Business growth resilient at pre-pandemic levels, COSBOA and Square report finds

The Council of Small Business Organisations Australia (COSBOA) and Square have today launched the third edition of the Quarterly Small and Micro Business Index shining a light on the resilience of business in Australia.

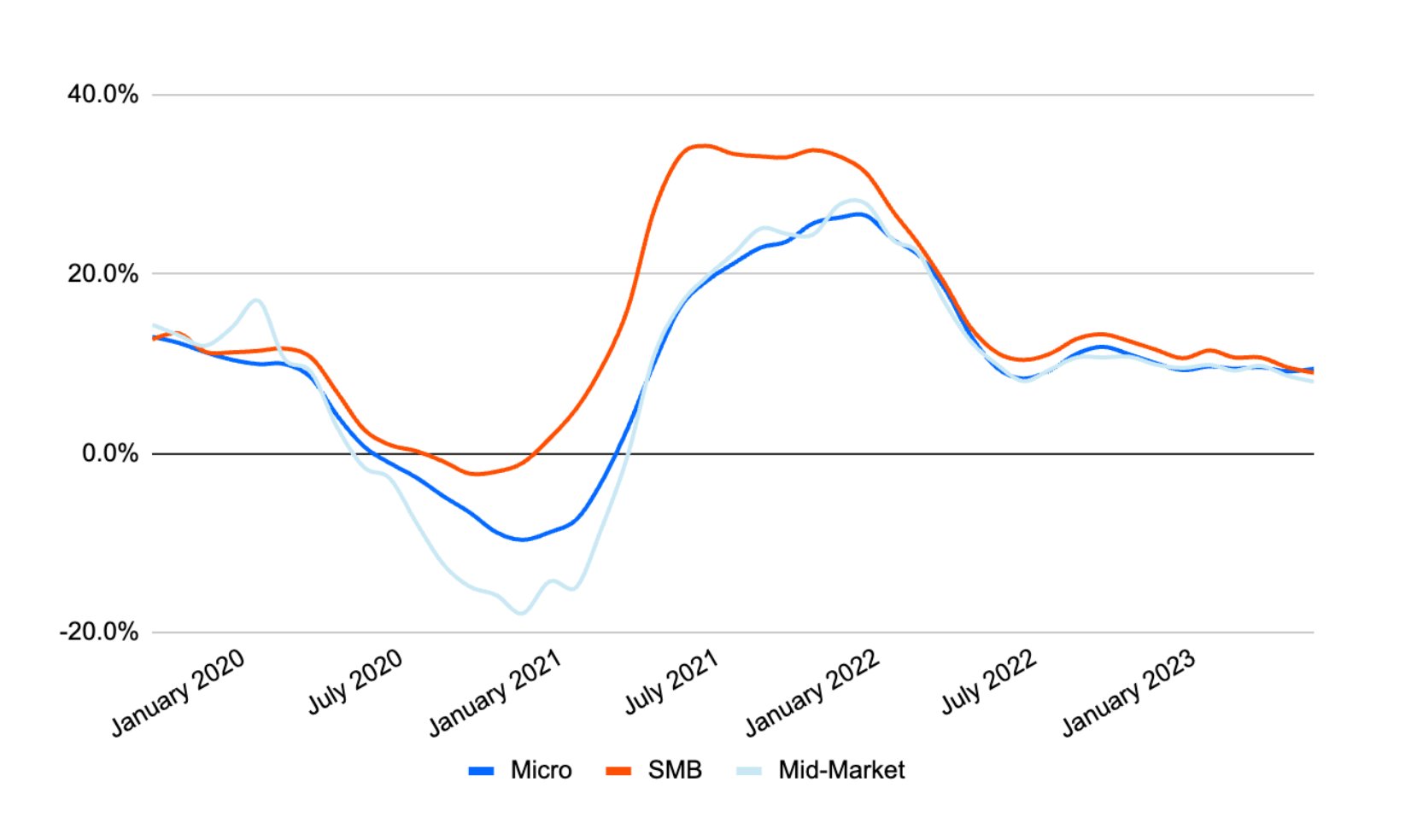

The latest report highlights how growth rates at Australian businesses have returned to pre-pandemic levels, following COVID-caused spending pull back and a subsequent strong spending rebound. Current growth rates are similar across all business sizes, despite SMBs growing faster than micro and mid-market businesses over the course of the last two years.

