Table of contents

Getting paid on time is crucial to keep your cash flow healthy, no matter the size of your business. Having an invoicing system and process in place keeps your accounts organised and helps you get paid faster. But finding examples of invoices that actually apply to your business can be tricky.

Whether you’re new to invoicing or looking to refresh your invoicing system, the first place to start is with the invoice itself – the most critical document in the process. Depending on the kind of business you run, your invoices should help you keep records of your projects, deadlines, cash in and cash out, and they might include specific fields. For example, a contractor’s invoice with instalments is different from a retail one with products and SKUs.

Here are some invoice examples and tips for creating a number of different invoices based on your business needs.

Invoice components

An invoice should always list the products or services you sold, what the customer owes for them and when and how to pay you. It’s also a good idea to add a logo, brand colours and any terms related to late payment charges, although these aren’t legal requirements according to HMRC.

Here’s everything to include in your invoices:

- Your company name and contact details: This shows the customer who the invoice is from and provides them with an easy way of getting in touch if needed. Include your company name, physical address and email address.

- Customer’s name and address: Display the name and address of the recipient so it’s clear who the invoice is addressed to.

- Your payment details: Include information about how the customer can pay, e.g., via a bank transfer (provide account details) or with a Square Payment Link.

- Invoice identification number: Every invoice should have a unique identifier to avoid duplicates and allow for easy tracking in your accounting software.

- Issue date: This is the date you officially send the invoice to your customer. If you draft the invoice at an earlier date, be sure to check the issue date is correct.

- Description of the goods or services rendered: Include details about the goods and services provided. This gives the customer a clear overview of what they’re being charged for and helps prevent confusion and disputes. If the invoice covers multiple item categories or service packages, break these down with quantities and individual costs.

- VAT (Value Added Tax): If you charge VAT, include a separate line showing the VAT amount.

- Total due: Make the total clear so customers understand right away how much they owe you.

- Due date for payment: If the due date is the same as the issue date, you can note that the payment is due upon receipt. If not, specify the exact due date. It is common to provide a payment window of 15 or 30 days.

- Logo and/or brand colours: No need to be a graphic designer to create a branded invoice that looks good – Square Invoices lets you easily customise templates to match your brand.

In the UK, you also have the option to charge late payment fees. This is 8% plus the Bank of England interest rate, worked out as an annual sum and applied daily. If you plan to impose late payment fees, it’s good practice to include a section outlining terms on your invoices.

However, you may wish to overlook the odd late payment, especially for regular customers. Failure to pay immediately isn’t always a sign of bad intent, and late payment fees run the risk of alienating customers.

