Consultar los requisitos de elegibilidad para un préstamo

Acerca de la elegibilidad para préstamos

Square ofrece préstamos comerciales a vendedores de Square para hacer crecer tu negocio. Mientras procesas con Square, evaluamos automáticamente tu cuenta para determinar si cumples con los requisitos de elegibilidad para un préstamo. La elegibilidad de la oferta se basa en una variedad de factores relacionados con tu cuenta de Square, incluyendo el volumen de procesamiento de pagos, el historial de la cuenta y la frecuencia de los pagos.

Actualmente, los Préstamos Square se ofrecen por invitación. Puedes verificar la elegibilidad de tu negocio en la pestaña Préstamos del Panel de Datos Square.

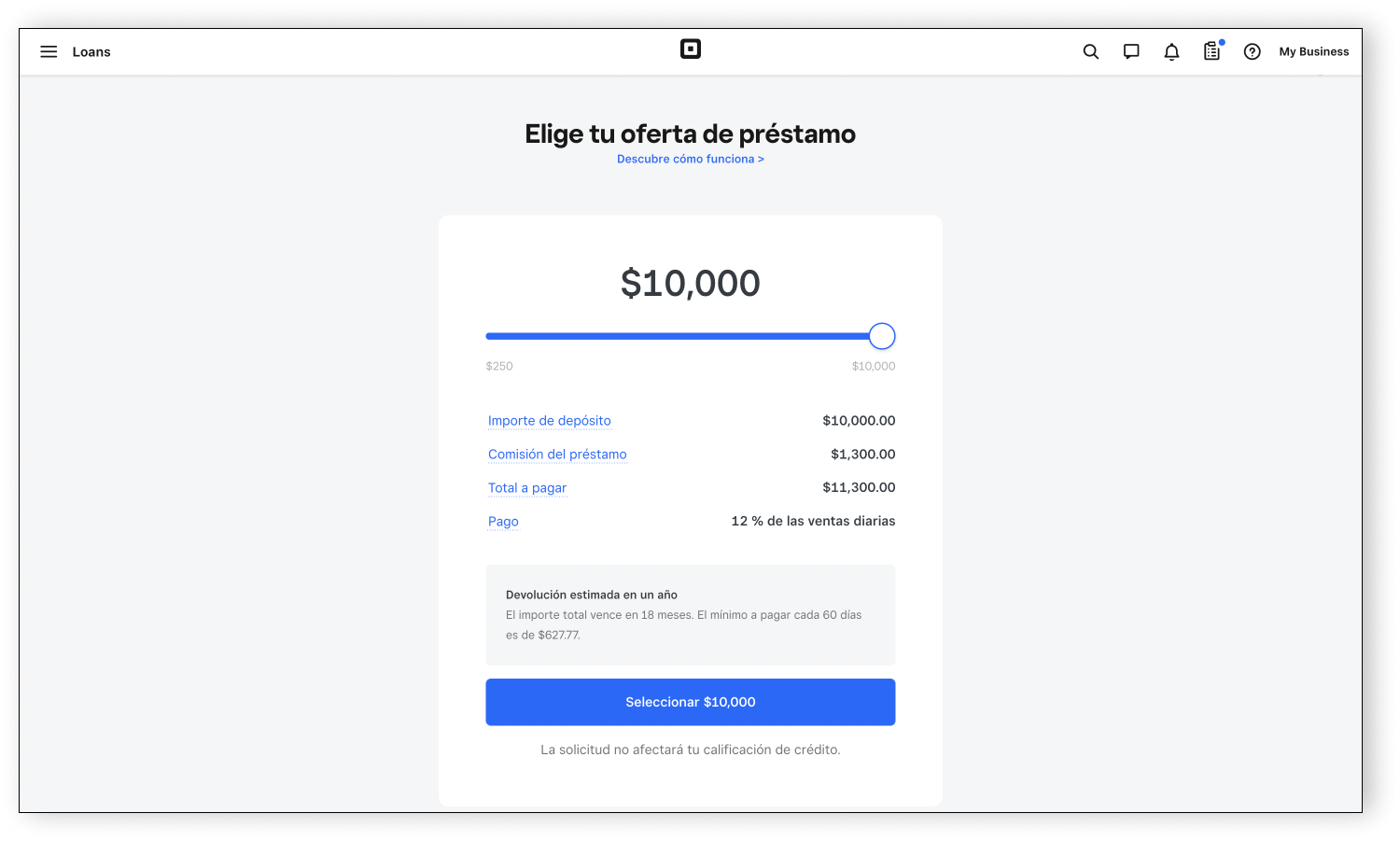

Las cifras son de carácter ilustrativo.

