Understanding Square processing fees.

During these times it’s even more important that we’re fully transparent in how our payment processing fees are distributed. When a customer spends money with your business, Square only keeps a fraction of the fees, and most of that goes right back into your business.

Square fees by payment type

Card-present payments

When a customer taps or inserts their card in person, you pay 1.6% per transaction. There is a lower risk of fraudulent activity when the cardholder is present.

Card-not-present payments

There are multiple types of card-not-present payments. Square pays more for these transactions and the fee increase goes directly to the card issuing bank to help mitigate the risk of fraud and protect your business.

Square charges 2.2% for card-not-present transactions. This applies to payments when you manually enter your customers’ card details or use a card on file. It also includes payments via your Square Online site, eCommerce API, Invoices or Virtual Terminal.

Transparent pricing means no surprises at the end of the month

There’s one rate per payment method. No hidden fees. With Square, you only pay for what you process.

Afterpay

6% + 30 cents

per Afterpay transaction (excl. GST)

Please note: Different pricing may apply with certain products and/or subscription plans.

1.6% card present rate applies for Square Sellers who sign up on or after 30 May 2024. The rate of 1.9% will apply for Square Sellers who signed up prior to this date when using Square Reader, Square Stand or Tap to Pay, as listed in the Square Fee Schedule.

Free services included in every transaction:

- Dispute management

- Active fraud prevention

- End-to-end encrypted payments

- Connected POS

- Live phone support

- PCI compliance

Card processing fees explained.

To process a sale, there are several types of set fees within a transaction. These are set not by Square but by cardholder banks and card networks. They are included as part of Square’s card processing fee. Learn more

Interchange fees

Every time a customer uses a credit or debit card in your store, a fee is charged by the cardholder’s bank, such as CommBank or NAB. This fee can vary greatly, depending on the cards being used by your customers. When Square processes a transaction on your behalf, Square is required to give a percentage of the funds collected to your customer’s card issuer.

Assessment fees

Associations such as Visa, Mastercard, eftpos, American Express and JCB also collect fees, called dues and assessments, for the use of their card brands as well as the ability to process transactions through their payment networks. Square is required to give a percentage of the amount collected from your customer to these associations.

Risk and PCI compliance

PCI DSS is a security standard all businesses that accept credit cards must comply with to safely and securely accept, store, process, and transmit cardholder data during debit and credit card transactions. Square’s tools help keep sellers PCI compliant. Square complies with PCI standards so you don’t have to validate your compliance, nor do you pay associated annual fees.

How Square processing fees work.

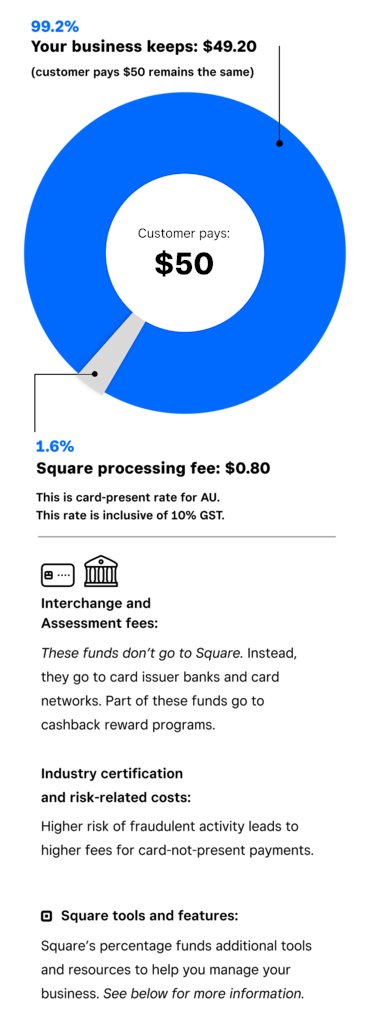

Here’s an illustrative example using the Australian card present processing rate of 1.6%.

Data in the figure is an illustrative example using the Australian card present processing rate and a blended cost across Australia, Japan, Canada, the USA and the UK.

Square tools and features.

With Square, you benefit from many resources designed to help you run your business. For example, on a $50 transaction, the $0.95 allows for Square to provide some of the following tools and features:

Point of sale and eCommerce solutions

Download the Square POS app or launch an online store so you can sell right away without any up-front investment.

Fraud prevention

Fraud can happen in both low-risk transactions and higher-risk transactions such as card-not-present purchases. We work around the clock to evaluate the legitimacy of your buyers to protect your business.

Dispute management

Get free dispute management services for chargebacks. We cover the fee for every dispute that we fight on your behalf. And we’ve saved sellers millions of dollars globally by managing and winning disputes for them.

Advanced reporting tools

Access important data and powerful tools straight from your Square Dashboard so you can easily keep track of your sales and make important decisions about your business.

Square support

Our in-house phone support is available from 9 a.m. to 5 p.m. (AEST), or you can email them anytime, 24/7. Connect with and learn from other sellers in our Seller Community.

Customer Directory

Keep your customers’ information organised and secure, make appointments, send invoices, and keep track of customer transaction history, all in the same place.

Team Management

Track team hours, overtime, and breaks. Free timecards that sync seamlessly to Square Point of Sale make payroll simple.

Inventory management

Change item details like price, name, or quantity in real time. Upload groups of items faster, track stock quantities, and get email alerts when items run low.

Square AU Pty Ltd., ABN 38 167 106 176, AFSL 513929. Square’s AFSL applies to some of Square AU’s products and services but not others. Please read and consider the relevant Terms & Conditions’s, Financial Services Guide and Product Disclosure Statement before using Square’s products and services to consider if they are right for you.

Frequently Asked Questions

Square charges 1.6% per transaction for in-person card payments. This flat rate applies across Visa, Mastercard, EFTPOS, JCB and American Express all at the same rate.

Yes. That fee includes access to the Square POS software free plan, which includes reporting, inventory tracking, dispute management, active fraud prevention and more.

Yes. If your business processes over $250,000 per year, you may be eligible for custom rates. Contact the sales team to learn more.

Each transaction fee covers a range of services including end-to-end encrypted payments, PCI compliance, dispute management, active fraud protection and live phone support. There are no hidden fees.

Card-not-present payments, such as online or manually entered transactions, carry higher fraud risk. The increased 2.2% fee helps cover additional costs paid to card networks and banks to help protect your business.