Table of contents

A point of sale, or point of purchase, is where you ring up sales for customers. When customers check out online, walk up to your counter, or pick out an item from your stand or booth, they’re at the point of sale. You can even do this on hardware you already use for your business, like your computer or phone.

Your point-of-sale system is the hardware and software that enable your business to make those sales.

How does a POS system work at a small business?

A POS system allows your business to accept payments from customers and keep track of sales. It sounds simple enough, but the setup can look and work differently, depending on whether you sell online, have a physical shopfront, or both.

A point-of-sale system used to refer to the cash register at a shop’s counter. Today, modern POS systems are entirely digital, which means you can check out a customer wherever you are. All you need is a POS app and an internet-enabled device, like a tablet or phone.

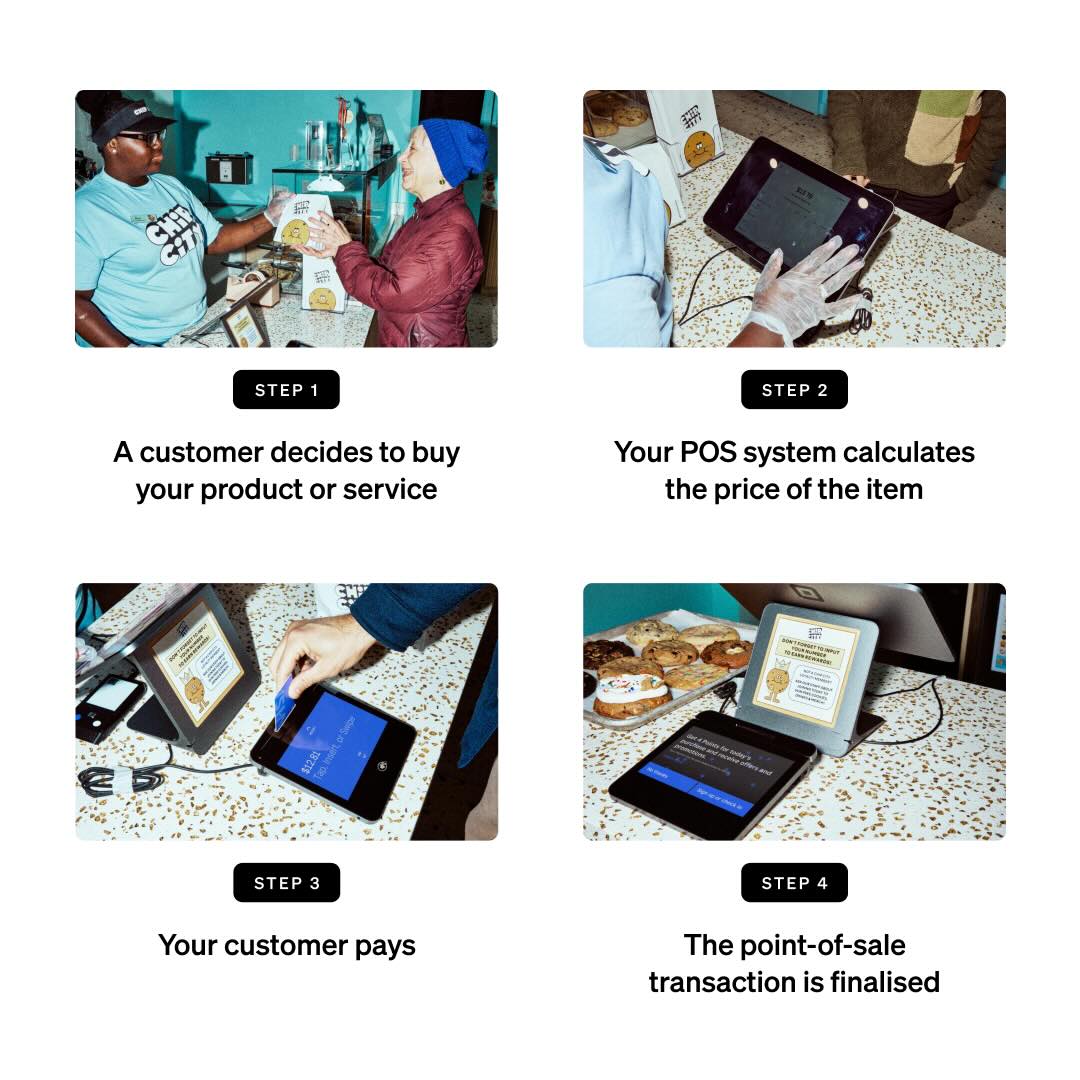

So what does a POS system do? Usually, it works like this:

- A customer decides to buy your product or service. If you have a physical shop, they may ask a sales assistant to ring them up. That assistant could use a barcode scanner to look up the item’s price. Some POS systems, like Square Point of Sale, also allow you to scan items using the camera on your device. For online stores, this step happens when a customer finishes adding items to their cart and clicks the checkout button.