Si no ves ninguna oferta de préstamo disponible, consulta los factores principales que podrían estar afectando tu elegibilidad a continuación o en la página de elegibilidad en Panel de Datos Square. Esta página ayuda a los vendedores a obtener información sobre el estado de la elegibilidad de su préstamo al tomar los datos en tiempo real de tu negocio y compararlos con los factores clave que determinan la elegibilidad. Si alguno de tus factores de elegibilidad necesita atención, puedes consultar los siguientes consejos para aumentar tus posibilidades de ser elegible.

Square no puede prometer una oferta de préstamo, incluso cuando todos los factores en la página de elegibilidad son buenos.

Antes de comenzar

La revisión de los requisitos de elegibilidad para un préstamo se realiza de forma periódica y automática. Las cuentas se analizan a diario para establecer ofertas de préstamos. Si cumples los requisitos para recibir una oferta, te avisaremos por correo electrónico y a través del Panel de Datos Square. Si no has recibido ninguna oferta, no podrás solicitar un préstamo en ese momento.

Las ofertas de préstamos no están garantizadas y no podemos generar o predecir ofertas manualmente. Como el proceso es automático, no es necesario que te comuniques con nosotros para solicitar una revisión de la elegibilidad. Revisamos constantemente las cuentas para determinar si cumplen los requisitos. Solo tienes que seguir procesando pagos con Square y tener en cuenta los factores de elegibilidad que se indican a continuación. Todos los vendedores deben calificar según los criterios de elegibilidad.

Recuerda que, si ya estás pagando un Préstamo Square, no recibirás nuevas ofertas automáticamente cuando hayas devuelto un porcentaje determinado del importe pendiente. Además, no es posible ampliar un préstamo existente. Sin embargo, tu negocio puede cumplir los requisitos para una nueva oferta cuando tu plan existente esté cerca de ser liquidado. Realizar un pago extra o liquidar anticipadamente tu préstamo no garantiza otra oferta de préstamo a través de Square.

No hay un importe fijo que tengas que devolver para recibir una nueva oferta de préstamo. Los detalles de la oferta de préstamo, así como el tiempo de elegibilidad, pueden diferir de tu préstamo Square actual. Cada oferta es única y se evalúa por separado.

Si cumples los requisitos, ten en cuenta que las ofertas de préstamos solo están disponibles por tiempo limitado. Evaluamos constantemente tu cuenta (incluso si tienes una oferta activa). Seguirás viendo una oferta mientras cumplas los requisitos.

Consultar los requisitos de elegibilidad para un préstamo

Existen muchos factores que pueden afectar tu elegibilidad y las cuentas se evalúan como un todo. Consulta el Panel de Datos Square para obtener más información sobre tu estado de elegibilidad actual y tu estado para cada uno de los factores clave de elegibilidad. Ten en cuenta que, si bien la página de requisitos puede ayudarte a comprender cómo se alinea tu cuenta con los factores clave, ver "bueno" en todos los factores no garantiza una oferta de préstamo.

A continuación se presentan algunos de los factores clave que consideramos al evaluar tu negocio para una oferta de préstamo.

El monto de tu oferta de préstamo suele depender de cuánto proceses mediante Square. En general, los negocios que hayan procesado al menos $10,000 o más en un año tiene mayor elegibilidad para una oferta. Además, tu negocio debe haber usado Square al menos 20 días en el último año.

Si tienes varias cuentas o sucursales de Square con Préstamos Square pendientes, asegúrate de que todos estén procesando de manera uniforme y que estén al día con el pago del préstamo.

Si aceptas pagos constantemente, es más probable que te des a notar. Para nosotros, un patrón constante de recepción de pagos muestra que tienes un negocio saludable.

Una buena combinación de clientes nuevos y frecuentes nos muestra que estás creciendo de diferentes maneras. Puedes usar las herramientas de análisis de Square para comprender mejor tu base de clientes.

Obtén más información sobre cómo usar las perspectivas de clientes.

Un reclamo de pago ocurre cuando un cliente reclama un cobro de tu negocio y se comunica con el emisor de la tarjeta para revertirlo. Y tener reclamos en tu cuenta puede afectar tu elegibilidad para un préstamo.

Deslizar tarjetas de crédito con chip es una forma de aumentar el riesgo de devolución de pagos. Cambia a Square Reader u obtén información sobre cómo controlar mejor las tarjetas de pago para evitar reclamos. Obtén más información sobre las devoluciones de pagos con tarjeta de crédito.

Square puede establecer un límite de pago en tu cuenta con el fin de protegerla. Los límites de pago son restricciones que ponen un tope temporal a tu capacidad de procesar transacciones a través de tu cuenta de Square, y tener uno en tu cuenta afecta tu elegibilidad para un préstamo.

Para ayudar con los reclamos de pago, Square puede colocar una reserva en tu cuenta, y tener esto puede afectar tu elegibilidad para un préstamo.

