Table of contents

You’re in Bunnings looking for a specific type of screw. Rather than zig zag’ing up and down the aisles, you jump onto the Bunnings website, select the store you’re in, search for the item and find the row on which it lives.

Perhaps you want to book an emergency trip to the dentist. Luckily your dentist has an online booking feature, so you jump on their site, browse the available appointments and select one that works best for you.

Around half of all consumers now regularly switch between digital and physical interactions with businesses, to the point that it’s now becoming expected. But, digital isn’t replacing physical to the extent that many had assumed it would. It is instead enhancing the physical, making the customer experience richer, deeper and more valuable.

The key to this connected customer experience: omnichannel payment processing.

What are omnichannel payments?

First things first: what is an omnichannel payment? An omnichannel payments platform integrates all of your business’s payments, which gives you a single, simple view of your customer interactions. Customers benefit too, as they enjoy a far more simplified, personalised, engaging and consistent experience with your brand.

It’s perhaps best to describe omnichannel payment processing with an example.

A customer walks into a store and asks a salesperson about a product. The customer is part of the store’s loyalty program, so the salesperson asks for their name and brings up their profile on a handheld tablet. The salesperson answers the customer’s queries, and uses their purchase history to recommend other products, one of which the customer wants, but it’s not in stock in this particular store, so the salesperson logs an order through the company website and the item is sent straight to the customer’s home.

Fast forward a week, and the product has arrived, but it isn’t quite right. The customer is looking to return it, so gets in contact with the company via Facebook. The company offers a couple of options – the customer can either drop the product to the nearest store, or send it back free of charge. When the item is returned, a credit is automatically logged on the customer’s account.

Multichannel payment processing is this web of digital and physical experiences, and the technology and payment solutions that underpin it. It is the practice of using technology to make the customer experience seamless, no matter when or where it occurs.

3 benefits of omnichannel payments

Why create this multifaceted experience? The pro’s are in abundance, and when combined together form a compelling case.

Increasing expectations: According to EY, 36% of consumers plan to do more of their shopping online and only visit stores that provide great experiences.

More sales: If you offer an omnichannel payment experience, you’ll gain access to customers who buy more regularly. The purchase frequency for omnichannel customers is 287% higher than for single channel customers.

Bigger sales: Not only are purchases more frequent for multi-channel customers, they’re also larger. According to Harvard Business Review, omnichannel customers spend 4% more in-store and 10% more online than single channel customers.

As more and more consumers expect their digital and physical buying experiences to meld across stores, marketplaces, websites and even social media, the time for omnichannel payment processing is now.

The question then is perhaps not one of why, but how.

How to provide an omnichannel experience for customers

Good news: while it might sound complicated, creating an omnichannel customer experience is getting easier by the day, particularly if you use an established multichannel payment platform like Square. To create a truly omnichannel experience you should make the following considerations:

Build a foundation of tech: Technology underpins the omnichannel experience. You need to choose software that is built for purpose and that works well together. Carefully choose business systems like your CRM, website and payment services provider.

Get to know your customers: Your tech stack should be built in a way that allows you to collect data about your customers, which you can use to get to know and better serve them. Customer journeys should be traced to understand exactly how they play out – information that can then be used to enhance that path.

A web-connected POS: Your POS system should be fully integrated with your website. There should be little difference in logging a sale online vs through your POS. You should also ensure a customer’s shopping cart follows them wherever they go, from the website to the mobile app and on to the in-store kiosk.

How Square helps you create an omnichannel environment for your business

At Square we have designed our suite of business tools to bring omnichannel payment processing to the masses. As a Square Seller you’ll gain access to technology that works together to create a complete and seamless customer experience – and saves you time:

Square Online: Every modern business, no matter its size, shape or industry needs a website, as this forms the foundation of your omnichannel experience. Square Online makes creating an ecommerce website easier than ever.

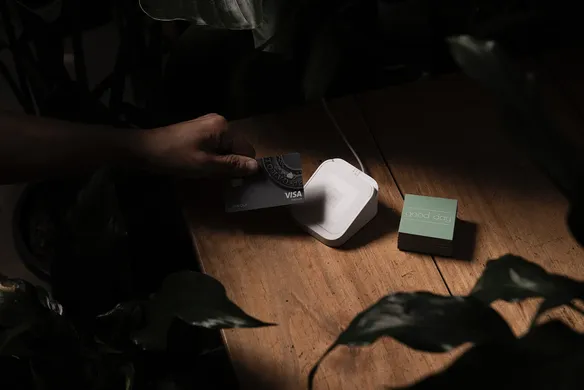

Square POS: To ensure a seamless customer experience, businesses with physical shopfronts need a POS that treats in-person transactions the same as online transactions, and that can build a profile of each customer. The ultra-capable Square POS does exactly that.

Square Online Payments: Already have a website? Adding payment processing functionality is easy with Square Online Payments, which works with all major website building platforms.

Square Marketing: You can’t expect customers to come to you; you need to go to them. Square Marketing offers a simpler and more effective way to develop loyal, multichannel customers.

Square Appointments: Are you a service based business who still requires a customer to call to make a booking? Square Appointments offers a more modern, multichannel alternative for your customers and makes your life a lot easier too!

If you combine all of Square’s payment and business tools together, you gain access to one of the most capable yet simple and intuitive multichannel payment processing systems. If you’re ready to offer your customers a better way to buy, Square is ready to help.

![]()