Our new Build with Square APIs offer sellers and developers a simple and elegant way to integrate Square’s powerful payments ecosystem into your website or point-of-sale app. But with so many features and opportunities to help start, run and grow your business, it’s easy to feel a bit overwhelmed. Here’s what you need to know:

Which Square APIs are available in Australia?

The following payment APIs are available to sellers and developers in Australia, the United States and Canada:

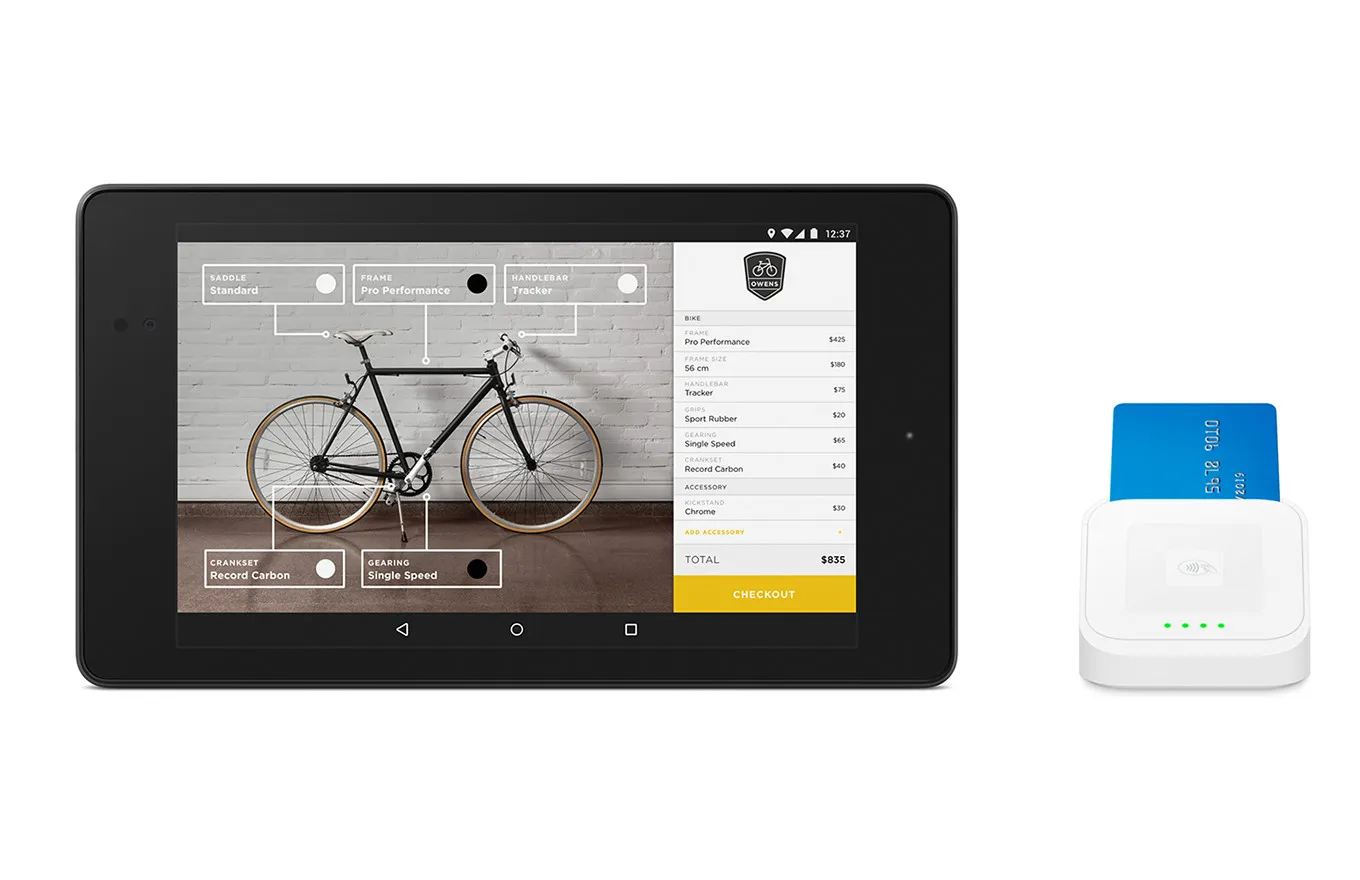

The Square API for point of sale enables you to build your own point-of-sale app on any iOS or Android device for use in your store or on the go. Our API will trigger an app switch that connects the customer from your app to the Square point-of-sale app to finalise the transaction.

The Square API for e-commerce enables you to accept credit and debit card payments online by integrating Square’s payment gateway on your custom website or leveraging our partnerships with website builders such as BigCommerce, Weebly, Ecwid, WooCommerce, Wix and Magento.

What do Square’s APIs offer?

There are a stack of benefits involved in using Square’s payment APIs to develop a solution for your business, including:

- PCI compliance for online payments is covered using end-to-end encryption.

- Payments are transferred into your bank account in one to two business days.

- Integration is simple: start processing payments with less than 10 lines of code.

- There’s no need to set up a merchant account or separate payment gateway.

- You can integrate with Square’s beautifully designed payments hardware.

- Get a 360-degree view of every transaction you’re processing in every location.

How much do Square’s APIs cost?

It’s free to integrate Square’s APIs into your software or website.

Visa, MasterCard, eftpos, JCB, and American Express credit or debit card payments processed online with Square are charged at 2.2% per transaction — whether they’re local or international. There are no monthly fees, contracts or long-term commitments required.

Card payments accepted in person using Square Reader via applications integrated with our point-of-sale API are charged at 1.6% per tap, insert or swipe for any Visa, MasterCard, eftpos or American Express transaction.

When I sell online with Square, how long will it take for my money to be transferred into my account?

Cash flow is critical to every small business, so helping you get paid fast is our priority. Tranfers for your payments are made into your nominated Australian bank account in one to two business days. Check out our standard transfer schedule.

Are Square’s APIs for e-commerce Payment Card Industry (PCI) compliant?

We’ve got you covered. Square takes on the burden of staying PCI compliant. No checklists, assessments, or audits required. We understand that dealing with PCI can be a heavy burden, so we’re happy to carry this for you. Using Square’s online payment processing APIs, we transmit your customer’s payment information safely and securely from the beginning to the end of the transaction, so you can focus on selling with confidence.

What currency will my sales be processed in?

In Australia, all transactions using Square’s point-of-sale and e-commerce APIs are processed in Australian dollars.

Will I still need a separate payment gateway API or merchant account to accept payments with Square’s APIs?

No. Square’s API includes our secure payment gateway, and you can link your Square account to any Australian personal or business bank account so we can transfer your money quickly. You can sign up for a free Square account in minutes.

![]()