Obtén más información sobre cómo administrar las reservas de pago con Square.

Tu cuenta de Square se revisa en busca de errores de débito debido a fondos insuficientes. Asegúrate de tener fondos disponibles en tu cuenta bancaria asociada para evitar errores al realizar el débito de tu cuenta.

Factores adicionales para cumplir con los requisitos si tienes un préstamo activo

We constantly review accounts for new loan offers, even if you have an active loan. Your business may become eligible for a new loan when your existing plan is closer to being repaid. However, reaching a certain percentage repaid or paying off a loan doesn’t guarantee a loan offer as other factors listed above are also considered.

Asocia una cuenta bancaria para mejorar las futuras ofertas

Si no cumples los requisitos de elegibilidad para recibir una oferta de préstamo, puedes vincular tu cuenta bancaria comercial principal con Plaid para proporcionarle a Square información adicional sobre tu negocio. Square solo usará esta información para mejorar las ofertas futuras de préstamos. Ten en cuenta que debes ser el propietario del negocio para completar este paso. Conectar tu cuenta bancaria o varias cuentas bancarias es opcional y no afecta tu estado de elegibilidad actual ni las posibles ofertas de préstamos. Para hacerlo, sigue estos pasos:

Inicia sesión en el Panel de Datos Square y ve a Banca > Préstamos.

Haz clic en Conectar un banco > Continuar.

Para conectar tu cuenta bancaria, selecciona tu banco e ingresa las credenciales asociadas a la cuenta bancaria.

Una vez que hayas vinculado correctamente tu banco, haz clic en Conectar otro banco si quieres vincular otra entidad bancaria.

Si no puedes encontrar tu institución bancaria con la herramienta de selección de bancos, es porque actualmente no es compatible con Plaid. Lamentablemente, no todos los bancos son compatibles en este momento.

Consulta los motivos de la denegación del préstamo

Después de solicitar un préstamo de Square, tu solicitud pasa por procesos de suscripción y verificación para determinar si tu negocio califica para el préstamo que solicitaste. Revisamos cada solicitud de préstamo caso por caso, independientemente de cualquier préstamo anterior.

Si tu solicitud de préstamo más reciente fue rechazada, las razones específicas por las que se rechazó se pueden encontrar en el aviso por correo electrónico que recibiste del equipo de Préstamos Square. Además, ser rechazado no impide que cumplas los requisitos para un préstamo en el futuro. Revisamos de forma rutinaria la elegibilidad de la cuenta y si tu negocio vuelve a cumplir los requisitos para un préstamo, aparecerán ofertas de préstamos en la pestaña Préstamos en el Panel de Datos Square.

Hay varios requisitos que deben cumplirse para poder calificar para un préstamo. Si a tu negocio le ha sido denegado un préstamo, puede deberse a una de las siguientes razones.

Durante el proceso de revisión de la cuenta, revisamos el historial de tus pagos con Square. Si te rechazaron por este motivo, significa que el historial reciente de pagos de tu cuenta parece inconsistente o que tus ventas a través de Square han disminuido en comparación con tu historial de pagos previo.

Cuando tu negocio está conectado a otro préstamo de Square, es importante mantener la cuenta conectada procesando los pagos de manera consistente hasta que se pague el préstamo. Si tienes una o más cuentas que no cumplen con estos criterios, es posible que tu solicitud de préstamo no sea aprobada. No podemos tomar ninguna medida para desasociar o desvincular las cuentas.

Para proteger tu negocio de las devoluciones de pagos, conserva recibos o facturas para demostrar que se proporcionaron los bienes o servicios a tus clientes. Una solicitud de préstamo puede ser denegada si tu negocio recibió demasiadas reclamaciones de devolución de pagos mientras usabas Square.

El anticipo en efectivo incluye procesar transacciones con tus propias tarjetas de crédito o débito, o con las de tus familiares, amistades o socios. Esta conducta está prohibida por las Condiciones del servicio de Square. El servicio de punto de venta de Square está diseñado para procesar pagos por la venta de bienes o servicios, y no está diseñado para procesar transferencias de persona a persona, o para facilitar pagos entre empresas propiedad de los mismos individuos o grupos de individuos o dentro de empresas.

Nota: Cash App está diseñada como producto para la transmisión de persona a persona y puede facilitar la transferencia de fondos entre familiares y amigos.

Tenemos la obligación de verificar la información sobre el solicitante del préstamo, el negocio y los propietarios beneficiarios. Es nuestra obligación confirmar algunos de los datos de tu solicitud.

Tenemos la obligación de verificar la información sobre el solicitante del préstamo, el negocio y los propietarios beneficiarios. Es nuestra obligación confirmar algunos de los datos de tu solicitud.

Todos los Préstamos Square son evaluados y otorgados por Square Financial Services, Inc., un banco industrial constituido en Utah.