Growth back on the menu for restaurants, retailers focusing on in-store experiences: Square study

Annual Square research signals cautious optimism that 2024 may be a year of long-awaited growth for businesses.

Today, Square released its fourth annual Future of Commerce report, with comprehensive analysis on how business owners and consumers are considering the evolution of the restaurants, retail, and beauty industries. The report offers insights on how these businesses are shifting – and how consumers are responding – particularly amid further advancement in automation and generative AI.

In collaboration with Wakefield Research, Square surveyed thousands of business owners and consumers on restaurant, retail, and beauty industry trends across Australia, the United States, Canada, and the United Kingdom.

“For businesses, the future is looking cautiously optimistic, and business owners say they’re looking to grow despite diverging consumer economic sentiment,” said Matthew O’Connor, Head of Verticals and Platform at Square. “With Square’s ecosystem, businesses can easily expand – whether that means opening a new location or introducing new non-core offerings – while continuing to drive customer loyalty and engagement.”

Around 90% of surveyed restaurateurs in Australia say they plan to expand their businesses in the next 12 months through offering new products or opening additional locations, and 80% report feeling more optimistic about the future of their restaurants.

One restaurant that has successfully added a new revenue stream is Canberra’s Fricken Chicken: “The Fricken Sauce and Satay Sauce are our top sellers, outselling our nearest two commercial items by over 400%,” said Mo Saad, co-owner at Fricken. “By offering these items as retail products, our customers can enjoy them at home, thus strengthening our brand presence.”

In 2024, restaurateurs need to invest in more efficient ways to find and engage customers in order to see return on their investments as around half of consumers (49%) predict that they’ll order less food delivery in 2024, compared to 2023 – particularly Gen Z and Millennials.

Diners are looking for a tech-forward approach from eateries – 61% of consumers globally surveyed are supportive of local restaurants using AI-based tools, while more than a quarter of Aussies would prefer to place their orders via self-serve kiosks. This bodes well for businesses where staffing is top of mind, as understaffing issues have persisted at restaurants for a reported average of 18 months.

Restaurateurs are not only investing in AI to address staffing challenges – more established automation tools are also on the agenda in 2024. 54% of surveyed owners plan to increase their spending on technology and automation tools in the next 12 months, and 76% of consumers want restaurants to invest in at least one area of automation when they’re not at full staffing capacity.

As restaurant owners look to expand, 77% of those surveyed say they’ll experiment in the coming year with non-core offerings like meal kits, subscriptions, events, and more. Restaurateurs say that right now, 19% of their revenue stems from products and services outside of their core restaurant offerings.

“Automation and AI are going to be key growth levers for restaurants in the coming year, though not in the way you may think,” said Ming-Tai Huh, General Manager of Square for Restaurants. “The vast majority of restaurants will be integrating AI into their operations in small, iterative ways – not through flashy robots but through automation in marketing or kitchen workflows – and these minor changes will add up to saved time and more profit.”

Growth is top of mind for retailers as well, with 57% of those surveyed saying they’re eager to expand in the coming year – though they are split on whether to prioritise brick and mortar (51%) or online offerings (49%). With 63% of consumers typically shopping in-store and 37% online, the research emphasises that keeping in touch with customers via digital channels is key no matter where or how they choose to shop.

