Actualiza tu navegador.

Descarga la última versión de un navegador compatible debajo para obtener el mayor beneficio de este sitio web:

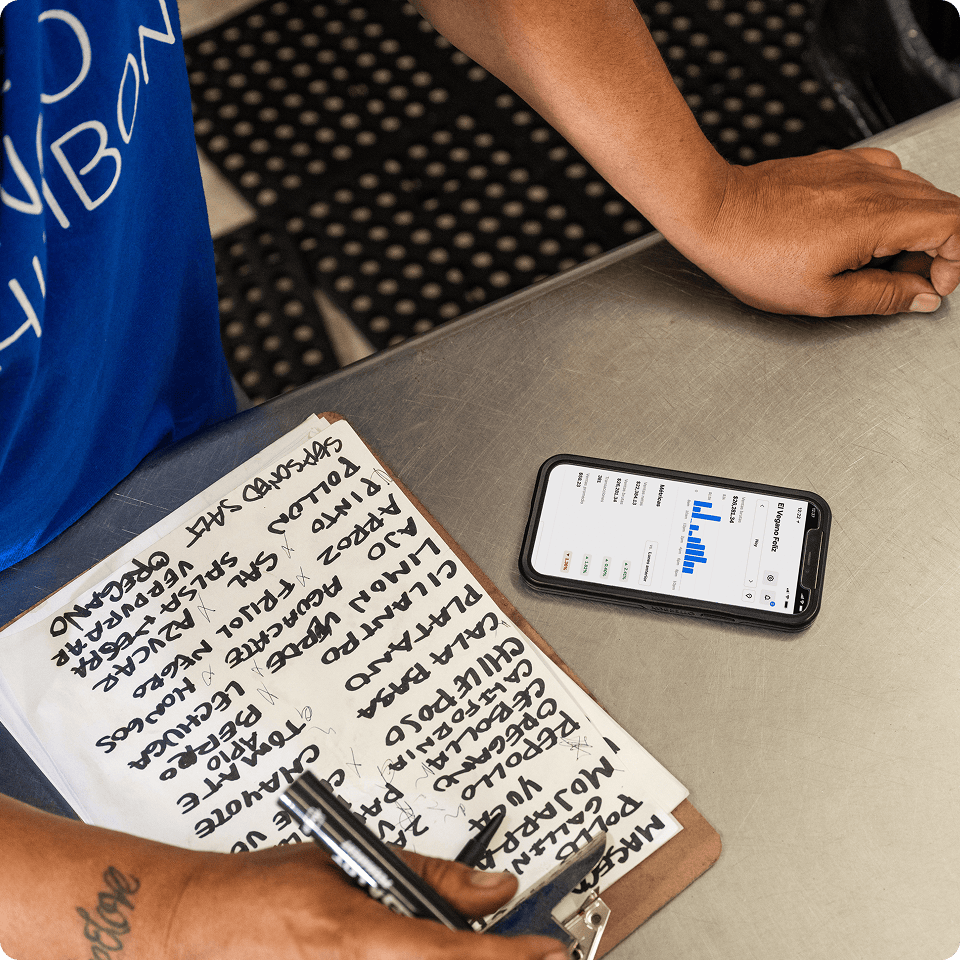

Cuenta de ahorros Square Ahorra de forma automática y proyecta tus gastos fácilmente

