Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Powerfully simple tools for your entire business

Get payments, POS and business loans1 all in one place.

See your whole business click into place

Take payments

Take payments

Sell in person and online with a point of sale platform that works for whatever you sell.

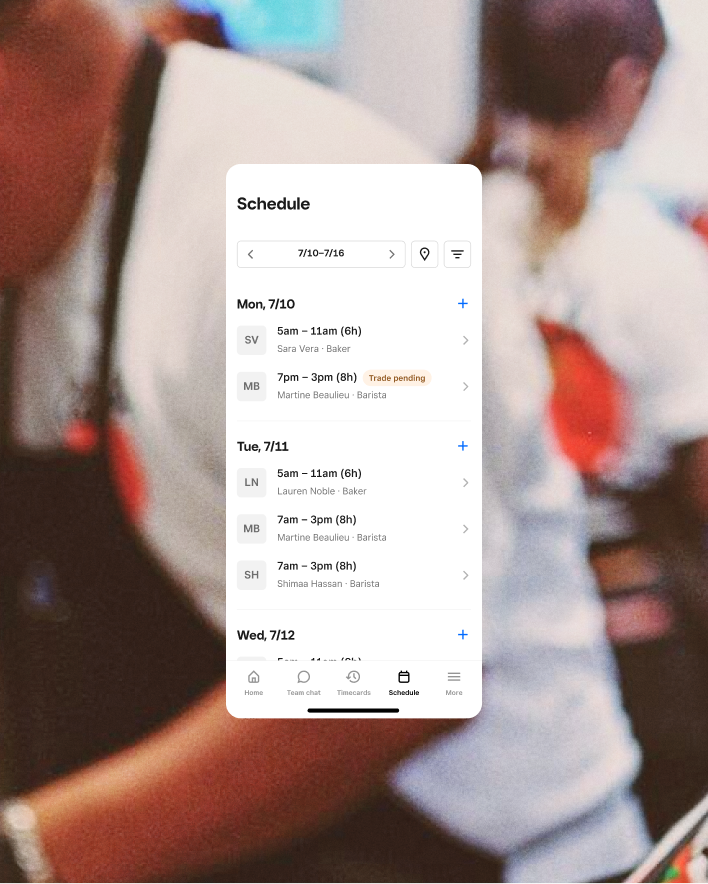

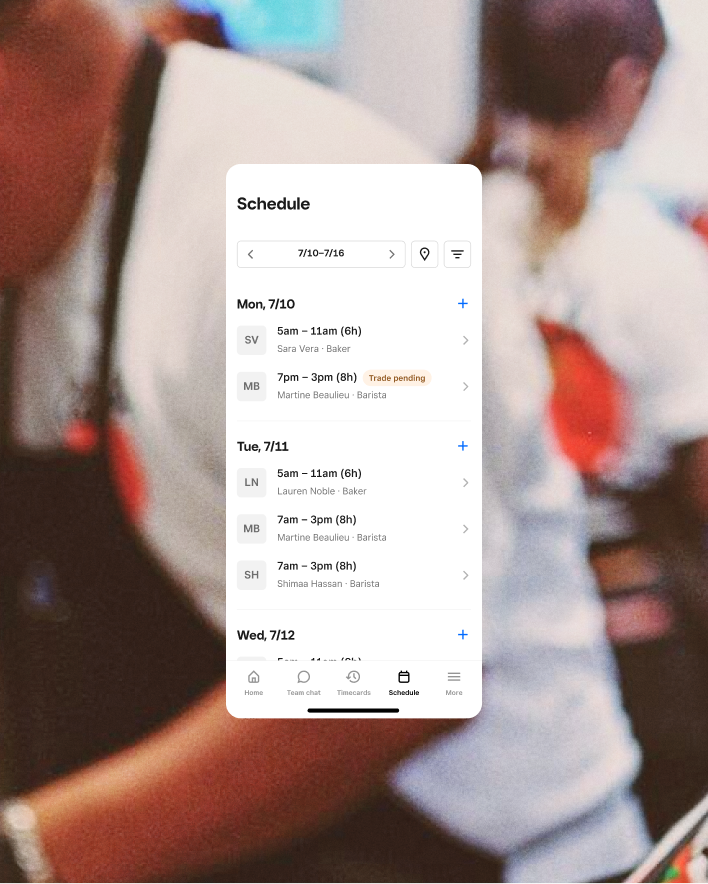

Manage your team

Manage your team

Schedule shifts and track your team’s hours—so you can spend less time on admin tasks.

