Square vs. Aloha: a smarter POS for the modern restaurant

Craving more from your POS? Today’s restaurants need flexible, modern tools to stay competitive. Let’s compare Square and Aloha to see how upgrading can simplify operations, reduce costs, and set your business up for long-term success.

Square delivers the flexibility modern food & beverage businesses demand

Legacy POS systems weren’t built for the pace of modern restaurants. Whether you run a quick-service or full-service operation, you need a system that’s affordable, intuitive, and built to scale—with predictable pricing, flexible hardware, and fewer add-on costs. Here’s how Square compares to Aloha.

| Category | Square Plus | Aloha Essentials |

|---|---|---|

| Software Base Cost | $49/mo. per location (no additional device fees) | ~$170/mo. per location |

| Additional Terminal | Included | $45/month |

| Online Ordering | Included | Included |

| Staff Management Tools | Included | Paid Add-on |

| Loyalty Program | Included | Included |

| Email Marketing | Included | Paid Add-on |

| SMS Marketing | 500 texts included, then 3¢ per text | Paid Add-on |

| Hardware Flexibility | Flexible / Bring Your Own Supported | Hardware tied to NCR kits |

| Contract Requirement | None (Month-to-month) | 3-year required |

Disclaimer: Pricing and features are based on publicly available information as of October 2025 and may vary by provider, plan, or location. Aloha pricing reflects approximate Essentials plan costs and may require custom quotes for add-ons. Square pricing shown is for Square Plus.

Over 450,000+ restaurants worldwide use Square. Here’s why:

Up and running fast

Getting started is as simple as downloading an app. With an intuitive platform and the advantage of a cloud system over a legacy platform, your team can hit the ground running — no intensive training required.

Simple, transparent pricing

No long-term contracts, hidden fees, or surprise rate hikes. Just clear, predictable pricing you can count on.

All-in-one platform for everything you do

From payments and online ordering to retail, catering, and events—manage your entire operation from one powerful system.

What you get with Square:

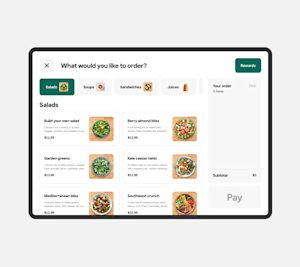

Square Kiosk is quick to set up and has an intuitive design for customer self-service.

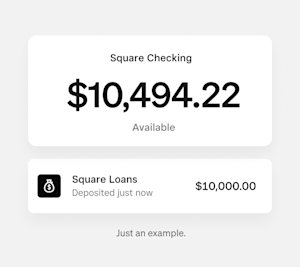

Square Banking gives you control over your cash flow: offering loans, instant transfers, and so much more to keep your business moving.1

Square Text Message Marketing helps your business stay connected and engaged with your customers, right where they are.

Leave that outdated tech behind and switch to Square if you:

- Want a POS that’s intuitive, quick to learn, and easy to set up

- Appreciate transparent pricing with no long-term contracts

- Need a flexible system that scales alongside your business

- Prefer a native cloud-based solution that works seamlessly

- Choose an all-in-one platform that handles payments, online ordering, and payroll

Square Handheld: Efficiency in the palm of your hand

Make service faster and smoother. Cut wait times, take orders tableside, process payments, manage inventory, and more—all from the palm of your hand.

Square Free

$0/mo.

per location

The essentials your business needs to sell in-person, online, over the phone, or out in the field. Only pay when you take a payment.

Processing fees

Tap, dip, or swipe 2.6% + 15¢

Online 3.3% + 30¢

What you get

- POS app for any payment

Accept any payment with an all-in-one POS app.

- Online site

Build an online ordering profile, a basic website or online store, or an online booking site.

- Item library

Add menu items, products, and services. Keep track of inventory and sales.

- Invoicing

Send estimates, contracts, and invoices.

- Booking

Schedule appointments and manage staff calendars.

- Checking and savings accounts

Access your funds instantly and plan for future expenses.

Square Plus

Best value

$49/mo.

per location

A full suite of features built specifically for food, retail, and appointment-based businesses. Designed to help you grow and thrive.

Processing fees

Tap, dip, or swipe 2.5% + 15¢

Online 2.9% + 30¢

What you get

- Everything in Square Free

- POS features for every industry

Access advanced POS features for food and beverage, retail, appointments, and invoicing.

- Lower processing fees

Save on in-person and online card processing fees.

- Loyalty rewards program

Create a custom rewards program that connects to your POS.

- Email and text message marketing

Send unlimited email marketing campaigns. The first 500 texts are free, then pay 3¢ per text.

- Staff management

Schedule shifts and track team attendance.

Square Premium

$149/mo.

per location

Our most advanced capabilities backed by 24/7 support. Built to streamline operations and help you scale with confidence.

Processing fees

Tap, dip, or swipe 2.4% + 15¢

Online 2.9% + 30¢

What you get

- Everything in Square Plus

- 24/7 priority support

Get 24/7 phone support when you need it.

- Advanced reporting

Access deeper insights into all sides of your business.

- Lowest processing fees

Save on in-person and online card processing fees.

- More text message marketing

The first 2,500 texts are free, then pay 1.5¢ per text.

- No gift card load fees

Add funds to physical and eGift cards with no load fees.

Choose Square and unlock your restaurant’s fullest potential

1Block, Inc. is a financial services platform and is not an FDIC insured depository institution. Banking services are provided by Square’s banking affiliate, Square Financial Services, Inc. or Sutton Bank, Members FDIC.

Loans are issued by Square Financial Services, Inc. Actual fees depend upon payment card processing history, loan amount and other eligibility factors. A minimum payment is required and you must repay your loan as specified in the loan terms. Loan eligibility is not guaranteed. All loans are subject to credit approval.

Square Checking is provided by Sutton Bank, Member FDIC.

Instant transfer requires a linked bank account or supported debit card and costs a fee per transfer. Funds are subject to your bank’s availability schedule. Minimum amount is $25 and maximum is $10,000 in a single transfer. New Square sellers may be limited to $2,000 per day.

Savings accounts are provided by Square Financial Services, Inc. Member FDIC.