Ahorra automáticamente con cada venta con tarjeta

Organización en carpetas

100% gratis, sin comisiones

Gana un APY competitivo¹

Herramientas de ahorro al alcance de tu mano

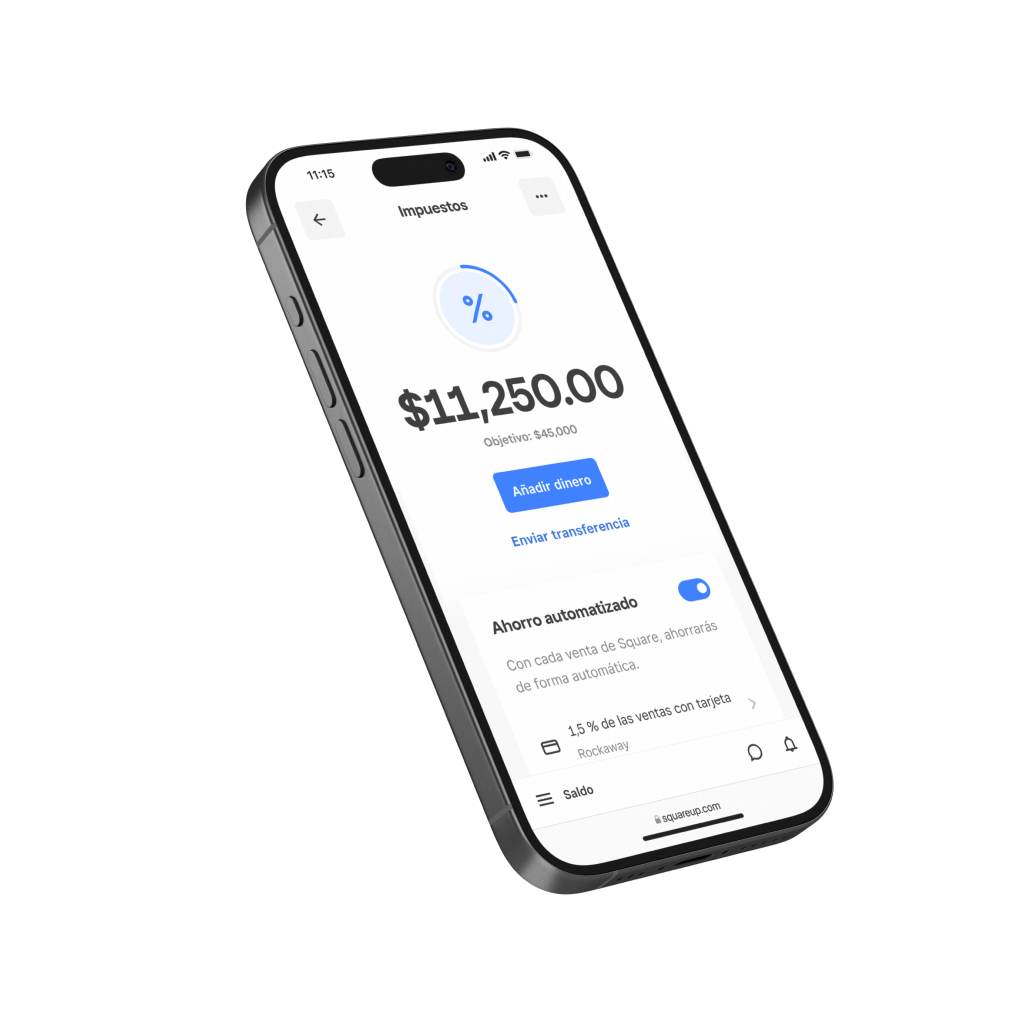

Proyecta tus gastos automáticamente

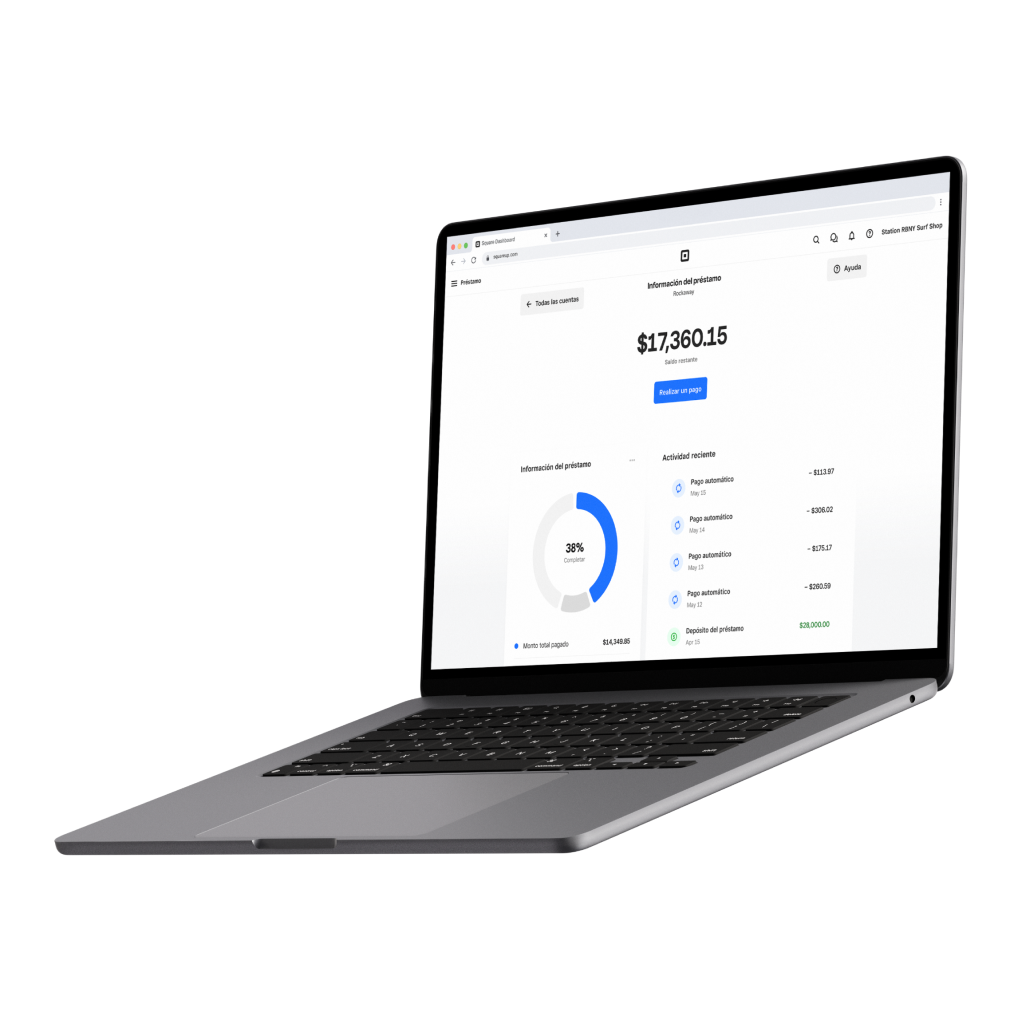

Planifica con anticipación los gastos futuros con ahorros predecibles. Reserva una parte de tus ventas con tarjeta de manera automática para impuestos, suministros y más con una cuenta de ahorros comercial. Haz un seguimiento de tu progreso, ajusta los objetivos y detén los ahorros automáticos cuando quieras.

Mantén tu dinero organizado en carpetas

Controla el destino de tu dinero. Ya sea que estés ahorrando para alcanzar objetivos comerciales o para cubrir gastos diarios, las carpetas te ayudan a controlar tus ahorros, todo en un solo lugar.

Novedad

Obtén recomendaciones inteligentes

Presupuesta tus gastos sin especular gracias a los consejos personalizados sobre cuánto reservar para los gastos principales, según las estadísticas de negocios como el tuyo.²

Haz crecer tu dinero con un APY

Gana intereses sobre tu dinero hasta el momento en que se gasta, con un 1.00% de APY en todo el dinero en las carpetas de ahorros (más del doble del promedio de interés nacional).³

Ten tranquilidad absoluta

Transferencias rápidas y gratis

Transfiere dinero de tu Cuenta de ahorros a tu Cuenta de cheques Square al instante y gratis. No esperes más.

