1.5% of amount |

| Standard | As soon as the next day into an external bank account. You can also customise your close-of-day schedule. | Free |

| Manual | Store a balance with Square and initiate transfers on demand. | Free |

Total control of your cash flow

Ready, set, transfer

Transfer funds to your linked bank account as soon as the next day with standard transfers. Need your money faster? Transfer instantly for a 1.5% fee.

Keep an eye on your money

Send and track your money the way you want – from customised close-of-day transfers to detailed activity and sales reports.

Transfer your way

Pick the transfer speed that suits your business – whether you need your money immediately, the next day, or on a custom close-of-day schedule.

“Instant transfers ensures we are able to place any last-minute orders and purchase what we need, when we need it, without worrying about not having enough in the bank.”

Ruby Winter and Jake Johari

Co-owners of The Street Easy, London

All your questions, answered in one place

An instant bank transfer is the movement of money from one account to another in a flash. You can expect instant transfers to become available in your account in minutes (or even seconds).

Instant bank transfers are a great way to get money from sales into your linked bank account as soon as you make a sale. This will help you manage cash flow for your business by giving you access to cash when you need it.

Making an instant transfer is as easy as 1-2-3.

- Go to Balance in your Square App.

- Select “Transfer Instantly.”

- That’s it!

Instant transfers require a minimum balance of £15 after Square’s processing and transfer fees, and a maximum transfer size of £3,500. Funds that are not eligible for instant transfers will be sent to the bank account linked to your Square account in one to two business days.

Note: New Square sellers start with a limit of up to £750 per day. As you run and grow your business with Square, a higher daily transfer amount may become available.

Yes. When you take payments with Square, you get access to instant transfers. Simply make sales with Square and visit Balance in your Square app to move your money in moments to a linked bank account.

Yes. Square Instant Transfers are available 24/7, including evenings, weekends, and bank holidays. Transfers typically arrive within minutes, though some banks may delay posting outside normal processing hours.

Don’t have an account with Square? Sign up today.

Payments processed by Squareup Europe Ltd.

Square Europe Ltd is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (registered reference no. 900846) for the issuing of electronic money and provision of payment services.

*Funds are subject to your bank’s availability schedule, but are generally available in your bank account within 20 minutes of initiating an instant transfer. Minimum amount is £15 and maximum transfer limit is £3,500 per day.