Grow your customer base

Grow your customer base

Set up the right marketing campaigns and loyalty program to welcome new customers and keep them coming back for more.

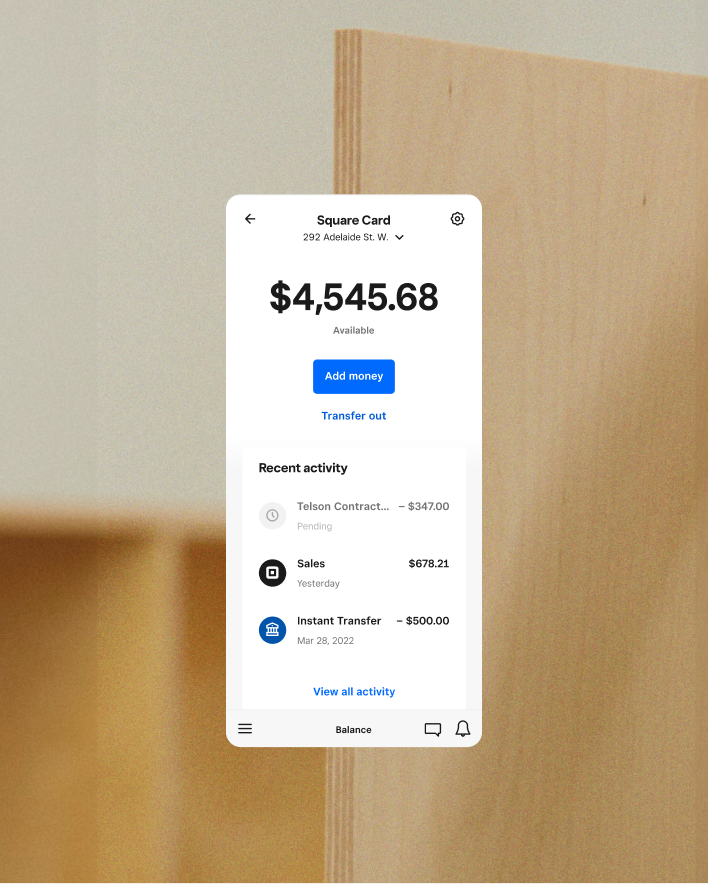

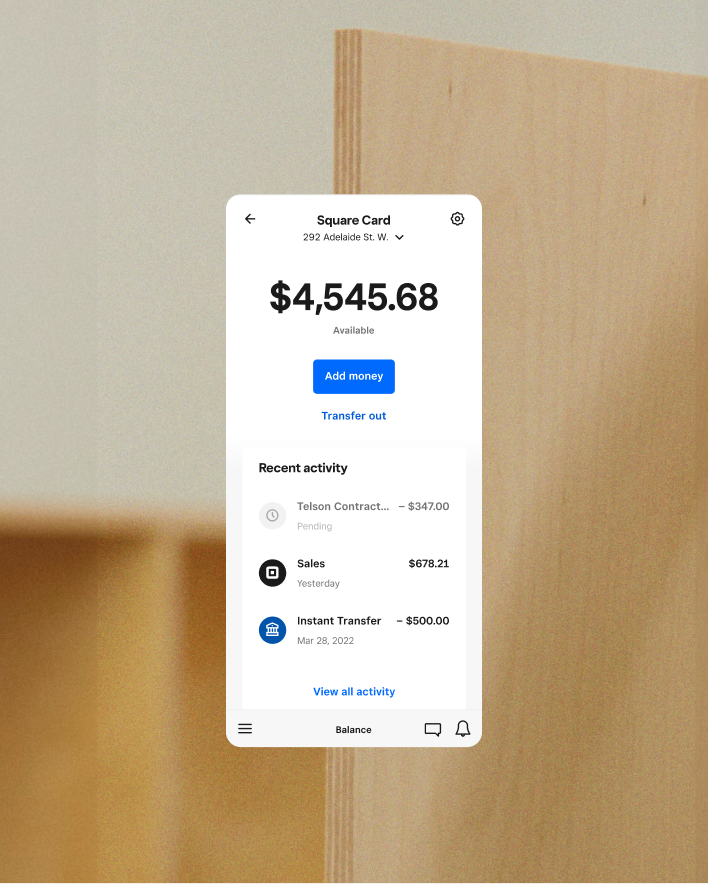

Control your cash flow

Control your cash flow

Spend, budget, move and grow your money effortlessly.

