Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Never miss a sale with offline payments.

Square makes it easy for your business to take reliable offline payments. Whether you temporarily lose internet or there’s an outage in your area, we’ve got you covered. Accept payments hassle-free, even without Wi-Fi.

What are offline payments?

If your Wi-Fi connection goes down or there’s an internet outage in your area, there’s no need to panic. You can still take payments offline from your Square device. Any payment you take will automatically be processed when you reconnect to the internet. There’s no additional cost to use the feature; you’ll only pay your usual transaction fees, even for those taken while offline.

Who can benefit from offline payments?

Any business owner who isn’t able to connect to the internet for any reason can benefit from offline payment processing. Offline payments can act as a safety net for businesses affected by unstable or unreliable internet or electricity services or service outages. It’s a reliable payment solution that can help limit business disruptions so you can continue serving your customers and not miss out on any sales.

Stay open for business even when you're offline.

Keep sales flowing

Continue taking secure, offline payments in the event your business loses internet or if there’s an internet outage in your area.

Maintain customer satisfaction

Let customers complete their purchases hassle-free, making their shopping experience smooth and encouraging them to come back.

Operate with confidence

Offline payments act as a reliable safety net for unexpected internet or service issues so you can keep running your business stress-free.

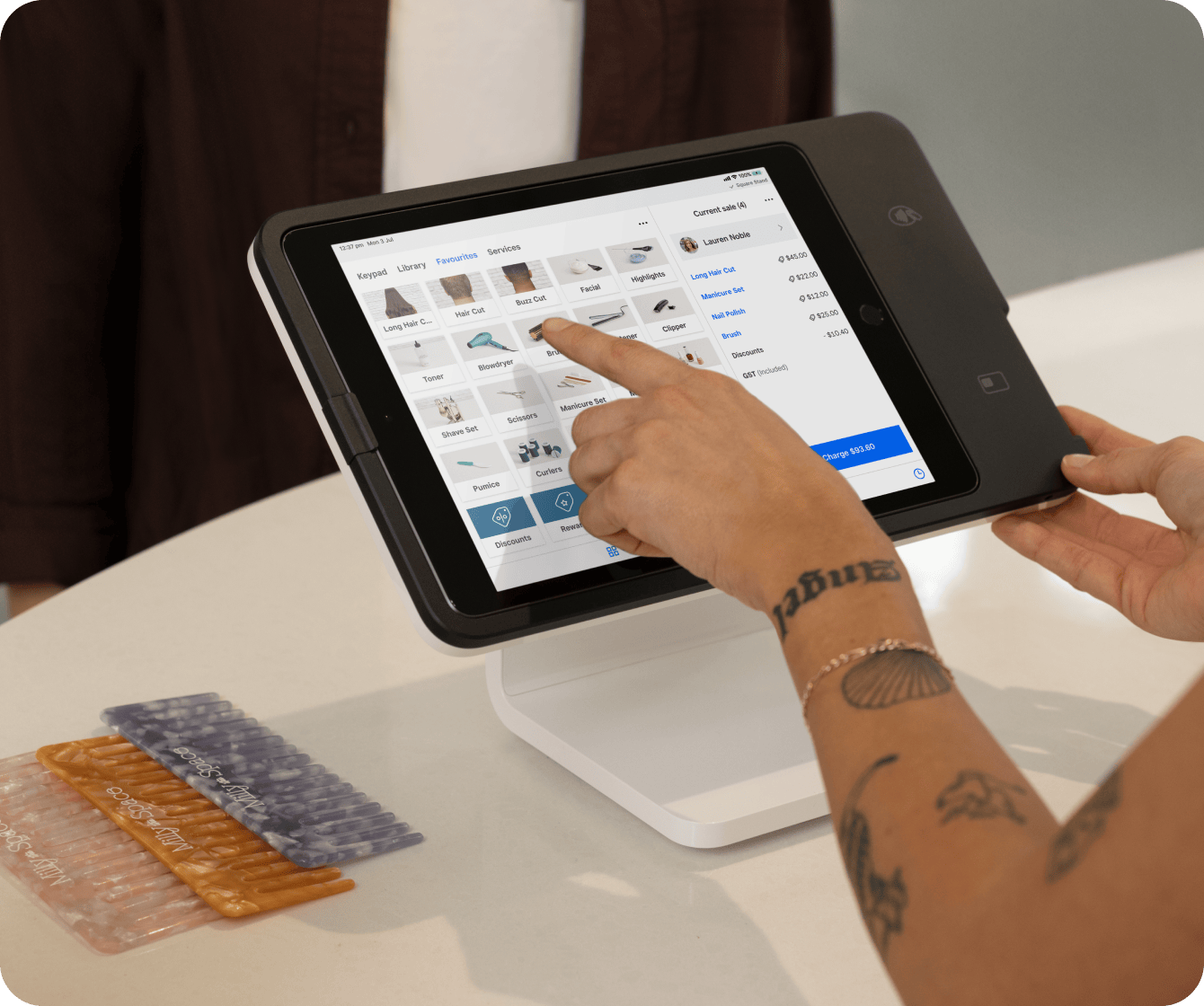

How to accept offline payments

You must enable offline payments from your Square app or device before you go offline. Follow these steps to set it up:

1. From your Square app or device, tap More.

2. Select Settings from the menu options.

3. Tap Checkout, then Offline payments.

4. Toggle on Allow to confirm.

5. Set a transaction limit that you’re comfortable with (you can change this at any time).

Unlock the power of Square

Keep your business secure

From fraud protection to dispute management to making sure your business is PCI compliant, Square provides you with tools and services designed to protect your business online and offline.

Fraud protection

Our systems monitor your payments to watch out for suspicious transactions. If we notice anything unusual, our team of fraud experts will get in touch with you.

Dispute management

We’re experts in payment disputes. We’ll let you know what you need to do for the best chance at winning your dispute. And we’ll do it all at no additional cost.

Merchant of record

Square handles all payment processing and fees for you. This means less time spent on administrative tasks and chargebacks, and more time focusing on your business.

