Table of contents

When you’re a small business owner, it’s key that your payment systems fit three criteria: quick, simple, and secure. That’s why technology like Apple Pay needs to be on your radar. Not only does it check all those boxes, but pretty soon, your customers will expect it.

There’s wider adoption among younger groups like Millennials, and as that group is now the largest generation (and one with big buying power), you should get comfortable with accepting mobile payments. To keep your business moving with the times, it’s especially important to accept Apple Pay in the UK sooner rather than later.

To help you do that (or to refresh your memory), here’s a primer on how to accept Apple Pay with Square.

What is Apple Pay?

Before you make a decision about accepting Apple Pay with Square, let’s go over how it works. Apple Pay is a type of contactless payment that is enabled through a technology called near field communication (NFC). NFC is what enables two devices—like a smartphone and a payments reader—to communicate with each other when they’re held close together.

Apple Pay is available on the iPhone, iPad, and Apple Watch. Learn more about how to set up Apple Pay on your device.

How does Apple Pay work?

Apple Pay is Apple’s mobile wallet. In stores, Apple Pay allows you to check out and pay by holding your phone over a payments reader that can accept Apple Pay. In apps, Apple Pay allows you to trigger a payment from just a tap on your phone. If you want to know how to use Apple Pay on websites, simply click the “Buy with Apple Pay” button on the checkout page and then confirm the payment with a tap on your phone or the button on your Apple Watch.

Apple Pay utilises NFC, which enables two devices to communicate wirelessly when they’re close together. Increasingly, NFC is being used to power contactless payments like Apple Pay.

Apple payment processing uses a system called tokenisation to safeguard bank details. After you take a picture of your credit card and load it into your iPhone, Apple sends the details to your card’s issuing bank or network.

The bank or network then replaces your bank details with a series of randomly generated numbers (the token). That random number is sent back to Apple, which then programs it into your phone. This means that the account details on your phone can’t be cloned into anything valuable to fraudsters.

During a transaction, NFC transfers a token from your iPhone to the payment processor, securely and quickly. It’s as easy as that.

Why accept Apple Pay and other mobile payments?

There are two main reasons to set up Apple Pay for your business: speed and security.

Mobile payments are processed faster than chip card payments, which means when you set up Apple Pay and other mobile payments, you can make a serious dent in wait times at the till (and, as a result, improve customer satisfaction).

When it’s the lunchtime rush and you’ve got a queue out the door, you need to ring up customers as quickly as possible. If the queue isn’t moving fast enough, customers might go somewhere else. In other words, the faster you serve customers, the more money your business makes.

