As the coronavirus pandemic began to sweep the world, so too did health and safety concerns among business owners. This raised questions of how to properly conduct business and accept payments during social distancing and stay-at-home mandates.

Seemingly overnight, we saw an increase in online ordering, touch-free cashless payment methods, curbside pickup and no-contact deliveries emerge as the new normal, all in the name of a safety-first approach to business.

At Square, we know how valuable data is to identifying trends and helping you run your business more efficiently. That’s why we have crunched the numbers from millions of transactions at thousands of Square businesses across the country in a new report, Cashless Payments and the Pandemic in Australia, that highlights how Coronavirus has changed the way we buy and sell with cash.

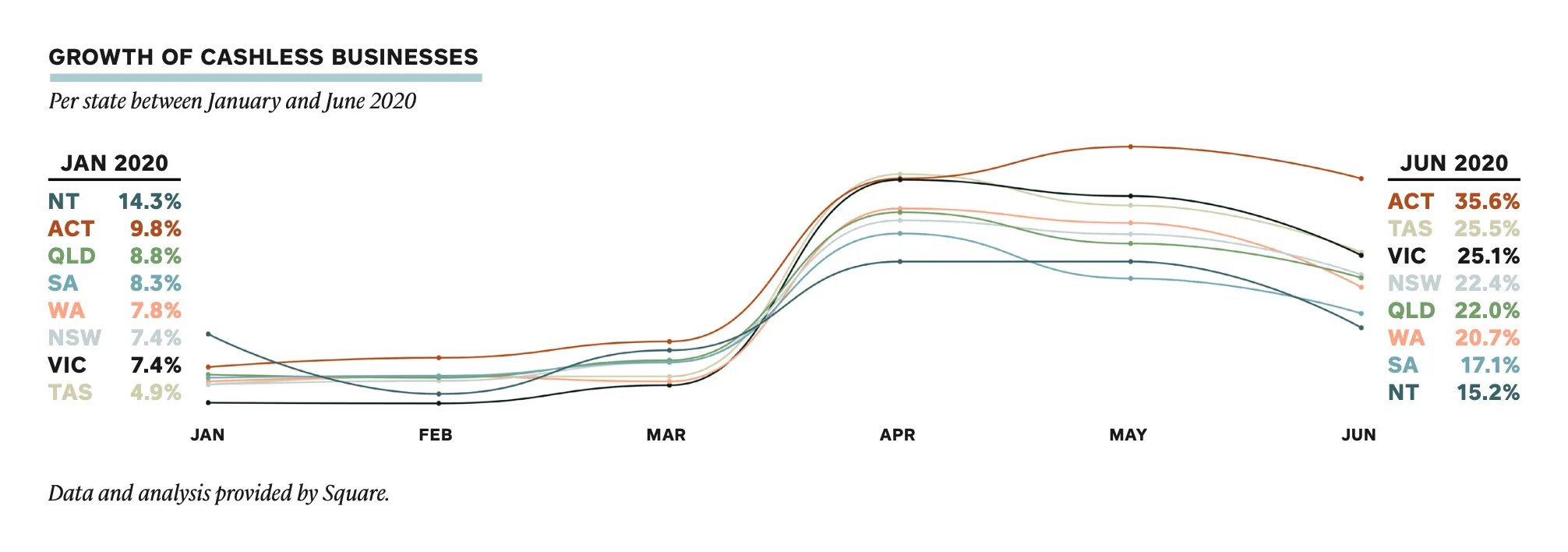

The report reveals that Australian businesses have experienced a cashless growth spurt amid the Coronavirus pandemic, with one in three businesses turning effectively cashless* at some point between January and June 2020. Despite the national trend, there were also significant variances between industries and different regions.