Seguro de la FDIC

Mantener tu dinero seguro es una prioridad: todos los fondos en la Cuenta de ahorros Square están asegurados por la FDIC hasta por $2.5 millones.¹

Sin ninguna comisión. Nunca.

Cuenta de ahorros Square

Otros bancos

Comisiones mensuales de servicio o mantenimiento

Cuenta de ahorros Square

$0

Otros bancos

De $4 a $8 al mes

Requisito de saldo mínimo

Cuenta de ahorros Square

$0

Otros bancos

$300–$500 mínimo

Depósito de apertura

Cuenta de ahorros Square

$0

Otros bancos

De $25 a $100

Comisiones por sobregiro

Cuenta de ahorros Square

$0

Otros bancos

De $10 a $36 por artículo

Tarifas de límite de retiro

Cuenta de ahorros Square

$0

Otros bancos

hasta $10

Transferencias a cuentas bancarias externas

Cuenta de ahorros Square

$0

Otros bancos

$0

“Empecé a usar una Cuenta de ahorros Square cuando alguien del Panel de la Comunidad de Square la recomendó como método de ahorro para los impuestos sobre la venta. Y esos impuestos son los peores. Fue fantástico poder configurar la carpeta y deducir automáticamente el 10% de mis ganancias diarias. Así, la última declaración de impuestos fue pan comido; fue increíble”.

Doran Tomako

Haute Beauty

Monterrey, CA

“Uso mi Cuenta de ahorros Square para reservar dinero para mis futuras necesidades comerciales. Estoy ahorrando para abrir una segunda sucursal, comprar más dispositivos, lanzar campañas de marketing y poder cubrir emergencias, como temporadas de pocas ventas o reparaciones necesarias”.

Fumio Tashiro

Casa de té con espejos

Brooklyn, NY

“Siempre he ahorrado para los impuestos. Al crecer, entendí lo importante que era. Square te dice cuánto debes reservar en la Cuenta de ahorros Square, y es fácil. Cuando llega el momento de pagar los impuestos, ya tienes el dinero disponible”.

Juan Saravia

La Pupusa Urban Eatery

Los Angeles, CA

“Me encanta Square: tiene una función que te permite ahorrar para los impuestos sin que te des cuenta, casi sin pensarlo. Tan pronto como alguien me paga, Square toma instantáneamente el porcentaje que configuré y lo envía directo a esa cuenta. No tengo que hacer nada”.

Lisa Giles

Life of Lisa G

Newport Beach, CA

Al 90%

de los usuarios les encanta la Cuenta de ahorros Square

Más de 185,000

vendedores utilizan ahorros automáticos

$3.86B

ahorrados para objetivos como pagar impuestos o comprar equipos nuevos

Haz que tu dinero se mueva a tu velocidad

Hablemos de dinero

Preguntas frecuentes

¿Qué es la Cuenta de ahorros Square?

La Cuenta de ahorros Square es una cuenta de ahorros comercial gratis que te permite ahorrar, estimar presupuestos y organizar el dinero de las ventas con tarjeta, de forma automática y mientras ganas intereses competitivos. Se integra con los pagos de Square para que puedas reservar automáticamente un porcentaje de cada venta con tarjeta y programar un presupuesto para los gastos clave, todo en un solo lugar. Puedes organizar tus ahorros en carpetas con el nombre de tus objetivos, lo que te permite ver, seguir y administrar tu progreso con facilidad. Todos los fondos reservados ganan un APY (porcentaje de rendimiento anual) del 1.00%, sin cargos de mantenimiento por mes ni requisitos de monto mínimo para abrir una cuenta.

¿Debo pagar comisiones por la Cuenta de ahorros Square?

¡No! No hay cargos de apertura, ni de mantenimiento mensual, ni comisiones asociadas con saldos mínimos. Tampoco se aplican tarifas asociadas por sobregiro ni por límites de retiro, que suelen cobrarse en las cuentas de ahorro comerciales tradicionales.

