Table of contents

Regional Australia is undergoing a revival. Powered by record migration from metropolitan areas and freedom from the longest and harshest of lockdowns, the growth and innovation of regional business has never been as important to the Australian economy.

Square’s State of Regional Business Report is based on aggregated data from millions of transactions across Square’s Australian sellers, comparing data since the onset of the pandemic with the same time period before March 2020, and a survey of hundreds of small business owners. The report uncovers business performance across the country, looking specifically at regional businesses, their outlook on the future, and top of mind challenges.

Growth in regions belies pandemic challenges

The pandemic tested the resilience of Australia’s small businesses like never before. However, in times of crisis the Australian small business community shows its adaptive and resilient best. This is particularly true for those businesses who are based in regional Australia.

A trend across Australia saw more people leaving their more expensive, inner city living for a life away from the hustle and bustle. ABS data shows net migration to regional Australia is the highest since records began two decades ago. As more people migrate away from metro cities and to more regional towns, small businesses in these areas have seen notable growth compared to their metro counterparts.

According to Square data, regional businesses have been outpacing their metropolitan counterparts with Square businesses in regional Australia processing 259% more in payments since the onset of the pandemic compared to the same time period before March 2020. Comparatively, businesses in metro areas processed just 178% more in payments. Not only has this mass migration enabled regional businesses to grow, but it has also sparked opportunities for aspiring entrepreneurs to start their own business, with the ABS reporting a 15.8% jump in registrations for small businesses in the last financial year.

Claire Hewson, co-founder of Flamin Galah, knows exactly how hard starting a new business in the height of a pandemic. The craft brewery, based in Huskisson, near Jervis Bay in regional NSW, opened its doors in March 2020 on the cusp of the pandemic.

“The last couple of years have definitely been challenging for us. We were uniquely impacted across two separate locations and at two separate periods of our business,” she said.

“To help us through and keep things fresh, we started offering new products to the local community as takeaway options. We’d still sell growlers of our beer, but we’re now also selling cocktail kits and working with some of our good friends who run a food truck, The Nest, and invited them on site to help them sell their products too.”

For Flamin Galah, local is best. Claire and her husband Sam credit the local community for coming together to help businesses in the area stay afloat, and they’re repaying that loyalty.

“We aren’t looking to take over the world just yet, and will stay local for the time being and give our locals and regulars the first taste of our new products or ideas. We’ve had tonnes of requests from other parts of Australia to start an eCommerce store, so we’ll be looking into how Square Online can help us grow a second revenue stream,” she said.

Regional Queensland leads growth

Australia is experiencing an entrepreneurship explosion. More businesses began taking payments with Square since the onset of the pandemic until now, compared to the same time period before March 2020 – with the pace of adoption growing more quickly in regional areas than in metro areas.

The small business boom is being driven in large part by a desire to have freedom to work on their own terms, with nearly 70% of survey respondents agreeing this was the biggest driver of establishing a new business, followed by wanting to be their own boss (55%), and passion for their field of work (39%).

While regional growth has outpaced that of metro area growth in every state, a small town in South Australia has seen the biggest jump of new business sign-ups. Port Pirie, a coastal town north of Adelaide, has seen a 300% increase in the number of businesses taking payments on Square’s platform since the start of the pandemic.

Regional Queensland towns like Goondiwindi, Palmview and Tamborine Mountain help the state to account for four of the top ten fastest growing regional towns on the platform. Other top performing towns outside of Queensland include:

- Devonport, TAS – 119%

- Jindabyne, NSW – 173%

- Collie, WA – 127%

- Port Fairy, VIC – 200%

E360 Design is a Square seller and art gallery based in Tamborine Mountain that was forced to pivot in order to survive the pandemic.

“Having started our business in the midst of the pandemic, we quickly learned to embrace uncertainty, upping our digital skills, and flexing our strategy accordingly,” said Jen Robson, owner of E360 Design. “We use Square for our in store payments and link it to an online store to give us better visibility on what products are selling the most, making it easier for us to predict what art pieces we will need to restock — which has been so helpful, as seasonal buying has been hampered by travel restrictions.”

