Clearpay and Square’s Retail Snapshot

Consumers are still reeling from the effects of inflation and are spending less due to higher cost of goods and services. Despite these headwinds, the retail industry continued to grow in the first quarter of 2023 based on Square and Clearpay data in the U.K. However, according to our data, annual growth has moderated from 2022, when the market observed a significant increase in retail spending as the pandemic subsided.

While the Office for Budget Responsibility has forecast that the UK will avoid a recession, it’s clear that changing consumer preferences and habits are creating both areas of opportunity for retailers as well as noticeable declines in once popular categories. Square and Clearpay have paired data from purchases made by millions of shoppers with sales from hundreds of thousands of retailers to help the industry identify today’s most influential consumer spending behaviours. These findings reveal new consumer trends and other opportunities that businesses can leverage as they wade through the dynamic macroeconomic climate.

Popular shopping channels

Next generation consumers want to shop from brands that meet them where they are, giving rise to the popularity of omnichannel shopping. Customers currently spend 2.3x more on pre-orders than the average online purchase through Square. Unsurprisingly, in-store shopping has bounced back to pre-pandemic levels. This trend, in part, can be attributed to the growing number of influencers leveraging their social platforms to encourage younger consumers to visit new stores, especially those with enticing experiences and features unique to a location.

Mobile commerce has also become a popular shopping channel for younger consumers. In the past year, 82% of online transactions using Clearpay from Millennial and Gen Zs were made on mobile, with the volume of transactions up 238% since 2020.