- Your POS system calculates the price of the item, including any GST, and then updates the inventory count to show that the item is sold.

- Your customer pays. To finish their purchase, your customer will have to use their debit or credit card, mobile wallet, loyalty points, gift card or cash to make the payment go through. Depending on the type of payment they choose, your customer’s bank then has to authorise the transaction.

- The point-of-sale transaction is finalised. This is the moment when you officially make a sale. The payment goes through, a digital or printed receipt is created, and you ship or hand your customer the items they bought.

What types of hardware and software does a POS system typically include?

Every POS system uses POS software, but not all businesses need POS hardware. POS software is typically internet-run and cloud-based, and can be accessed from multiple devices. POS hardware is the physical device that allows you to take a sale or print a receipt.

If you have an online store, then all of your sales happen on your website, so you don’t need POS hardware to help you accept payments. But if you have a cafe, you may need a register or a credit card reader to take physical payments. Some complex businesses, like large restaurants, may have several pieces of POS hardware synced with their POS software system, while other businesses simply use their POS software on their computer as a virtual terminal to collect payments from customers.

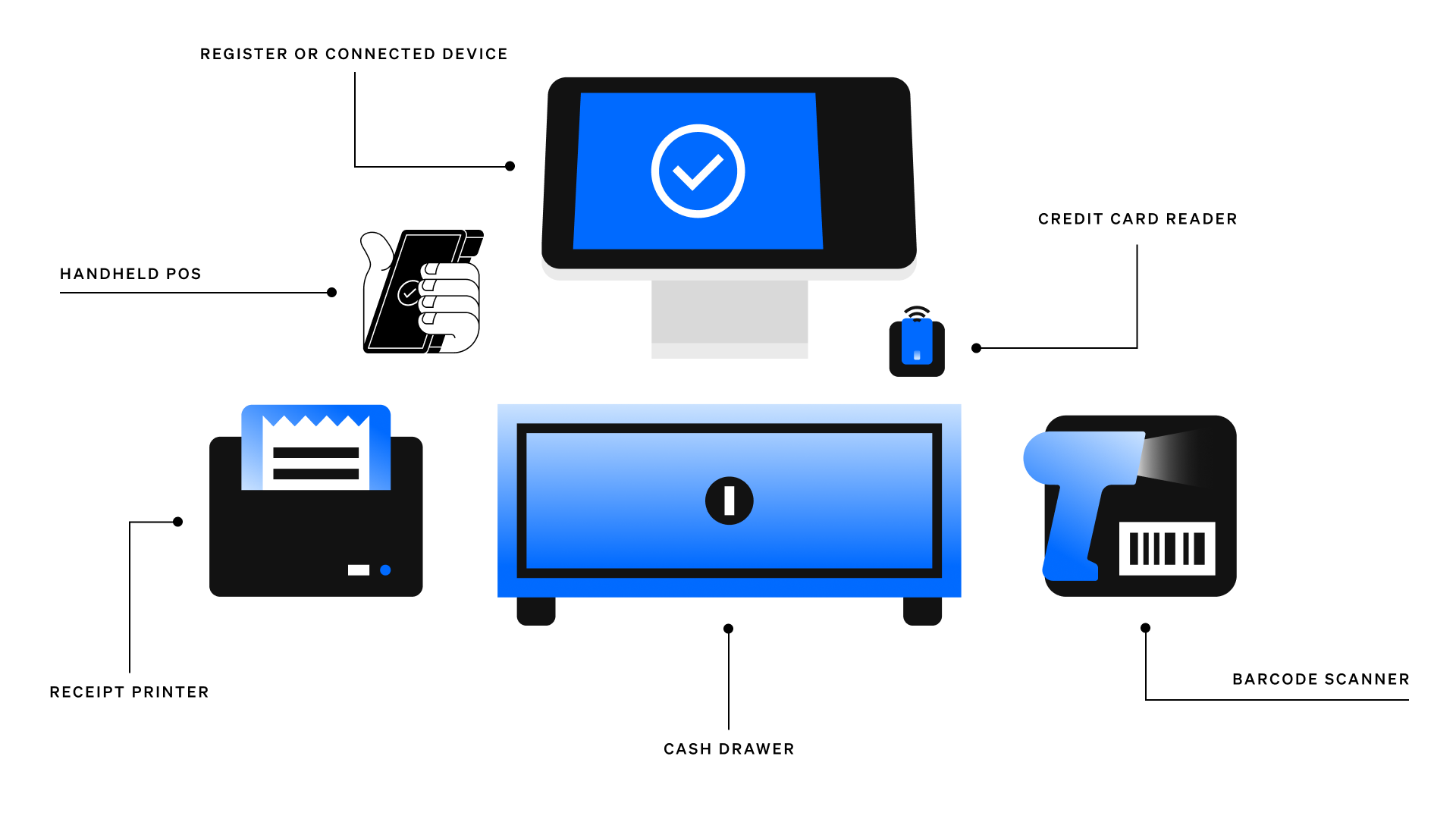

Here’s a rundown of common types of POS hardware and software, which can help you figure out the total cost of your POS system. Keep in mind that what you need depends on your business.