The digital divide

Overall regional growth is a cause for optimism, however, there still remains a significant digital gap between metro areas and regional areas. Metro areas are embracing eCommerce in every sector, but regional businesses remain well below the digitisation rate of their metro counterparts.

Regardless of location, there’s an urgent need for small businesses to embrace eCommerce. More than a quarter (27%) of small businesses do not have an online store, and only two in five of those without are planning to open one.

This lag is even more pronounced when we look at gender, with female business owners significantly more likely (64%) to have an online presence compared to male business owners (40%).

Despite the disparities, business owners are keen to improve and expand their skill sets. When asked what areas they would like to improve their knowledge in when it comes to running a successful business, almost half of entrepreneurs ranked how to best use social media to promote their business as the number one skill competency, followed by awareness of marketing methods (47%) and how to best manage business’ cash flow (38%).

This has a natural knock-on effect on potential customer bases, which have barely shifted post-COVID. With only 21% of sales coming nationally and 7% globally, there is ample opportunity for small businesses to expand customer bases through eCommerce offerings.

There is change underway, especially for regional areas, with the growth rate of regional businesses signing up to Square Online outpacing counterparts in metro areas over the past 12 months.

One business that’s seeing the benefit of moving online is gourmet deli, pantry and creperie, Provisions in Braidwood in regional New South Wales, about 200 kilometres south west of Sydney.

“We launched an online store with Square Online the day the lockdown commenced as we wanted to be on the front foot. We plan to keep it as it’s worked really well for us! Customers are so familiar with online shopping these days that we’re more than happy to continue this service for them,” said Julien Besnard, Operations Manager of Provisions Deli & Creperie.

