Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Powering all the ways you do business.

Work smarter, automate for efficiency and open up new revenue streams on the software and hardware platform millions of businesses around the world trust.

All business types

Customise your experience by ->

-

All

-

Restaurant

-

Retail

-

Beauty

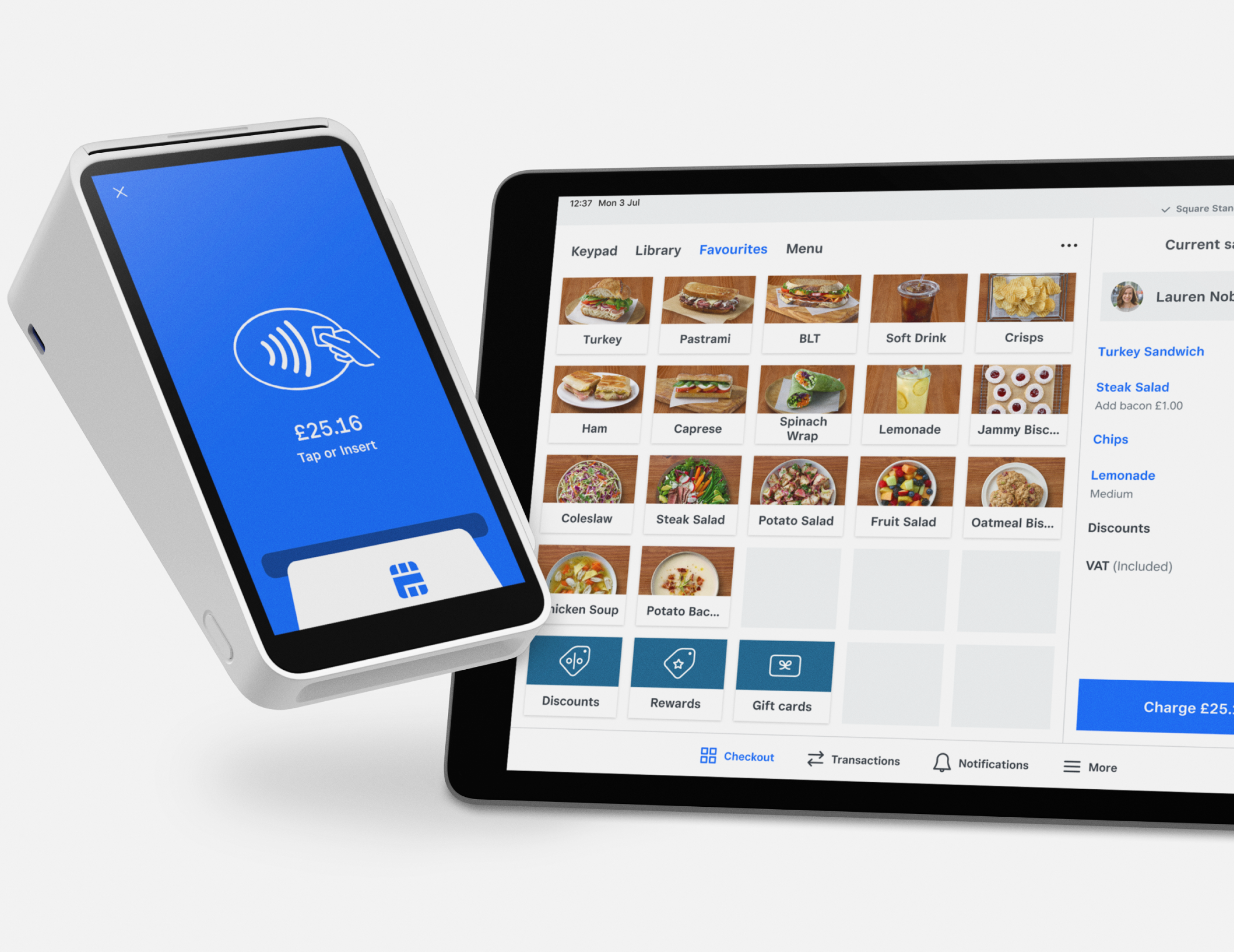

Sell anywhere easily, quickly and seamlessly.

Hardware and POS systems designed to sell anywhere.

Secure payments anywhere your customers are.

Click and collect, online ordering , local delivery and shipping options .

Optimise your operations.

Manage and streamline operations across multiple locations, sales channels and employees to improve efficiency and your bottom line.

Your business goal

How to solve it with Square

((1)) Manage cash flow

Cash out in minutes with instant transfers for a small fee – or for free with next-business-day transfers. ¹

For eligible customers, receive customised loan offers based on your Square sales. ²

((2)) Manage your team

Optimise your team’s shifts .