Connect your favourite apps

Connect your favourite apps

Square partners with hundreds of apps so you can manage your entire business without jumping between them.

Get the latest updates from Square

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualized content on the topics you care about most by telling us a little more about yourself.

FAQ

Does Square have tools for complex businesses?

Square has solutions for businesses of all sizes. Our connected tools are built to scale with future-focused, connected tools. Enhanced, customer-friendly experiences help build deeper data and better customer relationships. And our open platform means you can connect to prebuilt integrations or build out your own with our APIs. Learn how Square works with larger, more complex businesses.

What are merchant services?

Merchant services is an all-encompassing term that describes the hardware, software and financial services needed for a business to accept and process payments—credit cards, debit cards, NFC-enabled mobile wallets and other contactless payments—both online and in-store.

Does Square have tools for professional service businesses?

Square built a suite of integrated tools to help service businesses save time so they can focus on growing revenue and delivering exceptional service to their clients. Square Appointments works for any business that needs appointment scheduling capabilities and a point-of-sale system. Use Square Invoices—a free, all-in-one invoicing solution that helps businesses request, track and manage their invoices, estimates and payments in one place—to get paid faster. And Square Messages is a platform designed to keep your client communication (texts, emails, receipts, invoices, feedback, payment links, contracts and more) in one place; you can send and receive texts online, and your clients experience more immediate customer service. Learn more about our solutions for professional services.

How does Square compare to other business software providers?

Square point-of-sale software and suite of tools make it easy to sell in person, online, over the phone or out in the field. As your business evolves, you can quickly add tools that help your business, from managing team members to adding devices and locations, all with a couple of taps. You can also track customers’ preferences and purchases to create more personalized marketing and loyalty programs to keep them coming back more often. We stand out with best-in-class hardware and an all-in-one platform. See how we stack up against Shopify, Toast and Lightspeed with a feature-by-feature comparison. Or hear what our customers have to say about Square on our review page.

How does buy now, pay later work?

Buy now, pay later, or BNPL, is a payment option that allows a customer to pay for a purchase over time in instalments while merchants get paid in full. With Afterpay, Square merchants can let customers pay in four interest-free instalments over six weeks for eligible online purchases.

Does Square have an offline payment mode?

If your internet connection becomes temporarily unavailable or if you experience a rare service disruption by Square, you can accept offline payments during an offline session and upload them once you have a connection again. There are duration and card type limitations associated with how long you can accept offline payments once you go offline and when you need to upload offline payments once you regain a connection.

What kind of resources does Square provide businesses?

Square strives to provide the best hardware, software and resources to support you in every stage of your journey, whether you’re a first-time business owner or a seasoned entrepreneur. Explore our publication for modern business leaders, The Bottom Line, for the latest trends, insights and strategies. Find tips and tricks, videos and articles in our Support Centre to help you get the most out of Square hardware and software.

What are Square’s fees in Canada?

Square keeps pricing simple and transparent. You only pay when you get paid—there are no monthly processing fees, setup costs or hidden charges.

In-person payments: 2.5% per credit card tap, insert or swipe. There is an additional 1.5% processing fee for international card transactions

Debit: 0.75% + 7¢ per tap, insert or swipe

Online payments and invoices: 2.8% + 30¢ per transaction

Manually entered cards: 3.3% + 15¢

With Square, you get free point-of-sale software, fast deposits and built-in security—all with clear, flat rates. Learn more about Square’s pricing.

1All loans are issued by Square Canada, Inc. Actual fee depends on payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18 of the initial loan balance is required every 60 days, and full loan repayment is required within 18 months. Offer eligibility is not guaranteed. All loans are subject to approval. Not available in Quebec. Terms and conditions apply.

Offline payments are processed automatically when you reconnect your device to the internet and will be declined if you do not reconnect to the internet within 24 hours of taking your first offline payment. Interac debit cards are not compatible with offline payments. Any offline transaction attempted with an Interac debit card will auto-decline upon regaining connectivity. By enabling offline payments, you are responsible for any expired, declined or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. Learn more about how to enable and use offline payments here.

2All payment plans are issued by Square Technologies, Inc. APR is 0%. First payment will be due at checkout. Taxes will apply. Available plan lengths vary from 3, 6 and/or 12 installments based on purchase amount. All plans subject to credit approval.