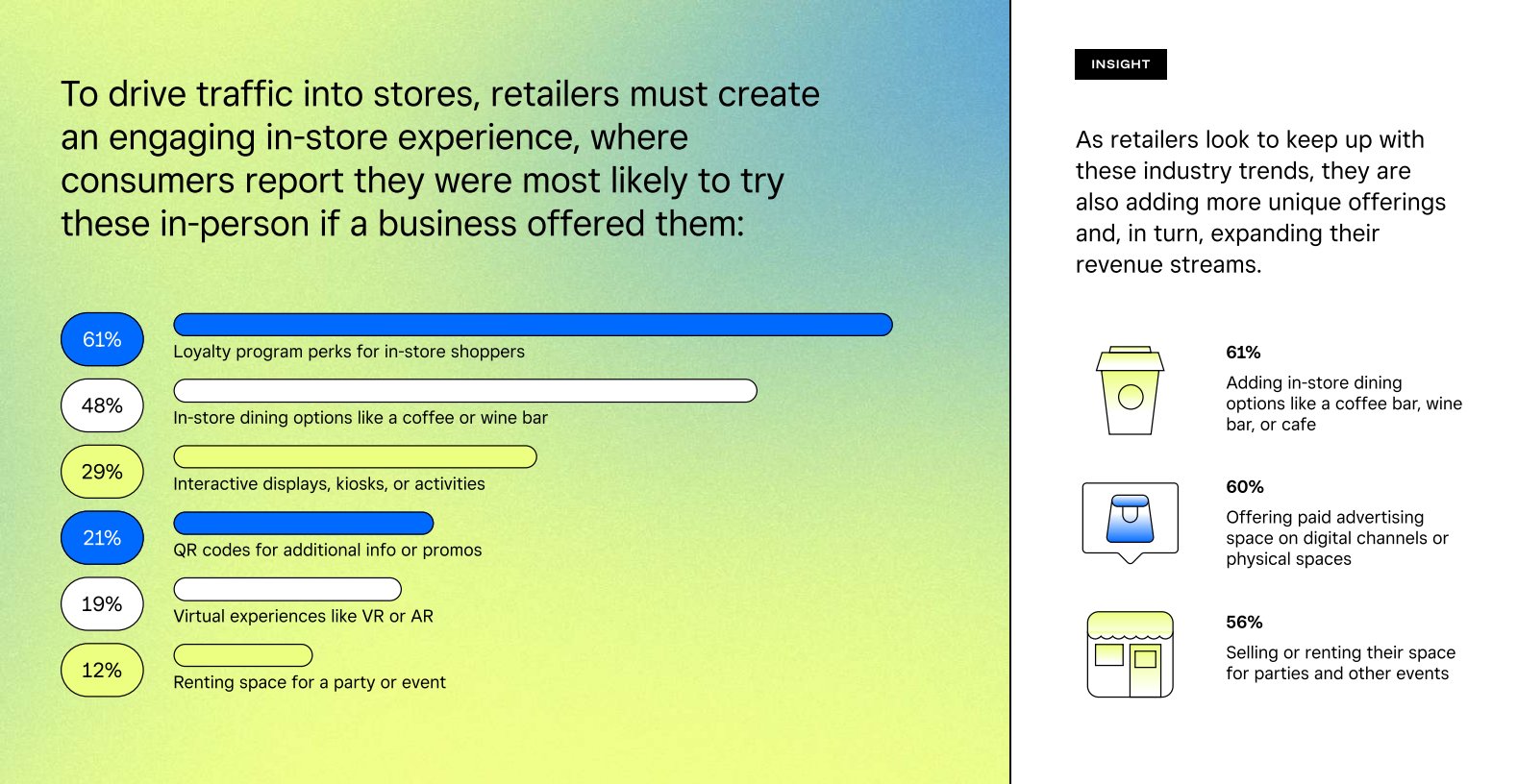

Offering compelling in-store experiences for customers is key for retailers this year to continue driving traffic into stores – consumers report they’re most likely to try offerings like in-person loyalty programs (61%), in-store dining options like a coffee or wine bar (48%), and interactive displays, kiosks, or activities (29%).

AI-powered product recommendations is the top priority tool for retailers of all sizes to implement, especially for those planning to add more online options over the next year (42%).

To compete in today’s marketplace, retailers are offering more choice and flexibility to reach new and existing customers – such as by implementing faster and easier communication channels with customers (42%) and providing Buy Now, Pay Later options like Afterpay (39%).

“Whether retailers are focusing on in-store or online shopping, it’s more important than ever to maintain communication with your customers,” said Roshan Jhunja, General Manager of Square for Retail. “Retailers should be building rapport and staying connected with their customers through social media, email, and text, and they should also be finding ways to create unique in-person experiences to bring folks into their stores.”

For a full analysis of the top restaurant and retail trends for 2024, industry data and insights from Square experts, and real-life examples from Square sellers, download the report here or reach out to press@squareup.com.

About Future of Commerce

The retail and restaurant surveys were conducted by Wakefield Research among 2,000 retail owners and managers and 2,000 restaurant owners and managers, with quotas set within each survey for 500 respondents per market in the U.S., Canada, the UK, and Australia between October 27 and November 8, 2023, using an email invitation and an online survey.

The consumer survey was conducted by Wakefield Research among 4,000 nationally representative adults ages 18+ in the U.S., Canada, the UK, and Australia, with quotas set for 1,000 respondents per market, between November 15 and November 28, 2023, using an email invitation and an online survey. Data has been weighted.