Square and the Small Business Technology Investment Boost

This page is for informational purposes only and does not constitute tax or legal advice. You should consider the products that are right for you and speak to a professional about the tax implications for your circumstances.

Digitising your business has never been more advantageous

On 29 March 2022, as part of the 2022–23 Budget, the Government announced a $1.0 billion investment to support small businesses through new tax incentive measures.

Read on to learn how it works, how you can take advantage of this opportunity, and the Square products you could claim with this incentive.

What is the Technology Investment Boost?

The government introduced a bonus 20% tax deduction, which means any businesses with turnover under $50 million could deduct an additional 20% on costs associated with business expenses that support them going digital, like Square’s software solutions and POS hardware.

What is a tax deduction?

Great question! Before we answer though, this is not tax advice, so it’s important that you talk with a professional about your specific circumstances to understand how this applies to your business.

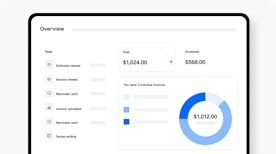

In general, a tax deduction is used to assess your business’ taxable income. This can reduce your overall tax bill at the end of the financial year. Your taxable income is your total income minus your tax deductions.

Your tax deductions are any expenses involved in running your business. So by increasing your tax deductions you will lower your taxable income which in turn reduces the overall tax you will owe the tax office next financial year.

You can learn more about income and deductions for business from the ATO website.

How would this work for your business?

For business expenses such as eCommerce platforms, cyber security, cloud computing, EFTPOS terminals and website design, you could claim a extra 20% deduction, to any expenditure made between 30th of March 2022 and 30th of June 2023 and is capped at $100,000 for each qualifying income year.

There are countless expenses that could fall under the category of “digitisation and adopting technology” that could allow you to take advantage of this scheme – as always, speak to your tax adviser to check before making any major investments. That said, here are some options to consider:

-

POS and payments hardware, including POS solutions tailored to your business type, like Square for Restaurants, Square for Retail and Square Appointments.

-

Payments technology that manages fraud with PCI-compliance and end-to-end encryption.

-

A connected online store where you can make sales at any time, with added engagement tools ranging from eGift Cards, to marketing, invoicing and more.

-

A Kitchen Display System or new equipment that helps you streamline back of house operations.

-

Square-compatible accessories for your point of sale countertop, including barcode scanners, receipt printers, cash drawers and USB scales.

Digitise with Square

The introduction of the Technology Investment Boost makes now the perfect time to upgrade your EFTPOS hardware and try out Square’s range of business solutions that can help you get paid. Your investment could include upgrading or expanding your point of sale, your online store or even engaging with your customers in new ways with a loyalty program or email marketing.

Square Hardware

Square has POS hardware and solutions for every business type. Whether you need a credit card reader, eftpos machine or fully integrated POS system, Square’s solutions allow you to start selling fast.

Commerce

Earn from anywhere with one of the Square POS options fit to your business type, a free website, and professional invoices. With no hidden fees or contracts, you can sign up now for free and then choose the plan that’s right for you at any time.

Restaurant POS

Square for Restaurants is an all-in-one POS system built to help owners, managers and staff make the most of every shift.

Customer Engagement

Build even stronger customer relationships with Square tools that help you keep your new and existing customers coming back again and again.

Marketing

Try Square Email Marketing to create, send and track automated email campaigns, specialised offers and newsletters and more.

Loyalty

Keep customers coming back more often with a customisable, easy-to-use Square Loyalty program.

Customer Directory

Track, manage and build better customer relationships with Customer Directory, Square’s free CRM.

Team Management

Managing your team just got easier with employee management, rostering and timecards. Square’s Team Management tool is trusted by over 200,000 businesses globally to make workplace management easier for you and your staff.

Helping every size of business succeed

It’s your business – so you should be able to run and grow it using the tools that serve you, not the other way around. Square products are flexible and ready to take on nearly any job. You can manage everything under one roof. Whether you’re online, in-store, on the road or what feels like everywhere at once, Square has all the tools to help you stay on top of your business.

The Technology Investment Boost is the perfect opportunity to digitise your operations, and see what business life looks like when you have everything in one place. With no lock-in contracts you can sign up now for free and choose the Square products that are just right for you. If you like it – and we are confident you will – then next tax time you could claim an additional 20% of the software and hardware fees that you spend in digitising your business with Square, until 30th 2023.