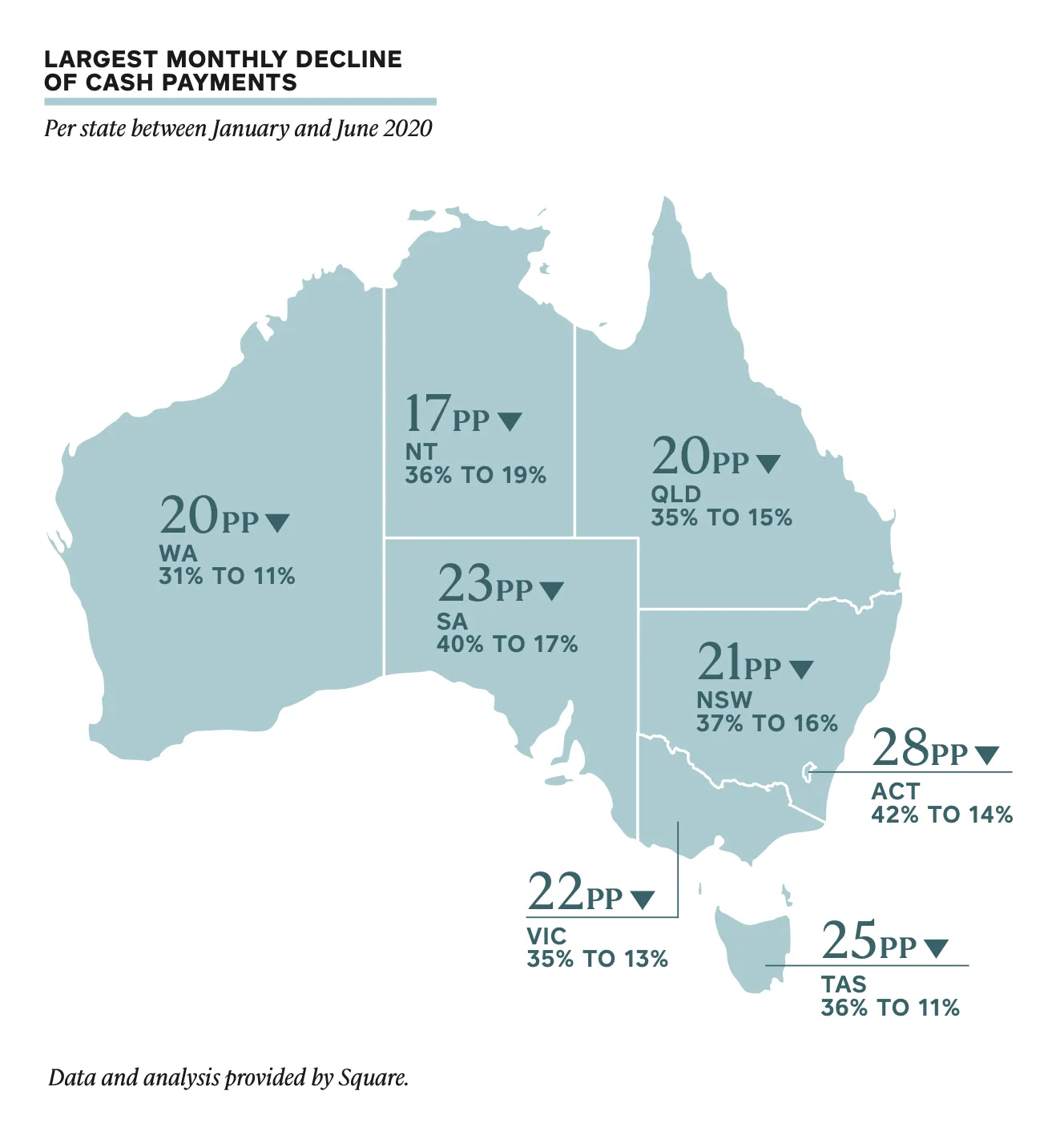

The ACT saw the most substantial abandonment of cash, with cash payments plummeting there from 42% of transactions in January to just 14% of sales during April. Tasmania, South Australia and Victoria weren’t far behind, with cash sales in those states also dropping by more than half over the same time period.

On the other end of the spectrum, the Northern Territory remained the most committed to cash, with around one in five Territorians (19%) still opting to pay with physical money during the peak of the pandemic’s first wave.

