Actualiza tu navegador.

Descarga la última versión de un navegador compatible debajo para obtener el mayor beneficio de este sitio web:

Préstamos Square Hazlo realidad con un préstamo

Haz tu solicitud en minutos, sin formularios largos

Sin intereses, solo una tarifa fija

Obtén tu dinero al instante1

Financiación rápida y sencilla para cada etapa del negocio

Procesa las ventas con Square para obtener una oferta personalizada

Las ofertas de préstamos oscilan entre $100 y $350,000 según el desempeño de tu negocio. Tomamos en cuenta tu tiempo usando Square, el volumen y la frecuencia de procesamiento, la combinación de clientes y más. Recibirás ofertas en el Panel de Datos Square y por correo electrónico.

Simplifica tu lista de pendientes con pagos automáticos

Los pagos se hacen automáticamente a través de tus ventas diarias de Square, por lo que tienes una cosa menos en qué pensar. El porcentaje que pagas sigue siendo el mismo: el monto se ajusta para que coincida con tu flujo de caja. Además, no tiene intereses, por lo que tu saldo nunca aumenta.

Acceso más rápido a los fondos

Solicitud sencilla

Solo te llevará unos minutos hacer la solicitud. Recibirás notificaciones en el Panel de Datos y por correo electrónico una vez que cumplas con los requisitos para una oferta.

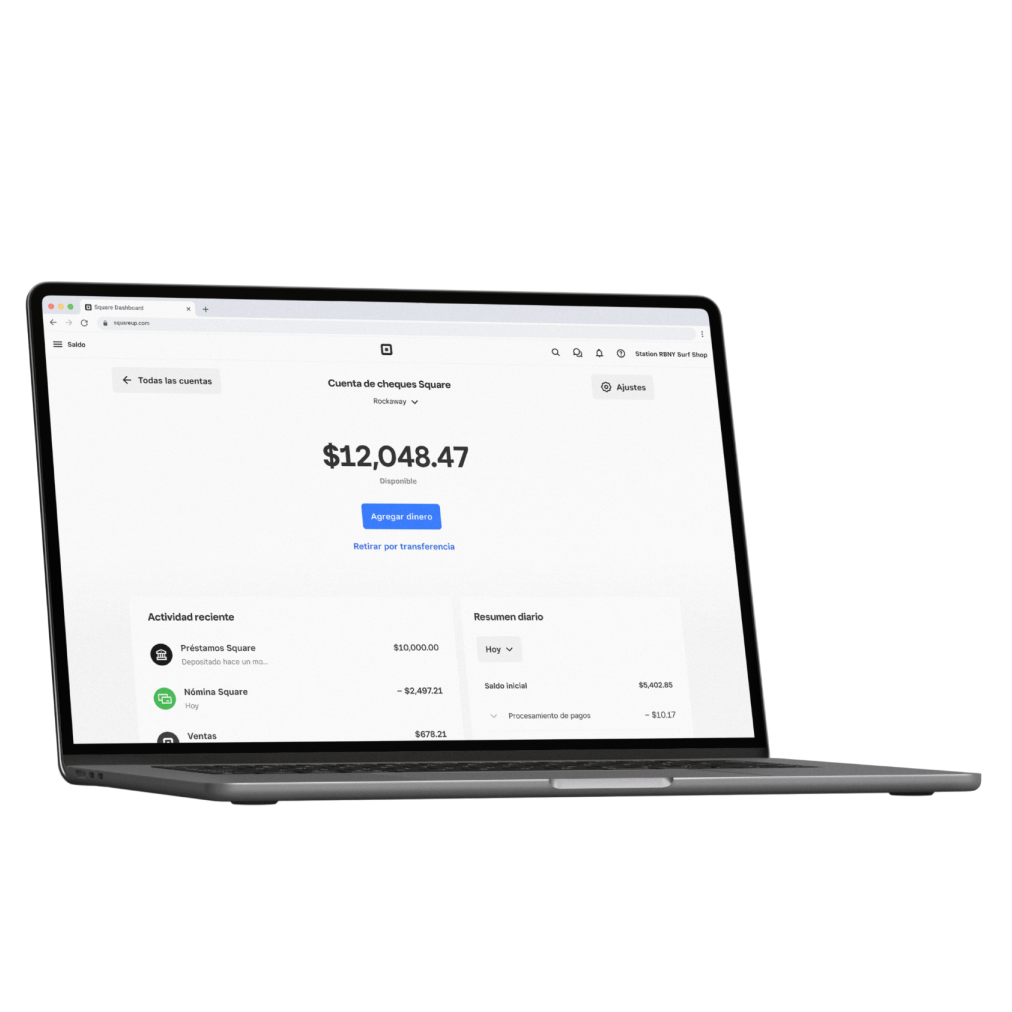

Depósito rápido

Una vez que se apruebe, el dinero se depositará en tu cuenta al siguiente día hábil, o al instante con la Cuenta de cheques Square.