Common types of POS software

POS hardware allows you to accept payments. If you’re getting a new POS system, you should make sure it accepts all forms of payment, including cash, credit cards and mobile payments. If it makes sense for your business, your POS system should also print receipts, store cash in cash drawers and scan barcodes. You can achieve this through multiple different setups and hardware accessories, even adding a printer and barcode scanner to your computer if you choose.

This list of hardware can give you a place to start as you’re evaluating your POS setup options.

- Register: A register helps you calculate and process a customer transaction.

- Connected device, such as an iPad or other tablet: A portable device can be a good alternative to a monitor. Tablets can be propped up with a stand, allowing your team to clock in and out. For businesses with a reception desk where payments are typically accepted, a computer with POS software is a setup to consider.

- Credit card reader: A card reader lets your customers securely pay by debit or credit card while in-store, whether that’s through a contactless payment like Apple Pay or a chip + PIN card.

- Cash drawer: Even if you accept contactless payments, you may still need a safe spot to keep your cash. POS software that’s connected to a cash drawer can minimise fraud by tracking exactly when the drawer is opened.

- Receipt printer: A paper receipt shows customers exactly when and what they purchased and how much they paid.

- Barcode scanner: A barcode scanner reads an item’s product details so you can ring it up. It can also be a quick way to double-check the price, stock level and other details.

- Handheld POS: A mobile POS is a compact device that seamlessly integrates with your point-of-sale system, enabling staff to take orders, process payments, and manage inventory from anywhere in your business.

Common POS software features

POS software is like your command centre. At a basic level, it allows you to find items in your library and ring up sales. More robust point-of-sale solutions also feature helpful tools such as sales reporting, customer engagement software, inventory management and more. POS systems also take care of routing funds to your bank account after each sale.

Some POS solutions, such as Square, include the features below. Other systems may require you to use third-party software to get the features you need. Learn more about how Square compares to other POS systems.

Payment processing

Payment processing is one of the core functions of a POS system. Each time a customer buys an item, your POS system processes the transaction.

There are several different payment types a POS system might accept:

- Cash

- Secure online payments through your eCommerce site

- Credit and debit cards with an embedded chip

- Contactless payments, which might include a contactless card that customers tap or a mobile wallet (e.g. Google Pay or Apple Pay)

- Card-not-present transactions, which happen when your customer and their card aren’t actually in front of you, so you have to manually enter their card details. This also happens when customers enter their payment details while checking out online.

Computer POS

The option and flexibility to take a payment without added hardware, like a register or even a terminal, is one aspect of a POS that might be more important for some businesses than others. With Square Virtual Terminal, you can have a computer POS with all of the benefits of an external POS terminal right on your computer.

Accepting card-not-present payments is an alternative to invoicing. If you’re a seller using Square Virtual Terminal, your business can accept payments through a computer without the need for additional hardware, making your computer the only hardware needed for accepting payments. Plus, you can send payment links via text, take payments over the phone or manually key in a card number. And if you do decide to add hardware, like a printer, card reader or an item scanner, you can always add those on too.

Inventory management

Inventory management software lets you keep tabs on all your products. Some automated inventory software can connect with your sales data and let you know when an item is running low.

POS reports

POS reports give you a quick look at how much you’re selling and earning. With clear reports, you can sell more and make better business decisions.

Employee management

Team management software lets you know when your employees are working and how they’re performing. Your team can also use it to clock in and out, and some types of software can grant permissions so employees can get access to certain tasks.

Customer relationship management (CRM)

A CRM tool that’s tied to POS software lets you see what your customers bought and when they bought it. This knowledge helps you personalise your communications, marketing and customer service.

Receipts

Receipts make processing refunds easier since there’s a digital or paper trail connected to the purchased item. They can also make your business look more polished.

Tipping support

For restaurants and service professionals, tips can add a nice boost to the daily takings. POS solutions that allow customers to add a digital tip during the checkout process make it more likely that they’ll tip.

Now that you have a better understanding of POS systems, you’re ready to find the right POS solution for your business, no matter what or where you sell.

![]()