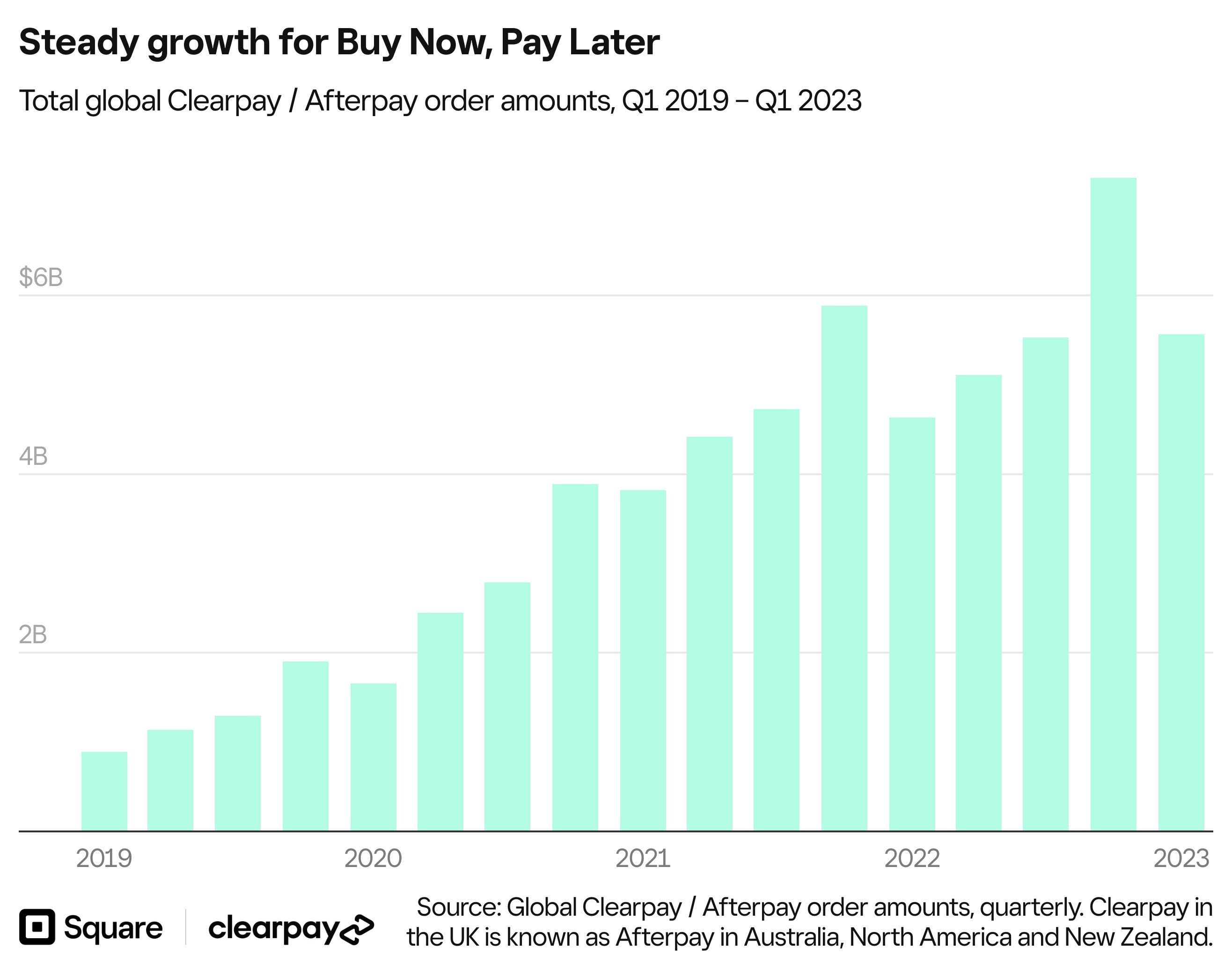

Buy Now, Pay Later (BNPL) goes mainstream

BNPL adoption is going mainstream across the globe, with sales increasing year on year and growth up across all consumer age groups. While Gen Z and Millennials continue to lead the charge as the primary BNPL users, older shoppers are also choosing to use Clearpay to budget their lifestyle and make everyday purchases. Over the last year, Clearpay orders made by Gen X and Boomers increased 286% and 20%, respectively. Businesses can reach more consumers by tapping into BNPL platforms, such as Clearpay, as a marketing channel.

Consumer spending trends

It can be easy to jump into selling short-lived trends that aren’t profitable due to the fear of falling behind competitors. In order to meet shifting consumer demands while managing an appropriate amount of inventory, consider focusing on an assortment of offerings that are grounded in utility, quality, and longevity.

__Quiet luxury

__

Since 2021, sales of designer fashion items on Clearpay have increased 72% as the demands of younger shoppers who prefer a flexible payment method increase. In parallel to the growth of the luxury market, the quiet luxury trend has taken off as a result of a return to the office and a desire for sophisticated staple items. Data has shown a yearly uptick in sales for workwear products such as trousers (+734%) and blazers (+56%).

Clearpay merchant E.L.V. DENIM is a quiet luxury pioneer. Founded in 2018, it offers understated premium fashion, coupled with local expert craftsmanship, created from preloved garments. With the rise of conscious consumerism, the brand offers both sustainable and timeless pieces that can last a lifetime. Brands like E.L.V. DENIM have put a new spin on the luxury market that other brands can follow.

__Beauty is still on the rise

__

Personal care and cosmetics boomed over the pandemic as consumers concentrated spending on their “Zoom face” and well-being. Despite salons being long open now, the demand has remained high with sales of beauty products growing more than five-fold on Clearpay since 2020 with a 7% increase year-on-year. This growth suggests that beauty spending has become a permanent habit, with customers moving into new beauty facets including new beauty tech, male cosmetics, and more.

While consumers are spending on at-home beauty care, there is still a demand to visit hair and beauty salons. Square recently revealed the impact that scheduling software has had on the UK’s dynamic Beauty and Personal Care (B&PC) industry, a sector worth £8.6bn. UK businesses that use Square Appointments, which allows sellers to accept payments and bookings through an all-in-one scheduling solution, saw an average of 50% increase in year-on-year reservations last year. This increase demonstrates the growth potential across the industry, with the number of beauty businesses using Square Appointments growing 44% year-on-year in 2022.