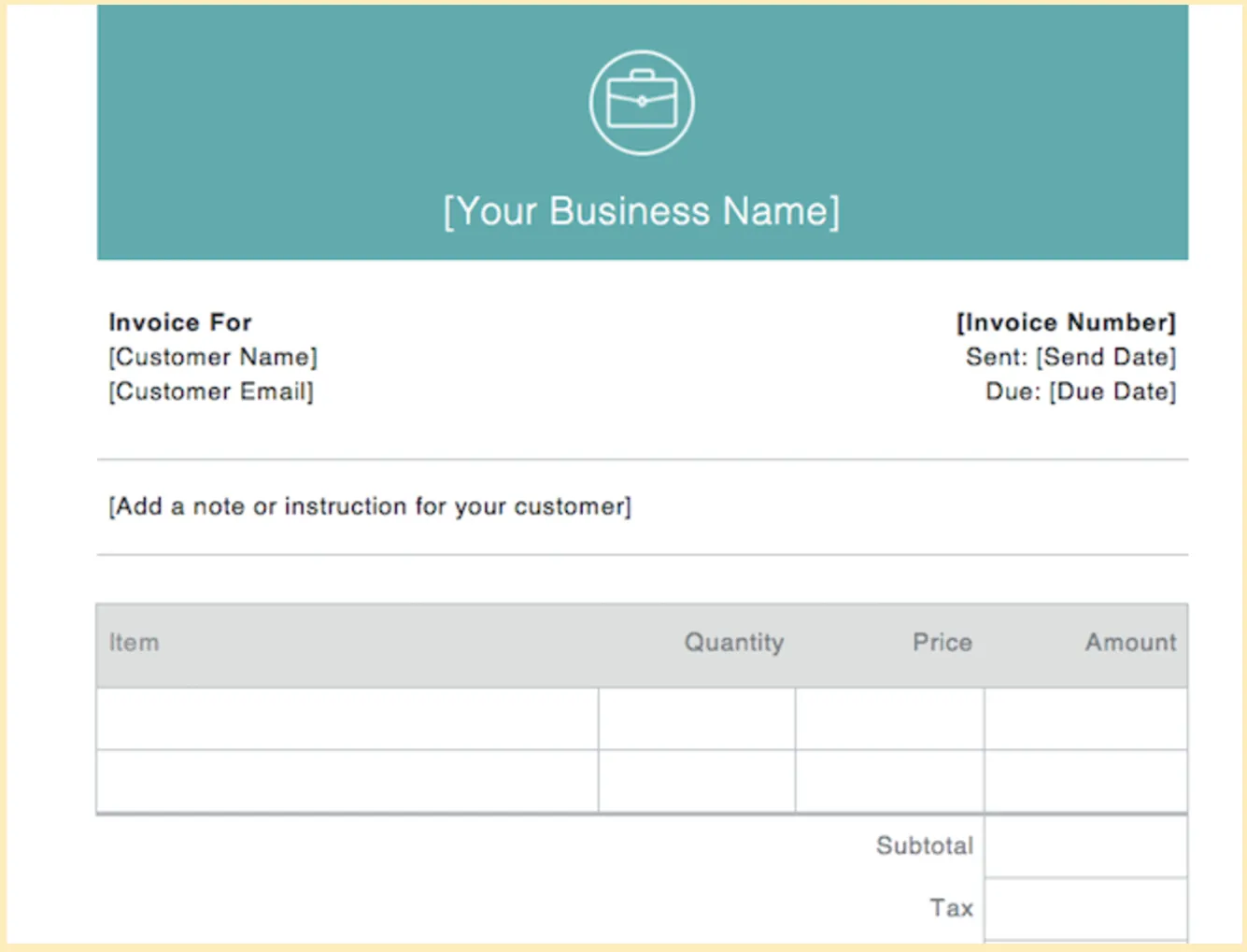

Basic blank invoice example

In the basic invoice sample above, you’ll see that only essentials are included. Basic invoices are a good option for smaller purchases and business-to-consumer (B2C) transactions. You can always use a basic invoice template as a starting point and add more information as needed.

For a basic invoice, include the following details:

- An invoice number

- Your business’ name and contact information

- Your payment information (e.g., bank account details)

- Your customer’s name and email

- A description of the goods or services rendered

- The total amount due

- A due date (so you get paid on time)

A lot of businesses like basic invoices because they’re easy to prepare, meet record-keeping needs, and don’t overcomplicate simple purchases.

Invoice examples for freelancers and consultants

Depending on the type of work you do and your preferences, consultants and freelancers are paid in a variety of ways, from hourly on demand to monthly retainers. A freelance or consulting invoice example should incorporate specific details about the projects you’re working on. For example, if you’re a strategy consultant charging a monthly retainer, list out the deliverables, like support with a business’s SWOT analysis.

Freelance/consulting invoice example components:

- Project details: List all the work produced. A designer, for instance, might input details like ‘website’ or ‘social media graphics’. If you bill by the hour, indicate how many hours you’ve spent on each task.

- Project rates: Clarify whether rates are flat or hourly.

- Software or licensing fees: Itemise any software or licensing fees you have incurred while working on your projects, e.g., font licensing for a design project.

- Tip line: Consider adding a tip line if it’s customary to tip in your industry. Square Invoices gives customers a convenient payment link with the option to tip.

- Payment terms: If you’re issuing the invoice before you’ve completed the work, include a delivery date and note when payment is due.

Invoice examples for contractual work

Like a freelance invoice, an invoice for contractual work is all about project specifics. Suppose that you have divided a building project into stages. Make it obvious you are billing a customer for the design phase by listing all completed tasks related to the design. Break down expenses for materials and tools, too.