PCI compliance

Square systems are PCI compliant. Safely and securely accept, store, process and transmit cardholder data with card transactions.

Don’t let Wi-Fi issues slow you down

Take payments even when your business is offline so you never miss a sale.

Software designed for how you do business

Take care of your entire business with Square software. Our tools are built for desktop, tablet and mobile, so you can run your business from anywhere.

Hardware to push your business further

Square has the hardware you need to ring up items and accept payments fast, both online and offline. There are no hidden fees or hardware rental fees to worry about.

Clear pricing to meet your needs.

In person

1.6%

per tap or insert1

Online

2.2%

per payment on Square Online, Square Online Checkout, eCommerce API and in-app payments and online invoices

Manually entered

2.2%

per manually entered payments on Square Virtual Terminal, the Square POS app and card on file payments

If your business processes over $250K in sales each year, you may be eligible for a custom pricing package.

FAQs

-

Offline payment processing allows you to take secure card payments anywhere, anytime, even if there’s no internet access. You can keep taking payments for up to one hour. Just reconnect to the internet within 24 hours to upload any transactions. Learn more about offline payments.

-

You can accept offline payments when your customer uses a card with a Visa, Mastercard, American Express or JCB logo. EFTPOS debit cards cannot be processed offline or when your internet connection is restored. Currently, offline payments are only available with tap and insert payments with a payment card and Apple Pay or Google Pay via Square Terminal. Swiped payments or EFTPOS debit cards are not supported.

-

Credit card transactions taken as offline payments can be cancelled after you reconnect and allow the pending payment to complete. At that point, you can issue a refund. First, complete the pending payment by reconnecting within the 24-hour window. When you do that, the transactions will automatically sync. Then you can issue a refund from the Transactions tab of your POS. Remember, offline payment transactions can’t be cancelled when they’re pending.

-

Offline payments are automatically processed when your device has connectivity again. Once your device goes offline, you must reconnect to the internet within the time limit, depending on what Square hardware and connected hardware you are using. Learn more about complete time-limit details. Transactions expire and funds will not be received from your customer if they’re not processed within the time limits.

1For Square Sellers who sign up on or after 30 May 2024. The rate of 1.9% will apply for Square Sellers who signed up prior to this date when using Square Reader, Square Stand or Tap to Pay, as listed in the Square Fee Schedule.