Confidence is high, but barriers still persist

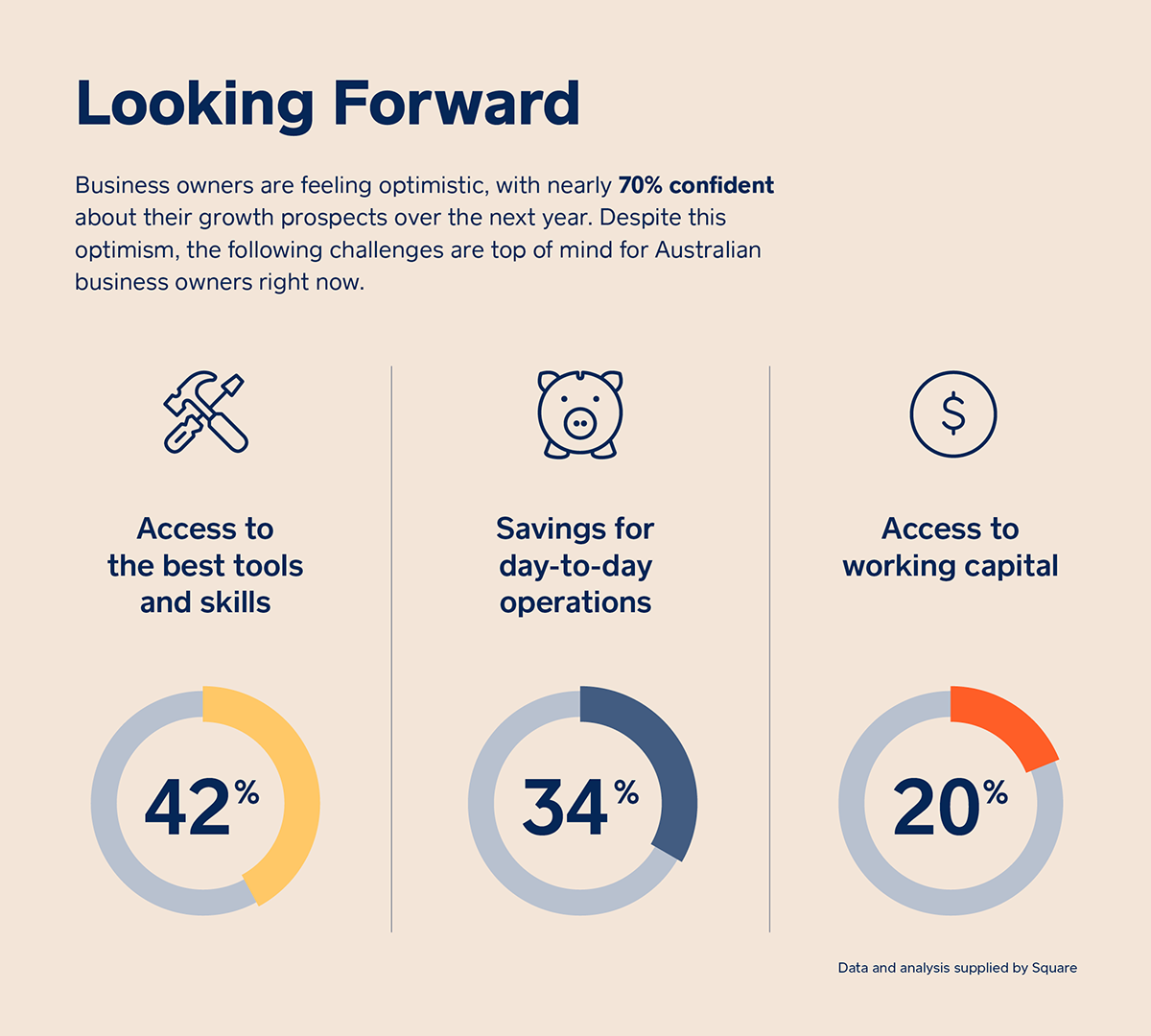

Despite nearly two years of snap lockdowns, border closures and reduced tourism, business owners are feeling optimistic, with nearly 70% having confidence in their growth prospects over the coming year.

Gold Coast based specialist beauty parlour, The Lash Spa, is optimistic about its future and pins its success down to building an amazing customer experience.

“Square has been a huge asset to our business. The Square Reader is incredibly reliable, which helps us focus on what’s most important: servicing our customers,” said Melissa Bergen, founder of The Lash Spa. “We put a huge emphasis on client experience and invested everything we had to ensure our clients kept coming back to us. We’re really excited about what’s coming for The Lash Spa, and are investigating different ways to scale the business.”

