Table of contents

You’ve done the work, now it’s time to get paid. Web designers, law firms, freelancers, contractors, physicians, and photographers are just some of the professionals who use invoicing.

Square Invoices provides a simple and easy way for people in the professional service industry to send invoices to clients and get paid fast. Here are some helpful tips:

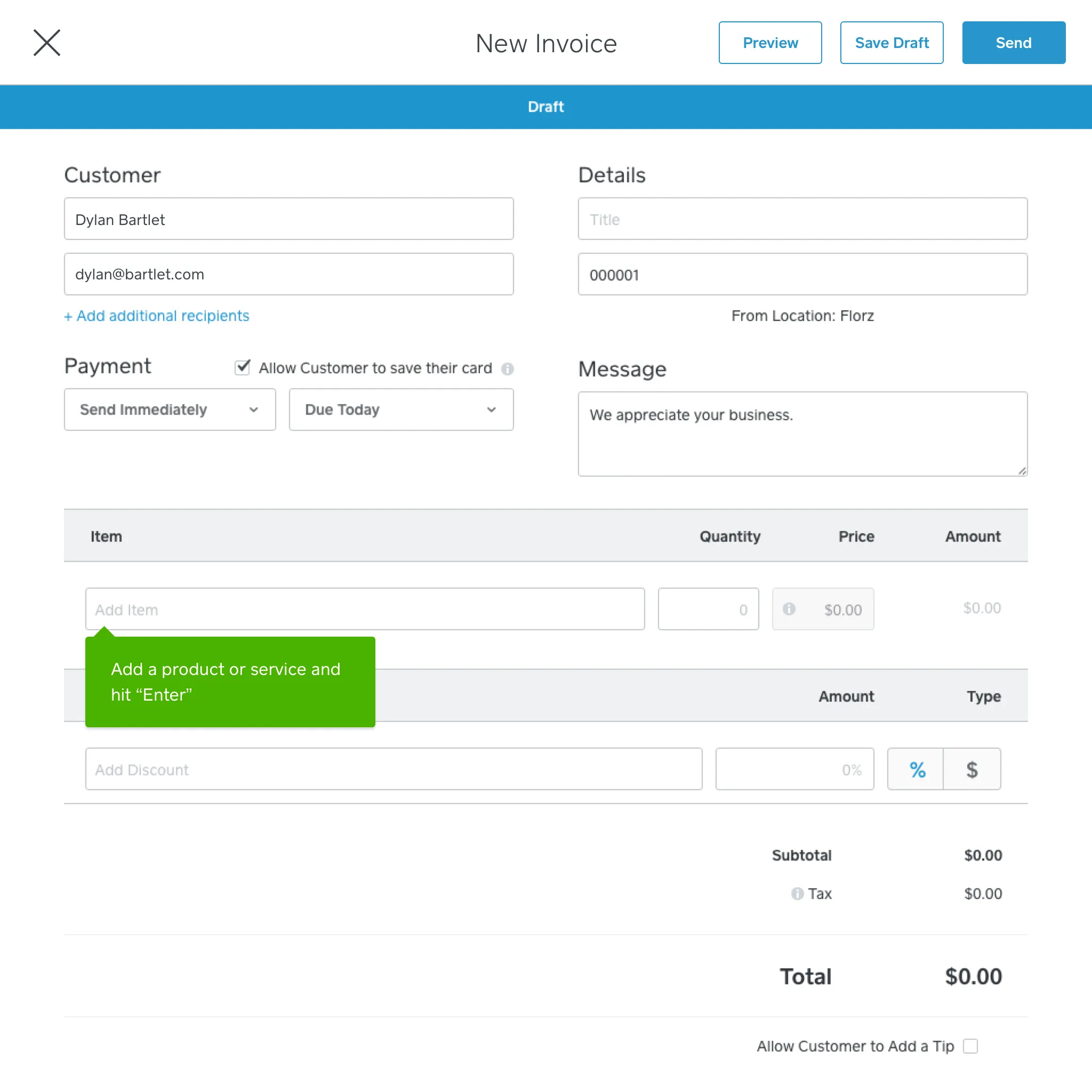

How to invoice on a desktop computer

- Log in to your online Dashboard with your free Square account and go to Invoices. Sign up for a free account here.

