Square Q3 Restaurant Industry Report: Post-Pandemic Dining Traffic Stabilizes in American Downtowns

Thanksgiving Meal Calculator gives consumers key data for holiday dinner decisions

New insights shed light on downtown recovery and restaurant worker wages

Today, Square released the latest edition of its quarterly Restaurant Industry Report, which uses data across Square’s food and beverage sellers to examine dining trends and shifts in both consumer spending and restaurant wages.

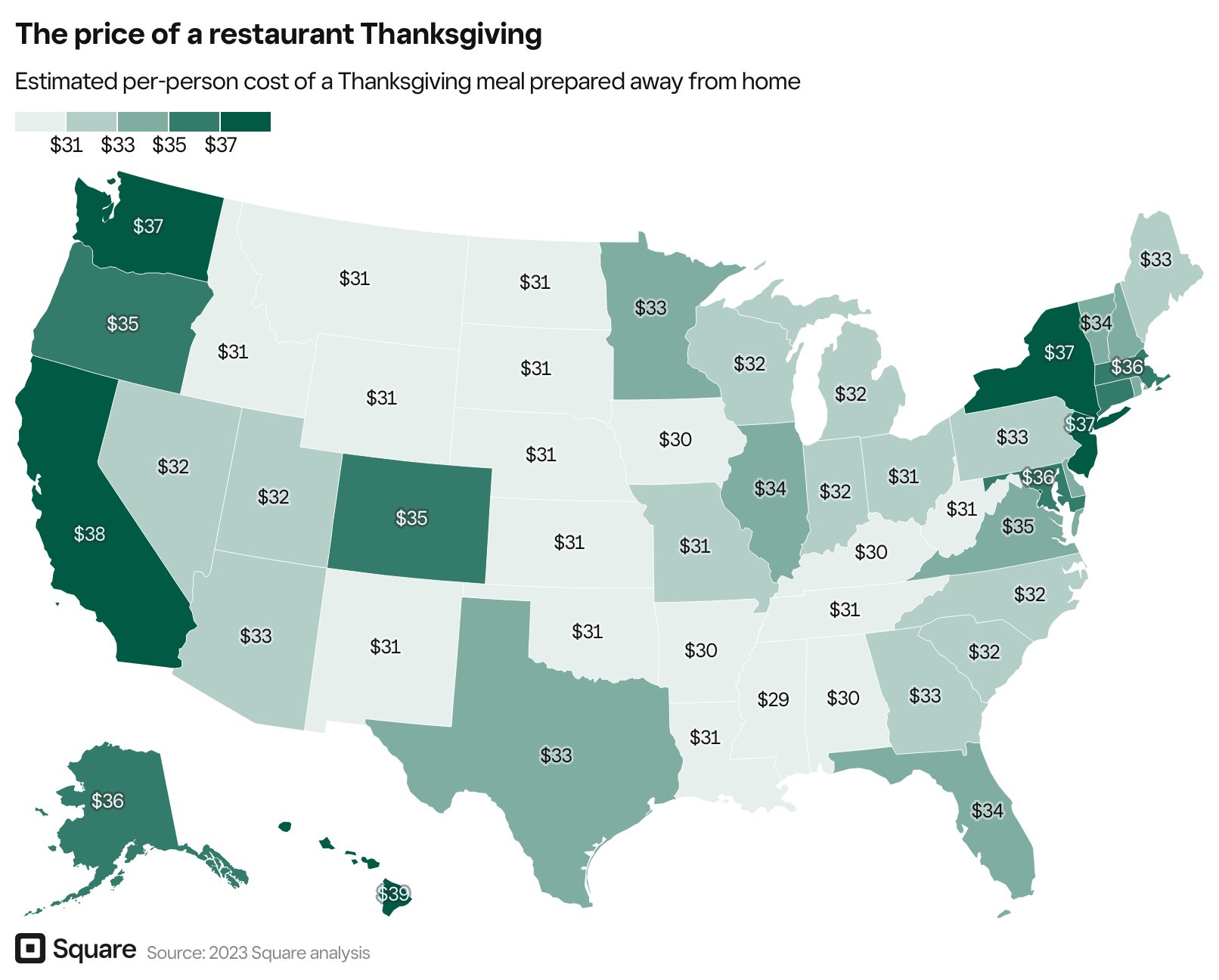

This Thanksgiving, consider ordering out

As restaurants continue expanding their offerings to include meal kits, branded merchandise, and more, some eateries are now offering prix fixe Thanksgiving meals to bring consumers the luxury of choice and convenience.

