Table of contents

Many business owners struggle with getting started when it comes to managing their business finances. If this resonates with you, you’re not alone. In a 2021 Clutch survey, half of the business owners surveyed said they didn’t have a documented budget for 2020, and those that made a budget were more likely to stick to them.

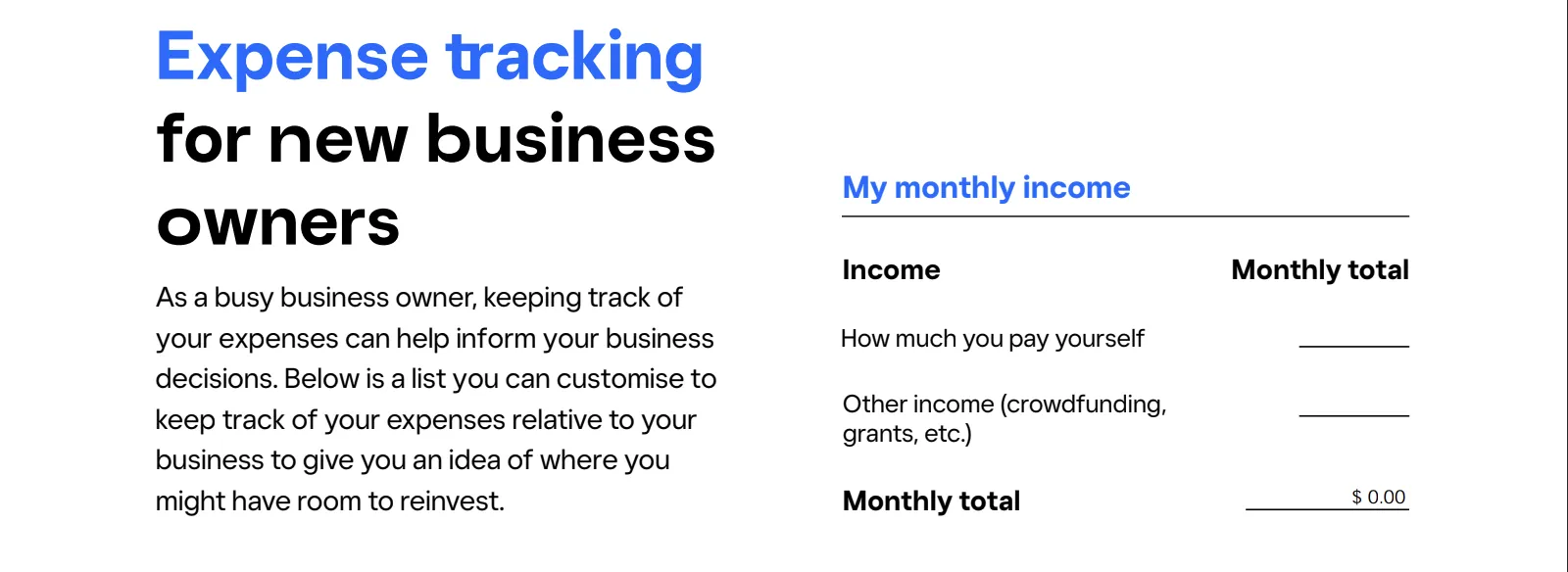

If you’re a business owner just starting out, getting the basics of your business going and starting to separate your business from personal finances, using an expense tracker can help you see how your spending is tracking against your budget.

Download the Expense Tracker Here

Tracking your expenses

Whether you’re setting a goal for a vacation, paying off a loan or building an emergency fund, an expense tracker can give you a quick look at your cash inflows and outflows. This allows you to easily understand your budget so you can stick to it and make any adjustments.

Using the expense tracker

This tool is a PDF that allows you to insert your own inputs and change the amounts as needed. If you notice you’ve entered the wrong amount, be sure to clear the total at the bottom and hit Refresh. This tracker can help you track personal expenses and some business expenses. If you’re a business owner looking to track only business expenses, consider using a balance sheet template.

Gaining a better understanding of your business finances

As you plan your yearly or monthly budget, start with this expense tracker. This will set a foundation for you to understand how much you’re spending for yourself in relation to your business. As a next step, consider using a balance sheet, cash flow template and profit and loss template to gain a holistic picture of your business, which can help you make more timely and informed decisions.

Square has a broad set of flexible tools ready for nearly any job and you only ever pay for what you need. If you are a Square seller, there are a range of solutions you can leverage to better manage your cash flow. Consider using this tool with some of these solutions to get a good sense of your budget and what you can do to best streamline it for your business.

This article is for educational purposes and does not constitute legal, financial or tax advice. For specific advice applicable to your business, please contact a professional.

![]()