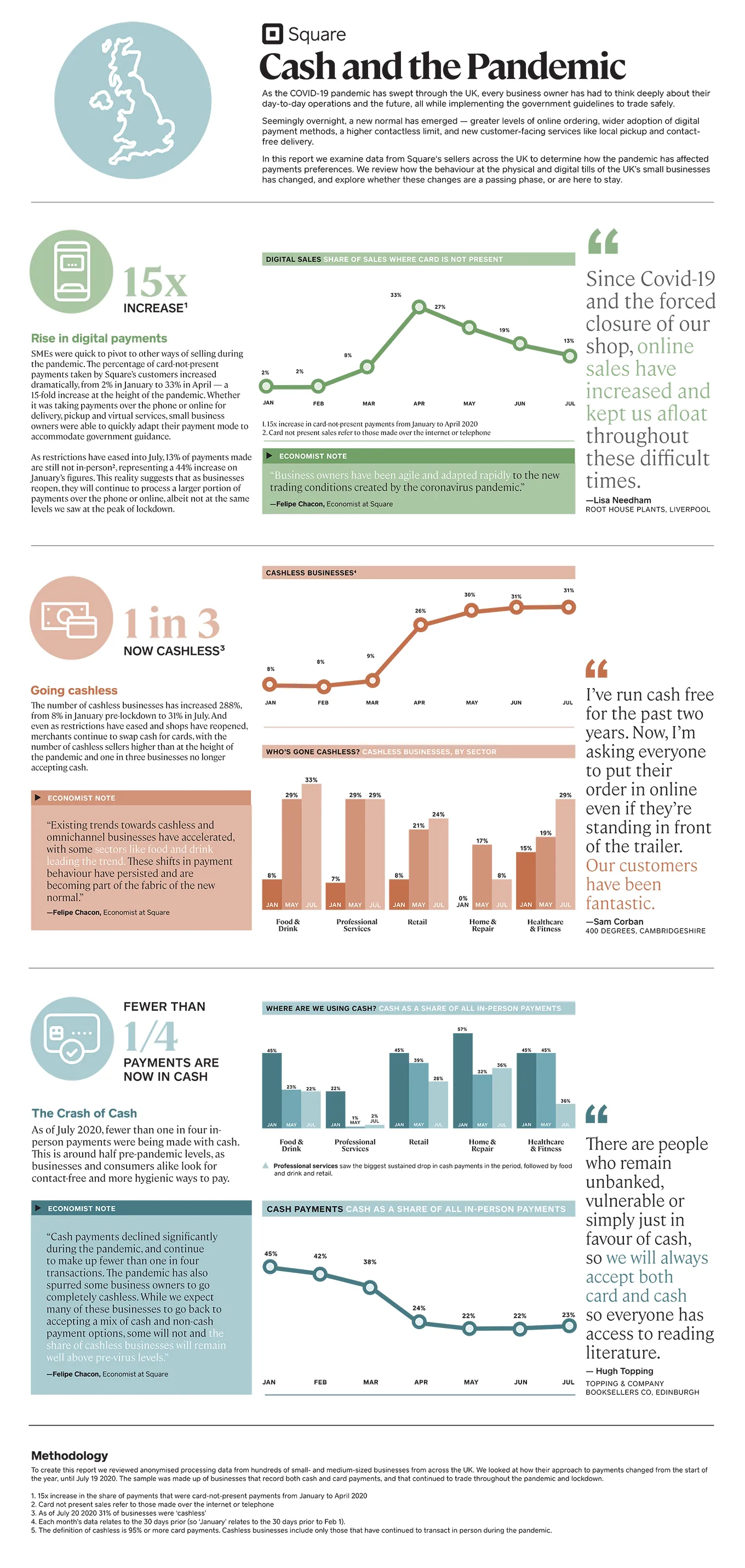

As the COVID-19 pandemic has swept through the UK, every business owner has had to think deeply about their day-to-day operations and the future, all while implementing the government guidelines to trade safely.

Since March 23, there have been some periods whereby businesses could operate freely and continue to take payments; in others, they had to shut up shop in the face of mandatory closures. Regardless of sector, every business owner has had to think deeply about their day-to-day operations and the future of their businesses, all while implementing the government’s advice and respecting social distancing.

Seemingly overnight, a new normal emerged — greater levels of online ordering, wider adoption of digital payment methods, a higher contactless limit, and new customer-facing services like local pickup and contact-free delivery — all in the name of a safety-first approach to business.

In the report below we examine Square data from our sellers across the UK to determine how the pandemic has affected payments preferences. We review how the behaviour at the physical and digital tills of the UK’s small businesses has changed, and explore whether these changes are a passing phase or are here to stay.

![]()