Apply for a loan

About applying for a loan

Square Loans are business loans which are designed to help you grow your business, and there aren't any hidden fees or lengthy applications to fill out. Because each business is unique, eligible Square sellers are extended loan offers that are personally tailored and customized. Upon approval, funds are deposited as soon as the next business day so you can increase inventory, buy equipment, hire more employees, or whatever you need to help your business grow and succeed.

Keep in mind that Square Loans are offered by invitation. If you don't currently have an offer available, you are not able to apply at this time. If you’re a Square merchant and eligible to apply for a Square loan, you’ll see loan offers presented in the Loans tab in your Square Dashboard.

Before you begin

Square loans range from $100 to $350,000 and loan offers are based on a variety of factors related to your business, including payment processing volume, account history, and payment frequency. Accounts are reviewed on a daily basis and you’ll be notified if you're eligible.

If you have a loan offer available, that is the only offer available at this time. Square isn't able to manually increase loan offers. Offer availability and loan sizes are based on many different factors including, but not limited to, your current payment processing volume, your customer mix, and your Square account history. Square cannot predict if or when your business may receive a higher offer.

Applications generally take 1-2 business days to review, but review may take longer if additional information is requested. You’ll be notified via email for application status updates or if additional information is needed.

Once a loan application is approved, you’ll receive funds in your external linked bank account in 1-3 business days, or into your Square Checking account instantly. If your loan is deposited into your Square Checking account, you can access and spend your funds with your Square Debit Card.

Applying for a loan doesn’t impact your credit score and Square doesn't report to third-party credit bureaus. But Square Financial Services may perform a soft credit check to evaluate your business for future loan offers in addition to evaluating your Square account.

Once you’ve repaid your first loan, you may become eligible for additional loan offers. If you are eligible for another loan, you’ll follow the same process to apply.

All Square loans are issued by Square Financial Services, Inc., a Utah-Chartered Industrial Bank.

Numbers are for illustrative purposes only.

Apply for a loan

If you have a loan offer available, please follow these steps:

Sign in to Square Dashboard and go to Banking > Loans to view your loan offer.

Click and drag the slider bar to select the loan amount that’s right for your business. As you slide across different loan amounts, the fee and hold rate will adjust accordingly. The lower the loan offer size you select, the lower the percentage of daily card sales used to repay your loan.

Complete the application by filling out your personal and business information. When applying for a loan, we’re required to ask for information about both you and your business for identity verification purposes. Information about your business such as your EIN (if your business has one) as well as information about you such as your SSN (or ITIN), date of birth, and full name is required. There isn’t a way to apply without providing information about you such as a valid SSN or an ITIN.