Referencing specific contract clauses related to payment terms or the scope of work can also help prevent uncomfortable surprises down the road, especially with complex, long-term work.

Contractual work invoice example components:

- Project details: Itemise tasks and subtasks. For example, the design process might involve subtasks like clarifying requirements and creating 3D models.

- Milestones achieved: Put down notes about the key milestones achieved, e.g., ‘Phase 1: Design’ and ‘Phase 1: Planning Permission’, which helps your customer keep track of progress.

- Extra costs: List the price of any supplies, equipment or permits you need to finish the projects.

- Contract references: Reference the contract as needed. For instance, when billing the customer for tools, mention ‘Clause 3.2 (Materials and Equipment)’.

- Installment schedules: From the initial deposit to the last payment, display the entire installment schedule along with the due dates.

Invoice examples for professional services

If you offer professional services, you’re likely no stranger to payment disputes and clarifications. Completion dates often change and quality of work is subjective. To avoid issues, provide extra details in your professional service invoices: full descriptions of the services provided, timelines and a clear cost breakdown. A clear invoice template ensures that you won’t miss any information.

Fee structures can also vary, as a lawyer might charge a retainer and also bill hourly, an accountant might charge a flat rate for support with bookkeeping or tax submissions, and a designer might charge customers on a per-project basis. Explain these nuances in your invoice.

Professional services invoice example components:

- Fee structure: Are you working with a flat rate or hourly rate, or both? Are you charging a retainer or billing a customer based on tiers? It should be obvious on your invoice.

- Service descriptions: From an initial consultation call to time spent on research, describe what you did to support the project.

- Project timelines: Let’s say that you’re a wedding photographer who takes deposits to confirm a booking. Your package may include an engagement shoot, a wedding day shoot and time after the wedding to work on edits. Clearly list when each service will be delivered from the get-go.

- Terms and conditions: Use the notes section of your invoice to clarify your terms and conditions. For example, a writer might specify how many rounds of revisions are included before extra fees apply.

Invoice examples for retail

Retail invoices can play a big role in inventory tracking and can help you streamline operations when filled out correctly. For example, when you use Square Invoices to create retail-specific invoices, you can set up automated inventory tracking to adjust stock levels in real-time when a payment is made.

Retail invoice example components:

- Product names and SKUs: A description like ‘graphic T-shirt’ is not enough on its own. Write down details about the brand, style and colour in product names. Here’s an invoice text example for retail product descriptions: “Nike, Blue T-Shirt, Size 10, Male.”

- Shipping and delivery: List delivery fees separately and add a note about the estimated timeline in business days.

- Discounts: Show applicable discounts on each line item and on totals to keep sales data accurate. This also helps you process refunds with the correct amount quickly if the need arises.

- Return policy: A simple note like ‘returns accepted within 30 days of purchase’ and a link to your online return process saves time and cuts down the need for email communication.

Invoice examples for catering

When you cater for an event, you’re charging customers for multiple components at once, from staffing and setup to the meals served. Your invoice needs to be transparent and reflect the value of your services so customers know what they’re paying for – and why there may be extra charges based on factors like the guest count or menu choice.

Let’s say that you want to add a 15% mandatory service charge on your invoice to cover tips. In the UK, this is referred to as a compulsory service charge, making it taxable for VAT and subject to PAYE if distributed among staff.

Catering invoice example components:

- Guest count: Your guest count impacts costs, so list it on your invoice along with line items like ‘buffet-style meal’.

- Menu pricing: Include the price(s) of the specific menu(s) your customer chose and clearly identify any add-ons, like a main course with premium ingredients or extra hors d’oeuvres. Details like this are unique to examples of invoices in the catering industry, and it’s good practice to show them.

- Staffing and service fees: Maybe you offer a full-service catering package complete with servers, bartenders, linens, setup and cleaning, or you’re just doing a drop-off. Show all staffing and service fees involved.

- Deposits and instalments: Break down deposits and scheduled payments. And, if you send an invoice after deducting the initial deposit used to secure the order, display that deposit as a line item that you’re subtracting from the total.

- Service charges: Service charges should be their own line item, and you may have to pay VAT (if you’re VAT registered). Put a clear note disclosing the service charge at the end of the invoice to comply with consumer protection and transparency regulations.