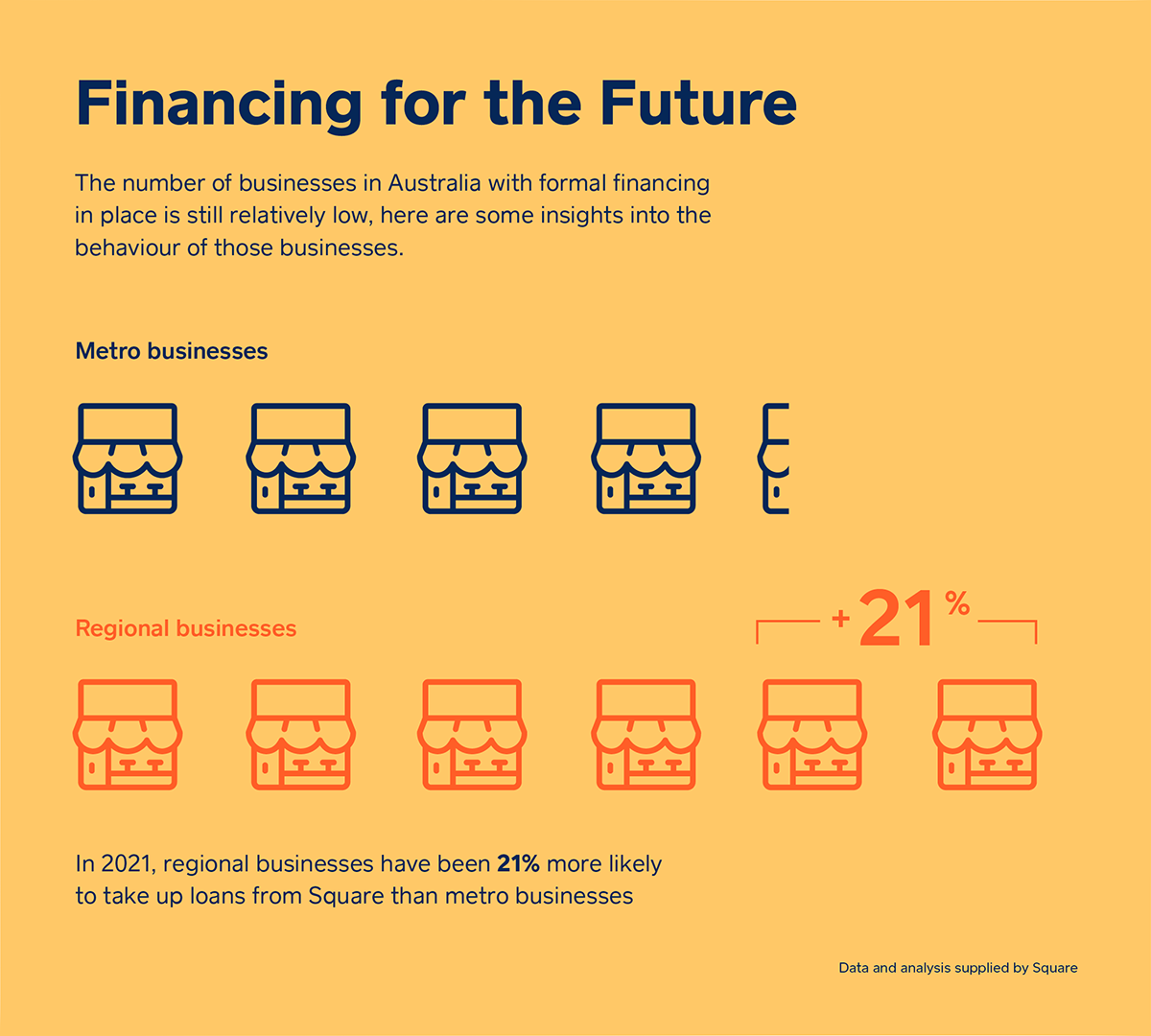

And while there’s optimism within the national small business community, there are a number of challenges to be addressed. Looking forward, small business owners across the country are citing better access to the right tools and skills (42%), the savings needed to finance day to day and operations (34%) and access to working capital (20%) top the list as the biggest obstacles.

Cameron Giddings, owner of Little Larder in Stanthorpe in regional Queensland, was looking to invest in his business to allow them to scale during the pandemic and so looked to Square for a loan.

“We use Square for in store payments, gift cards and everything else, so when we heard that they were helping small businesses out with loans, we were keen to see what they could offer,” he said. “The faster we could access new funding, the quicker we could invest it back into our business. When we were approved in 40 mins, we were delighted. It allowed us to go out and buy a new company vehicle the next day which we now use to expand our catering operation.”

Normality on the horizon

Normality on the horizon

While business is still not completely back to normal, there are a number of pandemic pivots that are going to remain in place to help businesses across Australia, regardless of their size or type, continue to thrive and grow. “Our regions have been particularly savvy and have turned to technology to help them adapt and enable continued growth. We’ve seen huge numbers of our Australian sellers turning to Square Online to build an omnichannel business and tap into a Square Loan to invest in their business to build new revenue streams.”

— Colin Birney, Head of Business Development at Square Australia

“The last two years have shown the entrepreneurial and adaptive best of Aussie business,” said Colin Birney, Head of Business Development at Square Australia. “Our regions have been particularly savvy and have turned to technology to help them adapt and enable continued growth. We’ve seen huge numbers of our Australian sellers turning to Square Online to build an omnichannel business and tap into a Square Loan to invest in their business to build new revenue streams.”

Disclaimer

The data used in this report was collated from a general population survey of more than 300 Australian business owners, plus aggregated data from millions of transactions across Square sellers in Australia between March 2020 and October 2021, compared to the same time period before the onset of the pandemic. This article is for informational purposes only and does not constitute professional advice. For specific advice applicable to your business, please contact a professional.

![]()