The payment platform designed to save you time and money.

Simplify your payments operation.

You can now leverage the payment platform that millions of businesses depend on to meet your customers’ unique needs. It’s flexible, secure, and reliable—so you can focus on your business, not on your payments.

Payments solutions, at any scale

Our platform processes millions of payments every day. We work directly with multiple networks and acquirers on your behalf so you can rely on your cash flow coming in.

Compliance is on us

As the merchant of record, our reputation is as much at stake as yours. We’re dedicated to protecting both sellers and customers. Square takes on the burden of PCI compliance for our sellers and includes AML and KYC checks in our system at no extra cost.

Data security is taken care of

With end-to-end encryption, customers’ payment data is secure from the browser to our servers. We’re constantly testing our applications, infrastructure, and incident response plans.

Solutions for every way you want to sell.

Take payments on your website

Accept payments securely from your eCommerce site with our online payment APIs and customisable payment form.

Take payments in your mobile app

Now you can easily integrate the Square payment platform into your app, allowing customers to make purchases directly. Customise the payments UX to match the look and feel of your app.

Build your software solution, or use ours

Use Square hardware to take in-person payments. Or build a custom point of sale, self-service kiosk, or any other in-person payment solution with our Terminal API or POS API.

Take payments with existing software

Square’s payment platform integrates seamlessly with popular point-of-sale software and online store providers to minimise disruption of your day-to-day business.

Your ideal payments solution (no matter what you need).

Flexible enough for any business

You can build the perfect solution for you, or use Square payments with our point of sale and online store partners.

One system, no headaches

One payments solution for all channels gives you less to manage, a better experience for your customers, and centralised data for a full view of your business.

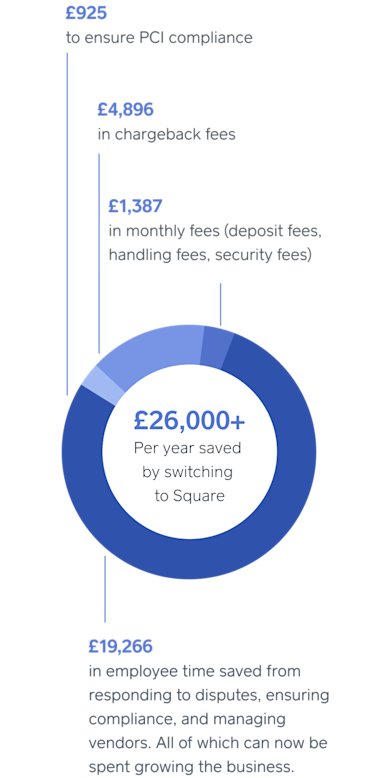

Time and cost savings example (based on typical U.S. Square businesses)

Our typical seller owns an online retail business and plans to open six physical locations this year, which will account for 30% of sales. Annual sales are £15.4M, average sale is £88.

Your case may vary. We’ll be happy to help you figure out what your savings would be.

Set up hardware quickly, easily, and affordably.

Square Stand

Turn your iPad into a point of sale and accept chip and PIN cards and contactless payments.

Square Terminal

The all-in-one device designed to accept chip and PIN cards and contactless payments, plus print or email receipts.

Square Reader

A simple way to start taking payments — just connect to accept chip and PIN cards and contactless payments.

Track more than payments.

Make informed decisions with a complete view of your business across all your online and in-person sales with our Customers API, Catalog API, and Inventory API. Square APIs allow you to transfer transaction data into a CRM, OMS, ERP, or any enterprise business solution.

Your apps, powered by Square

Custom pricing

Our standard rates are designed for businesses that process less than £250K per year. We design pricing packages for larger businesses depending on payment volume, average transaction size, your history as a Square seller, and more. We’d love to have a conversation about it.