- Terms and conditions: Do you have special policies in place for circumstances like a last-minute change to the guest count? Add them to the notes section of your invoice so customers understand if they can make changes and what it means for them.

Invoice examples for restaurants and coffee shops

If you own a restaurant or coffee shop, diversifying your services to add new revenue streams can keep your bottom line healthy. For example, 76% of UK restaurant leaders surveyed in the Square Future of Restaurants 2025 report said offerings beyond made-to-order food are important to their growth plans.

Expanded offerings mean you’ll have to keep invoices organised. For private events, including itemised menu details and modifiers is important to prevent issues after the fact – say, a customer asking why there was only one vegetarian choice or why they were charged more for wine. Just like with a catering invoice, you need to disclose any mandatory service charges.

With recurring orders, it’s a good idea to get customers to sign clear payment terms, which can save time and reduce the risk of non-payment and disputes. Square Invoices lets you set up automated recurring invoicing to streamline admin tasks.

Restaurant and coffee shop invoice components:

- Itemised menu details: Will guests be enjoying a three-course dinner, complete with wine pairings? List every single item, including modifiers related to allergies and special requests. Your invoice is a way to document your customer’s exact order.

- Service charges: Service charges, like an 18% fee automatically applied to the tab of large parties, need to be listed on their own line item with an explanation.

- Payment method: Clearly stating the payment methods you accept gives your customer options and prevents surprises later.

- Payment schedule: For recurring invoices, specify the payment frequency, e.g., whether you’ll be charging your customer weekly or monthly.

Invoice examples for wholesale

If you have a wholesale business – for example, if you create beauty products that you sell to retail stores – an invoice catered to your business is important to keep track of your large transactions.

Wholesale invoices are similar to retail invoices but should also include the regular price of your products, the wholesale discount, the wholesale price your customer is being charged, and VAT if applicable.

Wholesale invoice example components:

- Itemised bulk order details: To keep things organised and show customers exactly how much they’re paying at a volume, list product names, SKUs, quantities and unit prices.

- Tiered pricing: With this model, the more quantities of a product a customer purchases, the better of a deal they get on the unit price. How do you put this on a wholesale invoice? List tiers as separate line items, e.g., Tier 1 (1-30 units), and add the quantities and unit prices for each tier.

- Shipping costs: Competitive shipping costs can attract and retain customers in the wholesale world, so mention them on your invoice – it’s simple but nurtures the relationship.

- Discounts: To give customers a quick glimpse of savings, bulk orders frequently display a percentage discount on the subtotal before the full tax-adjusted amount.

Lump sum invoice examples

A lump sum invoice is used when offering a fixed rate for a number of products or services. Lump sum invoices are ideal for class packs at a yoga or fitness studio or flat rate projects.

If you are offering bulk deals for a large sum, make sure you clearly describe the package or lump sum in the itemised section. Also, be aware that many lump sum invoices have tax included, so there’s no need to add more (as pictured here).

Lump sum invoice example components:

- Description of the package purchased: Don’t simply write ‘personal training’ if a customer bought a bundle of 20 sessions; instead, specify the precise number of sessions.

- Terms and conditions: If a customer has six months to use their sessions, it’s something you’ll want to specify in your invoice notes to avoid disappointment and refund requests.

- VAT: If you charge VAT and don’t absorb it into the final price, include the percentage and amount before the total.

Invoice VAT rules

In the UK, you must issue a special type of nvoice, called a VAT invoice, if both you and your customer are VAT registered. This generally means that you turn over more than £90,000 per year.

The one exception is if all goods or services are zero-rated (carry a 0% VAT rate) or are considered exempt according to HMRC, which may include:

- Insurance and finance

- Education

- Charity fundraising

- Subscriptions to certain membership organisations

- Selling and letting of commercial buildings

VAT invoices are important – and legally mandated – because they’re the main documents companies use to recover the VAT they’ve been charged.

There are three types of VAT invoices in the UK. A full or modified invoice must be issued for sales exceeding £250. Full invoices display the price of goods/services and their VAT charges separately line by line, and modified invoices show single combined amounts. Check your customer is happy to receive a modified invoice before sending one.