Hosting and cooking Thanksgiving can be quite the feat. As consumers begin planning for their Thanksgiving dinners, Square has created a Thanksgiving Meal calculator that enables consumers to estimate the cost of a take-out Thanksgiving meal from local restaurants. Nationwide, a hearty meal would cost $34 per person on average.

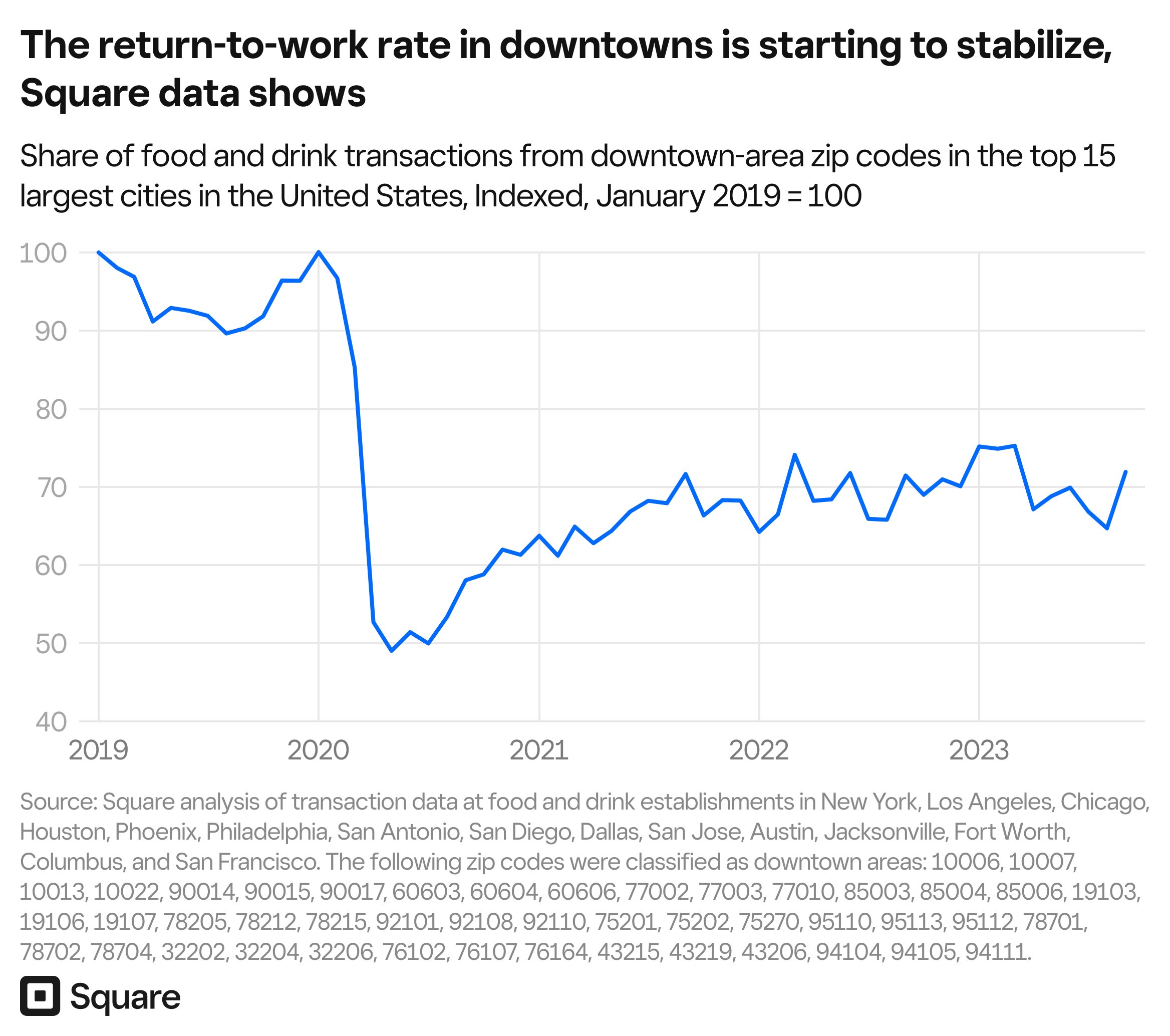

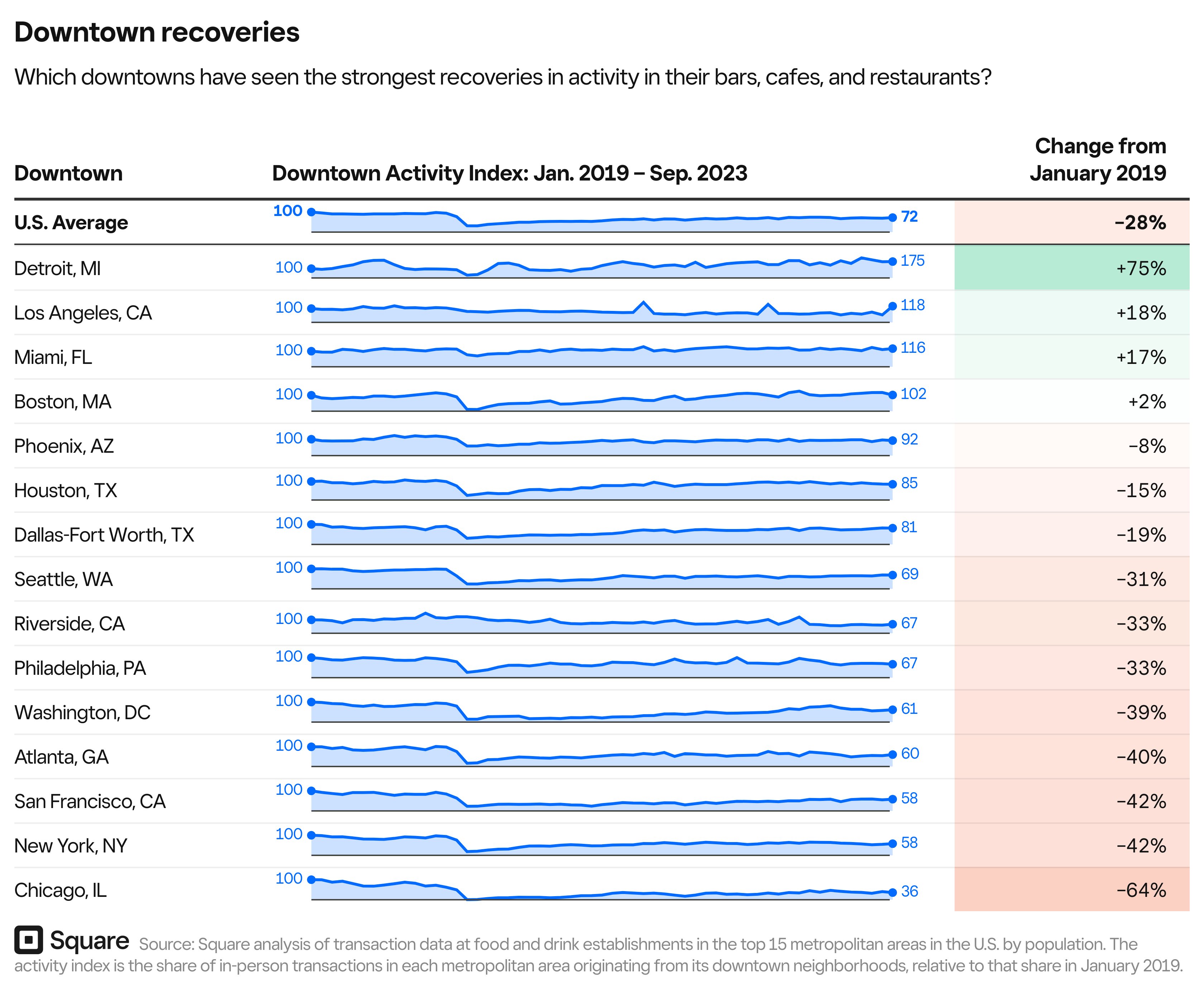

Dining out plateaus post-pandemic in America’s downtowns, but some cities thrive

As many consumers continue working from home at least part time, demand at restaurants in downtown areas is stabilizing. Square analyzed the hourly share of card-present transactions at food and drink establishments in the United States from 2019 through September 2023. Compared to January 2019, downtown neighborhoods in American cities appear to have flatlined at roughly 72% of their pre-pandemic activity as of the end of September 2023.