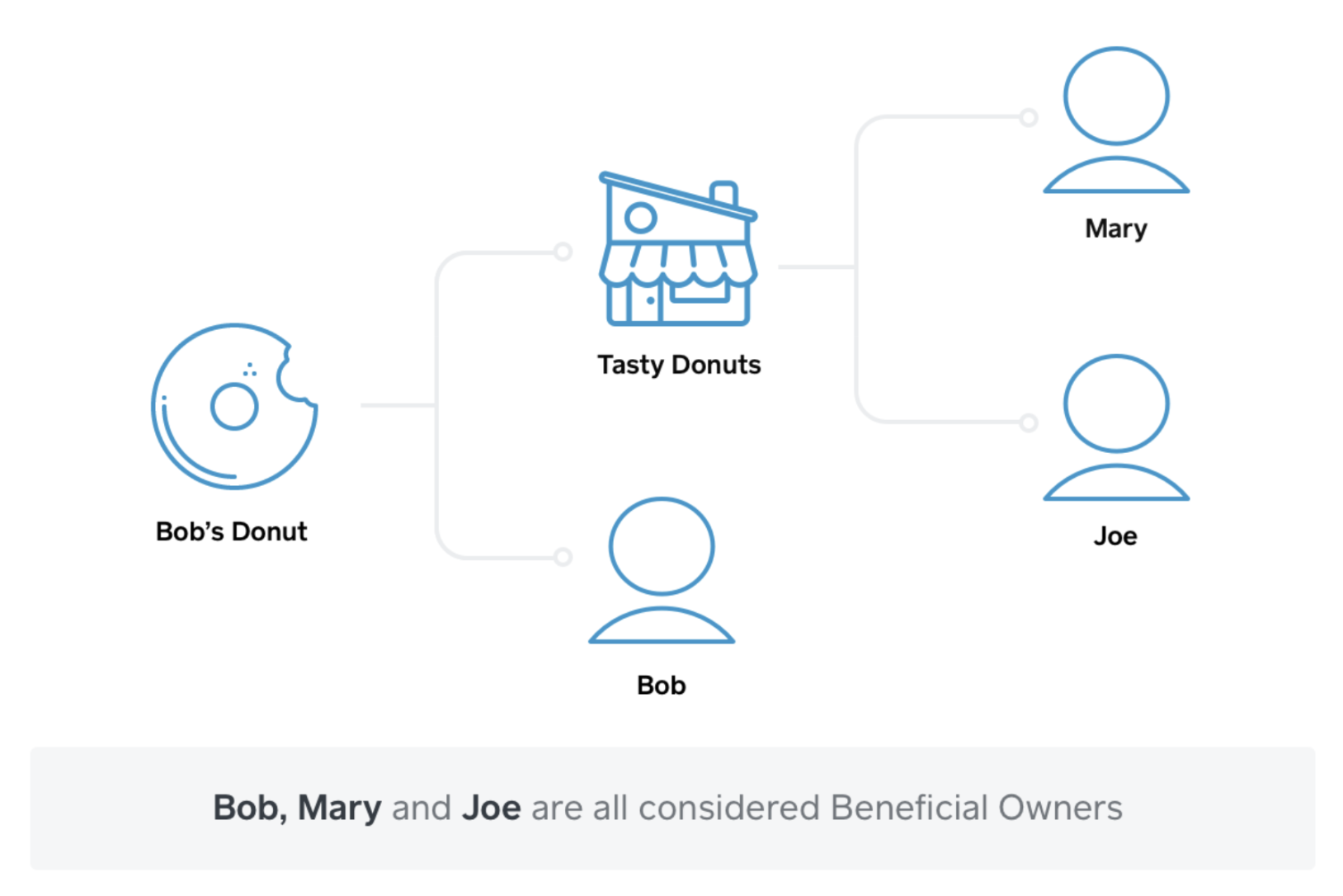

If your business is an LLC, S Corp, C Corp, Partnership, or a Cooperative, provide additional information regarding the control and ownership of your business. We are required by law to collect this information. You will also need to provide information about any Beneficial Owners of your business (individuals that directly or indirectly own 25% or more of the business).

Review and select I accept to submit your application and accept the terms of your loan.

Additional information regarding loan applications:

Business Managers: A Business Manager is someone who has significant responsibility to control, manage, or direct the business applying for the loan, including but not limited to, a President, Chief Executive Officer, or other senior manager. If you’re not a Business Manager, you’re required to submit additional identifying information on behalf of the Business Manager, as well as your business role or title.

Beneficial Owners: A Beneficial Owner is someone who directly or indirectly owns 25% or more of the business applying for the loan. If you’re not a Beneficial Owner, you’re required to submit additional identifying information on behalf of the Beneficial Owners. We won’t contact any listed Beneficial Owners or ask them to review your request for a loan.

All loan applications are subject to credit review. Once you’ve submitted your application, your request is sent over to our team for review. If additional information is requested from you during the review process, you’ll be notified in your Square Dashboard and via email. We will notify you via email when there is a status update on your application.

If you want to opt out of giving Square Financial Services access to your credit score for evaluating your loan offer, contact us and clarify that you’re requesting to opt out of a credit check.

Download your loan agreement

Sign in to Square Dashboard and go to Banking > Loans.

Click (•••) on your plan details.

Select Download loan agreement.

A PDF of the loan agreement will open in a new tab within your browser.

Review loan collateral details

We don't require collateral for loan amounts of $100,000 or less. For loan amounts over $100,000, we may take a security interest in your business assets and file a UCC statement with the Secretary of State where your business is organized.

We require a personal guarantee for loans over $250,000.

After you've finished paying off your loan, you can contact us with a request to remove the UCC-1 filing. A UCC-1 filing is a publicly available record that provides notice of a security interest in certain property of a debtor. UCC statements are typically filed with the Secretary of State where a business is organized.

We only file UCC-1 statements on loan amounts above $100,000, and that it can take up to 10 business days after repaying your loan for the lien termination to be filed. Once the lien termination is filed, it could also take additional time for the Secretary of State to process the termination and provide a UCC-3 termination statement.

Institutions will sometimes use a third-party to file, track, and maintain lien positions as the registered agent of the institution. Corporation Services Company is a common third-party representative. If you are unsure of what institution the third party is acting on behalf of, the best practice is to reach out directly to the third party.