“The scale of Square’s platform, which is used across the country for both in-person and online commerce, gives us an accurate picture of the business landscape and is a key barometer of the health of businesses in Australia”, said Luke Achterstraat, CEO of COSBOA. “Our aim is to use data from Square and other sources to present a realistic picture of what small businesses are experiencing. We know macroeconomic data doesn’t always tell the whole story, so this report fills in the gaps. Our hope is that this report brings further context and clarity to small businesses, industry, and decision makers, aiding evidence-based decision-making.”

“While the data is showing growth rates at pre-pandemic levels, many businesses are preparing for a pullback of consumer spending,” said Marco Lamantia, Executive Director for Square in Australia. “But rather than bunker down, we’re seeing businesses be proactive. They’re creating new revenue streams to unlock growth, and turning to software to automate their operations to do more with less and build resilience.”

Along with business growth data, the report from COSBOA and Square also observes how broader macroeconomic factors, like business entries and exits, and job vacancies, are shaping the small business landscape.

New businesses stable as exits rise

Data from the Australian Bureau of Statistics shows that - despite an increase in business exits - there remains a net positive in new businesses being started in the last quarter (March to June saw a net increase of 11,349 new businesses in Australia).

“While an economic downturn can be extremely stressful for businesses, it can also be a time to really encourage owners to innovate,” says Lamantia. “At Square, our sellers get creative and diversify how they generate income from their businesses. We’ve seen barber shops open merch lines to bring in retail revenue, while growing their brand presence; we’ve seen delis use their products to begin an evening dinner service.”

Job vacancies show staff shortages

High vacancy numbers (189.3% of pre-pandemic levels) highlight just how much strain small businesses are on from a labour standpoint. Arts and recreation, as well as accommodation and food services, may have recorded the largest improvements since Q2’23, but these industries are still facing the highest job vacancy rates of all industries at 227.8% and 188.3% of pre-pandemic levels respectively.

The current market dynamics have already significantly increased the cost of employment for small businesses.

For some businesses, that’s too much to handle: “In many cases, people are handing back their ABNs and ceasing trading,” says Achterstraat from COSBOA. “With the small business sector facing increasing costs across the board, it is vital that the Federal Government continue to provide support and fit-for-purpose policy settings.”

Other businesses, however, are turning to technology to reduce labour stresses.

“As businesses are needing to do more with less, we’re seeing them embrace technology to streamline their operations in innovative ways,” says Lamantia from Square. “Generative AI tools are being used by our sellers to help craft more effective marketing campaigns and customer loyalty propositions; automation tools are helping take on some of the administrative burden to give employees time back to focus on growth or customer experience. Using the right software can sometimes make it feel like businesses have an extra employee.”

About the report

This report is the third in a quarterly series that aims to provide a unique insight into the reality of small businesses in Australia.

COSBOA has traditionally been recognised for its ability to draw on anecdotal evidence from its base of 45+ industry associations in its conversations with media, governments, and regulators. Now that anecdotal evidence of small business sentiments and struggles is being supported with real and up-to-date data.

The reports leverage data and analytics from COSBOA’s partner, Square, as well as numerous existing data-sets that incorporate the experience of hundreds of thousands of small businesses from across Australia.

With this series of reports, COSBOA endeavours to offer an additional perspective – to show what small businesses, and the broader community, are seeing on the ground – to be considered by bureaucrats, and to challenge some of the macroeconomic data that is often too heavily relied upon to make policy decisions.

Click here to read the full report.