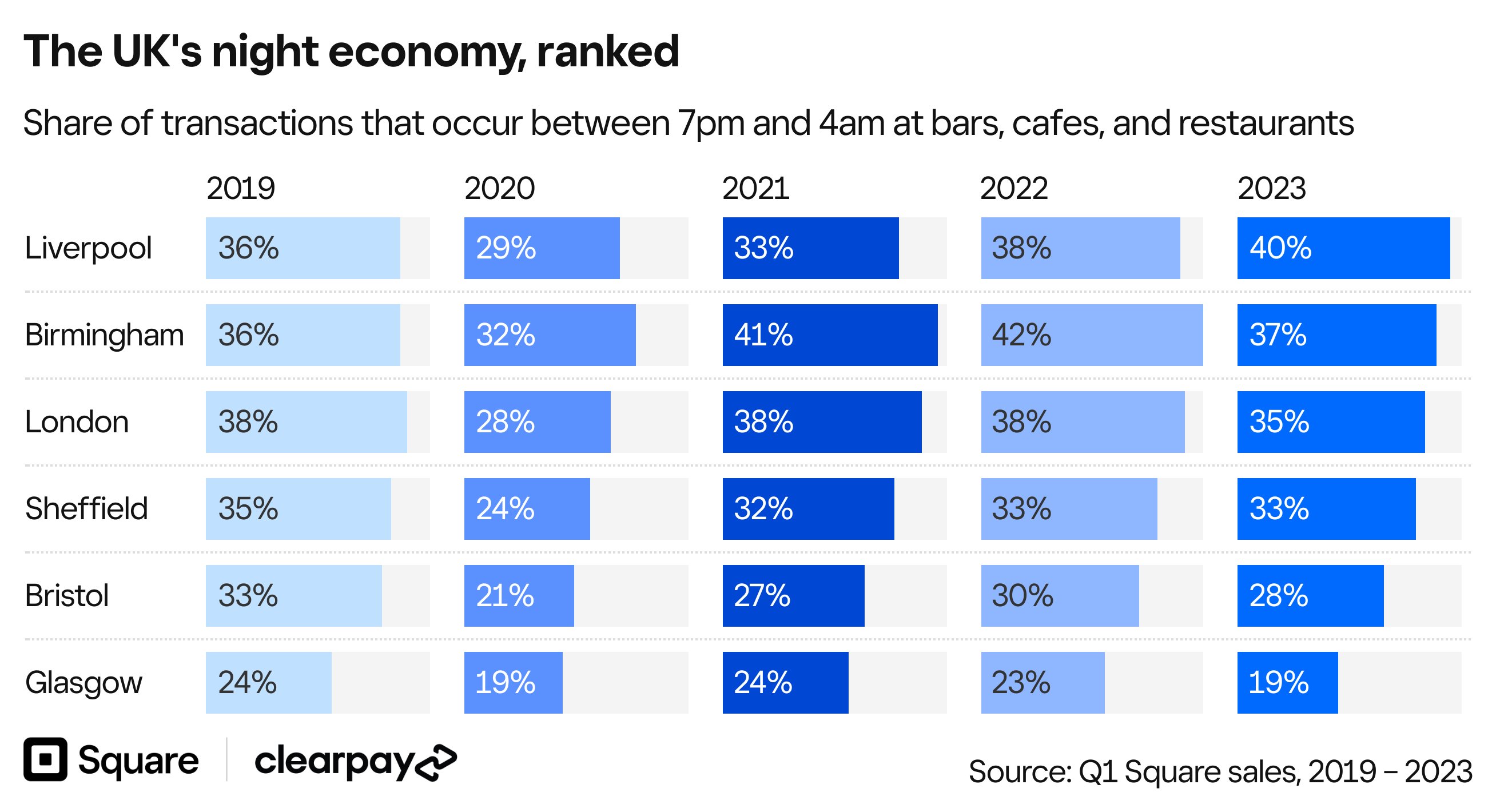

__Evenings are the “new Saturdays”

__

Saturdays used to be the busiest shopping day of the week, but now it’s all about early evenings. Consumers are winding down after a hard day’s work with a spot of retail therapy. Throughout the week, the period between 6pm and 9pm is consistently the highest spend of the day and is often 20% higher than any other three-hour period throughout the day. Looking for a mid-week lift, Wednesday evening is the biggest shopping period of the week with £50m¹ worth of transactions between 6pm and 9pm.

Holiday preparations

The holidays are one of the most challenging and lucrative times of year for any retail business, making it critical to start preparing six to eight months in advance and ensuring a business is set up for success. While the average staff size has increased by 8% since 2019, optimising staff availability has remained an area of opportunity for retail businesses. To maximise staff impact during the holiday season, sellers should lean into AI-powered tools that can automate their back-end processes. Team management software, for example, can improve workflows and empower employees to focus on more strategic and creative tasks that will move the needle for a business.

To improve customer relations, an automated messaging tool can expedite frequently asked queries and marketing software can automate personalised customer communications. Businesses that use Square Marketing can help drive traffic and repeat customers to your online and physical stores. Automated solutions will not only make business operations more efficient, but can also play a role in saving employees from burn out typically experienced during the holiday grind.

To cut through the noise during the holiday season, create an exceptional shopping experience through curated in-person events, brand or influencer collaborations, selling memberships and subscriptions, or open up a branded coffee or smoothie bar. These elements can elevate brand discoverability for new customers and create a lasting impression for existing ones.

*Source: Unless specified, Square and Clearpay analysis of transactions from 2019 to March 31, 2023. Unless specified, all monetary metrics are displayed in GBP. All data presented are unaudited and subject to adjustment.

*1. Based on data from April 2022 to March 2023

*