While dining and going out has not fully returned to pre-pandemic levels across all cities, a few downtowns nationwide are thriving. When looking at the top 15 metropolitan areas in the country, Detroit has seen major growth in food and beverage transactions with a 75% increase since 2019, followed by Los Angeles and Miami (increasing 18% and 17%, respectively). Other cities that are at or nearly back to 2019 levels of dining activity include Boston (up 2%) and Phoenix (down 8%).

“While dining trends are normalizing, restaurants in cities that are experiencing spikes or slumps can take advantage of technology to help handle increased orders or drive more traffic,” said Ming-Tai Huh, General Manager of Square for Restaurants. “For restaurants that fill up at lunchtime or right after work, consider using handhelds for line-busting or an easy-to-use KDS to get orders out faster, and for those that are seeing a slow-down, lean into automated marketing tools to attract the crowds.”

To continue bringing in guests and create repeat customers, restaurants can harness marketing and loyalty tools. With Square Marketing, restaurants can easily promote new menu items, events, or deals, and they can also take advantage of automated campaigns to welcome new customers, bring back lapsed customers, send birthday promotions, and more. With Square Loyalty, restaurants can drive repeat guests through fully integrated and easy-to-enroll loyalty programs that provide operators with real-time visibility into customer activity and sales impact.