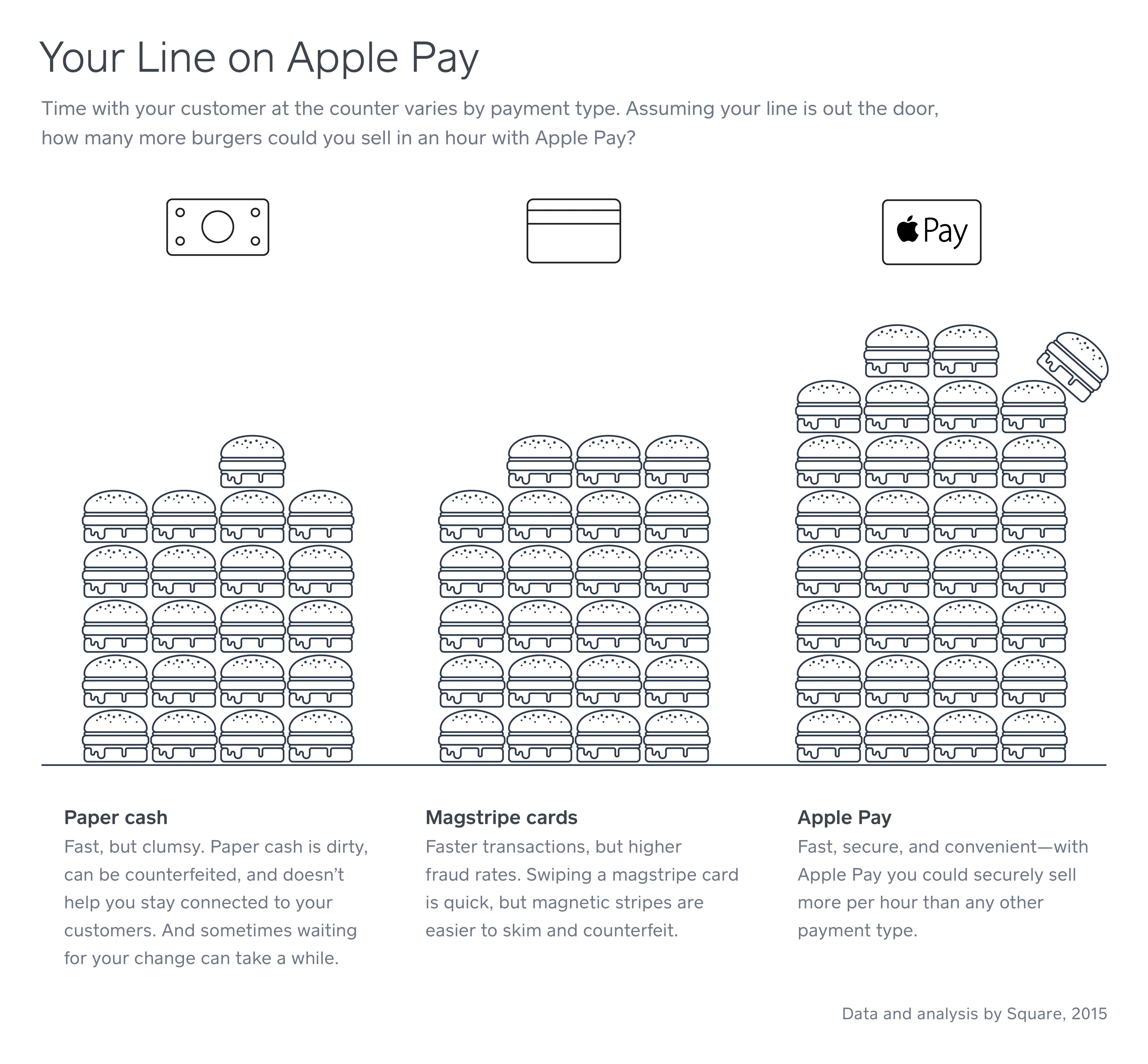

We’re using burgers to represent an “item.” Of course, there are a number of factors here—how many customers are fumbling for change or how long it takes your staff to give change back, how quick customers are with their phone, how fast your short-order cook can flip burgers—but the graph gives you a good idea of each payment type’s speed.

What’s the gist? Shops that accept Apple Pay can move people through their queues more quickly, and that’s better for business.

Even more important than speed, Apple Pay payment processing is very secure. The card data is tokenised, encrypted, and constantly changing, which makes it way more difficult for fraudsters to do anything with it.

Apple Pay has an added layer of security, requiring fingerprint verification or authentication from your phone password. That means even if thieves are able to unlock your phone, they still won’t be able to access your Apple Pay account. Accepting Apple Pay means you’re better protected against fraud, which benefits everyone.

Is Apple Pay Secure?

It’s natural to question the safety of loading your credit card and bank information on a device, but rest assured, it’s very secure. Here’s why: in order to authenticate a payment through your phone, you have to insert a passcode or hold your finger on the Touch ID button to have your print scanned and verified or use Face ID which utilises TrueDepth camera and machine learning technology for a secure authentication. The entire transaction is complete in just a few seconds.

Beyond passcodes, fingerprints and facial recognition, the data associated with your cards is encrypted and always changing, so even if your phone is stolen, thieves wouldn’t be able to do anything with the information. That makes the technology more secure than magnetic-stripe cards, or even cash for that matter.

