If you’re a company just starting out, then the ring of the till is probably the one sound you’re most eager to hear. But in these modern times, it’s not enough to just stick a till on your counter and await the paying masses. This is the era of contactless cards and digital wallets, a time when ‘money’ is not synonymous with ‘cash’. In fact, if your business is still relying on customers coming in with pockets full of cash, you’re at risk of losing sales.

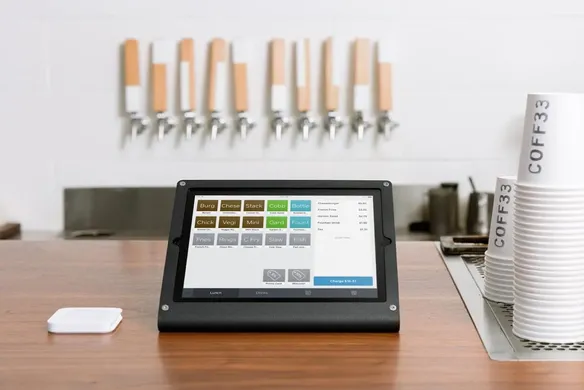

How to safeguard against this fate? By equipping your business with payment solutions that work for you, your customers and the range of modern payment methods they may wish to use. In short, you need an Electronic Point of Sale (EPOS).

How do EPOS Systems Work?

The short answer? However you want them to. EPOS systems are amazingly versatile. The basic technology lets you finalise sales and accept all sorts of card and digital payment, all this requires is POS software and a card reader. EPOS systems also make portable payment systems a breeze, with their tech able to be squeezed into pocket-sized hardware, run on smartphones or loaded onto a laptop.

For large retailers like supermarkets, an EPOS can be made to work with barcode scanners, touchscreen input and weighing scales – all tech you’re sure to have noticed in your nearest self-check out. But EPOS tech isn’t just for the big names and high street giants, powerful tech is just as applicable to the smallest business. EPOS is about convenience and efficiency, no matter how big or small your business is.

How is EPOS Different to Standard Cash Tills?

If you are a cash-only business not yet initiated into the world of EPOS, you run the very real risk of losing sales. With the average Aussie carrying less and less cash, substantial purchases won’t be very forthcoming unless an EPOS/card reader is, too. Not only is the cash-only approach crippling to your sales figures, it also gives the impression of your business being old fashioned (an ipad EPOS vs a standard cash till makes for quite the contrast).

So, how is an EPOS different to a standard cash till? Simple, one is the past, the other is the future of your business.

Here are six key reasons you should get your business equipped with an EPOS system:

1. They don’t have to be expensive

Electronic cash till? $140. EPOS? Free (with Square hardware).

That’s a pretty good argument. Cash registers are rarely cheap, require maintenance and need to be constantly plugged in, so they do your utility bill no favours, either.

A good EPOS (we think we know just the one) requires no more than your smartphone or iPad to run, can be connected with other EPOS hardware that runs wirelessly and only requires charging at intervals – and, in our case, is completely free.

2. They’re fast

Cash is slow — and can be expensive for your business.

Waiting for customers to fish the correct amount out from their pocket, dealing with change, trying to make sure you give the correct amount back. EPOS systems make it all digital. You pay by card or digital wallet – just press your phone or tap and go card to the reader, or type in your PIN – and that’s it. The electronic POS system charges you the exact amount, no cash, no fuss and no human error that may end up with customers being short-changed. It’s faster, fairer and for your small business, it’s a game-changer when it comes to getting those sales through.

3. You don’t need to pay for yearly maintenance or monthly fees

Once you download Square’s EPOS app, it’s yours to use. No user fees or membership costs. Rates for accepting card and contactless payments are fair and low-priced, and features like employee management and customer feedback are completely free to use.

4. You can use them to process new payment methods like contactless payments

Contactless cards, chip and PIN, Apple Pay, Google Pay, Samsung Pay, even magnetic stripe cards from overseas, Square’s EPOS combined with our EFTPOS machine and backup magnetic stripe card reader means your EPOS will do far more than an old-fashioned cash register ever could. Which means you’ll also be making far more sales.

Square accepts Visa, Mastercard, American Express, JCB, and eftpos chip cards for one flat fee.

5. They save you time and money

EPOS systems are easy to learn (no need to have senior staff spend a whole day training new starters), easy to use (sales done in seconds) and do far more than they say on the tin (there’s a whole lot of value for money in this one little app). Plus, they run from your smartphone or tablet – EPOS watches, Aussie smartwatch owners will be happy to hear, are even a thing with Square being compatible with Apple Watch.

Here’s a quick rundown of just some of the ways our EPOS system could revolutionise your business, cut down your costs and boost up your sales:

- Faster checkout

Less staff needed to man the tills equals lower overheads and happier customers - Accurate, real-time inventory management

Our EPOS software tracks your stock, so you can reducing the risk of waste or stagnant goods by always being on top of your stock - Improved customer experience

Accept any way customers want to pay, send them a digital receipt and have their purchase complete in seconds - More accurate pricing

You can save discounts, happy hour deals and other offers within our EPOS, so your staff will always price things up correctly at the till and customers always get the deal they expect - Affordable integrations

Square has teamed up with top industry apps including Ecwid and Weebly so you can look after every aspect of your business from your EPOS. Better yet, it makes going omnichannel – the future of any successful retailer – a breeze, even for the smallest business - Real-time sales analytics

Track sales by period or employee and get an unrivalled overview of what works best for your business, your customers and your sales figures

6. You can integrate them with other software like inventory and accounting

Because EPOS is all digital, it’s quick, easy and completely seamless to integrate it with other software. Our App Marketplace is full of helpful extra apps to let you make the most of your EPOS system. It’s not all about sales either, our app extras ensure the smooth running of your business at every turn. Xero gives you the option to perform online accounting and integrates with Square so your numbers are all there and ready to get calculated in-app. Shopventory gives you enhanced analysis of your business, stock, inventory and profit margin, with key facts and figures about the state of your inventory and profit ready at any time.

An EPOS is a small change that will make a huge difference to how easily and effectively you can achieve success in your business.

Related articles

What is NFC?

What’s the Best Point of Sale for my Business?

The Best EFTPOS Machine for Your Business

![]()