- Click Create Invoice.

- Choose a customer from your Customer Directory, or type in a new name and email address. (You can enter up to nine recipients, which can be useful if your main contact is different than the person who will settle the bill. More about this later.)

- Add items or services from your item library, or type in new ones along with the price. You can select taxes for each item or service if appropriate — the amount is calculated automatically.

- Fill out the other fields, including any discounts if relevant.

- Under Payment, choose when you want to send the invoice (immediately or at a later date) and select when the invoice for services rendered is due.

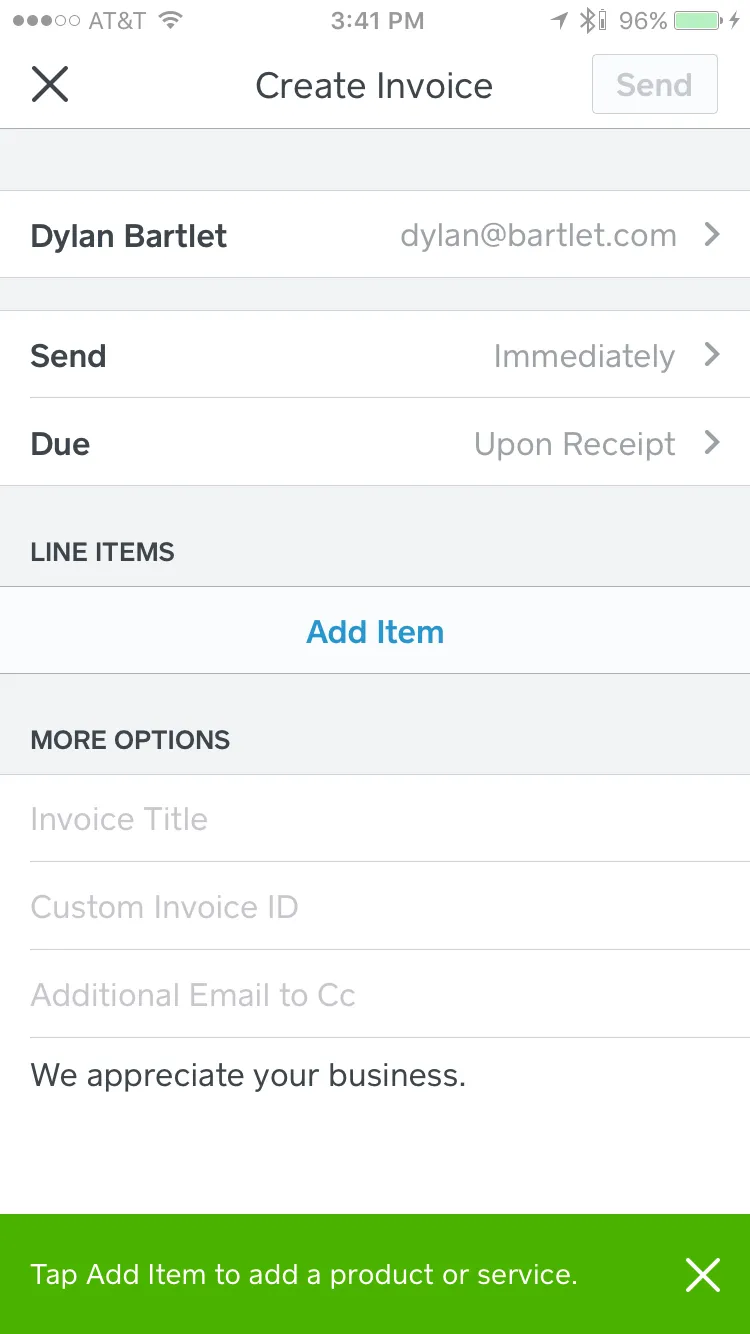

How to invoice on a mobile device

Square Point of Sale, our free POS app, also includes a free invoicing feature — so you’ll never need to download a separate invoicing app. This means you can send invoices right from your mobile device.

