Compare Square

Square was established to give every business owner an easier way to take card payments. From setting up a free online store to team management, it’s easy to see why businesses of all sizes choose Square to power their business.

Which commerce platform is right for you?

Learn why thousands of businesses choose Square every year to start, run and grow their business.

Save time and effort with tools that all connect together.

Business management software

Accept, request and collect payments.

Reach more customers in more places and keep every sale in sync.

Customer engagement software

Build customer relationships.

Keep new and existing customers coming back with tools that grow your business.

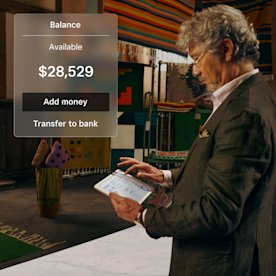

Money

Get a business loan* to make your next move.

Get fast access to your money and tools that put you in charge of your cash flow.

Team management software

Manage your team.

Simplify the way you take care of your team and keep it all connected to the rest of your business.

Consistent, fair and transparent pricing.

Always know what you pay with Square. Simple, transparent pricing means you always pay one low rate per payment method, so you can keep more of what you make.

In person

1.6%

Square charges a fee of 1.6% per tap or insert.

Online

2.2%

When a customer makes a purchase through Square Online, Square Online Checkout, eCommerce API, in-app payments or pays an invoice online, the fee is 2.2%.

Manually entered

2.2%

When you manually key in your customer’s card details on Virtual Terminal or a Square POS app, or use a card on file, the fee is 2.2%.

Buy now, pay later

6% + 30c (exc. GST)

Allow customers to pay in instalments over time with Afterpay. You get paid immediately, so there’s no risk. Bring in more business in person and online.

1.6% card present rate applies for Square Sellers who sign up on or after 30 May 2024. The rate of 1.9% will apply for Square Sellers who signed up prior to this date when using Square Reader, Square Stand or Tap to Pay, as listed in the Square Fee Schedule.

Start selling with Square.

Create your free account in minutes and join the millions of businesses using Square globally.

Accept contactless and chip + PIN cards, take tableside orders and more with a powerful, portable point of sale that fits in your pocket.

Take payments, print receipts and run your business with a compact, countertop payment terminal.

The fastest and most secure way to pay. Accept chip + PIN cards, contactless payments, Apple Pay and Google Pay. An easy solution for your on-the-go business.

The fully integrated touchscreen point-of-sale that lets you start selling right out of the box. Manage card and contactless payments, online sales and more, all from one POS register.

Turn your iPad into a powerful point of sale with payments built in.

Resources

How Square works

Square connects all sides of your business with easy to use tools designed to give you time to focus on what you do best.

Technology Investment Boost

The Technology Investment Boost allows businesses to claim a bonus 20% deduction for going digital.

Compare Square

Find out how Square stacks up against other payment providers and business solution tools.

*All loans are issued by Square AU Pty Ltd. Valid Australian bank account is required. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. Eligibility criteria include consistent and continuous payment card processing through Square. All loans are subject to credit approval. Terms and conditions apply.