“Ese préstamo realmente nos ayudó a avanzar cuando no teníamos nada en absoluto. Y cuando lo pagas, te sientes muy bien”.

Barb Batiste

B Sweet

Los Ángeles, CA

“El financiamiento de Square me permitió renovar el interior de mi tienda después de haber estado cerrada debido a la pandemia. Esto me permitió reabrir para ofrecer servicio de comidas en el interior, gracias a lo cual aumenté mis ventas en más de un 60%”.

Fumio Tashiro

Mirror Tea House

Brooklyn, NY

Más de $26,500 M

en fondos extendidos a nivel mundial

Incluye MCA, préstamos PPP de la SBA y préstamos comerciales desde octubre de 2013 hasta septiembre de 2024.

Más de 900 mil

negocios financiados

Datos internos de Square, 2025.

El 88%

de los negocios con Préstamos Square reportan crecimiento

Datos de encuestas de Square, 2025.

Haz que tu dinero se mueva a tu ritmo

Hablemos de dinero

Preguntas frecuentes

¿Cómo puedo ser elegible para Préstamos Square?

Actualmente, los Préstamos Square se ofrecen por invitación. Cuando procesas con Square, revisamos automáticamente tu actividad de procesamiento para evaluar la elegibilidad para un préstamo. Si detectamos que cumples con los requisitos para solicitar Préstamos Square, nos pondremos en contacto contigo de manera proactiva (en el Panel de Datos y por correo electrónico) con una oferta de préstamo personalizada.

También puedes usar la página de elegibilidad ubicada en el Panel de Datos para obtener más información sobre el estado de tu elegibilidad para Préstamos Square.

¿Cómo solicito un préstamo de Square?

Si una oferta de préstamo no está disponible en tu Panel de Datos Square, tu negocio no cumple los requisitos en este momento. Puedes tener la tranquilidad de que revisamos automáticamente las cuentas de Square a diario para evaluar los muchos factores sobre tu negocio que ya tenemos para evaluar tu elegibilidad para un préstamo. Te notificaremos si cumples los requisitos para los Préstamos Square más adelante. No es necesario que te pongas en contacto con nosotros ni que proporciones ninguna información adicional para calificar para una oferta de préstamo.

¿Cómo determinan la oferta de préstamo de mi negocio?

La elegibilidad para un préstamo se basa en diversos factores relacionados con tu negocio, tales como el volumen de procesamiento de pagos, el historial de la cuenta y la frecuencia de pagos. Obtén más información sobre los requisitos para acceder a los préstamos para negocios de Square.

¿Cómo pago un préstamo de Square?

Un porcentaje fijo de tus ventas diarias con tarjeta se deduce automáticamente hasta liquidar el préstamo. Si un día las ventas suben, pagarás más; en cambio, si las ventas bajan, pagarás menos. Debe pagarse un mínimo de 1/18 del saldo inicial cada 60 días. Obtén más información sobre el pago de préstamos Square.

¿Hay intereses para un préstamo de Square?

No, los Préstamos Square no cobran intereses continuos. El costo total del préstamo es la comisión del préstamo, que es la diferencia entre el monto total adeudado y el monto del préstamo inicial que solicitas en el Panel de Datos. El costo total del préstamo nunca cambia.

¿Puedo amortizar el préstamo?

Sí, puedes hacer prepagos sin costo adicional y en cualquier momento. El monto total que debes no se modifica en función de los prepagos.

¿Qué sucede si no realizo un pago?

Si tus ventas diarias con tarjeta no cubren el pago mínimo de 60 días, Square Financial Services puede debitar el monto de pago mínimo restante de tu Saldo Square o de tu cuenta bancaria asociada a Square.

¿Hay comisiones por pago tardío?

No, no hay cargos por pago tardío adicionales al monto total adeudado.

¿Solicitar un préstamo influye sobre mi calificación de crédito?

No, la solicitud de un Préstamo Square no afectará tu calificación de crédito. Además, no pedimos una garantía personal para otorgar un préstamo a tu negocio.

¿Quieres realizar operaciones bancarias con Square?

Obtén consejos financieros y descubre cómo otros negocios administran su flujo de caja con Square.

Encantados de conocerte.

Creemos que los negocios son tan únicos como las personas que los administran. Cuéntanos más sobre ti para obtener contenido individualizado sobre los temas que más te interesen.

Square, el logotipo de Square, Square Financial Services, Square Capital y demás son marcas registradas de Block, Inc. o sus subsidiarias. Square Financial Services, Inc. es una subsidiaria de propiedad absoluta de Square, Inc.

1Préstamos depositados instantáneamente en una cuenta de cheques Square.

Square Financial Services, Inc. emite todos los préstamos. La tasa real depende del historial de procesamiento de tarjetas de pago, de la suma del préstamo y otros factores de elegibilidad. Se requiere un pago mínimo de 1/18 del saldo del préstamo inicial cada 60 días y se debe realizar la devolución total del préstamo en un plazo de 18 meses. No se garantiza la elegibilidad para el préstamo. Todos los préstamos están sujetos a aprobación crediticia.