If the value of goods or services provided is less than £250, you can provide a simplified VAT invoice. For this, you should include the amount payable for each different VAT rate along with the rate itself, along with the overall amount payable inclusive of VAT. A tool like Square Invoices helps you calculate VAT for all types of invoices.

You must include all of the following in a full VAT invoice:

- An identification number for your own record keeping.

- The time of supply or “tax point” (this determines which VAT period the sale falls in and is usually the date by which services are performed or goods collected).

- The date you issued the invoice.

- Your name, company name, business address and VAT number (sole traders should use only their own name if they don’t use a trading name).

- A description of the goods or services provided.

- An item breakdown for each description detailing the quantity of goods, the cost without VAT, any added discounts and the rate of VAT.

- The unit price for countable goods and services, e.g., an hourly rate for freelancing services or the amount per distinct item.

- The total amount payable excluding VAT.

- The total amount of VAT payable (this must be in GBP).

HMRC provides an invoice sample, with a breakdown of how to calculate inclusive and exclusive amounts for modified and full invoices.

Benefits of invoices

Invoices can do much more than help you request a payment. From cash flow management to smoother operations, here are all the ways they benefit your business.

- Set and maintain clear expectations: From helping you get paid on time to reducing the risk of chargebacks, a well-laid-out invoice sets and maintains clear expectations between a business or service provider and a customer.

- Build brand credibility: Customers don’t necessarily notice that an invoice looks professional, but mistakes or a wonky layout can erode the trust they have in your business. With Square Invoices, you can create invoices from various layouts and customise them with your logo and brand colours for a polished touch.

- Get paid on time: Your chances of getting paid on time are increased if you send an invoice as soon as you finish the work and include a clear payment deadline.

- Track payments: Don’t let business revenue fall through the cracks. When you use invoicing software like Square Invoices, simple payment links allow for easy tracking and alerts.

- Manage cash flow: By enabling you to predict how much money will enter your company and when, a well-organised invoicing system helps you stay on top of cash flow.

- Maintain accurate financial records: Square Invoices automatically numbers invoices for you and lets you quickly retrieve them if you need to reference them again in customer conversations or if you ever get audited by HMRC.

- Streamlines operations: Whether you’re a service provider who bills customers on a monthly basis or a retailer who offers subscriptions, you can set up automated recurring invoices with a tool like Square Invoices. You can also add custom fields to invoice templates based on your business type and quickly reuse them in the future. And you can easily calculate and apply the correct VAT rate. With the right tools, invoicing can go from a chore to a simple system that helps your business run smoothly behind the scenes.

Invoice example FAQs

How do I write a simple invoice in the UK?

In the UK, a simple invoice should include your business name and address, the name of the recipient, a list of goods or services provided along with costs, and a total amount for payment. You can use a tool like Square Invoices to create a reusable template and add elements like a logo and brand colours.

What is an invoice and an example?

An invoice is a document you send to customers requesting payment. While the main purpose of an invoice is to tell customers how much they owe, it should also contain other important details like your company name and contact information, VAT number, and breakdown of individual costs. An example invoice that has been verified as correct by a trusted source ensures you don’t miss any of these components. Square offers a variety of free invoice templates you can use as reference points.

What does a typical invoice look like?

A typical invoice is a straightforward document with all the information a customer needs to check and pay for goods or services. Some types of invoices – like VAT invoices – need to contain additional information (like VAT calculations), but they follow the same basic layout.

How do I write and send simple invoice?

To write and send a simple invoice, use a trusted accounting application and follow best practices and examples (such as those outlined in this article). Many companies opt to create and issue VAT and other invoices electronically with a service like Square Invoices. Using electronic services helps save time and eliminate mistakes.

What are the best invoice examples for the UK?

The best invoice examples for the UK are those that include all necessary details as outlined by HMRC and have been adjusted for particular industries, such as freelancing or construction.

What should an invoice look like in the UK?

A UK invoice should include a line-by-line breakdown of the quantity and costs of goods or services, information about the seller and supplier, and a total payment amount. A VAT invoice – which you must send if both you and your customer are registered for VAT – must also include your VAT number and a VAT calculation.

![]()