Let your customers pay by ACH bank transfer

ACH payments are a simple, secure way for customers to pay your business through Square Invoices.

How ACH payments work.

Getting paid by bank transfer without using paper checks or credit cards is as simple as 1, 2, 3.

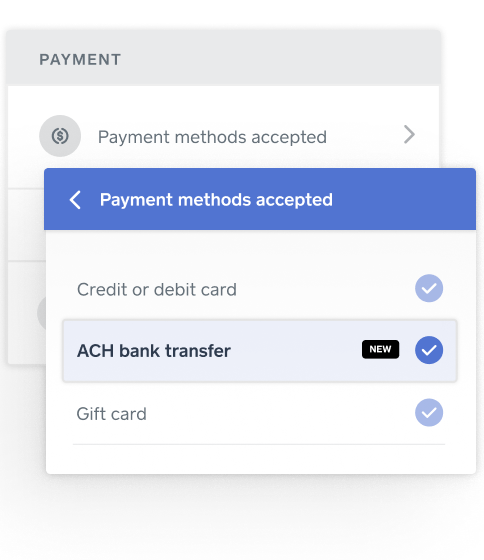

1. Enable ACH

Create a new invoice and enable ACH payments for your customers as a payment option.

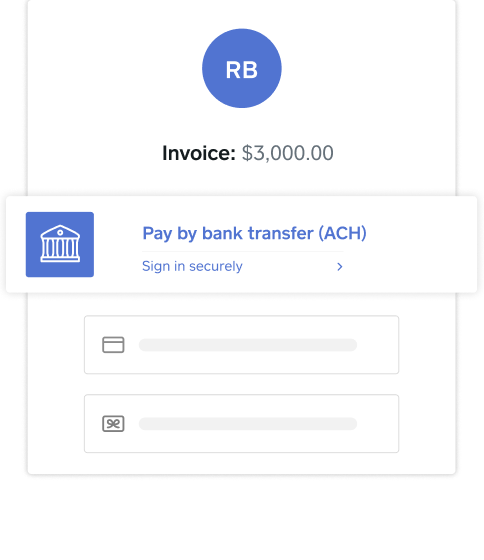

2. Collect payment

If a customer chooses to pay via ACH bank transfer, they will be directed to a safe and secure portal to log onto their bank and select an account for payment.

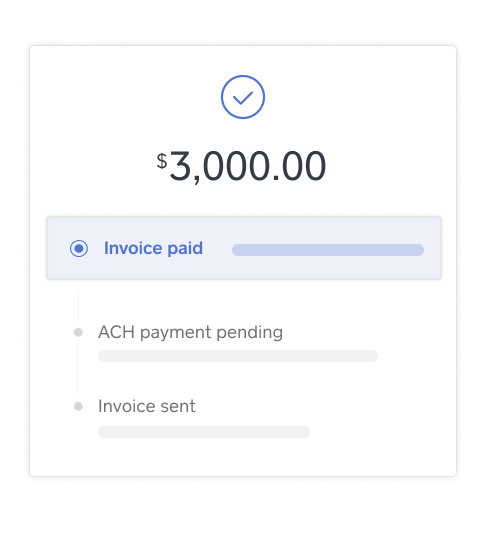

3. Receive funds

Once a customer pays the invoice via bank transfer, the funds will be in your Square account in two to three business days.

Give your customers another way to pay.

Offer your customers a simple, secure electronic payment method through Square Invoices that lets them avoid sending a paper check through the mail.

ACH payments save time, money, and reduce stress.

ACH bank transfers through Square are a simple, secure, and cost-effective way to get paid from anywhere.

- Reduce your costs

ACH payments through Square are less expensive than credit card transactions and don’t charge you any hidden fees for failed transactions.

- Protect your business

No need to collect or provide banking information on your own, Square can collect it through our secure payment network to help protect both parties.

- Get more time back

No more collecting and depositing checks—you’ll get access to funds in your Square account in two to three business days. With a Bank on File, you can collect and save customers’ bank information to automatically bill on a recurring basis.

Pricing

Processing rate

1%

Per ACH transaction

Minimum fee of $1 per transaction

Monthly fee

$0

Per month

Start using ACH payments through Square Invoices today.

FAQ

Square ACH payments will typically take two to three business days to arrive in your Square account.

If your business has to process paper checks regularly or has recurring customers, it would save you time to accept ACH payments. ACH payments are also convenient for B2B transactions.

Square uses a tokenized check system that leverages a connection through a third-party provider, Plaid, to present customers with their bank login UI at checkout. This verification option allows your customer to enter their bank login credentials instead of providing their account and routing numbers to you.

At Square, we have opted to provide a low, fixed processing rate that has no hidden fees for failed ACH transactions. Many of our competitors charge between $5–15 per failed transaction. Hidden fees can add up quickly.

Our current transaction cap per ACH transaction is $50K.

ACH stands for Automated Clearing House, which is a computer-based electronic network for processing transactions. The ACH network is how banks transfer money between each other. It’s similar to a wire transfer, but generally less expensive.

ACH credit means that a bank will send funds immediately upon the request of the payer. In an ACH debit transaction, the funds are sent upon the request of the recipient. In other words, the ACH credit has funds “pushed” into an account, and an ACH debit has funds “pulled” out of an account.

No, once you enable ACH payments in Square Invoices, you’re all set. No need to contact your financial institution, just start accepting payments.