Restaurant wages are up, but their growth is slowing

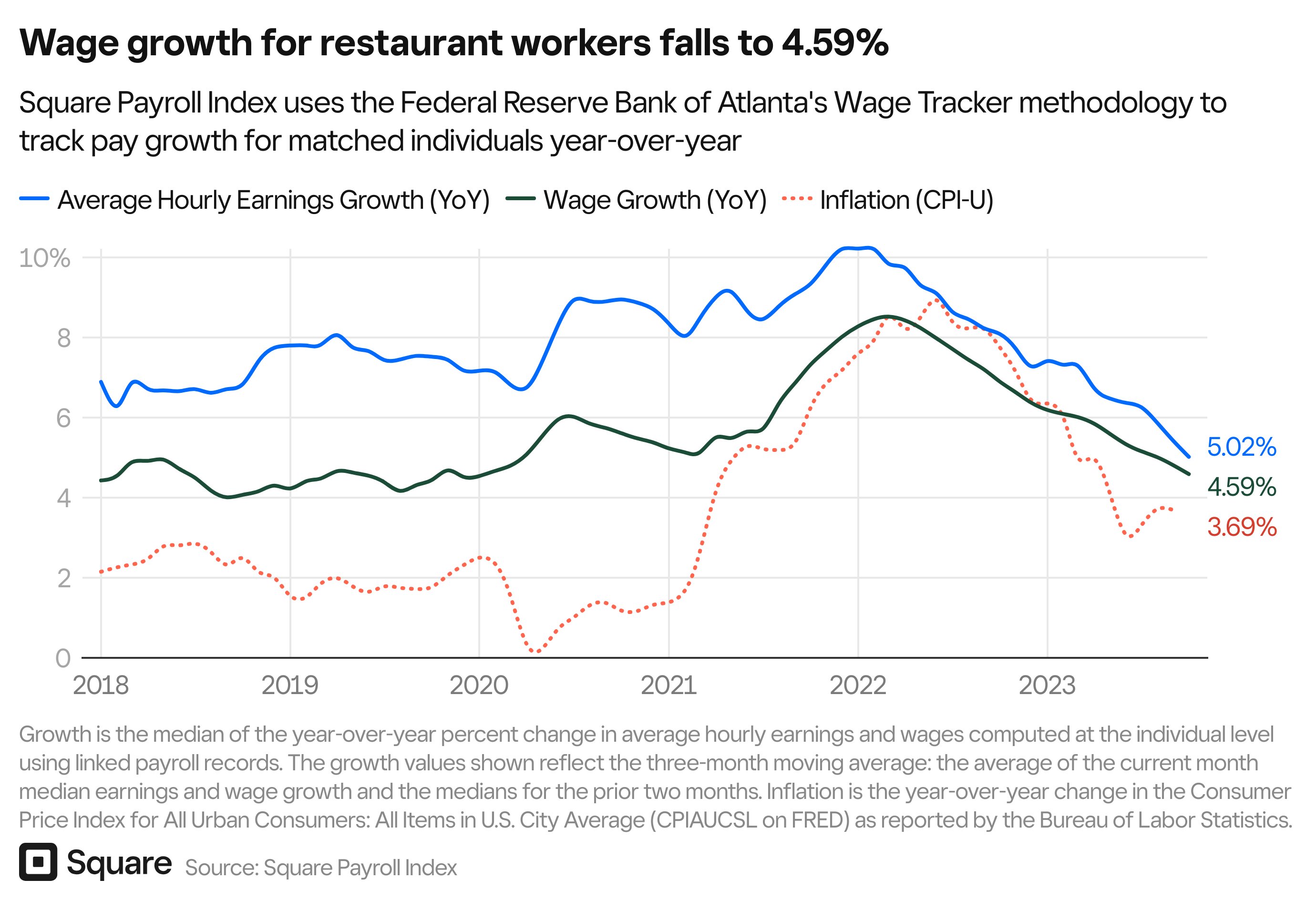

Last month, Square introduced the Square Payroll Index, a new economic indicator that measures compensation of service workers in the food and drink and retail sectors in the United States using data from Square Payroll. With this tool, you can see how base wages and total earnings (including tips and overtime) have changed since 2017, and business owners can better understand if the wages they offer are competitive in their market.

Amid the pandemic, restaurants faced major labor shortages – and in turn, had to quickly raise their base wages to attract the workers they needed to keep their businesses running. Wage growth for restaurant workers peaked in March 2022 at 8.52% when workers were making, on average, $12.80 per hour in base wages and $16.42 per hour in overall earnings.

A year and a half later, though, wage growth has slowed – while front- and back-of-house staff are making an average of $13.80 per hour in base wages and $17.67 per hour overall, wages are now growing at 4.59% and overall earnings at 5.02%.

Despite wage growth slowing for restaurant workers nationwide, some metropolitan areas are seeing above-average earnings growth – Cincinnati, Las Vegas, and Jacksonville saw year-over-year growth of 8.53%, 7.66%, and 6.46%, respectively, as of October 2023.