- Sign up for your free Square account.

- Download our Point of Sale app for Android or iOS.

- Navigate to Invoices in the main menu.

- Tap Create Invoice.

- Enter the recipient’s name and email address, then save by tapping “Add to Invoice.”

- Tap Add Item to manually add and itemize items. Or add saved items from your item library.

- If you’d like to preview the invoice, tap the Preview button. When you’re satisfied, tap Send and you’re done!

Pro tip: Want to schedule your invoice to send later? Just choose a different date before tapping Send.

Invoices are free to send and you pay just 0.75% + 7c for each invoice paid securely online with a credit or INTERAC debit card. If you have clients whom you regularly invoice, you can give them the option of saving their card on file. The next time you invoice them, the system charges them automatically so they don’t have to enter their credit card information each time. Card on File invoices are charged at 3.3 percent plus 15 cents per payment using a Card on File. Once paid, Square deposits funds directly into your bank account in one to two business days.

Invoicing tips for professional services

When invoicing for services rendered, it’s important that your invoices are clear and professional, and contain certain key pieces of information.

- Pick a strong hourly rate: Before you bid for a job or quote a prospective client, calculate your expenses and how long the job is likely to take. If you’re self-employed or an independent contractor, remember to include your own taxes when setting an hourly rate.

- Consider a deposit: For sizable projects, it can be a good idea to ask for a deposit. For example, an interior designer might send an invoice before starting a project to help cover the up-front cost of materials. Similarly, a wedding photographer could invoice for a nonrefundable deposit to lock in her schedule for the big day.

Invoicing for services rendered vs. invoicing for goods sold

Here are a few things to remember when you sit down to invoice for services rendered:

- Itemize costs: Correctly calculate your hourly rate, or state your flat rate if that’s how you’ve agreed to bill, and give an itemized list of services performed.

- Calculate GST and any necessary other provincial tax if applicable. If your business offers a mix of goods and services, don’t forget to calculate tax on the goods sold. Online invoicing software, like Square Invoices, can help you make these calculations.

Invoices can also be used to collect payment for goods purchased by your customers. Just as with invoicing for services rendered, you should include an itemized list of the goods they have purchased.

Depending on your location and what your product is, you most likely need to charge GST and any other provincial tax, if applicable, for those items. Tax can easily be added to an invoice and should be visible to your customers so they’re aware of additional charges.

You can learn more about GST/HST by location here.

Tips for getting your invoices paid faster

Getting paid faster is better for cash flow and means less time spent chasing delinquent clients. Here are some tips for how to invoice for services so you get your funds quicker.

- Be specific about what the invoice is for. When you invoice for services rendered, avoid industry jargon and spell out exactly what the invoice is for. Your clients might delay paying the invoice if they’re not totally clear on what they’re paying for. For example, instead of writing “Repairs” on the invoice, you could be more specific and say, “Reshingled south-facing side of roof.”

- Send your invoice promptly. The best practice is to send out your invoice as soon as you’re finished with a project or deliverable. The faster you send your invoice, the faster your client can pay you. Keep in mind that this could take a little time if you’re invoicing a company where a number of people need to sign off. However, they often can’t start that process until they receive your invoice, so it’s a good idea to set the wheels in motion.

- Invoice the right person. Your main point of contact may not be the person who pays the bills. In a medium-size (or larger) company it might be someone in accounting. Even if you’re dealing with individuals, you might need to send the invoice to a person other than your main contact. For example, if you cater a wedding, you might need to send the bill to the groom’s parents even if you’d only been in touch with the couple up until that point.

Now that you know how to invoice, you can easily bill your clients and get paid faster, so you can get on with running your business.

![]()