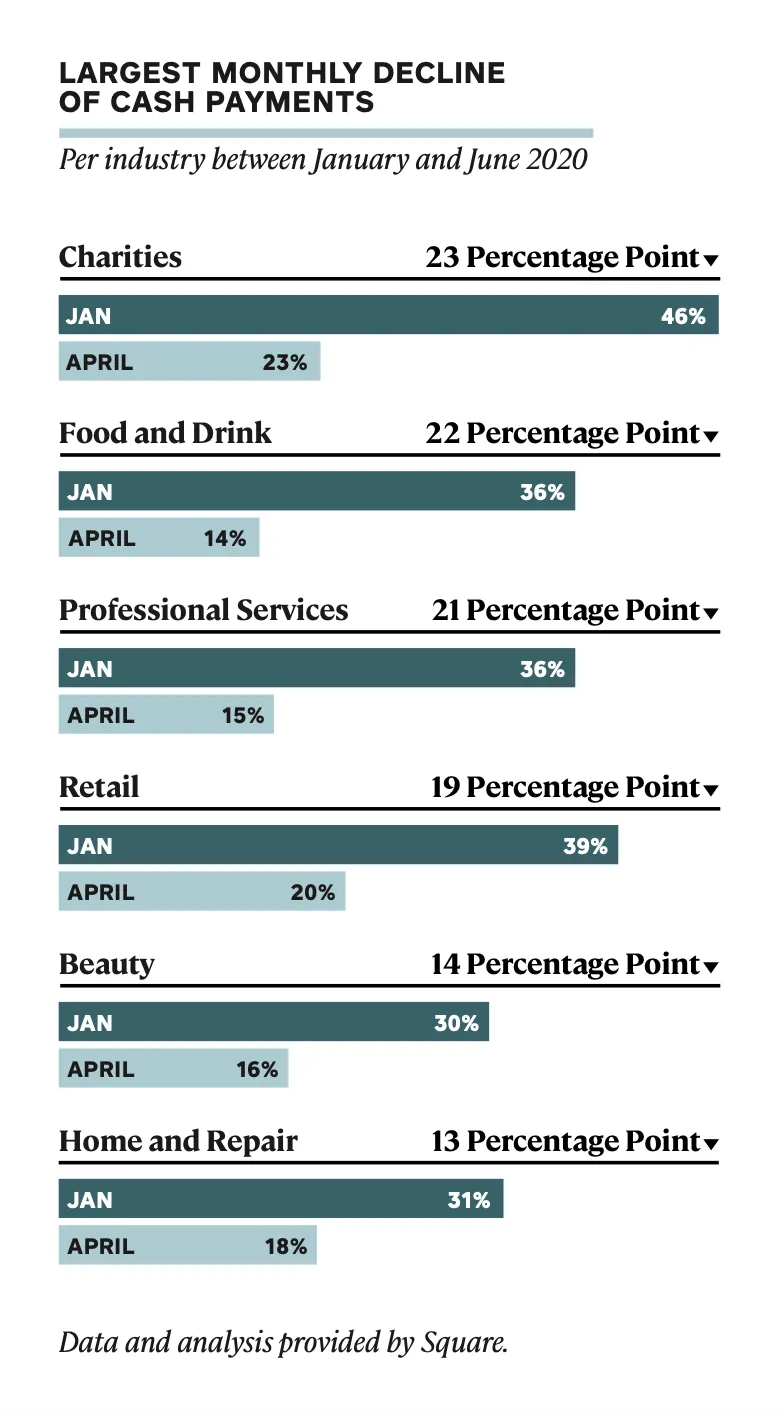

From an industry perspective, charitable organisations have shifted most dramatically away from cash, with donations made in cash dropping by more than half, from 46% to 23%. Cash payments at cafes and restaurants also dropped by more than half, from 36% to just 14%.

We spoke to Professor Steve Worthington from Swinburne University Business School about this significant change in behaviour, here’s what he had to say:

“Australians are renowned for being early adopters of technology, particularly when it comes to banking and contactless payments. The ongoing pandemic is only serving to sharpen the shift that we’ve seen over recent years, where consumers and businesses are increasingly prioritising digital forms of payment over cash.

“There are a number of factors contributing to the steep decline in cash use over recent months as a direct response to the pandemic. For consumers, fears over social distancing and a preference to minimise contact with physical currency is likely to be top of mind. What’s more, with banks closing branches, reducing operating hours and fewer ATMs available in towns and cities across Australia, there’s less cash in circulation. Combining that with the fact that many businesses favour digital payments for speed and security, there’s less incentive now for any of us to carry cash.”

And less cash we are carrying indeed. Square also conducted a short survey of Australian consumers around their recent cash use and found that more than half (~55%) reported that they did not have any cash in their wallet and that they had not visited an ATM for at least two months or longer.

Additionally, the survey highlighted that four in five Australians preferred contactless forms of payments, opting to use their mobile wallet, credit or debit cards over cash. One in three Australians also said their relationship with cash had changed as a direct result of the Coronavirus pandemic, reporting that they were now less comfortable handling cash.

Download a full copy of the Cashless Payments and the Pandemic report.

*Cashless is defined here as accepting 95% or more of transactions through credit or debit cards.

![]()