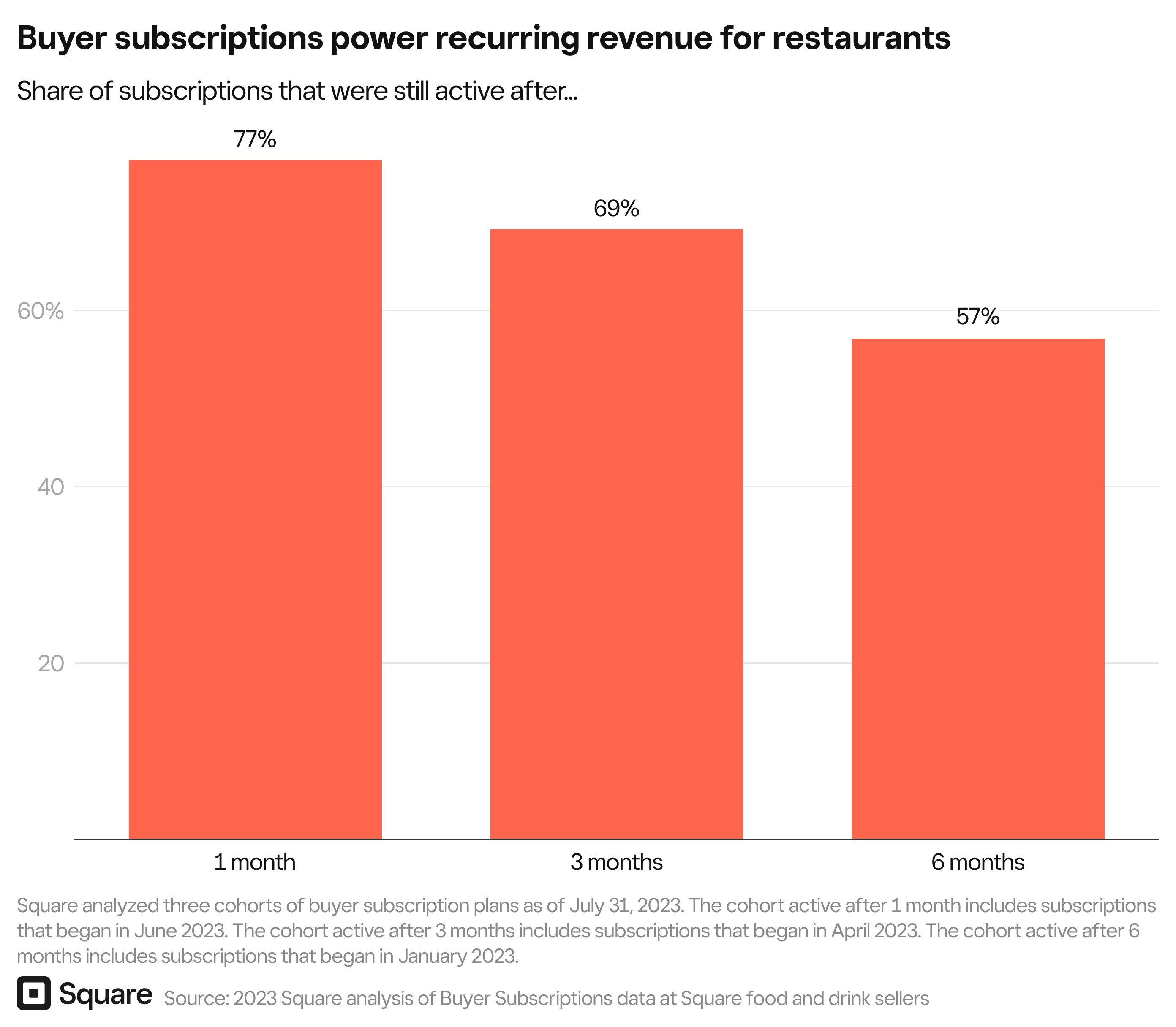

Restaurants lean into subscriptions for recurring revenue

Over the past few years, restaurateurs have faced challenges from inflation to economic uncertainty, and they are now finding increasingly innovative ways to adapt and strengthen their businesses through additional revenue streams. One way food and beverage sellers have diversified their offerings is through subscriptions for memberships, such as a monthly wine club or a quarterly shipment of fresh jams and sauces.

As of August 1, 2023, Square observed 54% growth YoY in food and drink sellers with active buyer subscriptions. What’s more, 57% of the subscriptions that consumers purchased from food and drink sellers were still active after 6 months, according to a cohort analysis of Square sellers using Subscriptions.

Using technology like Square Subscriptions, sellers are able to engage and bring back customers while also automating recurring payments. With a clear consumer appetite for these sorts of offerings, food and beverage businesses are able to easily take advantage of this reliable revenue stream.