Manage your team quickly and securely with Square Team Management .

((3)) Reach customers

Increase customer loyalty and value with centralised customer data and insights .

((4)) Advanced reporting

Get powerful data to make confident decisions.

((5)) Diversify revenue

Diversify your revenue by opening up new streams .

Track profit margins with inventory management and reporting capabilities.

Create an expertly branded website to take online orders, showcase your items and sync inventory with any Square POS.

View more View more

Hear from Square sellers.

Named Best Overall POS System for Restaurants.

Square by the numbers.

4m+

Trusted by 4m+ Square sellers globally ‡

$4bn+

in Square Loans originations globally ‡

4bn

individual sales transactions annually ‡

Build custom commerce experiences.

APIs

Integrate Square with your business software or website using Square APIs for payments , commerce , customers , staff and merchants .

Integrations

Connect Square payment hardware to your business software using Terminal API and POS API .

Apps

Use our prebuilt, vetted partner integrations in the Square App Marketplace .

Help

Learn more on how Square works for you .

APIs

Integrate Square with your business software or website using Square APIs for payments , commerce , customers , staff and merchants .

Integrations

Connect Square payment hardware to your business software using Terminal API and POS API .

Apps

Use our prebuilt, vetted partner integrations in the Square App Marketplace .

Help

Learn more on how Square works for you .

Built for all kinds of restaurants.

Built for all kinds of retailers.

Built for all kinds of services.

Get support

Learn more about Square.

Stay up to date on new products, expert advice, and more.

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualised content on the topics you care about most by telling us a little more about yourself.

FAQs

-

Square has solutions for businesses of all types and sizes . Our connected tools are built to scale with future-focused, connected tools. Enhanced, customer-friendly experiences help build deeper data and better customer relationships. And our open platform means you can connect to prebuilt integrations or build out your own with our APIs. Learn how Square works with larger, more complex businesses .

-

Merchant services is an all-encompassing term that describes the hardware, software and financial services needed for a business to accept and process payments – credit cards, debit cards, NFC-enabled mobile wallets and other contactless payments – both online and in-store. Just getting started and need a simple way to take payments? Square Reader is only £19 + VAT and allows you to take both contactless and chip and PIN payments.

-

Square built a suite of integrated tools to help service businesses save time so they can focus on growing revenue and delivering exceptional service to their clients. Square Appointments works for any business that needs appointment scheduling capabilities and a point-of-sale system. Use Square Invoices – a free, all-in-one invoicing solution that helps businesses request, track and manage their invoices, estimates and payments in one place – to get paid faster. Learn more about our solutions for professional services .

-

Buy now, pay later, or BNPL , is a payment option that allows a customer to pay for a purchase over time in instalments while merchants get paid in full. With Clearpay, Square merchants can let customers pay in four interest-free instalments over six weeks. ³

-

Square point-of-sale software and suite of tools make it easy to sell in person, online, over the phone or out in the field. As your business evolves, you can quickly add tools that help your business, from managing team members to adding devices and locations, all with a couple of taps. You can also track customers’ preferences and purchases to create more personalised marketing and loyalty programmes to keep them coming back more often. We stand out with best-in-class hardware and an all-in-one platform. See how we stack up against Shopify, Toast, SumUp, Dojo and others with a feature-by-feature comparison . Or hear what our customers have to say about Square on our review page .

-

Square strives to provide the best hardware, software and resources to support you in every stage of your journey, whether you’re a first-time business owner or a seasoned entrepreneur. Brush up on your basics with our business glossary , which covers everything from front of house to automation . Explore our publication for modern business leaders, Town Square , for the latest trends, insights and strategies. Find tips and tricks, videos and articles in our Support Centre to help you get the most out of Square hardware and software. Need a little extra help? Our team is ready to support you via phone, email, Facebook or X.

¹ Funds are subject to your bank’s availability schedule, but are generally available in your bank account within 20 minutes of initiating an instant transfer. Minimum amount is £15 and maximum transfer limit is £3,500 per day.

² All loans issued by Squareup Europe Ltd., registered in England and Wales (no. 08957689), 6th Floor, One London Wall, London, EC2Y 5EB. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Offer eligibility is not guaranteed. All loans are subject to approval. Terms and conditions apply.

³ See Clearpay merchant terms of service here .

Create a free account in 5–10 minutes.

Join millions of businesses worldwide who use Square and discover why they rely on us.

What’s needed?

You’ll be asked for brief information about yourself and your business like your address, phone number and business structure.

What’s this information used for?

Your information is used for verification, which helps ensure secure transactions.

It also allows for customised product offerings catered to your business.