¿La Cuenta de ahorros Square está asegurada por la FDIC?

Sí, tus Cuentas de ahorros Square están aseguradas por la FDIC por hasta $2,500,000.

¿Puedo acceder a mi dinero en cualquier momento? ¿Hay límites en los retiros?

Tienes acceso las 24 horas, los 7 días de la semana a tu Cuenta de ahorros Square sin límites en la frecuencia con la que puedes retirar dinero. Puedes transferir fondos al instante a tu Cuenta de cheques Square y gastarlos de inmediato con tu Tarjeta de débito Square, sin costo. También puedes realizar transferencias ACH estándares a cuentas bancarias externas, que generalmente se liquidan en 1 o 2 días hábiles. Si utilizas los ahorros automáticos, las contribuciones diarias se depositan a las 5 p. m. MST.

Las contribuciones realizadas después de esa hora se depositarán al día siguiente.

Nota: Puedes retirar dinero en cajeros automáticos mediante la Cuenta de cheques Square, pero no con las Cuentas de ahorros Square.

¿Cómo funcionan los ahorros automáticos?

Con los ahorros automáticos, puedes establecer que se transfiera un porcentaje de tus ingresos por ventas con tarjeta con Square a una carpeta exclusiva para ahorros. Muchos propietarios de negocios apartan fondos de su cuenta bancaria comercial principal de manera automática para cubrir gastos, como los impuestos sobre la renta o sobre las ventas, facturas o suministros, o para cumplir objetivos de ahorro a largo plazo.

¿Cómo transfiero fondos hacia y desde la Cuenta de ahorros?

Puedes transferir dinero fácilmente hacia o desde tu Cuenta de ahorros Square. Solo tienes que seleccionar la carpeta desde la que deseas transferir, elegir “Transferir” y seguir las indicaciones para mover dinero hacia o desde tu Cuenta de cheques Square o cuenta bancaria externa asociada.

¿Dónde encuentro mis estados de cuenta mensuales?

Los estados de cuenta mensuales están disponibles en el Panel de Datos Square. Ve a tu Cuenta de ahorros, selecciona “Estados de cuenta” y podrás consultar o descargar tus estados de cuenta anteriores en cualquier momento.

¿Quieres realizar operaciones bancarias con Square?

Obtén consejos financieros y descubre cómo otros negocios administran su flujo de caja con Square.

Encantados de conocerte.

Creemos que los negocios son tan únicos como las personas que los administran. Cuéntanos más sobre ti para obtener contenido individualizado sobre los temas que más te interesen.

¹ Las cuentas de ahorro Square son proporcionadas por Square Financial Services, Inc. Miembro de FDIC, y acumulan un rendimiento porcentual anual (APY) del 1.00% por carpeta sobre saldos de carpeta superiores a $10. El APY está sujeto a cambios y es vigente al 23 de enero de 2026. No se requiere un depósito mínimo para abrir una cuenta de ahorro Square y estas cuentas no tienen cargos mensuales. El programa de barrido de depósitos de Square Savings distribuye sus fondos entre múltiples bancos asociados asegurados por FDIC, lo que significa que sus depósitos de ahorro elegibles tienen una cobertura de seguro FDIC de hasta $2.5 millones. Los saldos pendientes no están sujetos al seguro FDIC.

² Las recomendaciones de ahorro son solo para fines informativos y no representan asesoramiento financiero.

³ La tasa de nuestra cuenta de ahorros es más del doble del promedio nacional de 0.41% de APY, según el promedio nacional de las tasas de las cuentas de ahorros publicadas en las Tasas Nacionales Semanales de la FDIC y los Límites de las tasas precisos al 1/21/2025.

© 2026 Square, Inc. y Square Financial Services, Inc. Todos los derechos están reservados.