What hardware do I need to accept Apple Pay?

Most NFC-enabled terminals (like Square Reader) accept Apple Pay. Customers just hold their Apple device over the terminal and complete the transaction with their passcode, Touch ID, or Face ID. Square Reader connects with Square Stand, and you can also use it for transactions outside your store, like at events or outdoor markets.

So how do you accept Apple Pay with Square if you don’t have a physical store? Fortunately, you don’t have to have a brick-and-mortar store to accept Apple Pay in the UK—now you can use it within certain apps and websites. There’s obviously no NFC reader involved in these transactions. If you’re using Apple Pay in an app, just insert your passcode, place your finger on the Touch ID button or use the Face ID function.

If you’re using it on a website, click the “Buy with Apple Pay” button on the checkout page and then confirm the payment with the passcode, Touch ID or Face ID on your phone. You can use Apple Pay within the apps of businesses such as Addison Lee, Uncover, Airbnb, British Airways, Miss Selfridge, and Zara.

How do I accept Apple Pay at my business?

It’s easy to set up Apple Pay for your business. Here are some best practices for setting up your Square Reader and Apple Pay marketing kit:

- Get a new NFC-enabled payment terminal that accepts contactless payments like Apple Pay. Square Reader, Square Stand, Square Terminal and Square Register all accept contactless payments. Our newest Square Stand fits iPad (2021, 2020, 2019), iPad Air (2019) and iPad Pro 10.5.

- Set up your new reader. Square Reader connects to your device wirelessly as long as you have a compatible iOS device. If you’re setting it up with Bluetooth LE, make sure Bluetooth is enabled on your mobile device. Then open the Square app and connect the reader. Make sure the reader is facing your customers and is within their reach so they can make Apple Pay payments easily.

- To accept payments, have customers hold their iPhone, iPad or Apple Watch near the reader until four green lights appear and a chime sounds. When you see the checkmark on your screen, the transaction is complete.

You can also accept Apple pay on your website. Square Checkout, a hosted checkout that developers can implement with a single integration, supports Web Apple Pay.

In addition, Square e-commerce API supports Web Apple Pay and makes it easy for developers who are building their own checkout flow and want to learn how to accept Apple Pay with Square.

How do I train my staff to use Apple Pay?

The more knowledgeable your employees are about Apple Pay, the more likely they are to recommend it to your customers. So use the materials provided with your Apple Pay marketing kit training sheet that explains how to accept Apple Pay payments. It also explains how to help your customers set up Apple Pay, in case they need a hand.

The kit also includes stickers that are cheat sheets for your staff—in case they need a reminder about how to accept Apple Pay or tell a customer how to set it up. Put the stickers near your point of sale so they are easy to access during transactions.

How do I let customers know I accept Apple Pay?

Once you’ve set up Apple Pay for your business, let your customers know about it.

Placing Apple Pay decals throughout your store is an easy way to let customers know that you’re one of the shops that accept Apple Pay.—Decals are included free in your Apple Pay marketing kit. Each kit includes: one window decal, two register decals, and six POS terminal decals, with a maximum order of one per business. It’s a pretty low-tech way to get the message out, but surprisingly effective. (Apple offers free Apple Pay decals on its website, too.)

To make sure you reach people who haven’t been in your store lately, post on your social media accounts that you’re all set for mobile payments. Maybe post a picture of your new Square Reader to show your most tech-savvy customers that you’re ready for mobile payments.

Or, send an email to inform your regular customers of the update (while you’re at it, it’s a good opportunity to let them know about new items or services). We’ve created a template that you can send your customers right away.

Using Apple Pay also makes it easy for you to run your business on the go. So now that you know how to accept Apple Pay with Square, the next thing is to make sure you order what you need to accept mobile payments.

**Ready to use Apple Pay at your business? Order our Square Reader for just £19.00 + VAT.

![]()